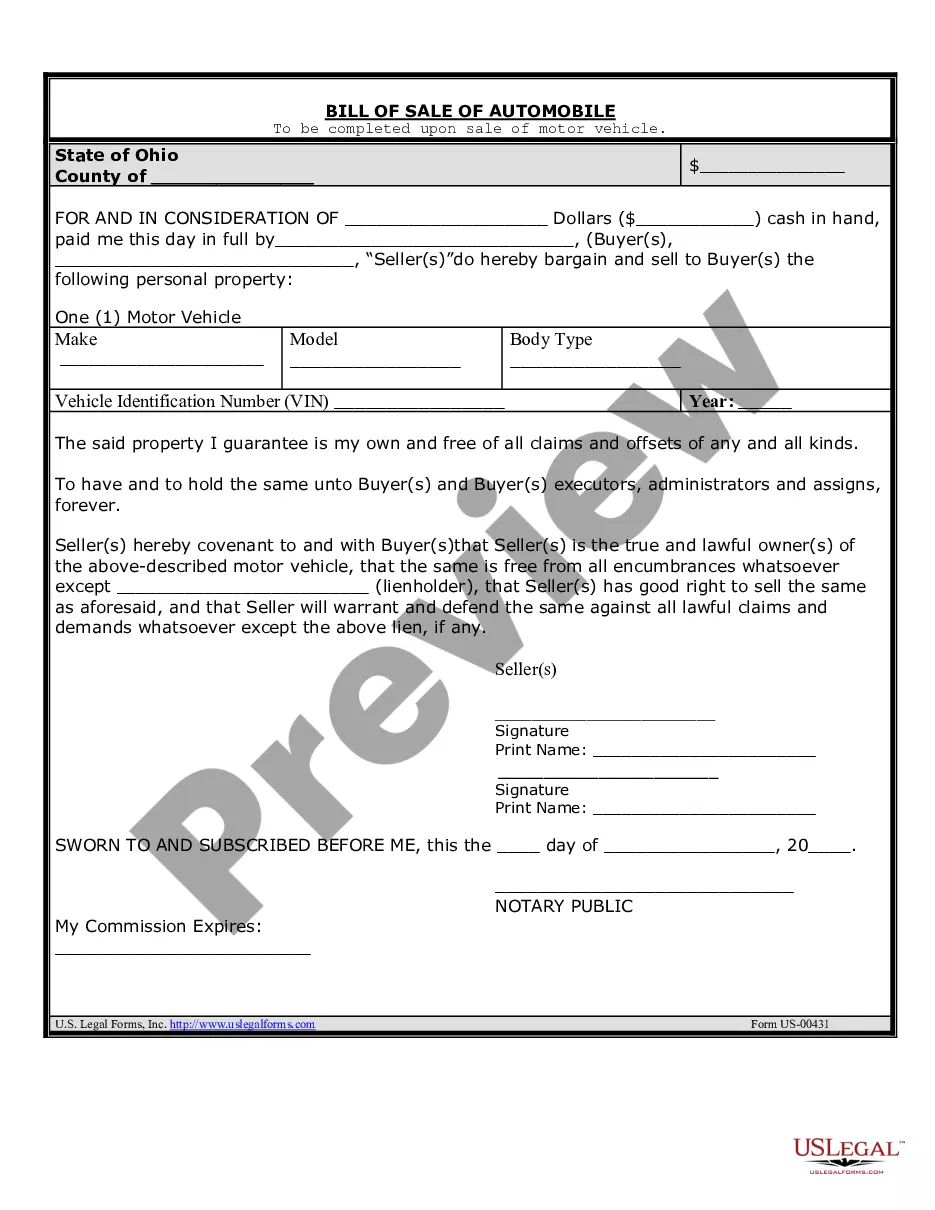

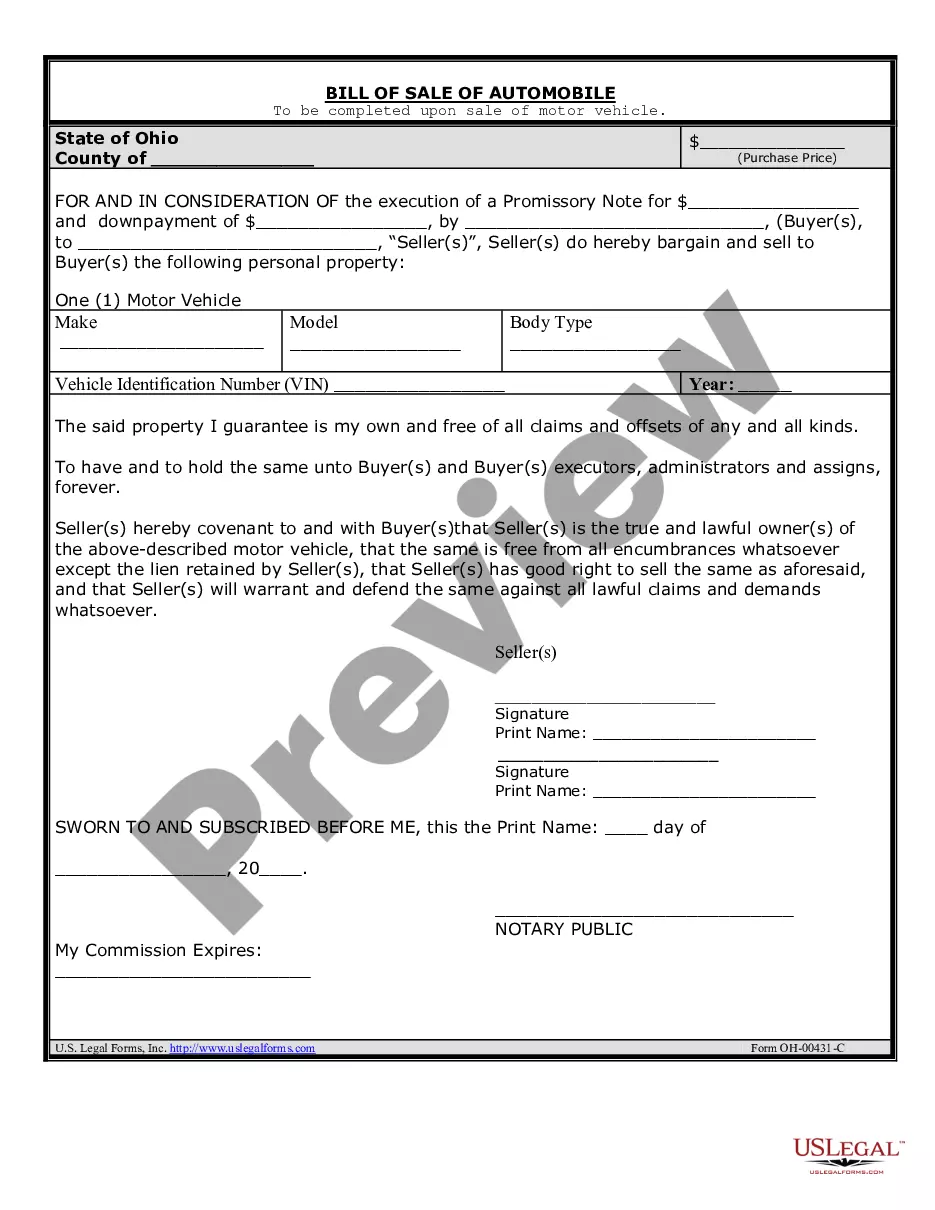

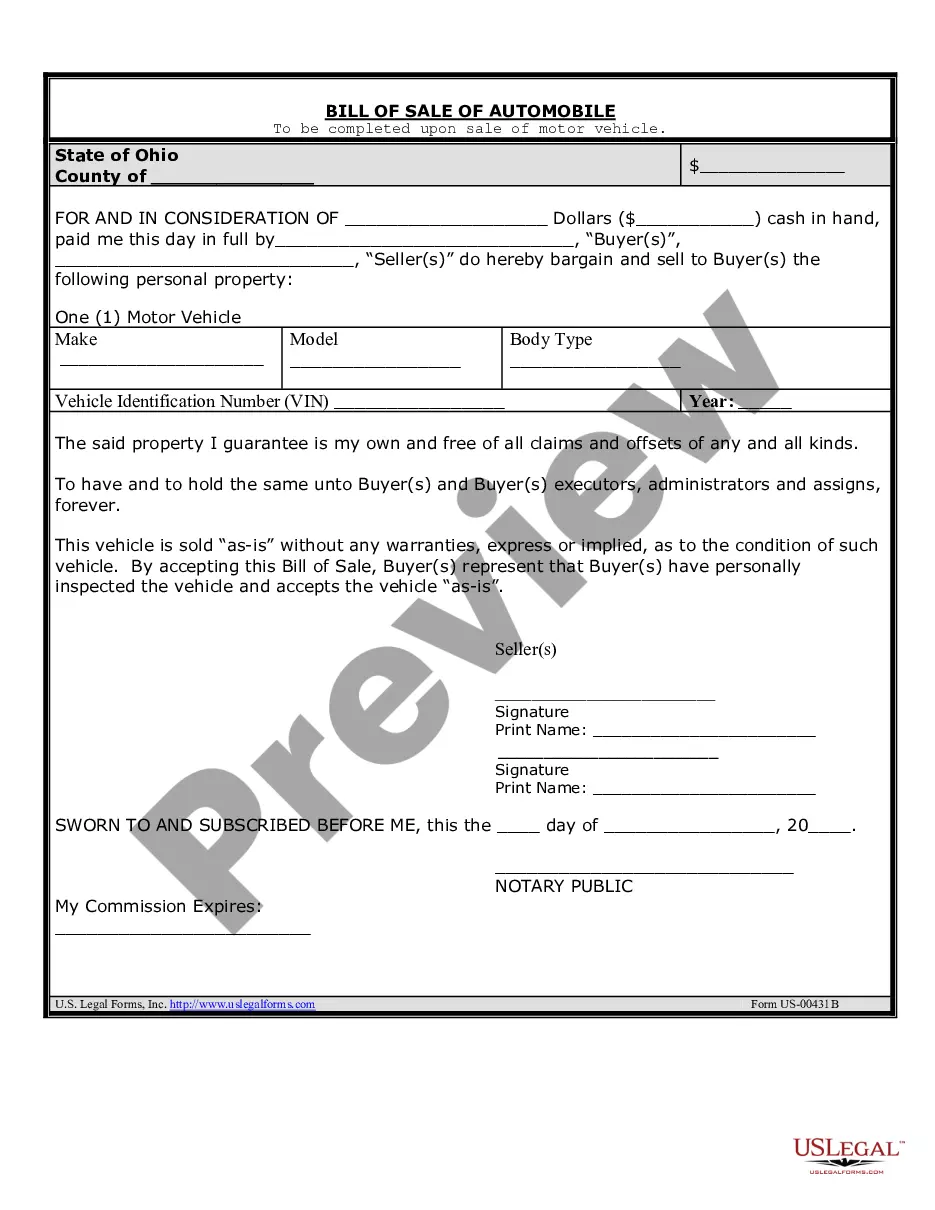

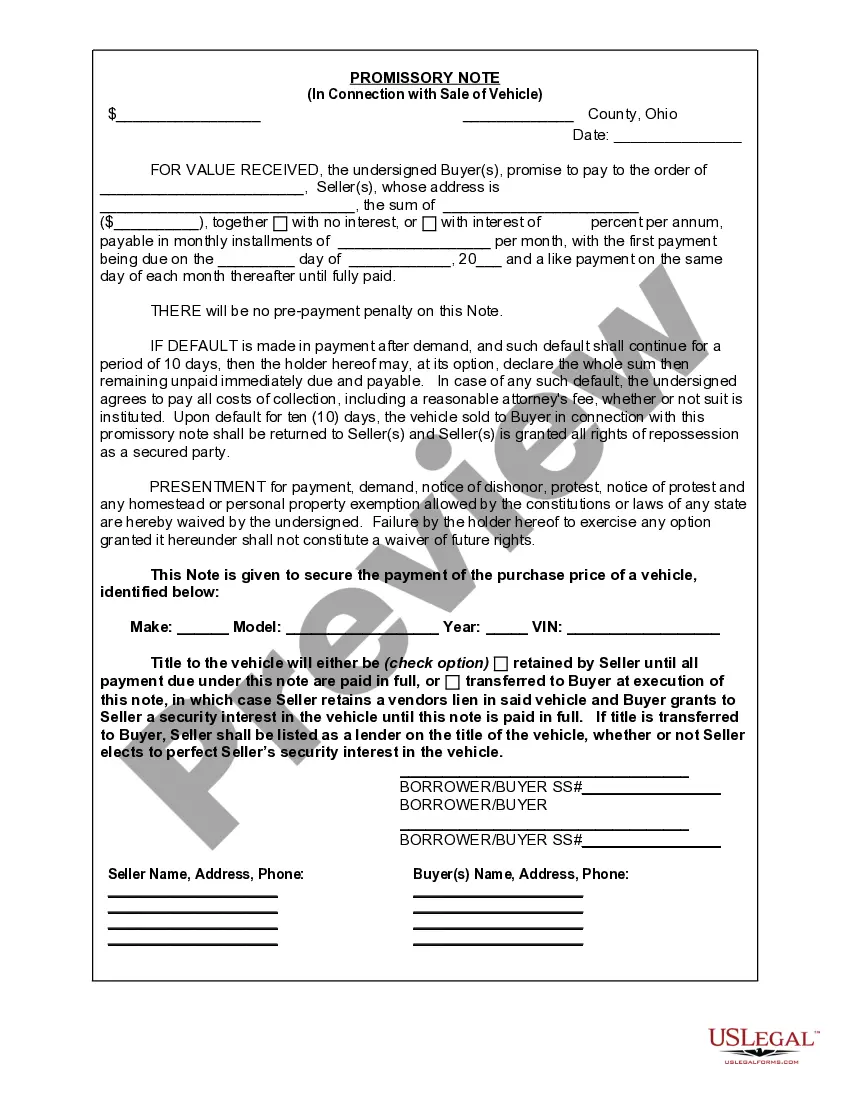

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Cincinnati Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan made for the purchase of a vehicle. It is a written agreement between the buyer (borrower) and the seller (lender), stating the amount borrowed, repayment terms, and consequences of default. The Cincinnati Ohio Promissory Note serves as evidence of the loan and ensures that both parties are aware of their obligations and rights. This document is commonly used when the buyer cannot pay the entire purchase price upfront and requires financing to complete the transaction. There are various types of Cincinnati Ohio Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used based on the agreement between the buyer and seller. Some common types include: 1. Installment Promissory Note: This type of note allows the buyer to repay the loan amount in equal installments over a specified period. The repayment schedule and interest rate are established in advance and included in the note. 2. Balloon Promissory Note: In this type of note, the borrower makes small monthly payments for a specific period. However, a significant portion of the loan balance becomes due at the end of the agreed-upon term, often referred to as a balloon payment. 3. Secured Promissory Note: This note includes a security agreement, usually the vehicle being purchased, which acts as collateral for the loan. In case of default, the lender has the right to repossess the vehicle to recover the outstanding loan amount. 4. Unsecured Promissory Note: Unlike a secured note, this type does not require collateral. It is based solely on the borrower's creditworthiness, and if the borrower defaults, the lender may have limited avenues for recovering the loan amount. The Cincinnati Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a vital legal document that protects the interests of both the buyer and the seller in a vehicle purchase. It is recommended to consult with a legal professional to ensure the note accurately reflects the intentions and provides adequate protection for all parties involved. Keywords: Cincinnati Ohio, Promissory Note, Sale, Vehicle, Automobile, Loan, Financing, Repayment, Installment, Balloon, Secured, Unsecured, Collateral, Legal DocumentA Cincinnati Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan made for the purchase of a vehicle. It is a written agreement between the buyer (borrower) and the seller (lender), stating the amount borrowed, repayment terms, and consequences of default. The Cincinnati Ohio Promissory Note serves as evidence of the loan and ensures that both parties are aware of their obligations and rights. This document is commonly used when the buyer cannot pay the entire purchase price upfront and requires financing to complete the transaction. There are various types of Cincinnati Ohio Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used based on the agreement between the buyer and seller. Some common types include: 1. Installment Promissory Note: This type of note allows the buyer to repay the loan amount in equal installments over a specified period. The repayment schedule and interest rate are established in advance and included in the note. 2. Balloon Promissory Note: In this type of note, the borrower makes small monthly payments for a specific period. However, a significant portion of the loan balance becomes due at the end of the agreed-upon term, often referred to as a balloon payment. 3. Secured Promissory Note: This note includes a security agreement, usually the vehicle being purchased, which acts as collateral for the loan. In case of default, the lender has the right to repossess the vehicle to recover the outstanding loan amount. 4. Unsecured Promissory Note: Unlike a secured note, this type does not require collateral. It is based solely on the borrower's creditworthiness, and if the borrower defaults, the lender may have limited avenues for recovering the loan amount. The Cincinnati Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a vital legal document that protects the interests of both the buyer and the seller in a vehicle purchase. It is recommended to consult with a legal professional to ensure the note accurately reflects the intentions and provides adequate protection for all parties involved. Keywords: Cincinnati Ohio, Promissory Note, Sale, Vehicle, Automobile, Loan, Financing, Repayment, Installment, Balloon, Secured, Unsecured, Collateral, Legal Document