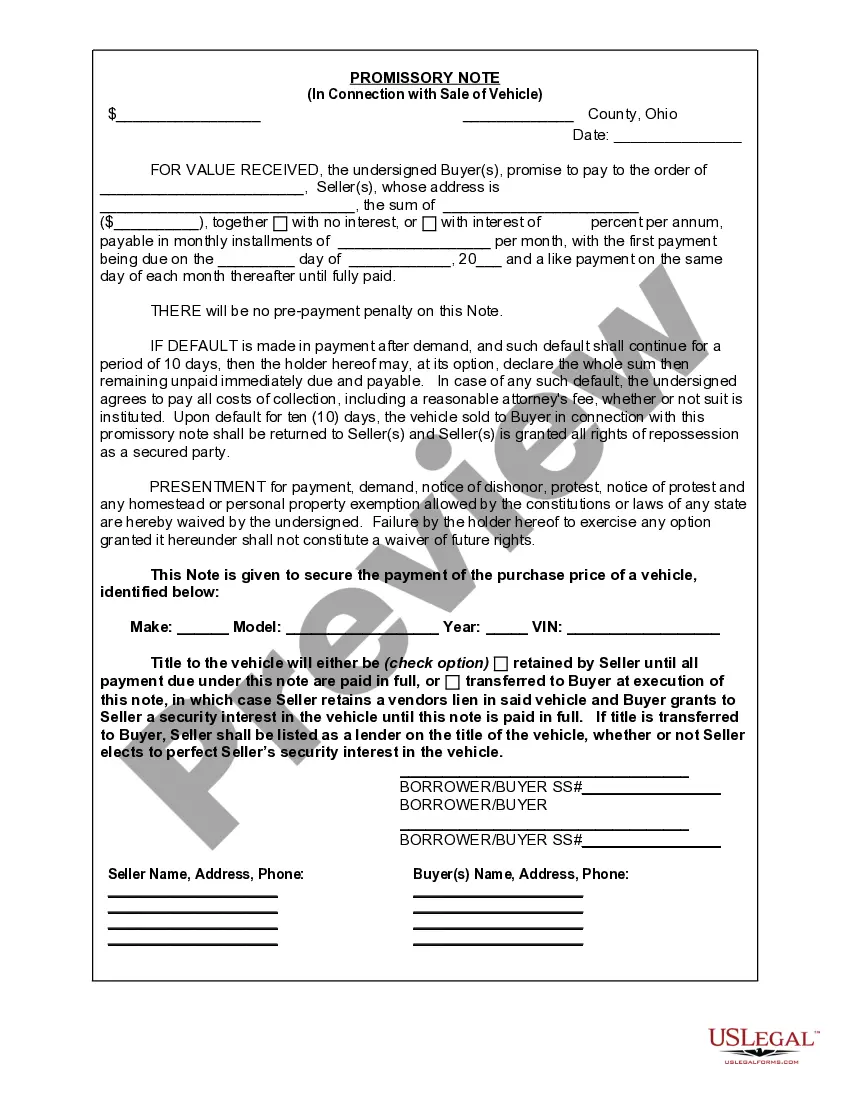

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile A Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding agreement between a buyer and a seller that outlines the terms and conditions of the sale of a vehicle. This document serves as evidence of the buyer's promise to repay the seller for the vehicle's agreed-upon purchase price. Keywords: Toledo Ohio, Promissory Note, Sale of Vehicle, Automobile This promissory note includes crucial details about the transaction, ensuring that both parties are on the same page and have a clear understanding of their respective obligations. It serves as protection for both the buyer and the seller, mitigating potential disputes or misunderstandings that may arise during or after the sale. Different types of Toledo Ohio Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Installment Promissory Note: This type of promissory note allows the buyer to repay the purchase price in predetermined periodic installments, along with any accrued interest until the balance is fully paid off. The note specifies the due dates, amount of each installment, and the interest rate (if applicable). 2. Balloon Promissory Note: A balloon promissory note defers a significant portion of the total purchase price, with only partial payments made during the loan term. At the end of the note term, the buyer is required to make a lump-sum payment, known as the "balloon payment," to satisfy the remaining balance. This type of note often includes a higher interest rate due to the added risk associated with the deferred payment. 3. Secured Promissory Note: In some cases, a Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile may be secured by collateral, typically the vehicle being sold. If the buyer defaults on their payments, the seller has the right to repossess the vehicle and sell it to recover the outstanding balance. 4. Unsecured Promissory Note: This type of promissory note does not require any collateral. It relies solely on the buyer's personal assurance to repay the agreed-upon amount. Unsecured notes often come with higher interest rates since the seller assumes more risk. Regardless of the specific type of Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile used, it is important to consult with legal professionals to ensure compliance with Ohio state laws and regulations. This helps protect the rights and interests of both the buyer and the seller involved in the transaction.Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile A Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding agreement between a buyer and a seller that outlines the terms and conditions of the sale of a vehicle. This document serves as evidence of the buyer's promise to repay the seller for the vehicle's agreed-upon purchase price. Keywords: Toledo Ohio, Promissory Note, Sale of Vehicle, Automobile This promissory note includes crucial details about the transaction, ensuring that both parties are on the same page and have a clear understanding of their respective obligations. It serves as protection for both the buyer and the seller, mitigating potential disputes or misunderstandings that may arise during or after the sale. Different types of Toledo Ohio Promissory Notes in Connection with Sale of Vehicle or Automobile may include: 1. Installment Promissory Note: This type of promissory note allows the buyer to repay the purchase price in predetermined periodic installments, along with any accrued interest until the balance is fully paid off. The note specifies the due dates, amount of each installment, and the interest rate (if applicable). 2. Balloon Promissory Note: A balloon promissory note defers a significant portion of the total purchase price, with only partial payments made during the loan term. At the end of the note term, the buyer is required to make a lump-sum payment, known as the "balloon payment," to satisfy the remaining balance. This type of note often includes a higher interest rate due to the added risk associated with the deferred payment. 3. Secured Promissory Note: In some cases, a Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile may be secured by collateral, typically the vehicle being sold. If the buyer defaults on their payments, the seller has the right to repossess the vehicle and sell it to recover the outstanding balance. 4. Unsecured Promissory Note: This type of promissory note does not require any collateral. It relies solely on the buyer's personal assurance to repay the agreed-upon amount. Unsecured notes often come with higher interest rates since the seller assumes more risk. Regardless of the specific type of Toledo Ohio Promissory Note in Connection with Sale of Vehicle or Automobile used, it is important to consult with legal professionals to ensure compliance with Ohio state laws and regulations. This helps protect the rights and interests of both the buyer and the seller involved in the transaction.