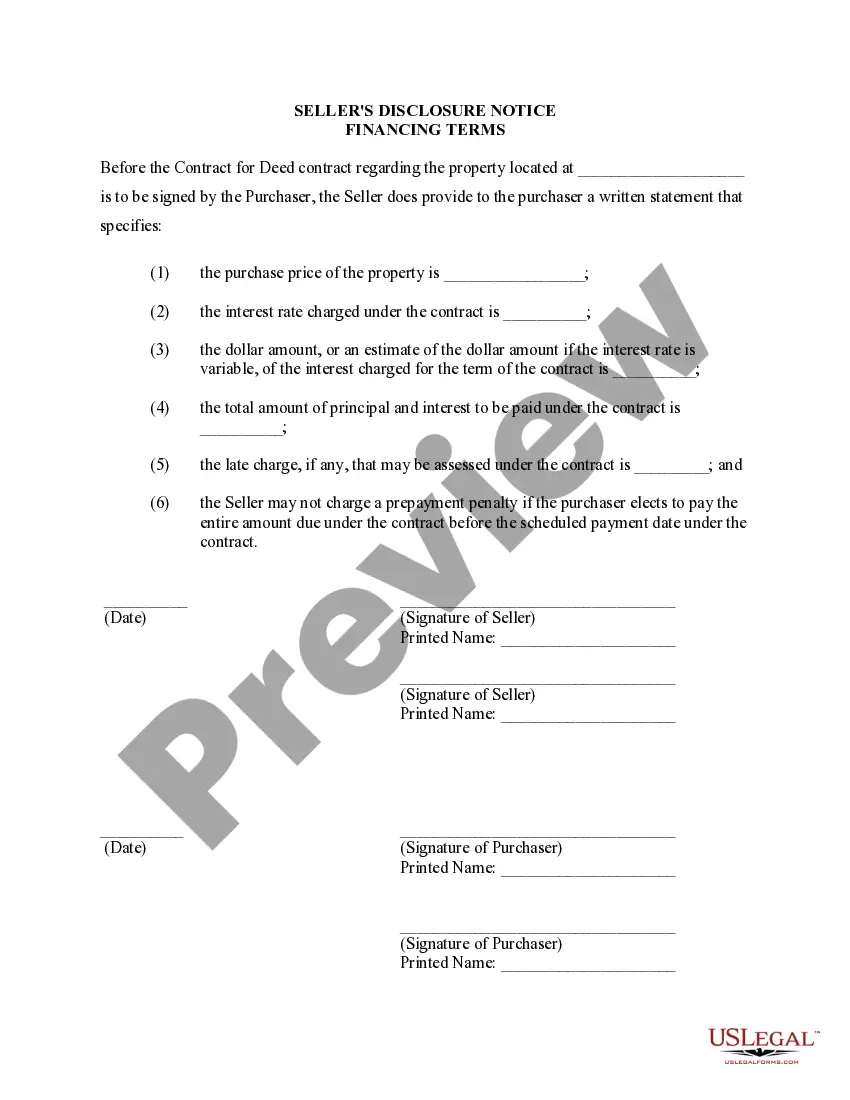

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Columbus Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the financial terms and conditions between the seller and buyer in a real estate transaction. This disclosure is required by law and provides important information about the financing arrangement, protecting the interests of both parties involved. It ensures transparency and allows the buyer to make informed decisions before entering into the agreement. The document typically includes key details such as: 1. Purchase Price: The agreed-upon price for the property is stated clearly in the disclosure. This is the amount that the buyer will pay over the course of the contract. 2. Down Payment: The initial amount of money that the buyer must pay upfront towards the purchase price. It is often expressed as a percentage of the total purchase price. 3. Financing Terms: This section outlines the specific terms of the seller financing. It includes details such as the interest rate, length of the contract, monthly payment amount, and any other relevant provisions. 4. Balloon Payment: In some cases, the contract may include a balloon payment. This means that at a specified point during the contract, the buyer must pay off the remaining balance in a lump sum. The disclosure will clearly state if this provision is included and when it is due. 5. Default and Remedies: This section outlines the consequences for both the buyer and seller if either party fails to uphold their obligations as outlined in the contract. It includes information about late payment penalties, default remedies, and the process for resolving disputes. Different types of Columbus Ohio Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may exist based on variations in specific terms or additional clauses. Some possible variations could include: 1. Adjustable-Rate Land Contract: This type of financing involves an interest rate that can change over time based on market conditions. The disclosure will specify the terms and frequency of rate adjustments. 2. Fixed-Rate Land Contract: In contrast to an adjustable-rate land contract, a fixed-rate land contract has a consistent interest rate throughout the duration of the contract. The disclosure will provide the fixed interest rate agreed upon by the parties. 3. Step-Up Land Contract: A step-up land contract involves a gradual increase in the interest rate over time. The disclosure will detail the schedule of rate increases and the subsequent changes in the monthly payment amount. It is important for buyers and sellers to carefully review the Columbus Ohio Seller's Disclosure of Financing Terms before signing the contract or agreement for deed. Consulting with legal professionals or real estate agents can provide necessary guidance and ensure that the terms are fair and reasonable for all parties involved.