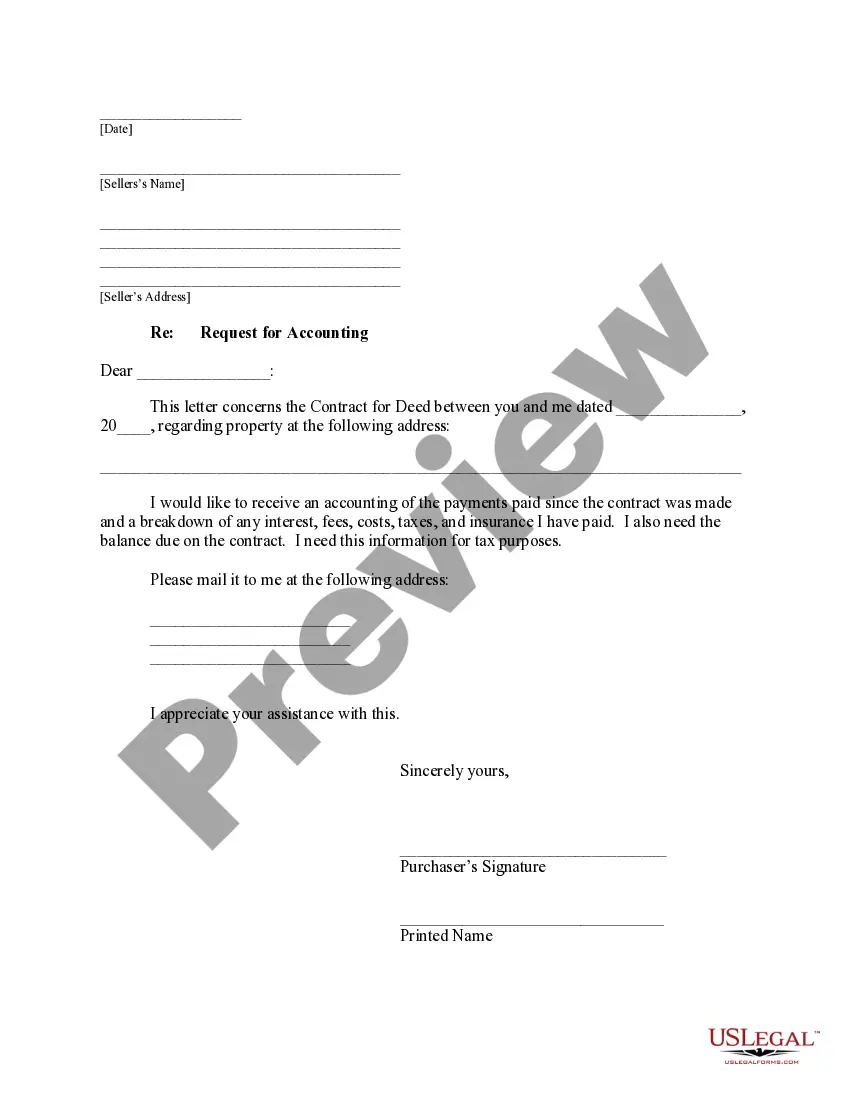

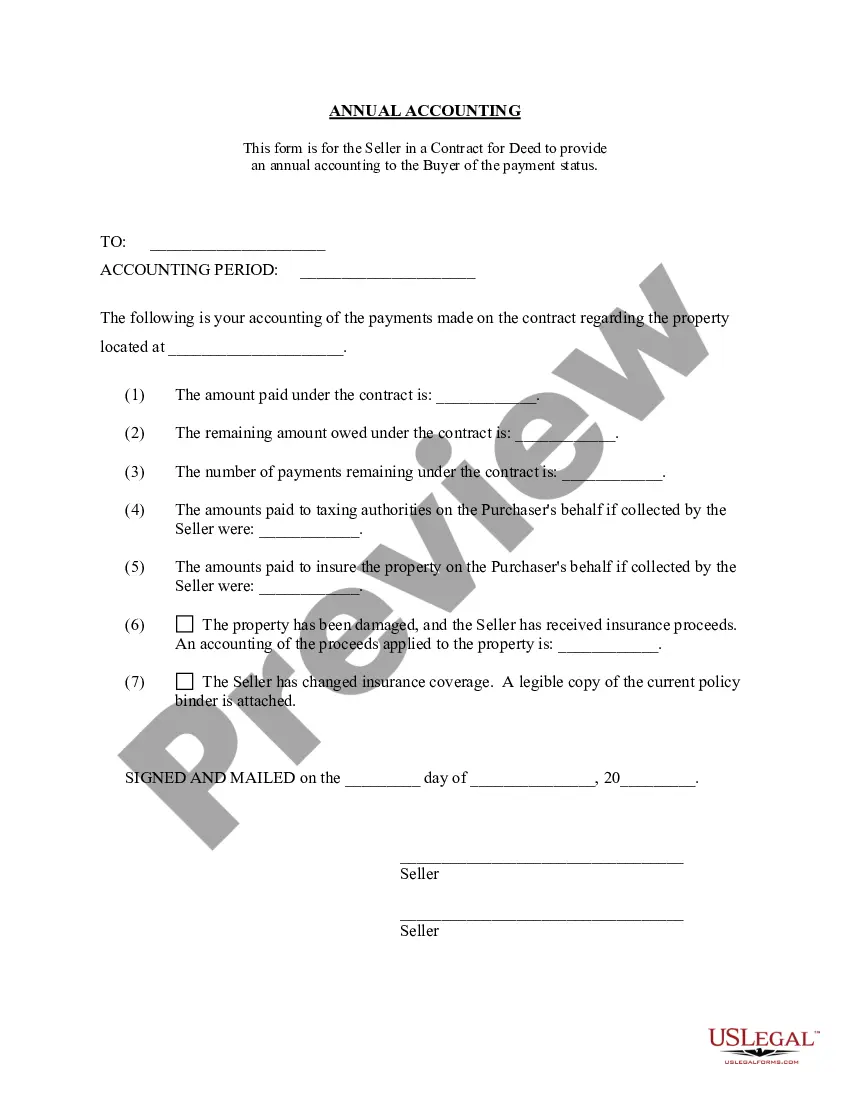

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

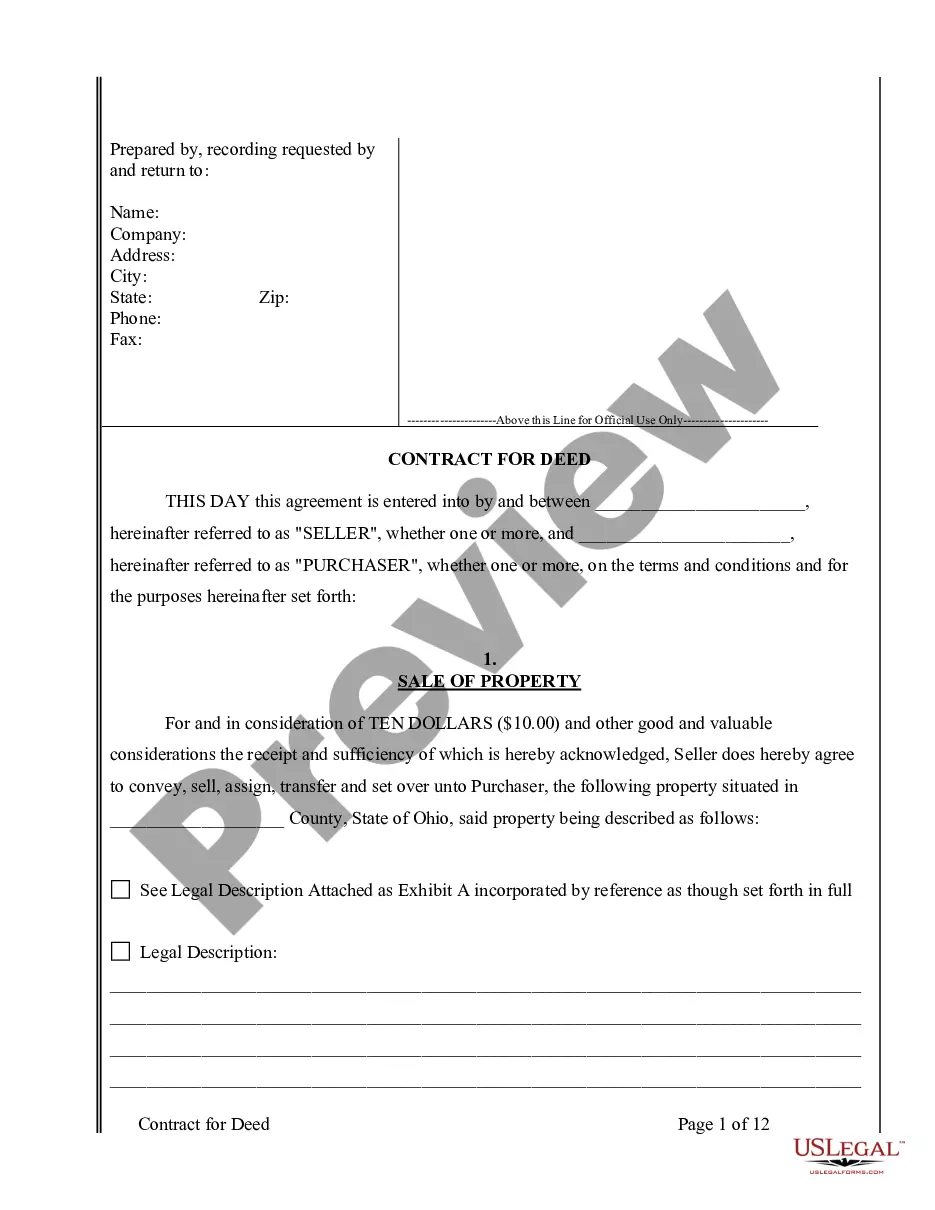

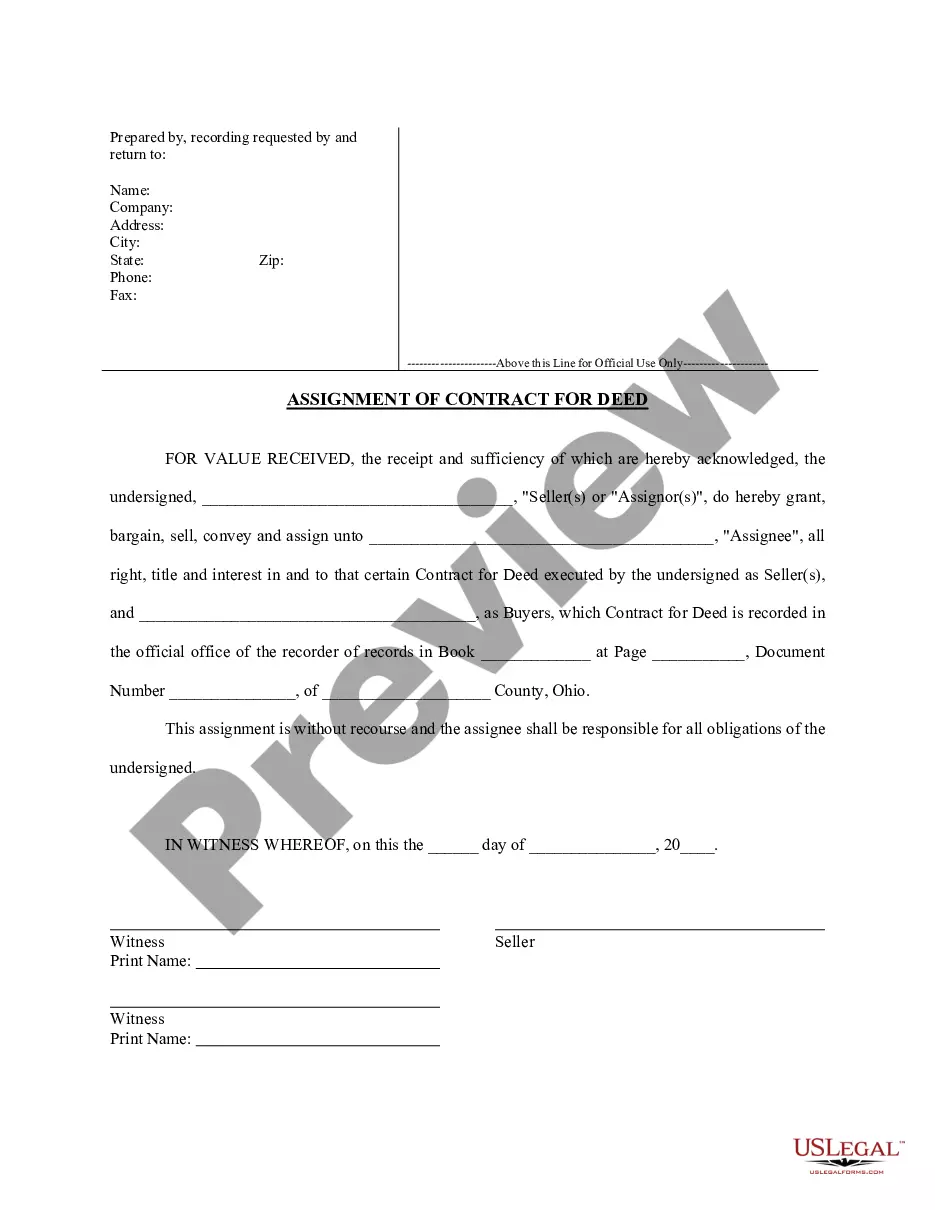

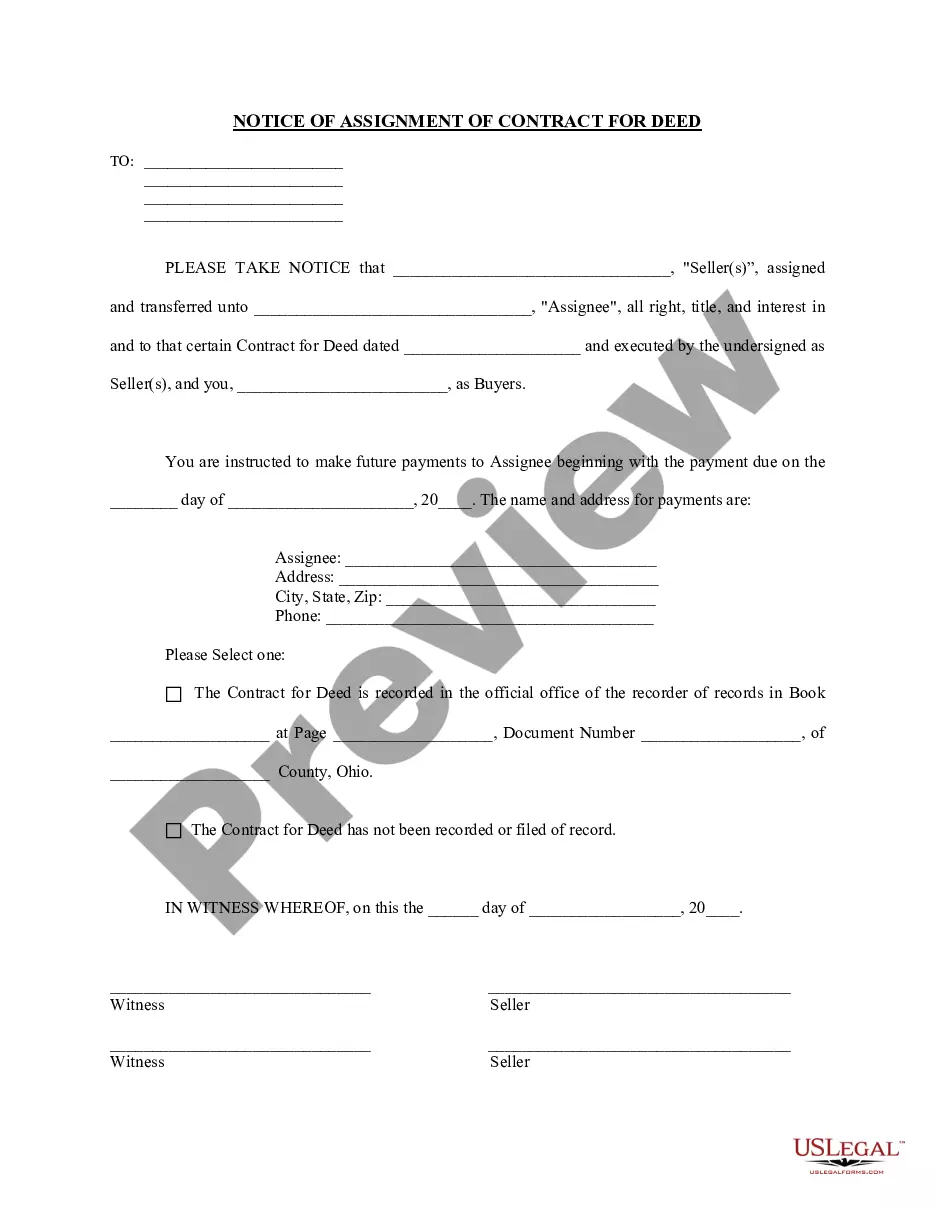

The Columbus Ohio Contract for Deed Seller's Annual Accounting Statement is a financial document provided by the seller of a property that is being sold through a contract for deed agreement in Columbus, Ohio. This statement serves as an annual report of the financial transactions related to the contract for deed agreement. The purpose of the Columbus Ohio Contract for Deed Seller's Annual Accounting Statement is to ensure transparency and accountability between the seller and the buyer of the property. It provides an overview of the income and expenses associated with the contract for deed, allowing the buyer to track their payments and understand the financial status of the agreement. The statement includes various relevant keywords, such as: 1. Contract for Deed: This refers to a legal agreement wherein the buyer agrees to pay installments directly to the seller instead of obtaining traditional mortgage financing. The seller retains legal ownership until the buyer fulfills the terms of the agreement. 2. Seller: The individual or entity that is selling the property and financing the transaction through a contract for deed. 3. Annual Accounting Statement: This statement is prepared annually, usually at the end of the calendar year, and provides a comprehensive overview of the financial transactions related to the contract for deed. 4. Income: This section of the statement includes all the payments received by the seller from the buyer, including principal and interest payments. 5. Expenses: This section encompasses any expenses incurred by the seller in relation to the property or the contract for deed agreement, such as property taxes, insurance, maintenance costs, or legal fees. 6. Outstanding Principal: This refers to the remaining balance of the purchase price that the buyer still owes on the property. 7. Interest: The interest section of the statement describes the interest charged on the contract for deed payments. It outlines the percentage rate being charged and the interest accrued during the reporting period. It is important to note that there may be variations in the types of Columbus Ohio Contract for Deed Seller's Annual Accounting Statement, depending on the specific terms and provisions of the contract for deed agreement. These variations may include different formatting styles or additional sections specific to certain agreements. However, the general purpose of the statement remains consistent across different types.

The Columbus Ohio Contract for Deed Seller's Annual Accounting Statement is a financial document provided by the seller of a property that is being sold through a contract for deed agreement in Columbus, Ohio. This statement serves as an annual report of the financial transactions related to the contract for deed agreement. The purpose of the Columbus Ohio Contract for Deed Seller's Annual Accounting Statement is to ensure transparency and accountability between the seller and the buyer of the property. It provides an overview of the income and expenses associated with the contract for deed, allowing the buyer to track their payments and understand the financial status of the agreement. The statement includes various relevant keywords, such as: 1. Contract for Deed: This refers to a legal agreement wherein the buyer agrees to pay installments directly to the seller instead of obtaining traditional mortgage financing. The seller retains legal ownership until the buyer fulfills the terms of the agreement. 2. Seller: The individual or entity that is selling the property and financing the transaction through a contract for deed. 3. Annual Accounting Statement: This statement is prepared annually, usually at the end of the calendar year, and provides a comprehensive overview of the financial transactions related to the contract for deed. 4. Income: This section of the statement includes all the payments received by the seller from the buyer, including principal and interest payments. 5. Expenses: This section encompasses any expenses incurred by the seller in relation to the property or the contract for deed agreement, such as property taxes, insurance, maintenance costs, or legal fees. 6. Outstanding Principal: This refers to the remaining balance of the purchase price that the buyer still owes on the property. 7. Interest: The interest section of the statement describes the interest charged on the contract for deed payments. It outlines the percentage rate being charged and the interest accrued during the reporting period. It is important to note that there may be variations in the types of Columbus Ohio Contract for Deed Seller's Annual Accounting Statement, depending on the specific terms and provisions of the contract for deed agreement. These variations may include different formatting styles or additional sections specific to certain agreements. However, the general purpose of the statement remains consistent across different types.