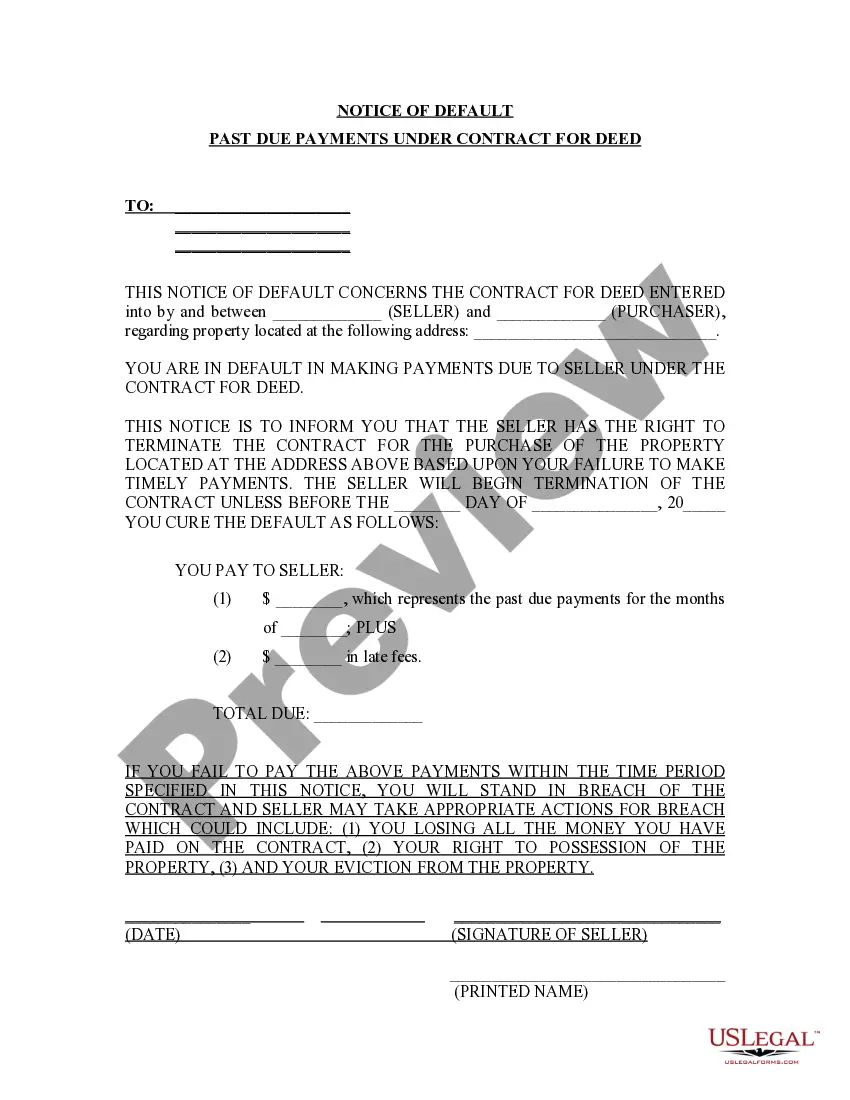

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

A Franklin Ohio Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that informs the buyer (also known as the Vendée) that they have failed to make timely payments as agreed upon in the contract. This notice acts as a warning to the buyer that they are in breach of their contractual obligations and gives them an opportunity to cure the default before further legal action is taken. This type of notice is specific to Franklin, Ohio and typically targets cases where a buyer has entered into a Contract for Deed, also known as a land contract. This agreement allows the buyer to purchase the property directly from the seller (also known as the vendor) without obtaining traditional financing from a bank or mortgage lender. Instead, the buyer pays the purchase price in installments to the seller over a specified period. Laurel Creek Estates, Brookside Estates, Willowbrook Estates, Highlands Estates, and Maple Creek Estates are some examples of residential areas where a Notice of Default for Past Due Payments in connection with a Contract for Deed may be relevant in Franklin, Ohio. When a buyer defaults on their payments, the vendor has the right to initiate the repossession process. However, the Notice of Default provides the buyer with a grace period to rectify the non-payment before the contract is terminated and foreclosure proceedings begin. Key information included in a Franklin Ohio Notice of Default for Past Due Payments may consist of the following: 1. Names and addresses of both the buyer (Vendée) and seller (vendor) 2. Date of the original Contract for Deed 3. Outstanding payment amount and dates of missed payments 4. Specific clauses from the Contract for Deed that have been violated 5. The number of days given to cure the default (usually 30 days) 6. Instructions for making the missed payments and potential penalties for late payment 7. Contact information for the vendor or their legal representative 8. Statement indicating that failure to cure the default will result in termination of the contract and potential foreclosure proceedings It is crucial for both the buyer and seller to understand the implications of a Franklin Ohio Notice of Default for Past Due Payments in connection with a Contract for Deed. Buyers should review their contractual obligations and ensure timely payments to avoid default and potential foreclosure, while sellers should utilize this notice as a means to enforce the terms of the agreement and protect their interests.A Franklin Ohio Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that informs the buyer (also known as the Vendée) that they have failed to make timely payments as agreed upon in the contract. This notice acts as a warning to the buyer that they are in breach of their contractual obligations and gives them an opportunity to cure the default before further legal action is taken. This type of notice is specific to Franklin, Ohio and typically targets cases where a buyer has entered into a Contract for Deed, also known as a land contract. This agreement allows the buyer to purchase the property directly from the seller (also known as the vendor) without obtaining traditional financing from a bank or mortgage lender. Instead, the buyer pays the purchase price in installments to the seller over a specified period. Laurel Creek Estates, Brookside Estates, Willowbrook Estates, Highlands Estates, and Maple Creek Estates are some examples of residential areas where a Notice of Default for Past Due Payments in connection with a Contract for Deed may be relevant in Franklin, Ohio. When a buyer defaults on their payments, the vendor has the right to initiate the repossession process. However, the Notice of Default provides the buyer with a grace period to rectify the non-payment before the contract is terminated and foreclosure proceedings begin. Key information included in a Franklin Ohio Notice of Default for Past Due Payments may consist of the following: 1. Names and addresses of both the buyer (Vendée) and seller (vendor) 2. Date of the original Contract for Deed 3. Outstanding payment amount and dates of missed payments 4. Specific clauses from the Contract for Deed that have been violated 5. The number of days given to cure the default (usually 30 days) 6. Instructions for making the missed payments and potential penalties for late payment 7. Contact information for the vendor or their legal representative 8. Statement indicating that failure to cure the default will result in termination of the contract and potential foreclosure proceedings It is crucial for both the buyer and seller to understand the implications of a Franklin Ohio Notice of Default for Past Due Payments in connection with a Contract for Deed. Buyers should review their contractual obligations and ensure timely payments to avoid default and potential foreclosure, while sellers should utilize this notice as a means to enforce the terms of the agreement and protect their interests.