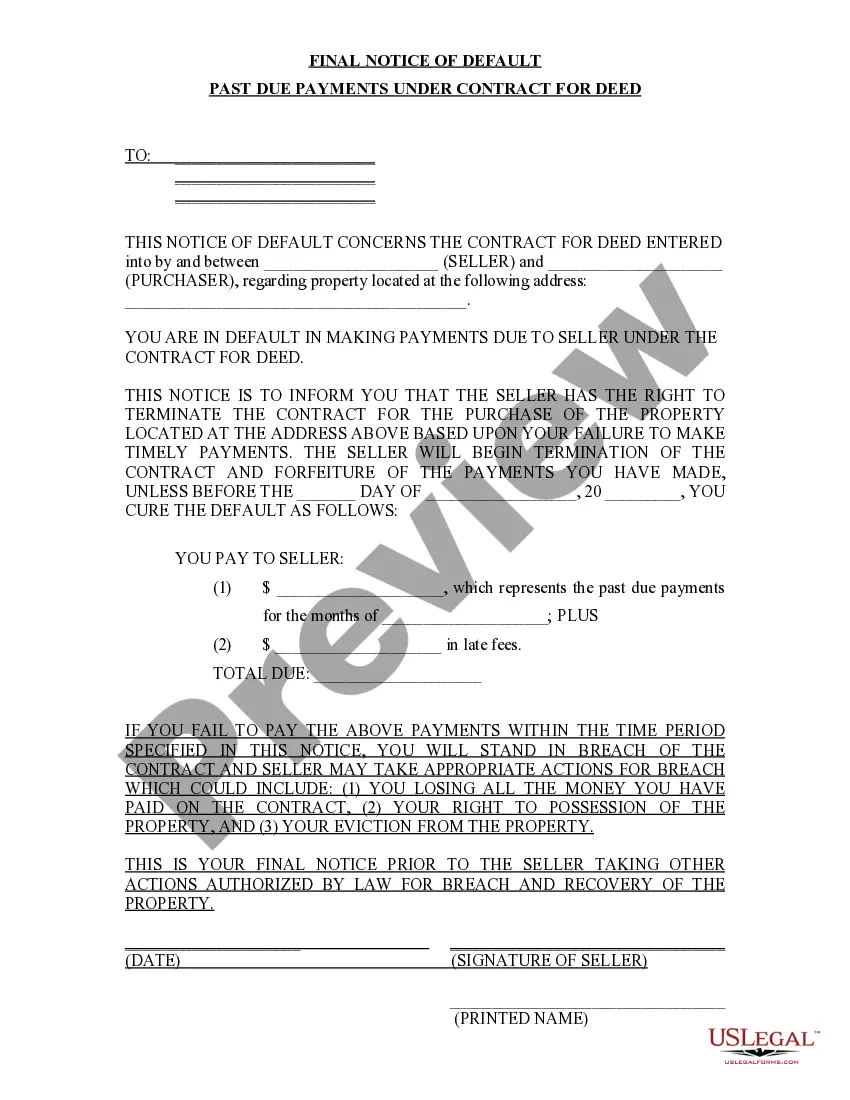

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with Contract for Deed Introduction: In Cuyahoga, Ohio, those involved in a Contract for Deed must be aware of the possibility of receiving a Final Notice of Default for Past Due Payments. This notice serves as an important document that highlights a breach in the agreed-upon payment terms. This article aims to provide a comprehensive understanding of what a Final Notice of Default entails and its implications for both parties involved. 1. Definition and Purpose: A Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal communication issued by the party holding the title of the property to the buyer or the one fulfilling the contract's payment obligations. Its key purpose is to notify the recipient that they are in default due to significant overdue payments. 2. Content and Language: The notice should be concise and include essential details such as the names of both parties involved, a specific description of the property, the exact amount overdue, and the duration of the delinquency. It should also mention that failure to remedy the default within a set timeframe may lead to further legal actions. 3. Types of Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with Contract for Deed: a) Initial Notice of Default: This is the first notice sent to the buyer as soon as they miss a payment or breach any payment condition mentioned in the Contract for Deed. It serves as an initial warning and gives the buyer an opportunity to rectify the situation promptly. b) Second Notice of Default: If the buyer fails to rectify the default within the specified period mentioned in the Initial Notice of Default, a Second Notice of Default is sent. This notice carries more significance and often outlines the potential consequences of continued non-compliance. c) Final Notice of Default: When all prior notices fail to evoke payment or a resolution from the defaulting party, the Final Notice of Default is issued. It serves as the last chance for the buyer to settle the overdue payment before further legal action is pursued by the seller. 4. Implications and Consequences: Receiving a Cuyahoga Ohio Final Notice of Default may have several consequences, including: — Potential cancellation of the Contract for Deed. — Possible forfeiture of any equity or payments already made. — Initiation of foreclosure proceedings by the seller. — The buyer's credit score being negatively impacted. Conclusion: Understanding the Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for buyers and sellers alike. It serves as a mechanism to ensure compliance with payment terms and facilitates the resolution of disputes. By responding promptly and working towards resolving the default, buyers can prevent the severe consequences associated with continued non-compliance, including potential foreclosure.Title: Understanding Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with Contract for Deed Introduction: In Cuyahoga, Ohio, those involved in a Contract for Deed must be aware of the possibility of receiving a Final Notice of Default for Past Due Payments. This notice serves as an important document that highlights a breach in the agreed-upon payment terms. This article aims to provide a comprehensive understanding of what a Final Notice of Default entails and its implications for both parties involved. 1. Definition and Purpose: A Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal communication issued by the party holding the title of the property to the buyer or the one fulfilling the contract's payment obligations. Its key purpose is to notify the recipient that they are in default due to significant overdue payments. 2. Content and Language: The notice should be concise and include essential details such as the names of both parties involved, a specific description of the property, the exact amount overdue, and the duration of the delinquency. It should also mention that failure to remedy the default within a set timeframe may lead to further legal actions. 3. Types of Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with Contract for Deed: a) Initial Notice of Default: This is the first notice sent to the buyer as soon as they miss a payment or breach any payment condition mentioned in the Contract for Deed. It serves as an initial warning and gives the buyer an opportunity to rectify the situation promptly. b) Second Notice of Default: If the buyer fails to rectify the default within the specified period mentioned in the Initial Notice of Default, a Second Notice of Default is sent. This notice carries more significance and often outlines the potential consequences of continued non-compliance. c) Final Notice of Default: When all prior notices fail to evoke payment or a resolution from the defaulting party, the Final Notice of Default is issued. It serves as the last chance for the buyer to settle the overdue payment before further legal action is pursued by the seller. 4. Implications and Consequences: Receiving a Cuyahoga Ohio Final Notice of Default may have several consequences, including: — Potential cancellation of the Contract for Deed. — Possible forfeiture of any equity or payments already made. — Initiation of foreclosure proceedings by the seller. — The buyer's credit score being negatively impacted. Conclusion: Understanding the Cuyahoga Ohio Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for buyers and sellers alike. It serves as a mechanism to ensure compliance with payment terms and facilitates the resolution of disputes. By responding promptly and working towards resolving the default, buyers can prevent the severe consequences associated with continued non-compliance, including potential foreclosure.