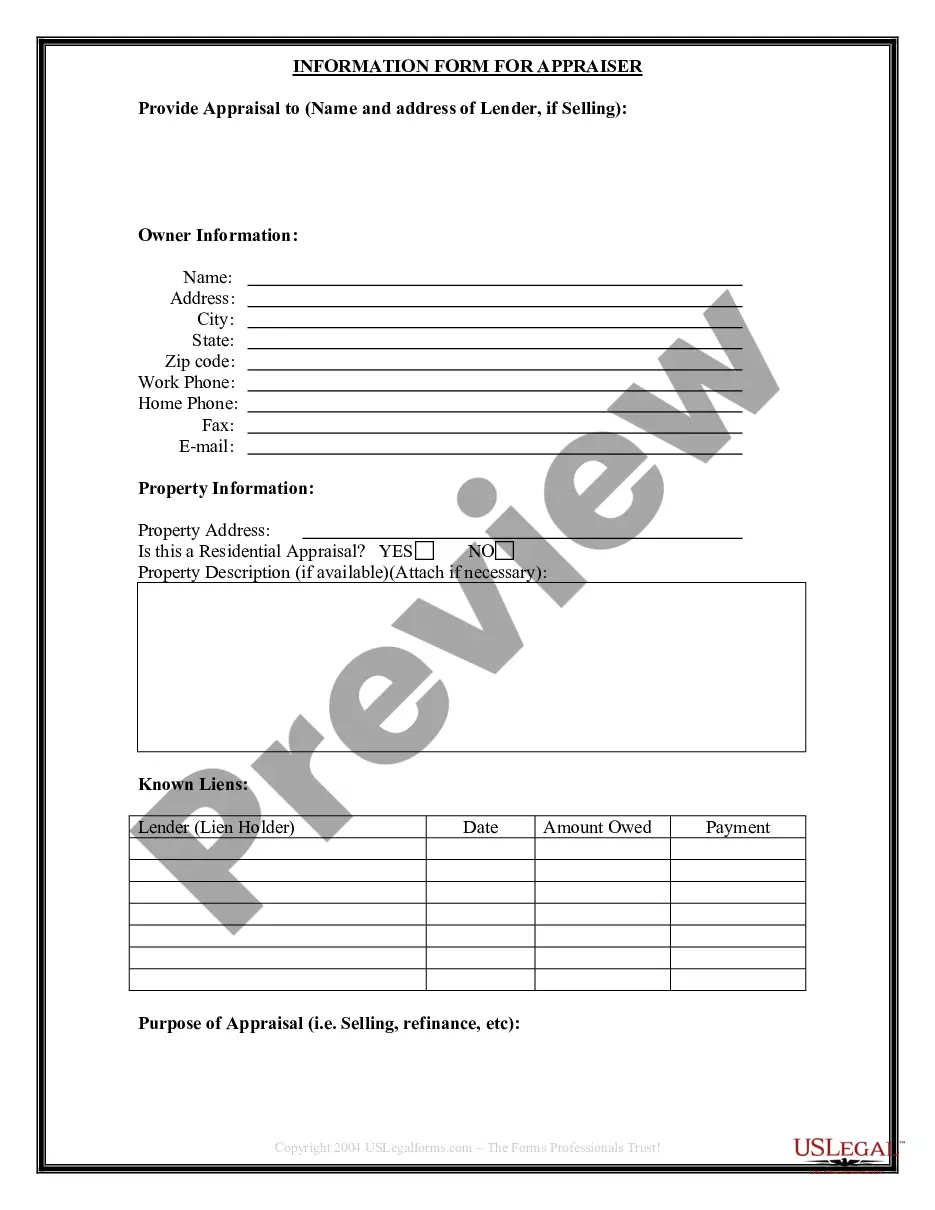

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Ohio to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Cuyahoga Ohio Seller's Information for Appraiser provided to Buyer serves as a valuable resource when conducting a property appraisal. This information is crucial for appraisers to gather insights about the property's history, condition, and any potential factors that may affect its value. By understanding the specific details related to a property’s seller, appraisers can provide accurate and informed valuations to potential buyers. When compiling Cuyahoga Ohio Seller's Information for Appraiser provided to Buyer, various categories can be included: 1. Property History: This section outlines the property's past ownership, including details regarding any transfers, renovations, or major repairs conducted over the years. It may also include information about previous sales, financing, and property tax history. Understanding the property's history is essential to evaluating its value accurately. 2. Property Characteristics: This segment focuses on the property's physical attributes. It encompasses detailed descriptions of the property's size, layout, number of rooms, and overall condition. Additional features like swimming pools, garages, or unique amenities may also be documented to provide a comprehensive overview to the appraiser. 3. Documentation of Improvements: This section emphasizes any recent enhancements or modifications made to the property. This can include details about renovations, additions, or upgrades to the house, such as new roofing, HVAC system installations, or kitchen renovations. Providing information about recent improvements helps appraisers determine how these changes may impact the property's overall value. 4. Existing Liens or Encumbrances: Appraisers need to be aware of any outstanding financial obligations associated with the property. This includes mortgages, liens, judgments, or other encumbrances that could potentially affect the property's value. It is crucial for sellers to disclose this information accurately and transparently to ensure the appraiser considers these factors during the evaluation. 5. Neighborhood and Surrounding Area: This component aims to familiarize the appraiser with the neighborhood where the property is located. Information about nearby amenities, schools, transportation, and crime rates may be included. This data gives appraisers an understanding of the property's location and its impact on value. 6. Seller's Reason for Selling: While not directly influencing the appraisal process, understanding the seller's motivation for selling can provide insights into the property's potential negotiation flexibility or urgency. Sellers may choose to share their reasons, such as downsizing, job relocation, or family-related needs. By providing comprehensive Cuyahoga Ohio Seller's Information for Appraiser provided to Buyer, sellers ensure that appraisers have access to all relevant details to conduct an accurate assessment. This transparency benefits both sellers and buyers by facilitating fair and reliable property valuations.