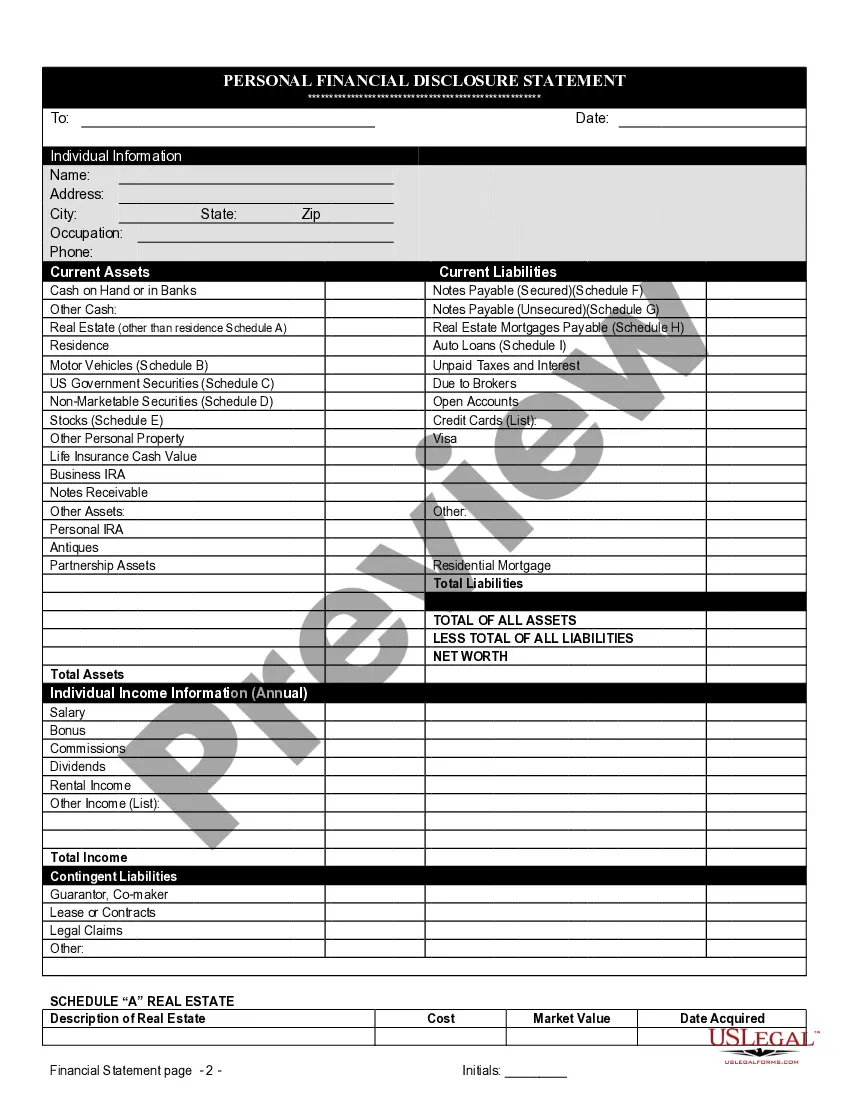

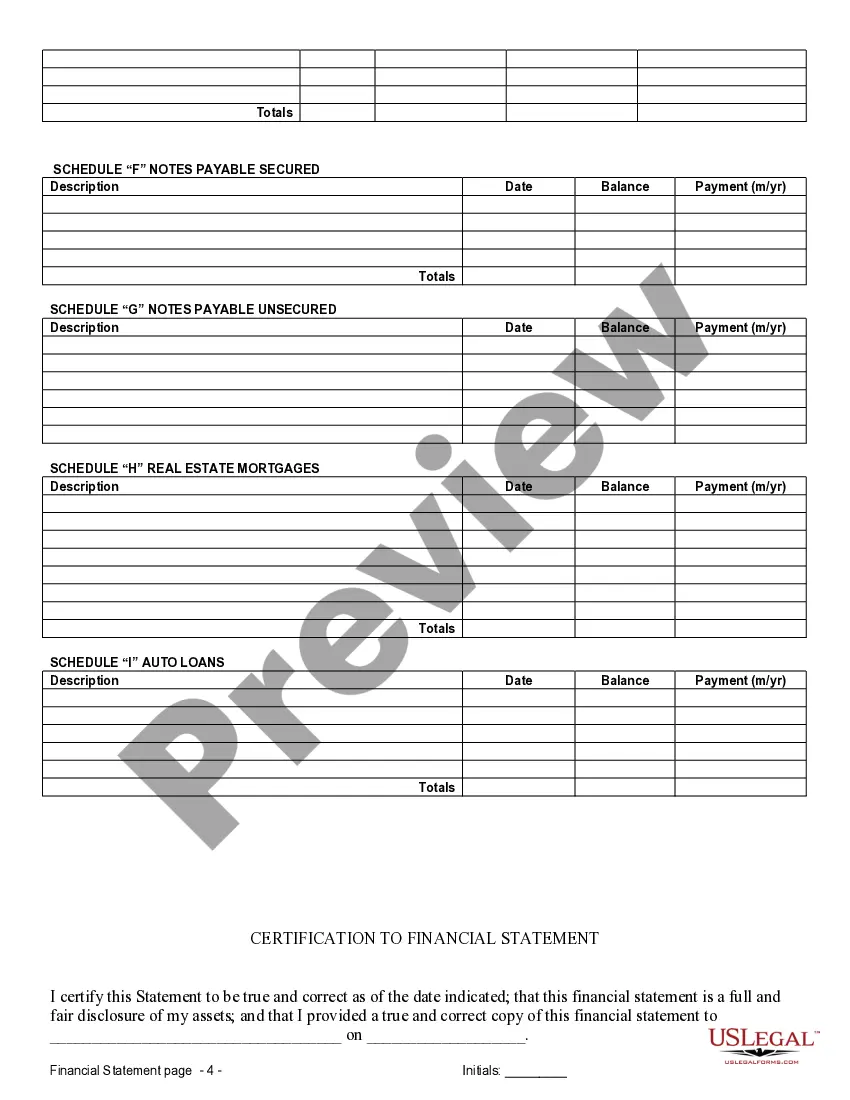

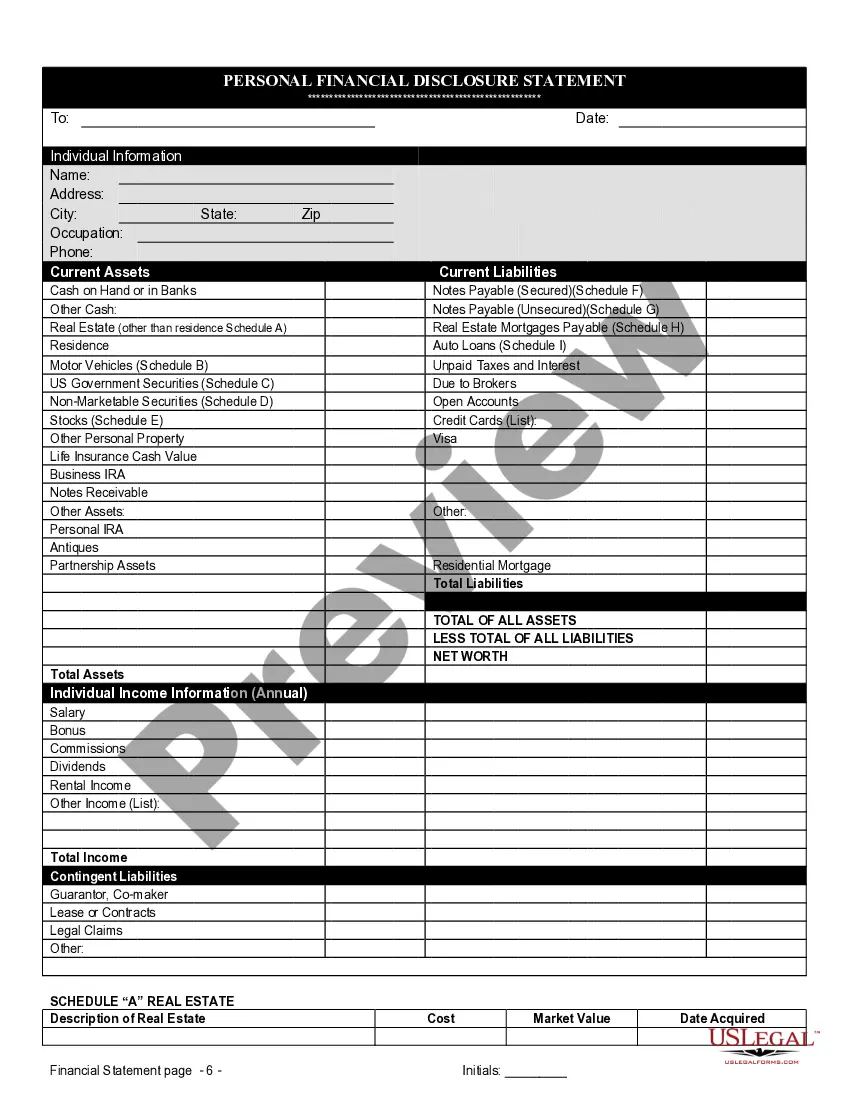

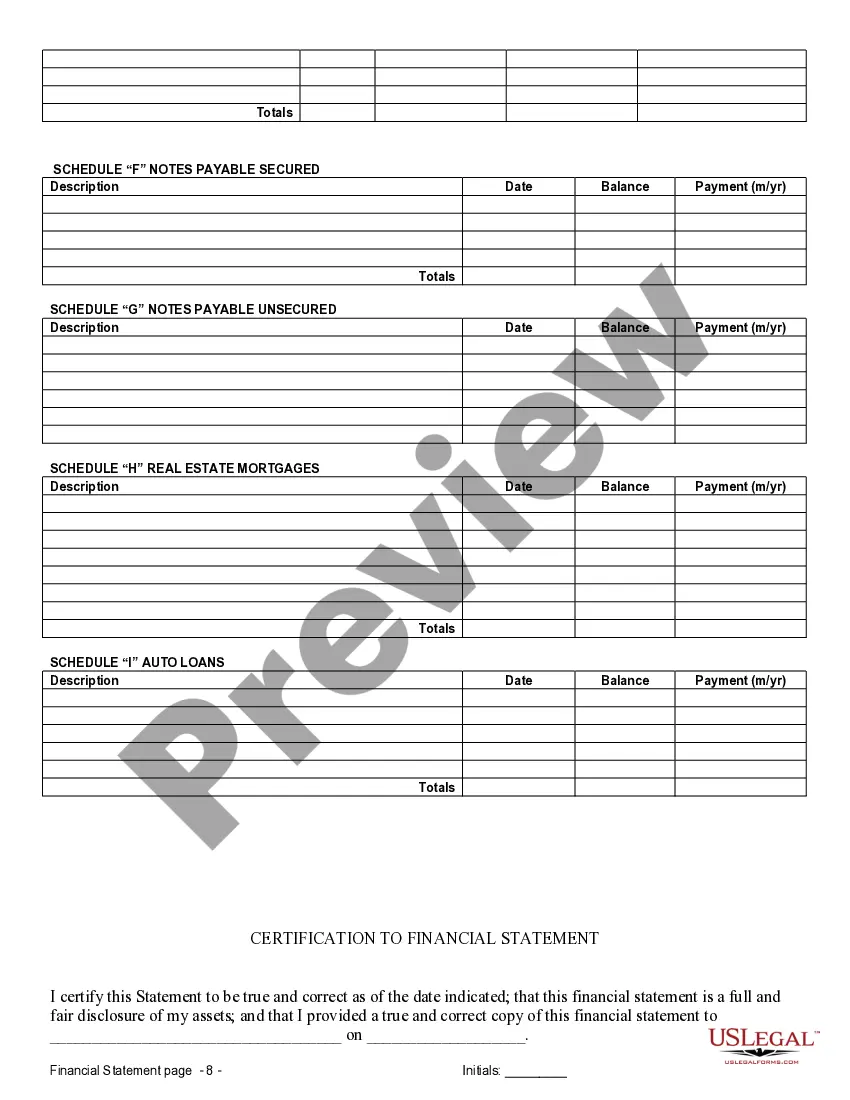

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Ohio Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Do you require a reliable and economical legal document provider to acquire the Cincinnati Ohio Financial Statements solely in Relation to Prenuptial Premarital Agreement? US Legal Forms is your prime selection.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a set of forms to progress your divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use.

All templates that we provide access to are not generic and are tailored based on the requirements of particular states and regions.

To obtain the document, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Now you can register your account. After that, select the subscription option and proceed with the payment. Once the payment is completed, download the Cincinnati Ohio Financial Statements solely in Relation to Prenuptial Premarital Agreement in any offered file format. You can return to the website at any moment and redownload the document without any additional costs.

Locating current legal forms has never been more straightforward. Give US Legal Forms a try today, and stop wasting your valuable time searching for legal documents online once and for all.

- Is this your first time visiting our site? No problem.

- You can create an account with great ease, but prior to that, ensure to do the following.

- Verify if the Cincinnati Ohio Financial Statements solely in Connection with Prenuptial Premarital Agreement complies with the regulations of your state and locality.

- Review the form's specifics (if available) to understand who and what the document pertains to.

- Restart the search if the template is inadequate for your legal situation.

Form popularity

FAQ

Most states, including Ohio, limit prenuptial agreements from including provisions regarding child custody and child support. Courts typically deem these matters essential to the welfare of the child, thus requiring that they be decided at the time of divorce rather than predetermined. When drafting your Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement, make sure to focus on financial matters and property rights, as this aligns with legal standards.

After signing a prenuptial agreement, it is advisable to wait until the agreement has been finalized and legally recognized before proceeding with your marriage. Typically, this could mean waiting a few days to a week. Ensure that both parties have had time to reflect on the Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement. This careful timing helps maintain clarity and commitment as you embark on your new journey together.

The 7-day rule serves as a guideline that suggests parties should give themselves at least seven days to review a prenuptial agreement before signing. This practice ensures both individuals can fully understand the terms and implications of the agreement, especially concerning Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement. It also helps safeguard against claims of coercion or lack of informed consent, promoting fairness in the relationship.

A prenuptial agreement holds significant value as it establishes clear terms for asset division in the event of a divorce. This agreement can reduce conflict and stress during an emotionally challenging time. In Cincinnati, Ohio, financial statements only in connection with prenuptial premarital agreements allow you to address complexities regarding your financial future openly. By approaching this topic proactively, you and your partner can achieve peace of mind and clarity.

Yes, Ohio recognizes prenuptial agreements as legally binding contracts. However, for them to be enforceable, both parties should fully disclose their financial situations. Utilizing Cincinnati, Ohio financial statements only in connection with prenuptial premarital agreements can provide transparency and mutual understanding. This practice promotes a successful and equitable agreement that benefits both partners.

In general, premarital assets are not automatically protected without a prenuptial agreement. Without a formal arrangement, courts often consider these assets in marital property disputes. In Cincinnati, Ohio, financial statements only in connection with a prenuptial premarital agreement play a crucial role in safeguarding your premarital assets. By outlining your financial situation clearly before marriage, you ensure better protection and clarity.

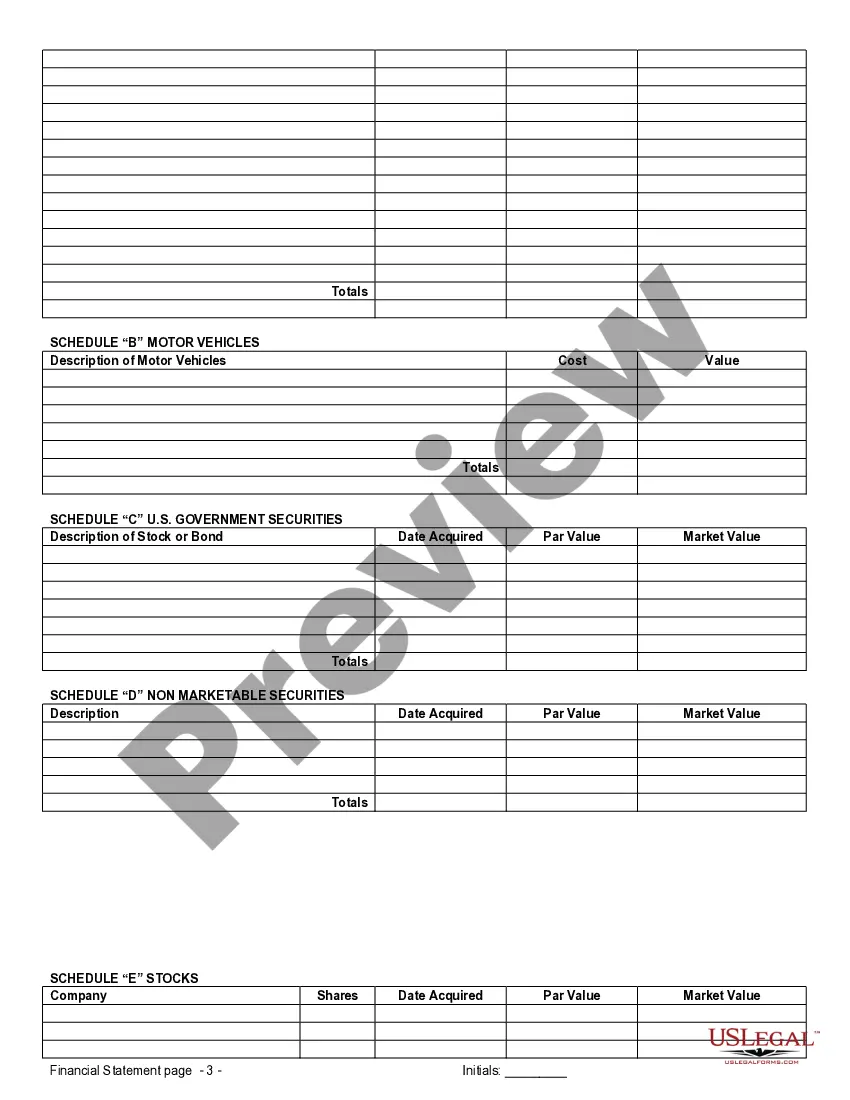

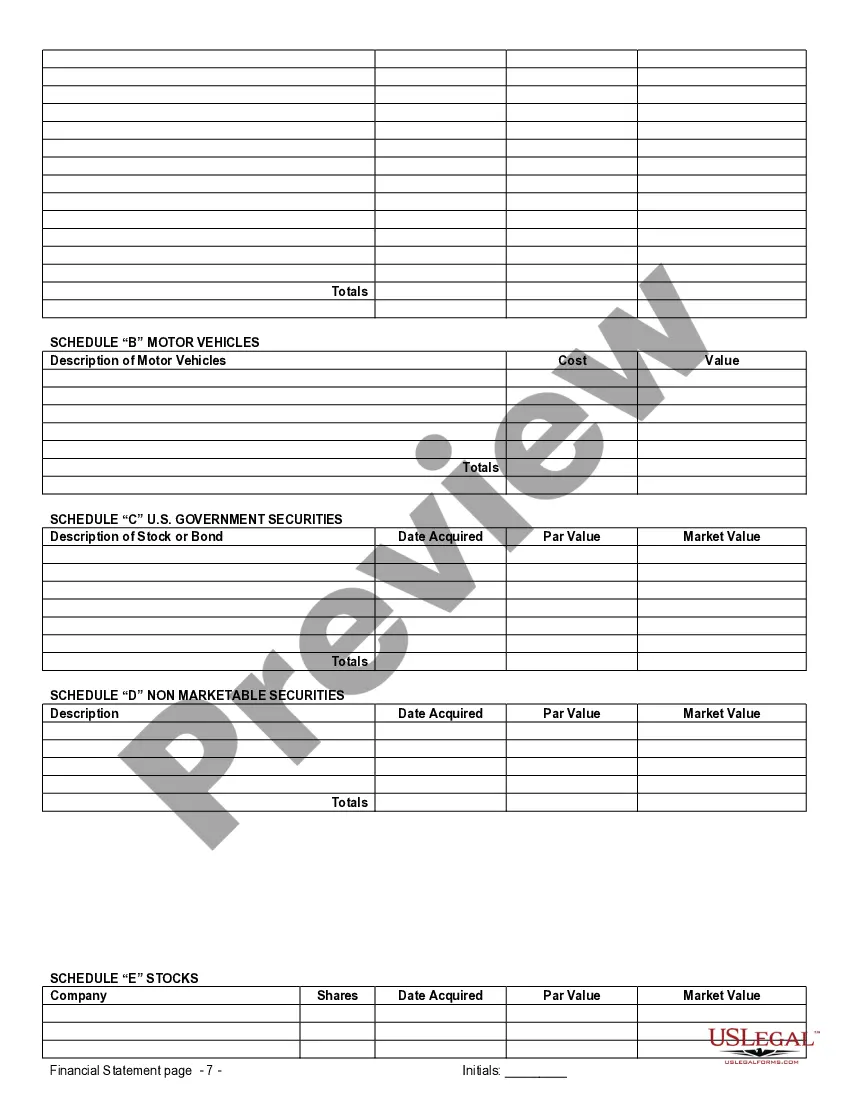

To effectively list assets for a prenup, create a detailed list of all financial accounts, properties, and valuable items. Ensure that each asset is described accurately, including its current market value. Using Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement can help you to compile this information systematically, making the prenuptial process more efficient.

Listing assets for divorce requires documenting all marital and individual property acquired during the marriage. This includes personal belongings, real estate, and investments. Engaging with Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement can facilitate a smoother process by providing a clear picture of asset distributions.

Documenting premarital assets involves creating a record of each asset's value and ownership prior to marriage. You can use official documents like titles, appraisals, and bank statements to establish proof of ownership. Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement serve as an effective tool to organize and validate this information.

A financial statement for a prenuptial agreement is a document detailing each partner's income, assets, and debts. This statement provides a clear overview of a couple's financial situation before marriage. Preparing Cincinnati Ohio Financial Statements only in Connection with Prenuptial Premarital Agreement ensures that both parties have an accurate reflection of their finances, which is crucial for a fair prenup.