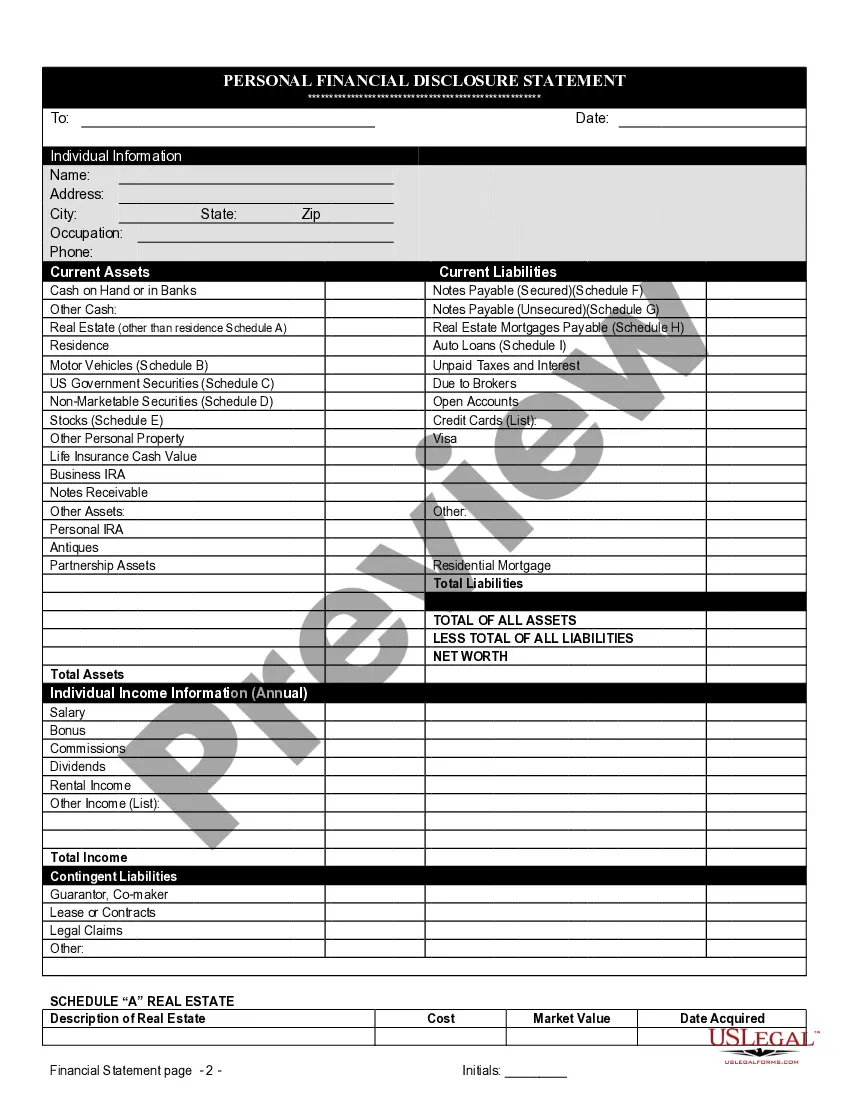

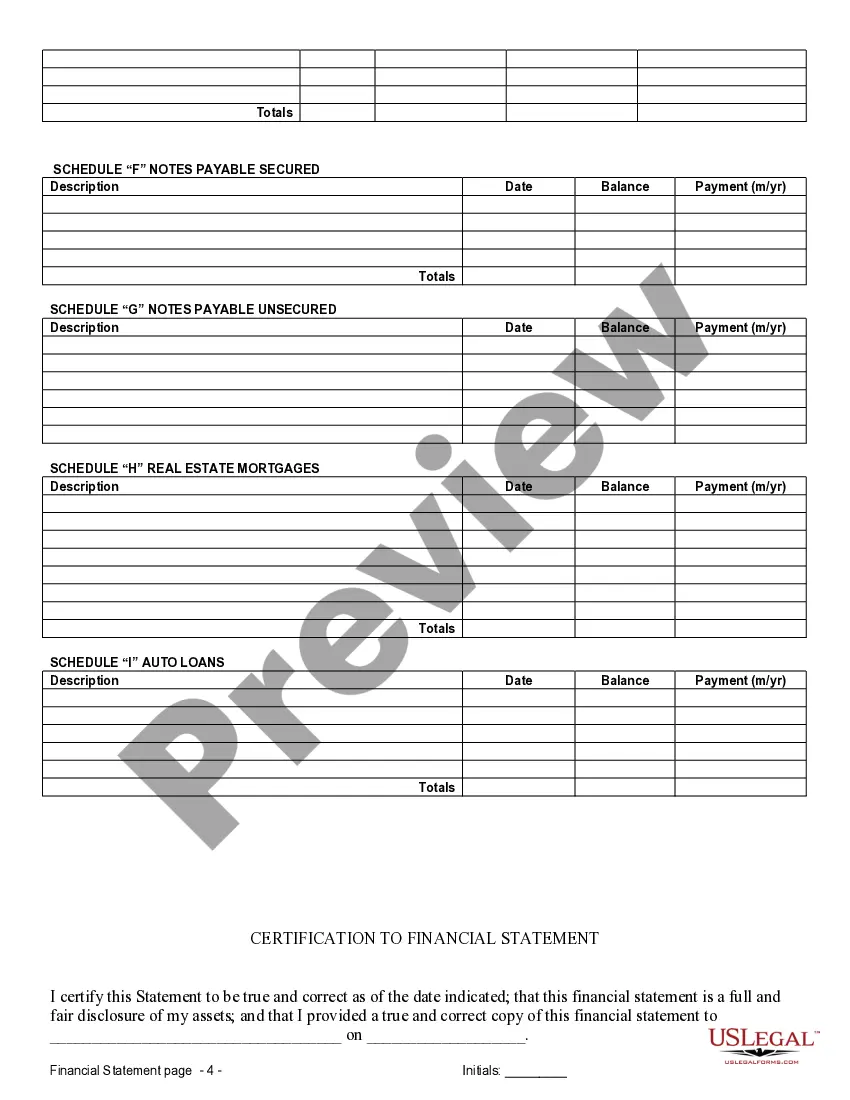

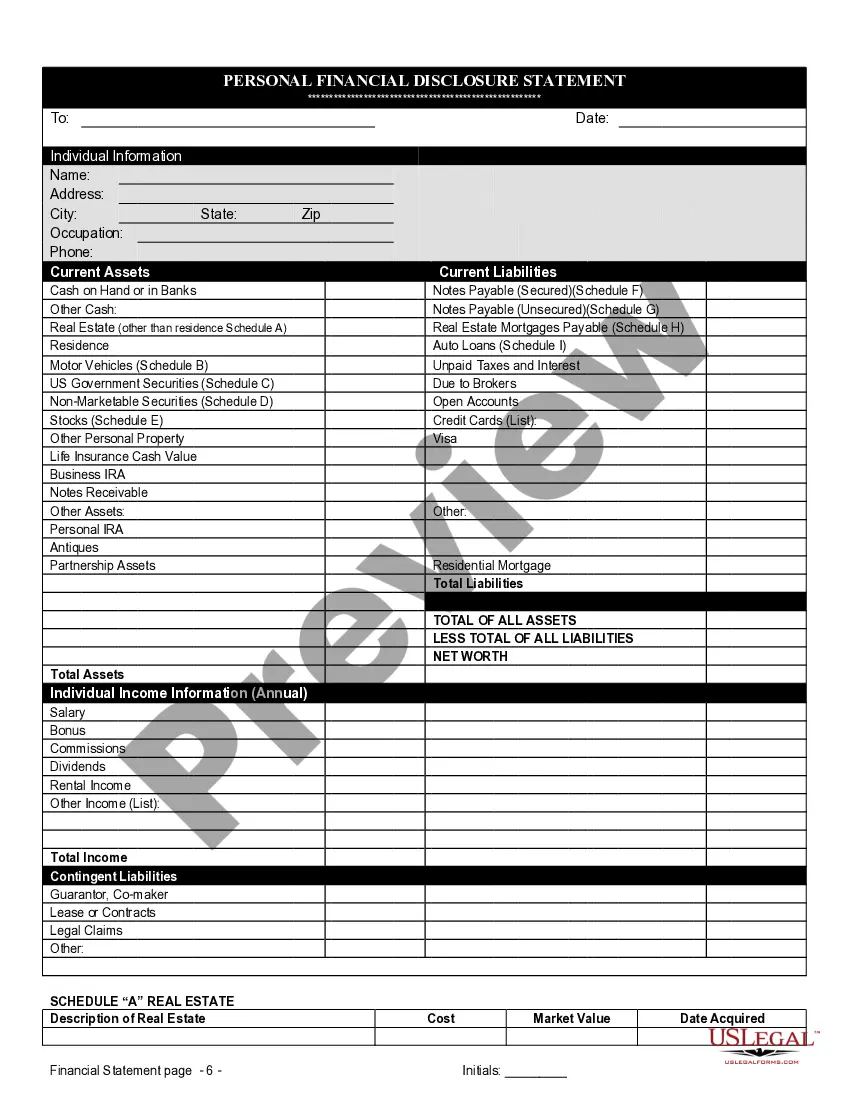

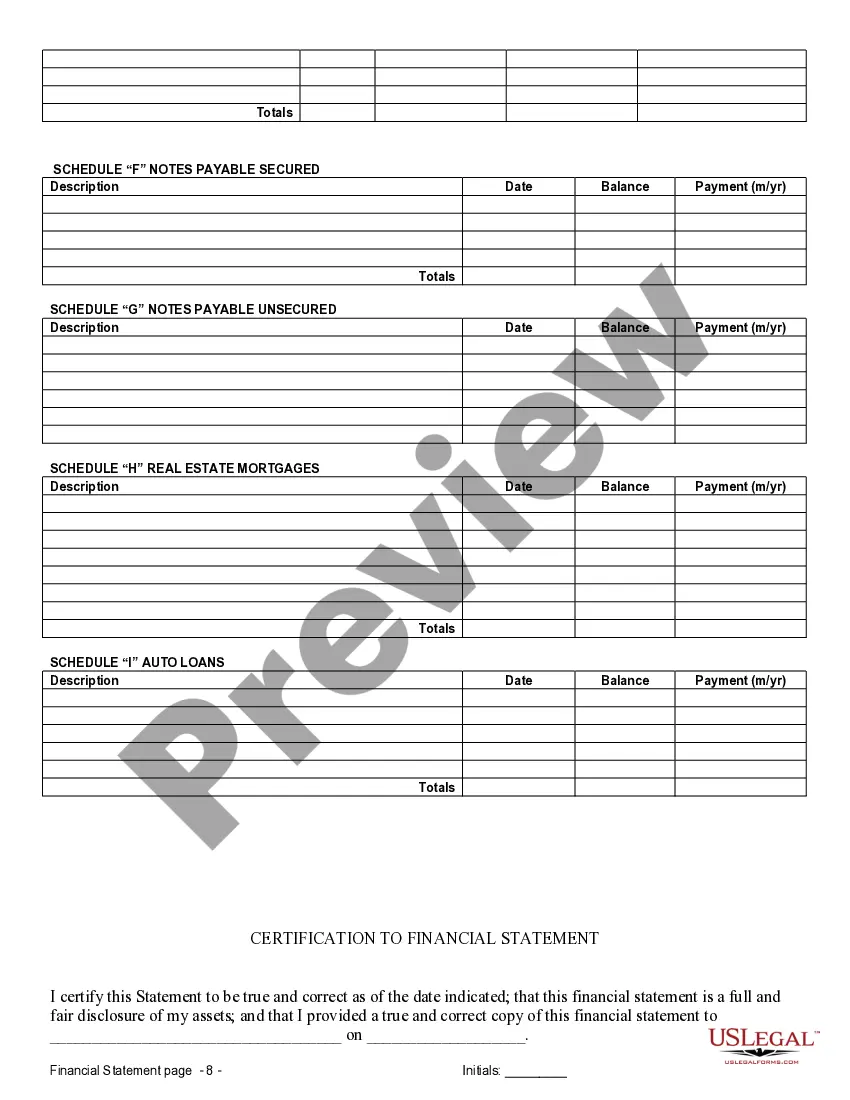

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

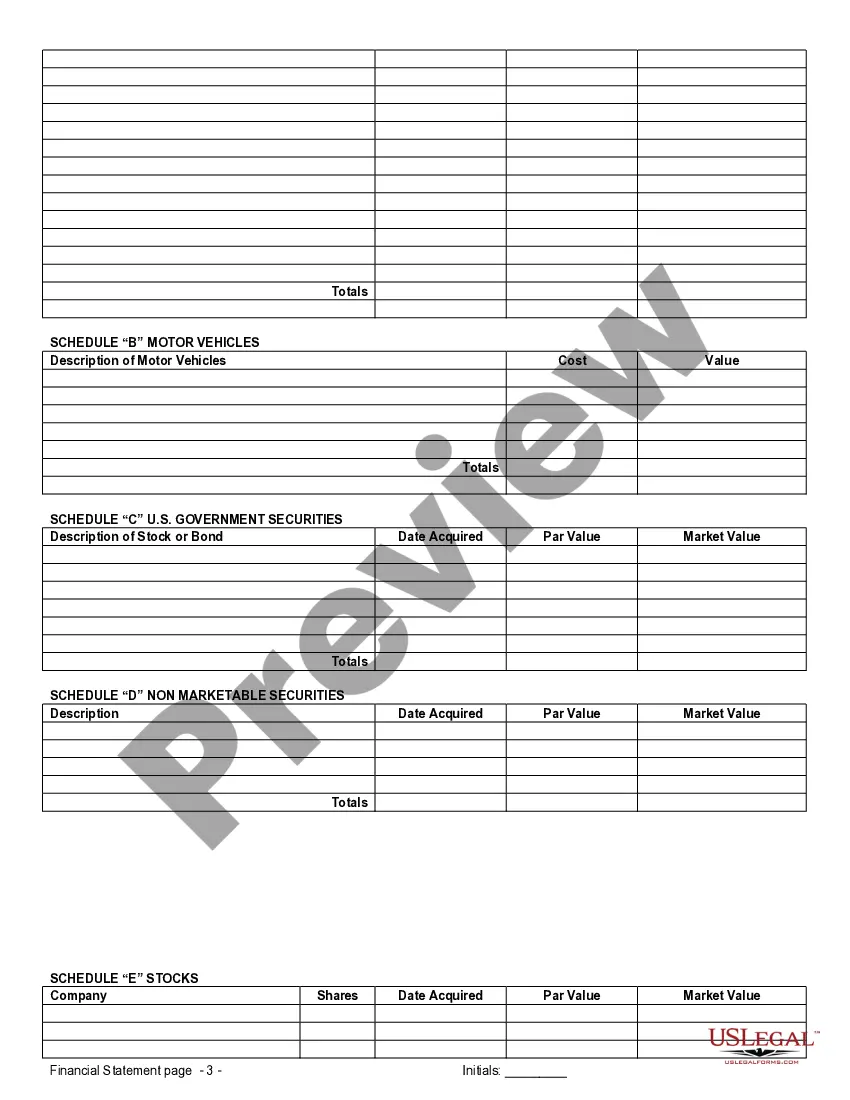

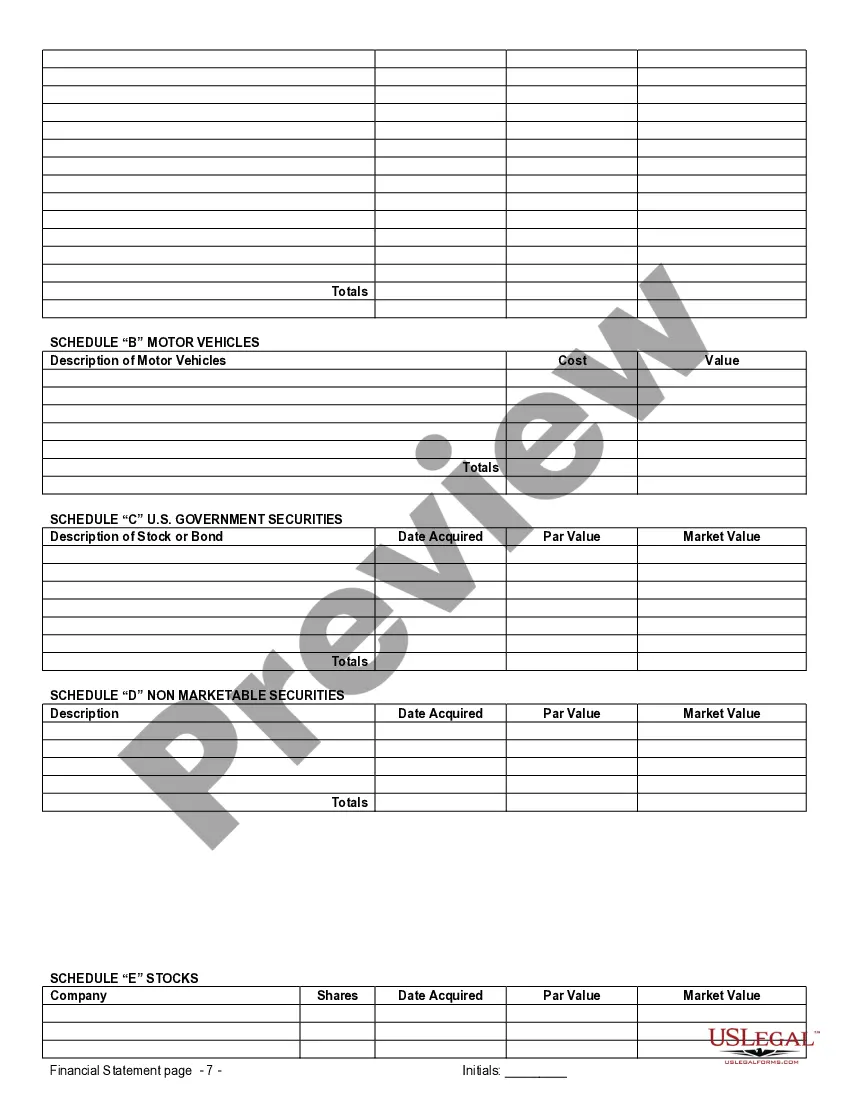

Columbus Ohio Financial Statements in connection with a prenuptial or premarital agreement refer to the comprehensive financial documents and reports required by individuals entering into a legal contract before their marriage. These statements aim to disclose the financial status, assets, liabilities, income, and debts of each party, ensuring full financial transparency between the spouses-to-be. When preparing a prenuptial agreement, the financial statements of both parties play a crucial role in determining the division of assets, debts, alimony, and other financial matters in case of divorce, separation, or death. These statements provide an accurate picture of each individual's financial standing, aiding in fair and equitable decision-making during the negotiation process. In Columbus, Ohio, there might be different types of financial statements used in connection with a prenuptial or premarital agreement, such as: 1. Personal Balance Sheet: This statement presents the individual's assets, including property, investments, bank accounts, retirement accounts, vehicles, and personal belongings, as well as their liabilities, such as mortgages, loans, and credit card debt. It offers a snapshot of one's net worth. 2. Income Statement: This statement showcases the individual's sources of income, including employment salaries, business profits, dividends, rental income, royalties, pensions, and any other means of earning. It also highlights expenses and financial commitments, helping to determine the financial contributions and potential maintenance obligations of each party. 3. Tax Returns: Individuals may be required to provide copies of their recent tax returns for a specific number of years. These documents substantiate the income declared, provide a record of previous financial dealings, and help gauge the taxable implications of certain assets. 4. Bank Statements: Providing bank statements demonstrates an individual's financial activities, account balances, and transactional history. It helps evaluate cash flow, spending patterns, and provides evidence for any financial claims made. 5. Investment Statements: Individuals may need to disclose their investment portfolios, including stocks, bonds, mutual funds, real estate portfolios, or any other investment holdings. These statements provide insight into the value, growth, and potential income derived from these investments. 6. Business Statements: If either party owns a business, financial statements related to the business, such as profit and loss statements, balance sheets, and cash flow statements, may be necessary to assess the business's value and potential income. It is essential to compile accurate and up-to-date financial statements as inconsistencies or incomplete information may potentially invalidate the prenuptial or premarital agreement. Seeking professional advice from lawyers or financial advisors experienced in family law and prenuptial agreements can help ensure compliance with Columbus, Ohio's requirements and guarantee the effectiveness of the financial statements in the legal context.Columbus Ohio Financial Statements in connection with a prenuptial or premarital agreement refer to the comprehensive financial documents and reports required by individuals entering into a legal contract before their marriage. These statements aim to disclose the financial status, assets, liabilities, income, and debts of each party, ensuring full financial transparency between the spouses-to-be. When preparing a prenuptial agreement, the financial statements of both parties play a crucial role in determining the division of assets, debts, alimony, and other financial matters in case of divorce, separation, or death. These statements provide an accurate picture of each individual's financial standing, aiding in fair and equitable decision-making during the negotiation process. In Columbus, Ohio, there might be different types of financial statements used in connection with a prenuptial or premarital agreement, such as: 1. Personal Balance Sheet: This statement presents the individual's assets, including property, investments, bank accounts, retirement accounts, vehicles, and personal belongings, as well as their liabilities, such as mortgages, loans, and credit card debt. It offers a snapshot of one's net worth. 2. Income Statement: This statement showcases the individual's sources of income, including employment salaries, business profits, dividends, rental income, royalties, pensions, and any other means of earning. It also highlights expenses and financial commitments, helping to determine the financial contributions and potential maintenance obligations of each party. 3. Tax Returns: Individuals may be required to provide copies of their recent tax returns for a specific number of years. These documents substantiate the income declared, provide a record of previous financial dealings, and help gauge the taxable implications of certain assets. 4. Bank Statements: Providing bank statements demonstrates an individual's financial activities, account balances, and transactional history. It helps evaluate cash flow, spending patterns, and provides evidence for any financial claims made. 5. Investment Statements: Individuals may need to disclose their investment portfolios, including stocks, bonds, mutual funds, real estate portfolios, or any other investment holdings. These statements provide insight into the value, growth, and potential income derived from these investments. 6. Business Statements: If either party owns a business, financial statements related to the business, such as profit and loss statements, balance sheets, and cash flow statements, may be necessary to assess the business's value and potential income. It is essential to compile accurate and up-to-date financial statements as inconsistencies or incomplete information may potentially invalidate the prenuptial or premarital agreement. Seeking professional advice from lawyers or financial advisors experienced in family law and prenuptial agreements can help ensure compliance with Columbus, Ohio's requirements and guarantee the effectiveness of the financial statements in the legal context.