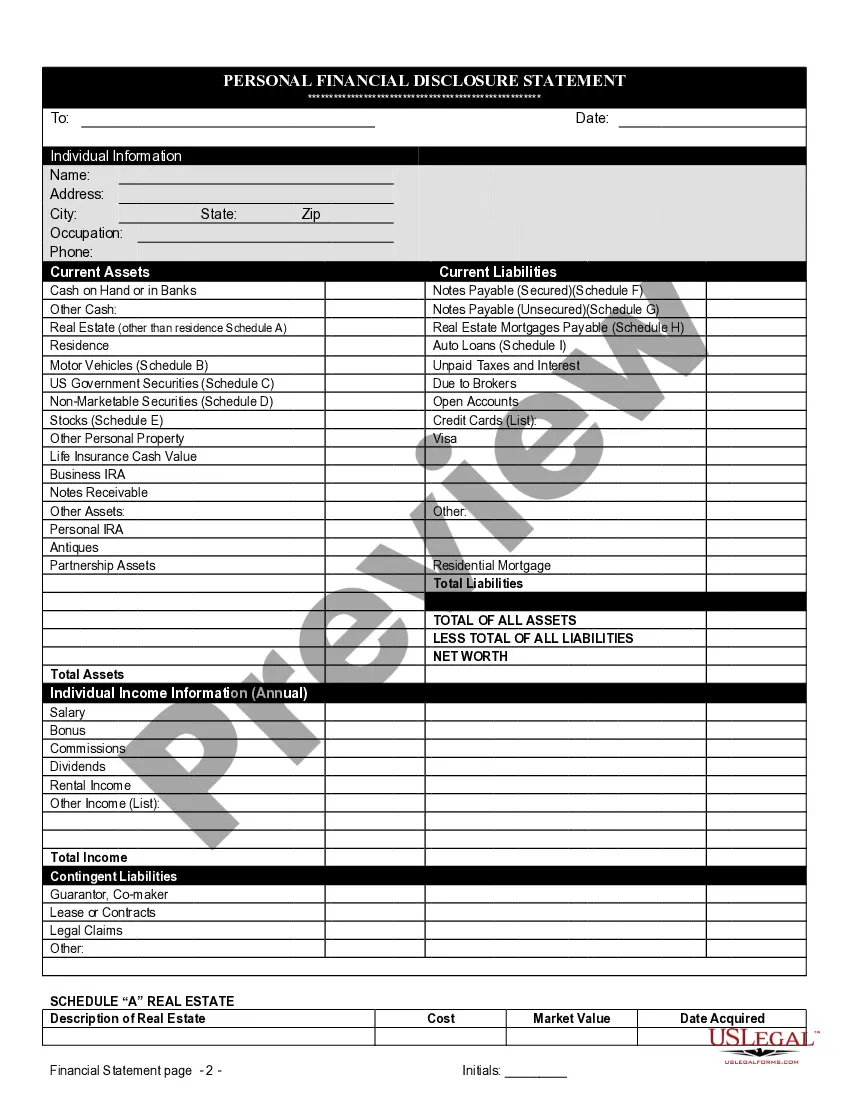

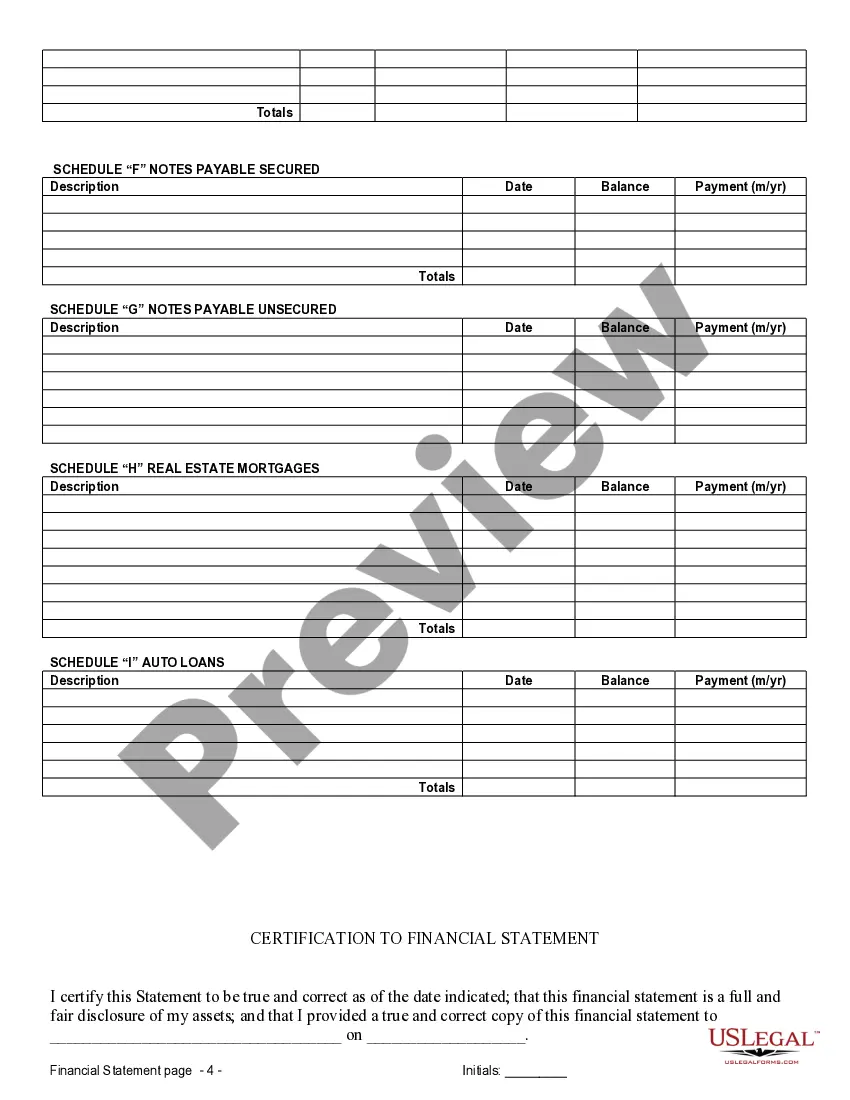

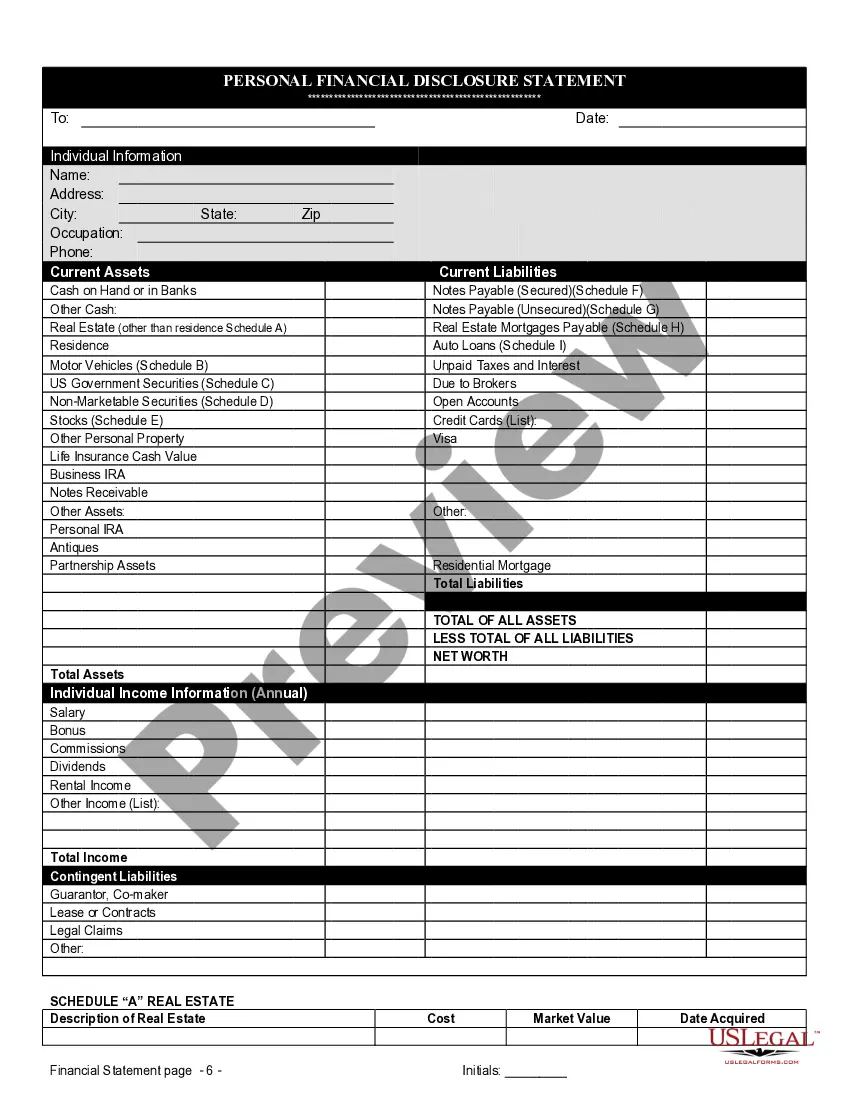

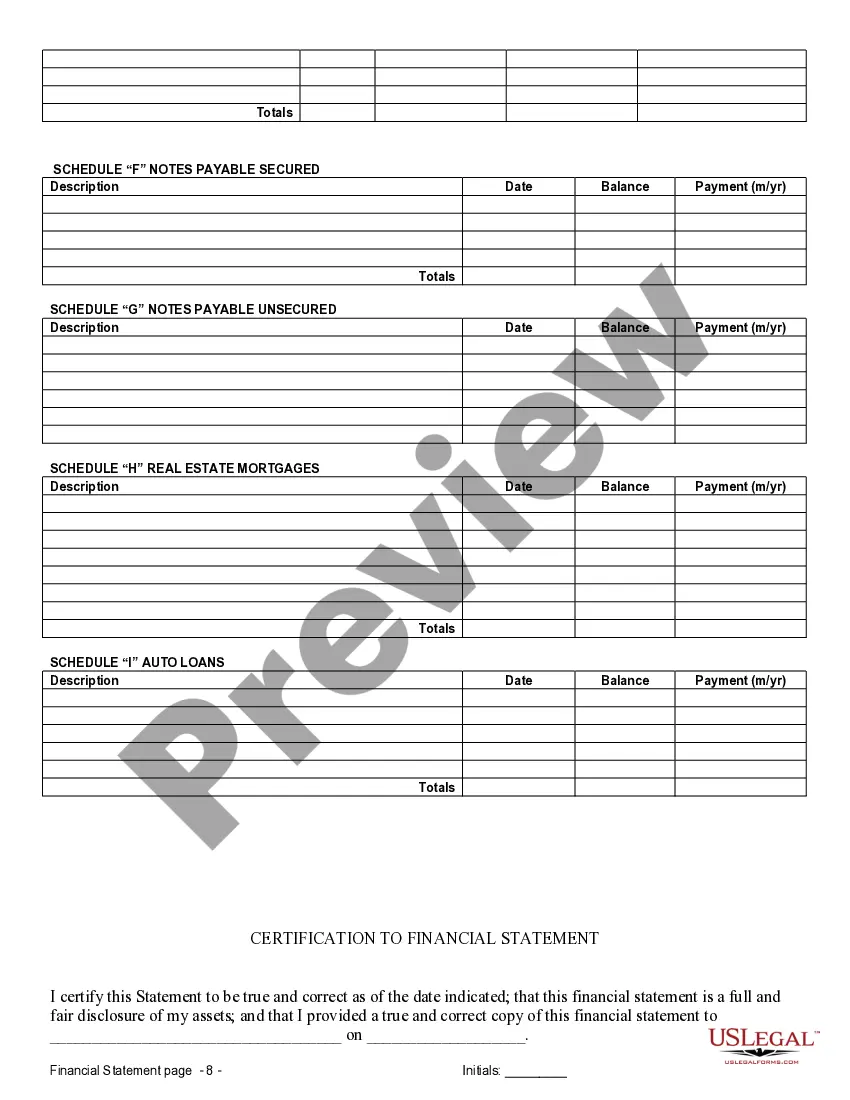

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

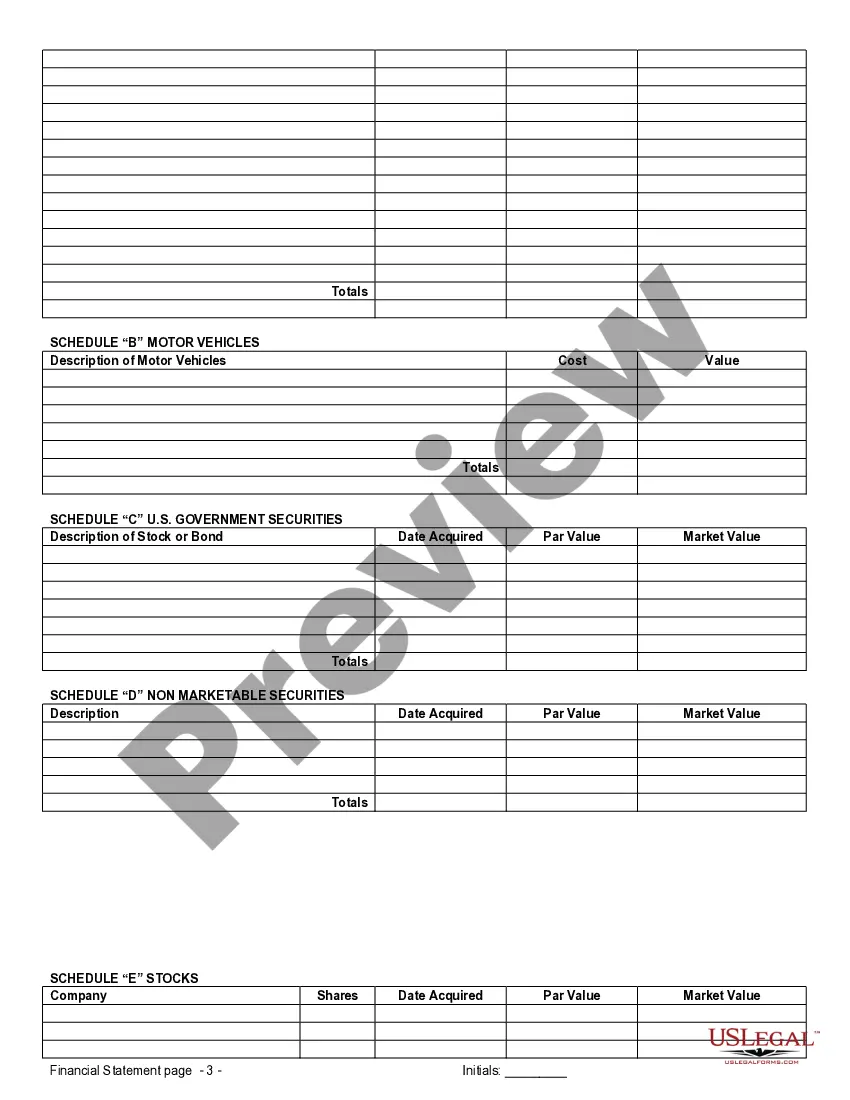

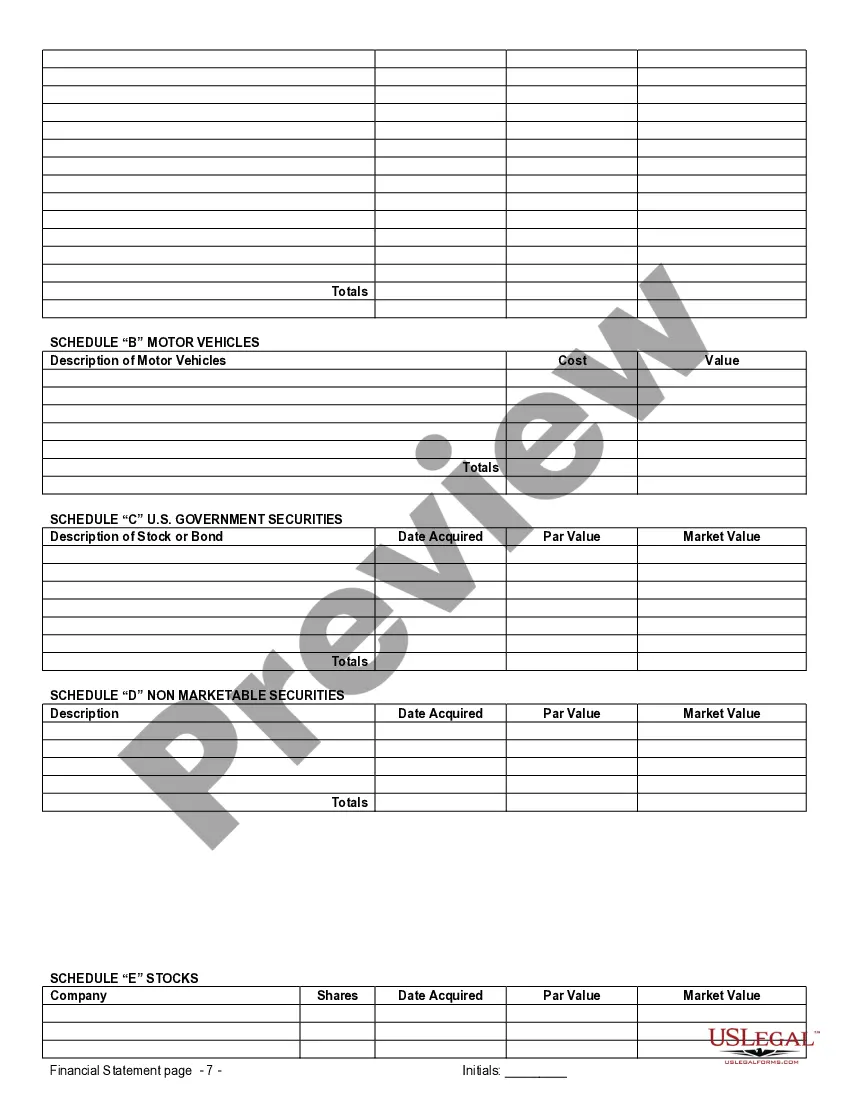

Cuyahoga Ohio Financial Statements in Connection with Prenuptial Premarital Agreement: Understanding the Essentials When entering into a prenuptial or premarital agreement in Cuyahoga County, Ohio, it is crucial to include detailed financial statements to protect both parties' assets and interests. These financial statements provide a comprehensive overview of each individual's financial situation, including assets, debts, income, and expenses. In this article, we will explore the importance of Cuyahoga Ohio financial statements in connection with prenuptial or premarital agreements, different types of statements, and how they contribute to securing a fair and equitable agreement. 1. Assets: Cuyahoga Ohio financial statements disclose all assets owned by each party, including real estate, investments, bank accounts, vehicles, valuable personal property, and any other owned assets of significant value. Comprehensive disclosure of assets ensures transparency and helps determine each party's financial worth. 2. Debts: It is equally important to disclose all debts or liabilities incurred by each individual before entering the marriage. This includes mortgages, personal loans, credit card debts, student loans, and any other financial obligations. Accurate debt disclosure ensures a fair allocation of liabilities and prevents surprises after tying the knot. 3. Income: Understanding the income of each party is integral when determining financial support obligations, such as spousal support or alimony. The financial statements should include details of regular income sources, such as employment, self-employment, investments, rental income, and any other sources contributing to the individual's overall income. 4. Expenses: Documenting personal expenses is essential for estimating the lifestyle and financial needs of each party. It helps create a foundation for potential support obligations, division of assets, and any future adjustments that may arise. Common expenses to include are housing costs, utilities, transportation, healthcare, education, entertainment, and general living expenses. 5. Separate Property vs. Marital Property: Cuyahoga Ohio financial statements also address the distinction between separate property and marital property. It is crucial to differentiate assets acquired before the marriage (considered separate) from those accumulated during the marriage (considered marital). This differentiation will significantly impact the allocation of assets in the event of a divorce or separation. 6. Professional Evaluation: In some cases, engaging a financial professional, such as a certified public accountant (CPA) or financial advisor, can add credibility and expertise to the financial statements. Their involvement can ensure accurate calculations, verify asset valuations, provide insights into tax implications, and compile a more reliable overview of the financial picture. By providing comprehensive and transparent financial statements in connection with a prenuptial or premarital agreement, couples in Cuyahoga County can minimize potential conflicts and misunderstandings regarding their financial resources. These statements lay the foundation for an equitable and fair agreement that protects the interests and assets of both parties involved. Remember, each case is unique, and it is essential to consult an experienced family law attorney specializing in prenuptial or premarital agreements in Cuyahoga County to ensure compliance with local laws and guidelines. Taking the time to create detailed financial statements will contribute to a smooth and orderly resolution in case of future disputes, allowing both parties to enter into the marriage with peace of mind.Cuyahoga Ohio Financial Statements in Connection with Prenuptial Premarital Agreement: Understanding the Essentials When entering into a prenuptial or premarital agreement in Cuyahoga County, Ohio, it is crucial to include detailed financial statements to protect both parties' assets and interests. These financial statements provide a comprehensive overview of each individual's financial situation, including assets, debts, income, and expenses. In this article, we will explore the importance of Cuyahoga Ohio financial statements in connection with prenuptial or premarital agreements, different types of statements, and how they contribute to securing a fair and equitable agreement. 1. Assets: Cuyahoga Ohio financial statements disclose all assets owned by each party, including real estate, investments, bank accounts, vehicles, valuable personal property, and any other owned assets of significant value. Comprehensive disclosure of assets ensures transparency and helps determine each party's financial worth. 2. Debts: It is equally important to disclose all debts or liabilities incurred by each individual before entering the marriage. This includes mortgages, personal loans, credit card debts, student loans, and any other financial obligations. Accurate debt disclosure ensures a fair allocation of liabilities and prevents surprises after tying the knot. 3. Income: Understanding the income of each party is integral when determining financial support obligations, such as spousal support or alimony. The financial statements should include details of regular income sources, such as employment, self-employment, investments, rental income, and any other sources contributing to the individual's overall income. 4. Expenses: Documenting personal expenses is essential for estimating the lifestyle and financial needs of each party. It helps create a foundation for potential support obligations, division of assets, and any future adjustments that may arise. Common expenses to include are housing costs, utilities, transportation, healthcare, education, entertainment, and general living expenses. 5. Separate Property vs. Marital Property: Cuyahoga Ohio financial statements also address the distinction between separate property and marital property. It is crucial to differentiate assets acquired before the marriage (considered separate) from those accumulated during the marriage (considered marital). This differentiation will significantly impact the allocation of assets in the event of a divorce or separation. 6. Professional Evaluation: In some cases, engaging a financial professional, such as a certified public accountant (CPA) or financial advisor, can add credibility and expertise to the financial statements. Their involvement can ensure accurate calculations, verify asset valuations, provide insights into tax implications, and compile a more reliable overview of the financial picture. By providing comprehensive and transparent financial statements in connection with a prenuptial or premarital agreement, couples in Cuyahoga County can minimize potential conflicts and misunderstandings regarding their financial resources. These statements lay the foundation for an equitable and fair agreement that protects the interests and assets of both parties involved. Remember, each case is unique, and it is essential to consult an experienced family law attorney specializing in prenuptial or premarital agreements in Cuyahoga County to ensure compliance with local laws and guidelines. Taking the time to create detailed financial statements will contribute to a smooth and orderly resolution in case of future disputes, allowing both parties to enter into the marriage with peace of mind.