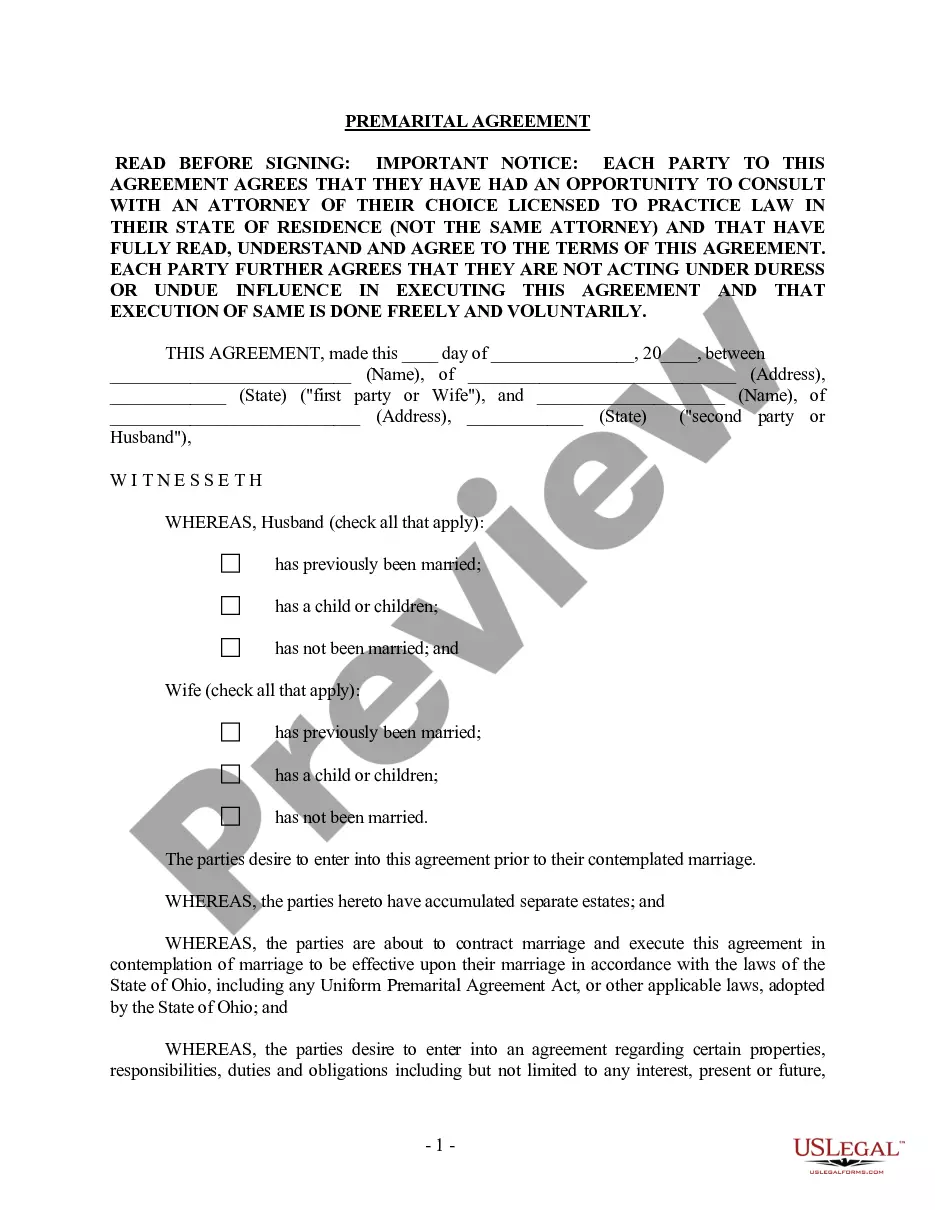

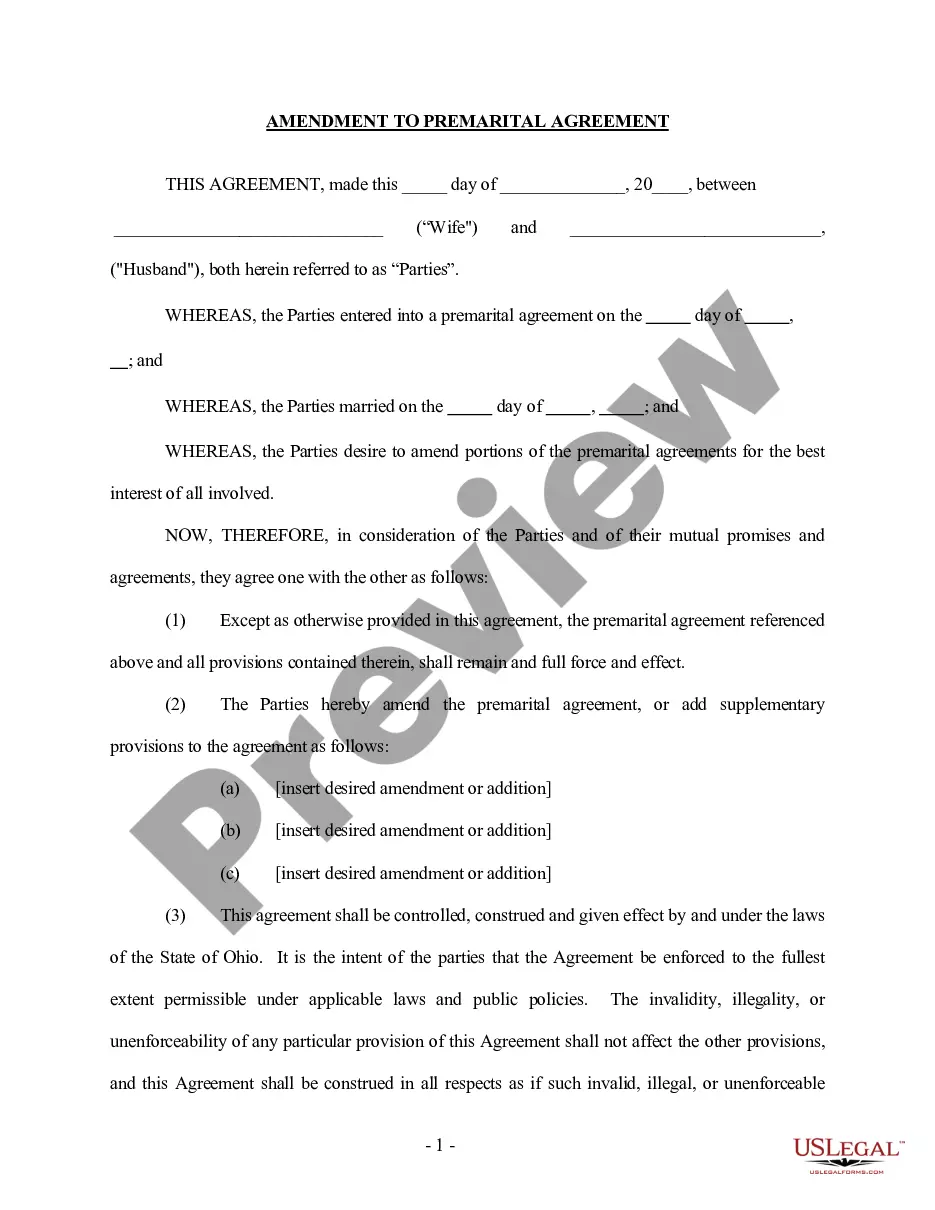

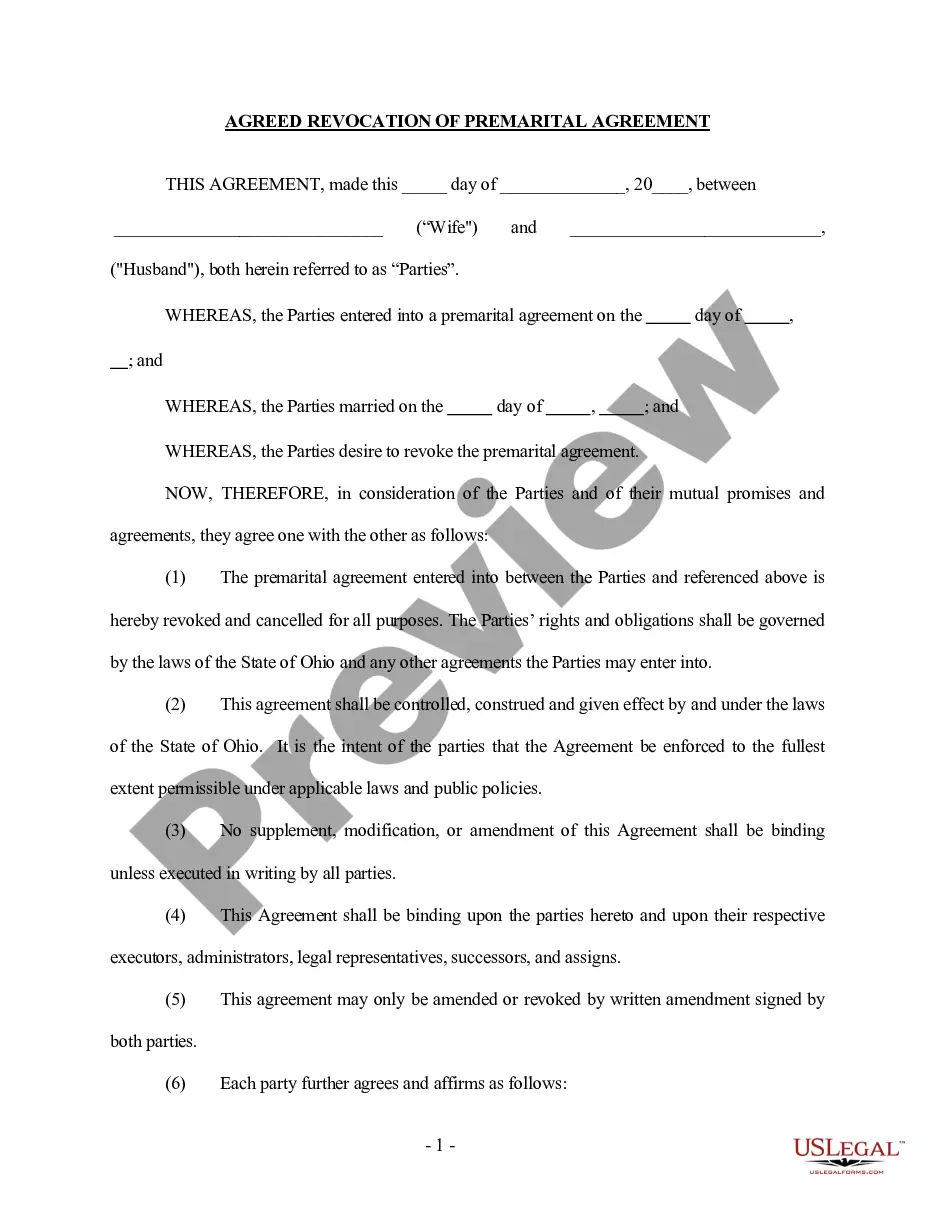

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements: What You Need to Know Overview: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements is a legally binding document entered into by couples in preparation for marriage. This agreement outlines the financial rights and responsibilities of each spouse and protects their assets and liabilities in the event of a divorce or separation. Here is a detailed description of what you should know about this type of agreement, its features, and the different types available. Key Features: 1. Asset Protection: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements allows couples to identify and protect their individual assets acquired before the marriage. This includes properties, investments, businesses, valuable belongings, and more. 2. Debt Responsibility: The agreement also specifies each partner's responsibility for any pre-existing debts, ensuring that one spouse does not assume the other's financial liabilities. 3. Alimony and Spousal Support: The document addresses alimony or spousal support obligations, stating whether it will be granted or waived in case of a divorce or separation. 4. Division of Marital Property: The agreement provides guidelines on how the couple's shared assets, acquired during the marriage, will be divided should the relationship end. This includes properties, vehicles, joint bank accounts, retirement funds, and other marital assets. 5. Estate Planning: Couples can include provisions for estate planning, such as inheritance rights, distribution of assets upon death, and protection of family heirlooms or businesses. Different Types of Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements: 1. Traditional Prenuptial Agreement: This is the standard form of a premarital agreement that covers the aforementioned key features. It ensures both partners' financial security while establishing clarity on the division of assets and potential spousal support. 2. Enhanced Financial Disclosure Agreement: Some couples may opt for an enhanced version of the agreement, which includes comprehensive financial statements. This entails submitting detailed information about each partner's income, expenses, assets, debts, and investments. This type of agreement offers greater transparency and can be particularly useful when significant financial imbalances exist between the partners. 3. Sunset Clause Agreement: In some cases, a prenuptial agreement may include a sunset clause. This provision outlines a predetermined period of time after which the agreement becomes null and void, typically after several years of marriage. The purpose of this clause is to accommodate changes that may occur throughout the marriage, allowing the couple to renegotiate their financial arrangement if necessary. Conclusion: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements is a valuable legal tool for couples entering into marriage. By clearly outlining financial rights and responsibilities, this agreement helps safeguard assets, protect against potential conflicts, and provides peace of mind to both partners. Whether you choose a traditional agreement, an enhanced financial disclosure agreement, or one with a sunset clause, consulting with an experienced family law attorney is essential to ensure its validity and enforceability under Ohio law.Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements: What You Need to Know Overview: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements is a legally binding document entered into by couples in preparation for marriage. This agreement outlines the financial rights and responsibilities of each spouse and protects their assets and liabilities in the event of a divorce or separation. Here is a detailed description of what you should know about this type of agreement, its features, and the different types available. Key Features: 1. Asset Protection: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements allows couples to identify and protect their individual assets acquired before the marriage. This includes properties, investments, businesses, valuable belongings, and more. 2. Debt Responsibility: The agreement also specifies each partner's responsibility for any pre-existing debts, ensuring that one spouse does not assume the other's financial liabilities. 3. Alimony and Spousal Support: The document addresses alimony or spousal support obligations, stating whether it will be granted or waived in case of a divorce or separation. 4. Division of Marital Property: The agreement provides guidelines on how the couple's shared assets, acquired during the marriage, will be divided should the relationship end. This includes properties, vehicles, joint bank accounts, retirement funds, and other marital assets. 5. Estate Planning: Couples can include provisions for estate planning, such as inheritance rights, distribution of assets upon death, and protection of family heirlooms or businesses. Different Types of Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements: 1. Traditional Prenuptial Agreement: This is the standard form of a premarital agreement that covers the aforementioned key features. It ensures both partners' financial security while establishing clarity on the division of assets and potential spousal support. 2. Enhanced Financial Disclosure Agreement: Some couples may opt for an enhanced version of the agreement, which includes comprehensive financial statements. This entails submitting detailed information about each partner's income, expenses, assets, debts, and investments. This type of agreement offers greater transparency and can be particularly useful when significant financial imbalances exist between the partners. 3. Sunset Clause Agreement: In some cases, a prenuptial agreement may include a sunset clause. This provision outlines a predetermined period of time after which the agreement becomes null and void, typically after several years of marriage. The purpose of this clause is to accommodate changes that may occur throughout the marriage, allowing the couple to renegotiate their financial arrangement if necessary. Conclusion: A Cuyahoga Ohio Prenuptial Premarital Agreement with Financial Statements is a valuable legal tool for couples entering into marriage. By clearly outlining financial rights and responsibilities, this agreement helps safeguard assets, protect against potential conflicts, and provides peace of mind to both partners. Whether you choose a traditional agreement, an enhanced financial disclosure agreement, or one with a sunset clause, consulting with an experienced family law attorney is essential to ensure its validity and enforceability under Ohio law.