This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

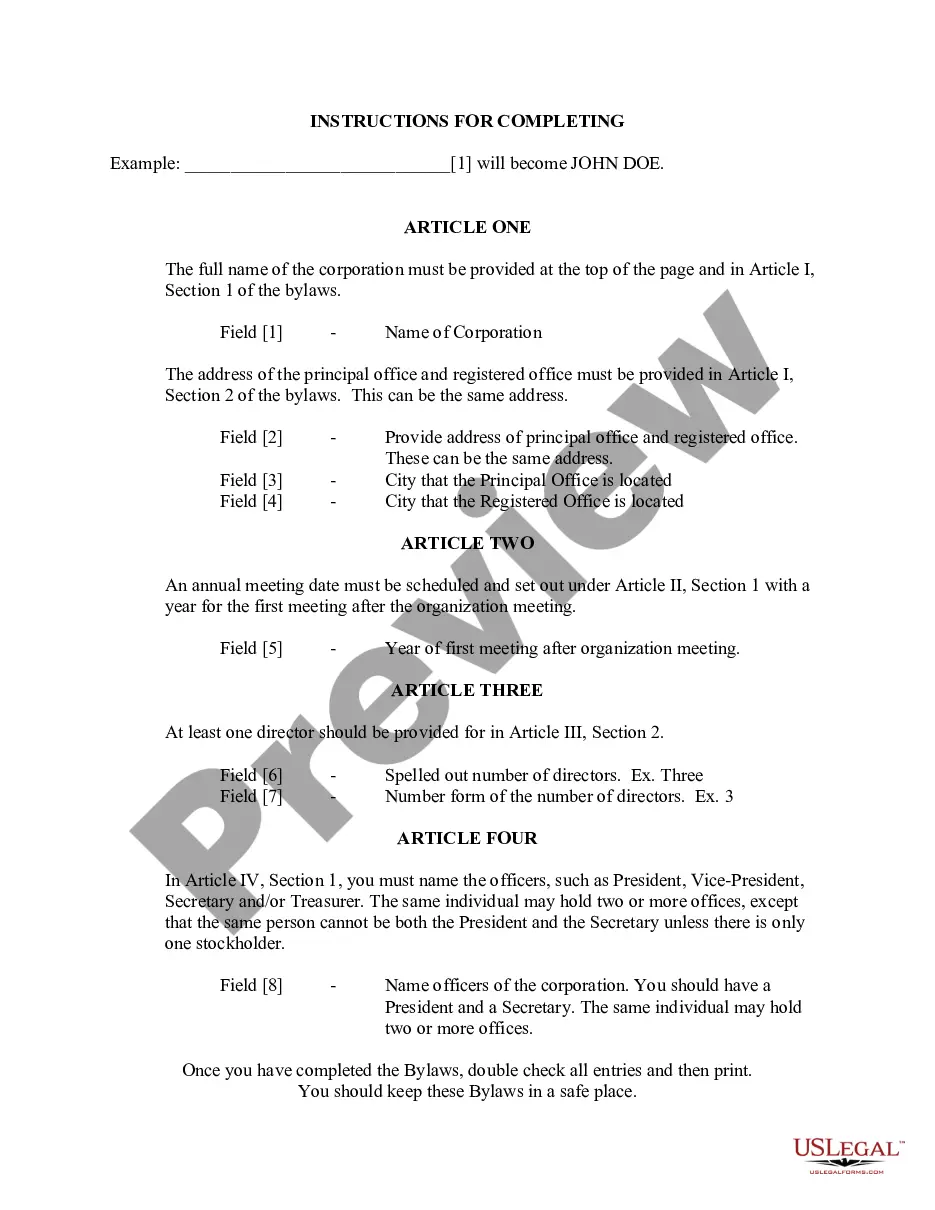

The Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation in Ohio are legal documents that need to be filed with the Ohio Secretary of State's office to establish a domestic for-profit corporation in Cuyahoga County, Ohio. These articles of incorporation outline the essential details and requirements needed to form a corporation and become legally recognized in the state of Ohio. The Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation typically include the following key information: 1. Corporation Name: The articles must include the proposed name of the corporation. It is essential to choose a unique name that is not already registered with the Ohio Secretary of State. 2. Purpose of the Corporation: The articles should clearly state the primary purpose or business activity that the corporation intends to engage in. This can be a general statement encompassing a wide range of business activities or a more specific description. 3. Registered Agent and Office: The articles must specify the name and address of the registered agent who will be responsible for receiving legal documents on behalf of the corporation. A registered office must also be listed, which is the physical address where the registered agent can be found. 4. Incorporates and Directors: The articles should include the names and addresses of the incorporates, who are the individuals initiating the incorporation process. Additionally, the initial directors and their addresses should be listed. The number of directors can vary depending on the corporation's structure. 5. Shares and Capital Structure: The articles must define the authorized shares of stock the corporation is permitted to issue, as well as any specific rights or restrictions associated with those shares. The initial capital structure, such as the number of shares and par value, should also be stated. 6. Duration of the Corporation: The articles should specify the duration of the corporation — whether it will be perpetual or if there is a specific date of dissolution. 7. Additional Provisions: The articles may include additional provisions or requirements that the corporation wishes to establish, such as specific bylaws or limitations on certain corporate actions. It is important to note that there are no different types of Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation in Ohio. The articles of incorporation mentioned above are the standard requirements for forming a domestic for-profit corporation in Cuyahoga County, Ohio. However, corporations may choose to include additional provisions that are specific to their business needs or objectives. It is recommended to consult with an attorney or professional service to ensure compliance with all the necessary legal requirements in Ohio.The Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation in Ohio are legal documents that need to be filed with the Ohio Secretary of State's office to establish a domestic for-profit corporation in Cuyahoga County, Ohio. These articles of incorporation outline the essential details and requirements needed to form a corporation and become legally recognized in the state of Ohio. The Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation typically include the following key information: 1. Corporation Name: The articles must include the proposed name of the corporation. It is essential to choose a unique name that is not already registered with the Ohio Secretary of State. 2. Purpose of the Corporation: The articles should clearly state the primary purpose or business activity that the corporation intends to engage in. This can be a general statement encompassing a wide range of business activities or a more specific description. 3. Registered Agent and Office: The articles must specify the name and address of the registered agent who will be responsible for receiving legal documents on behalf of the corporation. A registered office must also be listed, which is the physical address where the registered agent can be found. 4. Incorporates and Directors: The articles should include the names and addresses of the incorporates, who are the individuals initiating the incorporation process. Additionally, the initial directors and their addresses should be listed. The number of directors can vary depending on the corporation's structure. 5. Shares and Capital Structure: The articles must define the authorized shares of stock the corporation is permitted to issue, as well as any specific rights or restrictions associated with those shares. The initial capital structure, such as the number of shares and par value, should also be stated. 6. Duration of the Corporation: The articles should specify the duration of the corporation — whether it will be perpetual or if there is a specific date of dissolution. 7. Additional Provisions: The articles may include additional provisions or requirements that the corporation wishes to establish, such as specific bylaws or limitations on certain corporate actions. It is important to note that there are no different types of Cuyahoga Initial Articles of Incorporation for Domestic For-Profit Corporation in Ohio. The articles of incorporation mentioned above are the standard requirements for forming a domestic for-profit corporation in Cuyahoga County, Ohio. However, corporations may choose to include additional provisions that are specific to their business needs or objectives. It is recommended to consult with an attorney or professional service to ensure compliance with all the necessary legal requirements in Ohio.