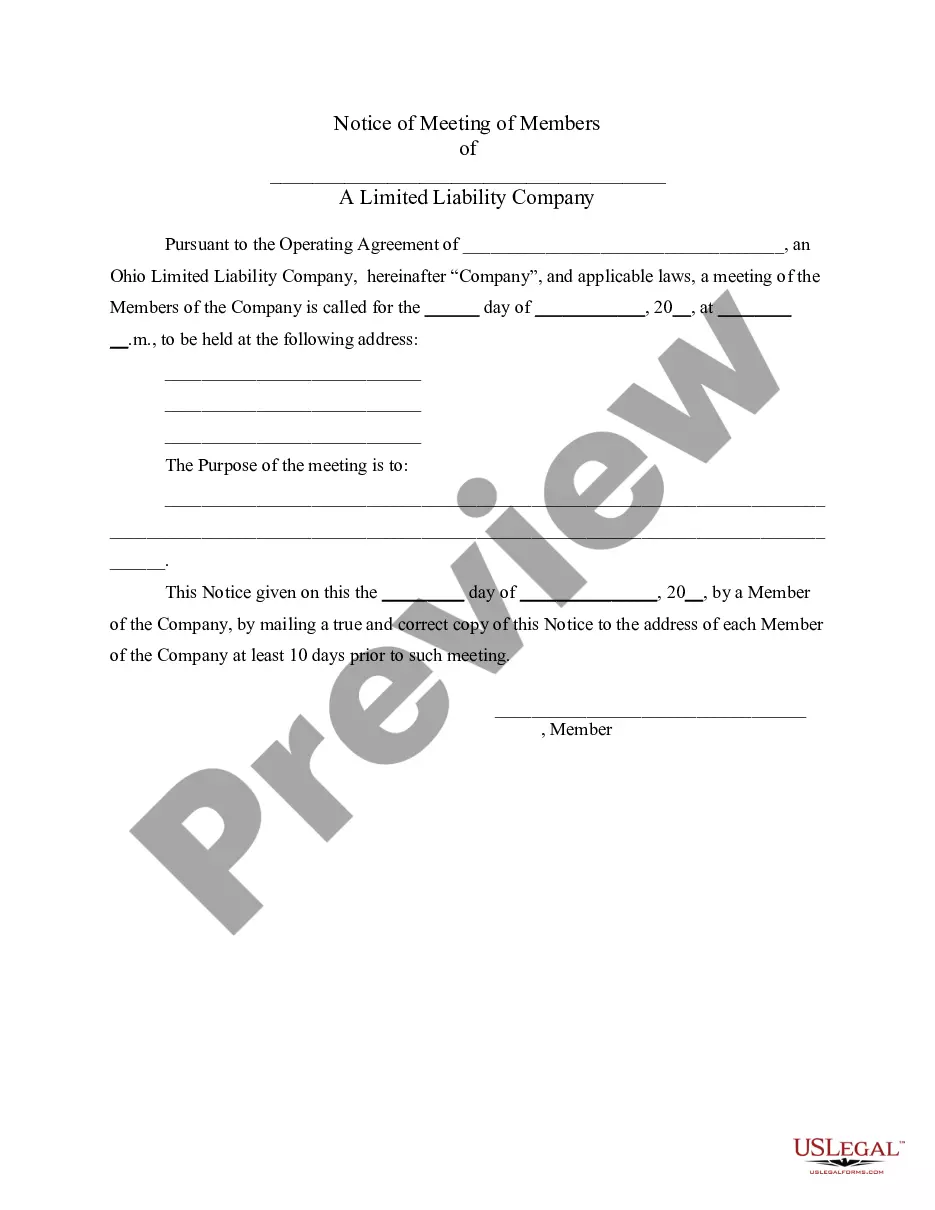

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

A Columbus Ohio Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the internal operating procedures and rules for a single-member limited liability company (LLC) located in Columbus, Ohio. It governs the interactions between the company's single owner, also known as the member, and the LLC itself. The purpose of the Columbus Ohio Single Member LLC Operating Agreement is to define the member's rights and responsibilities, as well as the powers and limitations of the LLC. It establishes crucial guidelines for the day-to-day operations, decision-making processes, and financial aspects of the company. Key provisions typically included in this operating agreement may cover crucial topics such as the LLC's purpose, member contributions, capital accounts, profit and loss allocation, management, voting rights, and decision-making procedures. Additionally, it may include provisions related to the transfer of membership interests, dissolution of the LLC, dispute resolution mechanisms, and the amendment process for the agreement itself. It is important to note that while the Columbus Ohio Single Member LLC Operating Agreement is specific to single-member LCS in Columbus, Ohio, the general principles and provisions outlined in this agreement are similar to those found in operating agreements for single-member LCS in other locations. Different types of Columbus Ohio Single Member LLC Operating Agreements may include: 1. Basic Columbus Ohio Single Member LLC Operating Agreement: This is a standard operating agreement that covers the essential elements required for the LLC's formation and operation. It typically includes provisions for management, decision-making, and member rights, among other key aspects. 2. Customized Columbus Ohio Single Member LLC Operating Agreement: This type of operating agreement is tailored to meet the specific needs and circumstances of the single member and the LLC. It may include additional provisions not found in a basic agreement, such as special voting requirements, restrictions on member actions, or unique tax considerations. 3. Professional Columbus Ohio Single Member LLC Operating Agreement: This operating agreement is often utilized by professionals, such as lawyers, doctors, accountants, or consultants, who operate as single-member LCS. It might include provisions that comply with professional regulations, address liability concerns, and cover aspects specific to the profession. 4. Multi-Member Columbus Ohio Single Member LLC Operating Agreement: Although it may sound contradictory, a multi-member agreement can be used by a single-member LLC. This type of agreement anticipates the addition of future members to the company, outlining the processes and rules they will follow upon joining. It is a strategic choice when the owner intends to expand the LLC by bringing in other members in the future. In summary, a Columbus Ohio Single Member LLC Operating Agreement is a comprehensive legal document that governs the operations, management, and decision-making of a single-member limited liability company located in Columbus, Ohio. It ensures clear communication, defines member rights and responsibilities, and establishes guidelines for the company's financial, operational, and legal affairs. The different types of Columbus Ohio Single Member LLC Operating Agreements include basic, customized, professional, and multi-member agreements.