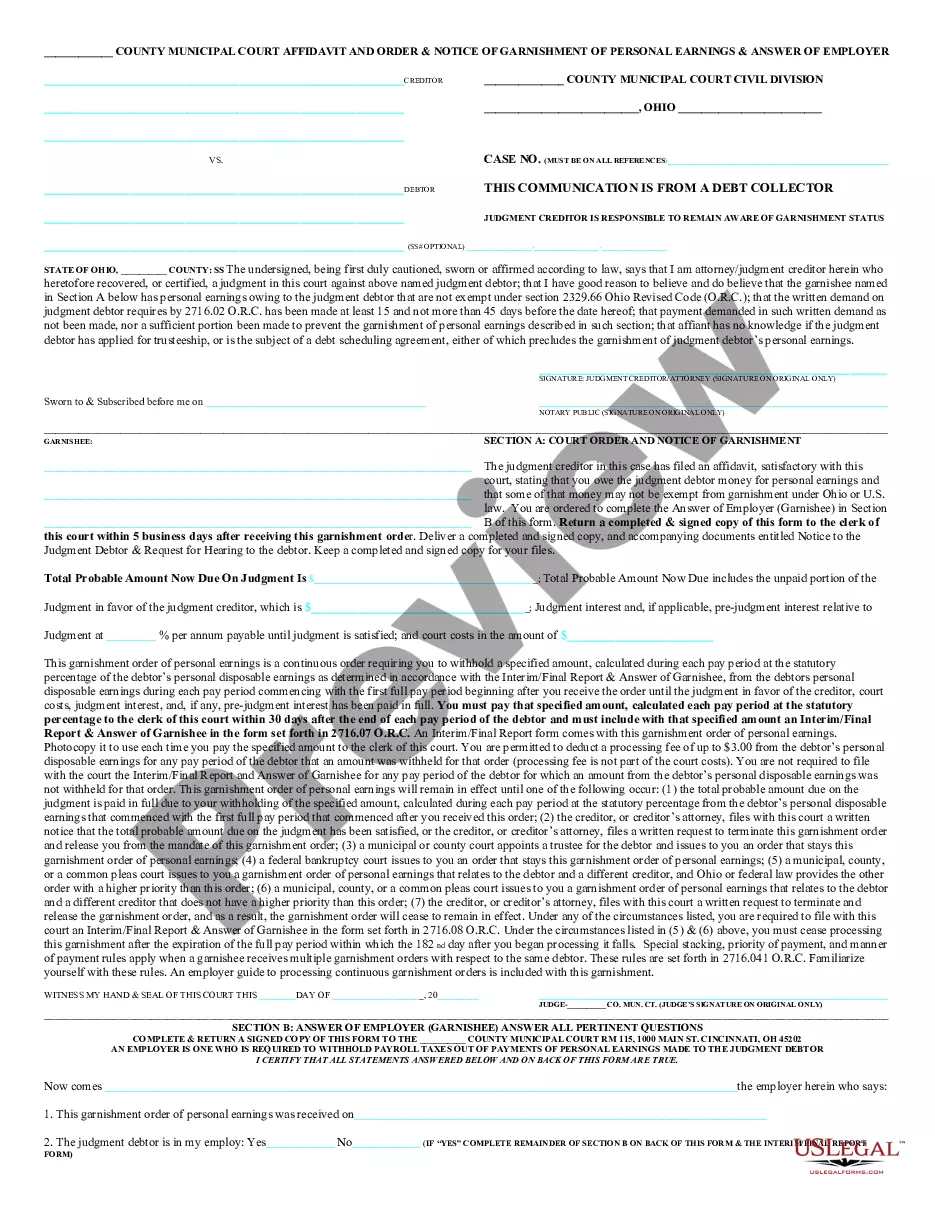

Affidavit and Notice of Garnishment of Personal Earnings and Answer of Employer

Note: This summary is not intended to be an all inclusive

discussion of the law and procedures of small claims in Ohio, but it does

contain basic and other information. This summary only discusses civil

claims (property and money claims) that may be filed in small claims court.

Criminal charges are not discussed.

Definition -

Small claims courts, also sometimes called "Peoples Court", is a court of limited jurisdiction.

Limited jurisdiction means only certain matters may be filed and heard

by the small claims court. There is also a maximum claim amount limitation.

Small claims court offers a quick, informal and inexpensive way of resolving

many types of disputes you may have with particular individuals or companies.

Maximum Amount of Claim Small Claims Court may

hear in Ohio:

$3,000.00

Which Court hears small claims in Ohio?

Small claims court is a division that operates through each municipal and county

court. Cases with a maximum amount of $3,000.00 may be filed in this particular

court.

Who hears the claims in small claims court?

The proceedings are conducted by a referee rather than a judge.

Claims over which the Small Claims Court has Jurisdiction:

The small claims court in Ohio may hear any of the following claims

if the amount in controversy does not exceed $3,000.00:

8. The above list is not exhaustive but does contain most of the

common claims. According to the Ohio Revised Code Annotated Title 19 Chapter

1925, Section 1925.02, the following claims MAY NOT be filed in small claims

court: libel, slander, replevin, malicious prosecution, abuse of process

actions, and actions for the recovery of punitive or exemplary damages.

Who may file a claim in small claims court?

An individual, partnership or corporation (or LLC) may

file a claim against another individual(s), partnership or corporation

(or LLC) in small claims court if jurisdiction exists to hear the claim

and the amount of the claim or property involved does not exceed $3,000.00.

Must you be represented by an attorney?

The parties are permitted to be represented by a licensed attorney.

Things to do before you File a Claim:

Get the facts straight so you can complete the forms correctly and answer any

questions court personnel may need to know. Be sure to obtain the correct

legal name of the defendant, correct address and place/address of employment.

If the defendant is a Corporation or Limited Liability Company you would

use the legal corporate or LLC name as the defendant. If the defendant

is a Corporation or LLC, you may need to contact the secretary of state

in your state and obtain the proper name and address to serve with a copy

of the suit. This person is called a registered agent and is designated

by the corporation to receive process or summons when the corporation is

sued. Be sure to also contact the small claims court to determine the filing

fee for filing the claim.

How to File the Claim:

According to Title 19 Chapter 1925 of the Ohio Revised Code, Section 1925.04, an action

is commenced in the small claims division when the plaintiff, or the plaintiff's

attorney, states the amount and nature of the plaintiff's claim to the

court as provided in 1925.04. The commencement constitutes a waiver of

any right of the plaintiff to trial by jury upon such action. At the time

of the commencement of an action, the plaintiff, or the plaintiff's attorney,

shall pay both the following: a filing fee as determined by the court and

the sum required by division (C) of Section 1901.26 or division (C) of

Section 1907.24 of the Revised Code. The plaintiff, or the plaintiff's

attorney, shall state to the administrative assistant or other official

designated by the court, the plaintiff's and defendant's place of residence,

the military status of the defendant, and the nature and amount of the

plaintiff's claim.

Who serves the Defendant with summons or process

and how is the defendant served:

The following methods may be used to serve the defendant: certified mail, personal service, or resident

service.

Return of Summons:

The sheriff, constable, or other process server shall, after effecting service, endorse that fact on a copy

of the summons and return it to the court clerk who will make the appropriate

entry on the docket sheet of the action. If notice is returned undelivered

or if in any other way it appears that notice has not been received by

the defendant, at the request of the plaintiff or his attorney, a further

notice will be issued.

Removal to another Court:

Pursuant to the Ohio Revised Code Title 19 Chapter 1925, Section 1925.10, a civil action

that is duly entered on the docket of the small claims division shall be

transferred to the regular docket of the court upon the motion of the court

made at any stage of the civil action or by the filing of a counterclaim

or cross-claim for more than $3,000.00. In the discretion of the court,

a case duly entered on the docket of the small claims division may be transferred

to the regular docket of the court upon the motion of a party against whom

a claim, counterclaim, or cross-claim is instituted or upon the motion

of a third-party defendant. The motion must be accompanied by an affidavit

stating that a good defense to the claim exists, setting forth the grounds

of the defense, and setting forth the compliance of the party or third-party

defendant with any terms fixed by the court. The failure to file a motion

to transfer the case to the regular docket of the court constitutes a waiver

by the party or third-party defendant of any right to a trial by jury.

How are hearings scheduled?

The clerk of the court will provide you with the procedure to set the case for trial

or hearing at the time you file your claim.

Subpoena of Witnesses:

If witnesses are required but unwilling to voluntarily attend unless they are subpoenaed,

you may obtain a subpoena issued by the court clerk for service on the

witness. The subpoena is an order for the witness to appear at the hearing

and testify. Some employers may require that an employee be subpoenaed

in order to be excused from work.

Trial Procedures:

The trial procedure is generally more informal than other courts although the formality will vary

from county to county and judge to judge. The case will usually be called

in open court and you will respond that you are present and ready to proceed.

You will then be advised when to present your claim. Be prepared

to present your claim in your own words. Be prepared to question witnesses

if witnesses are needed.

What happens if the defendant does not appear at

trial?

Usually, if the defendant does not appear at trial,

a default judgment will be entered in your favor for the amount of the

claim or other relief.

Judgment:

If the defendant fails to appear, or if the court rules for you after the hearing, a judgment

will be entered by the court for the amount of the claim, or other relief

sought.

Appeal:

The losing party is entitled to appeal the decision of the small claims court.

Collection of Judgment:

Pursuant to the Ohio Revised Code Annotated Title 19, Chapter 1925, Section 1925.13,

the court, in its discretion, may order that the judgment, interest, and

costs be paid at a certain date or by specified weekly installments, and

during compliance with the order, the court may stay the issue of execution

and other proceedings in aid of execution. If, within thirty days after

judgment, the judgment is not satisfied and the parties have not otherwise

agreed, the court, upon the request of the judgment creditor, shall

order the judgment debtor to file, on a form prepared by the court, a list

of the judgment debtor's assets, liabilities, and personal earnings. The

form shall contain a notice that failure to complete the form and return

it to the court within one week after receipt may result in a citation

for contempt of court. Any party who, with notice of the possible contempt

citation, willfully fails to comply with the order of the court may be

cited for contempt of court as provided in Chapter 2705 of the Revised

Code.

Other Matters:

Are Motions allowed?

Motions are allowed by the parties on a limited basis.

Continuances:

Either party may be granted a continuance for good cause shown.

Out-of-Court Settlement:

If a case is settled before the hearing date, one or both parties should notify the

court clerk as soon as possible so that the hearing can be canceled.

When Payment is Received:

When the judgment has been satisfied, the receiving party must send written notice to the

court that the judgment has been satisfied.

Cross-Claims, Counterclaims, and Third-Party Claims:

The defendant is entitled to file a counterclaim against the

plaintiff in small claims court. The claim must be filed and served on all

other parties at least seven days prior to the date of the trial of the

plaintiff's claim in the original action.

What happens if a defendant has filed bankruptcy?

If the plaintiff has filed a claim against the defendant and

the plaintiff is aware that the claim is listed as a debt in a bankruptcy

proceeding, federal law prohibits the plaintiff from pursuing the claim

in small claims court.

Common Forms used in Small Claims Court:

Claim Statement/Complaint

Summons

Return of Summons

Answer

Subpoena

Abstract of Judgment

Statutes:

For more information concerning the Small Claims process in Ohio,

please see the Ohio Revised Statutes Title 19 Chapter 1925 at http://onlinedocs.andersonpublishing.com/revisedcode/.