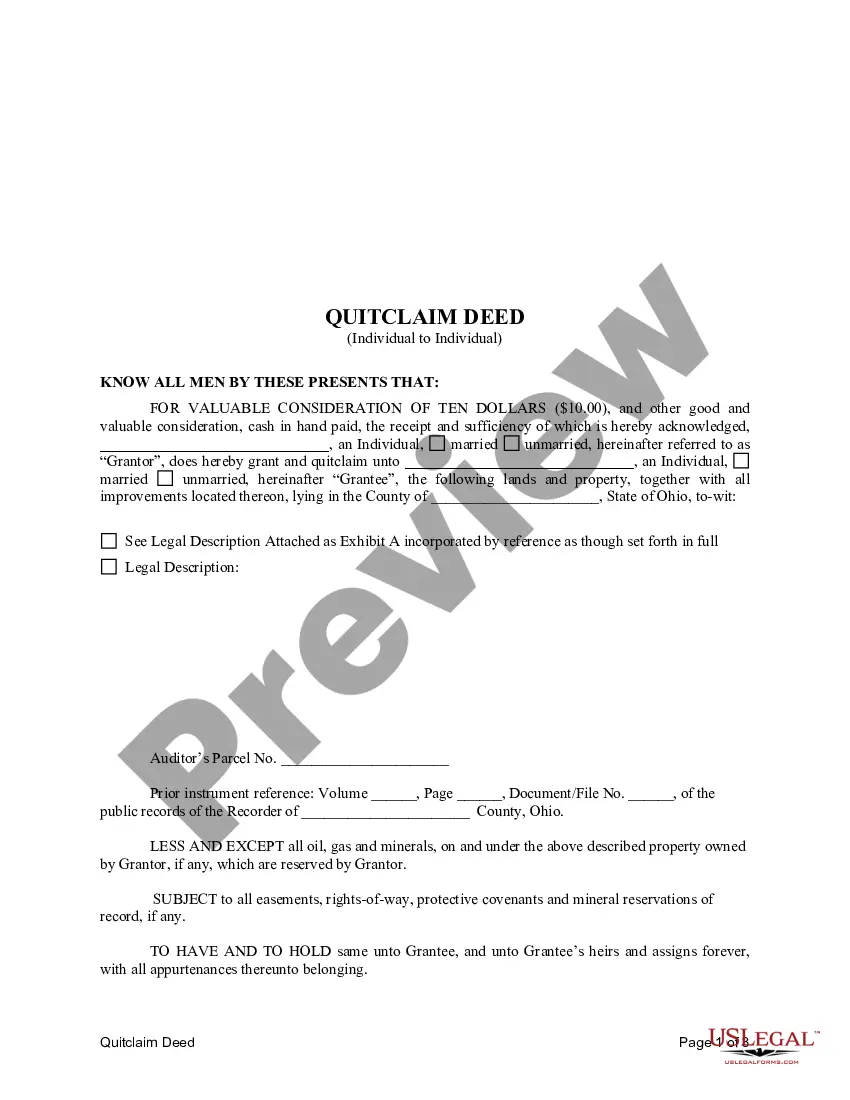

This Quitclaim Deed from Individual to Individual form is a Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Columbus Ohio Quitclaim Deed from Individual to Individual

Description

How to fill out Ohio Quitclaim Deed From Individual To Individual?

If you are in search of a legitimate form template, it is challenging to locate a more accessible location than the US Legal Forms site – one of the most comprehensive online repositories.

Here you can discover numerous form templates for business and personal use categorized by types and regions or keywords.

With our sophisticated search functionality, obtaining the latest Columbus Ohio Quitclaim Deed from Individual to Individual is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Select the format and download it to your device. Modify it. Complete, edit, print, and sign the received Columbus Ohio Quitclaim Deed from Individual to Individual.

- Moreover, the significance of each record is validated by a group of qualified lawyers who consistently scrutinize the templates on our platform and update them in line with the newest state and county regulations.

- If you are already familiar with our service and possess a registered account, all you need to do to acquire the Columbus Ohio Quitclaim Deed from Individual to Individual is to Log In to your user profile and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have opened the necessary sample. Examine its description and utilize the Preview option (if available) to review its content. If it does not meet your requirements, use the Search option at the top of the page to find the appropriate record.

- Confirm your selection. Choose the Buy now option. Afterwards, select your desired subscription plan and provide the details to create an account.

Form popularity

FAQ

Once a deed is recorded it cannot be changed. We recommend you consult a real estate attorney or title company to prepare a new deed. If a married couple held the property jointly as tenants by entireties and one spouse dies, it is not necessary to remove that spouse's name from the deed.

The conveyance fee consists of two parts. A statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of Ohio's coun ties. In addition, counties may also impose a permissive real property transfer tax of up to 3 additional mills.

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

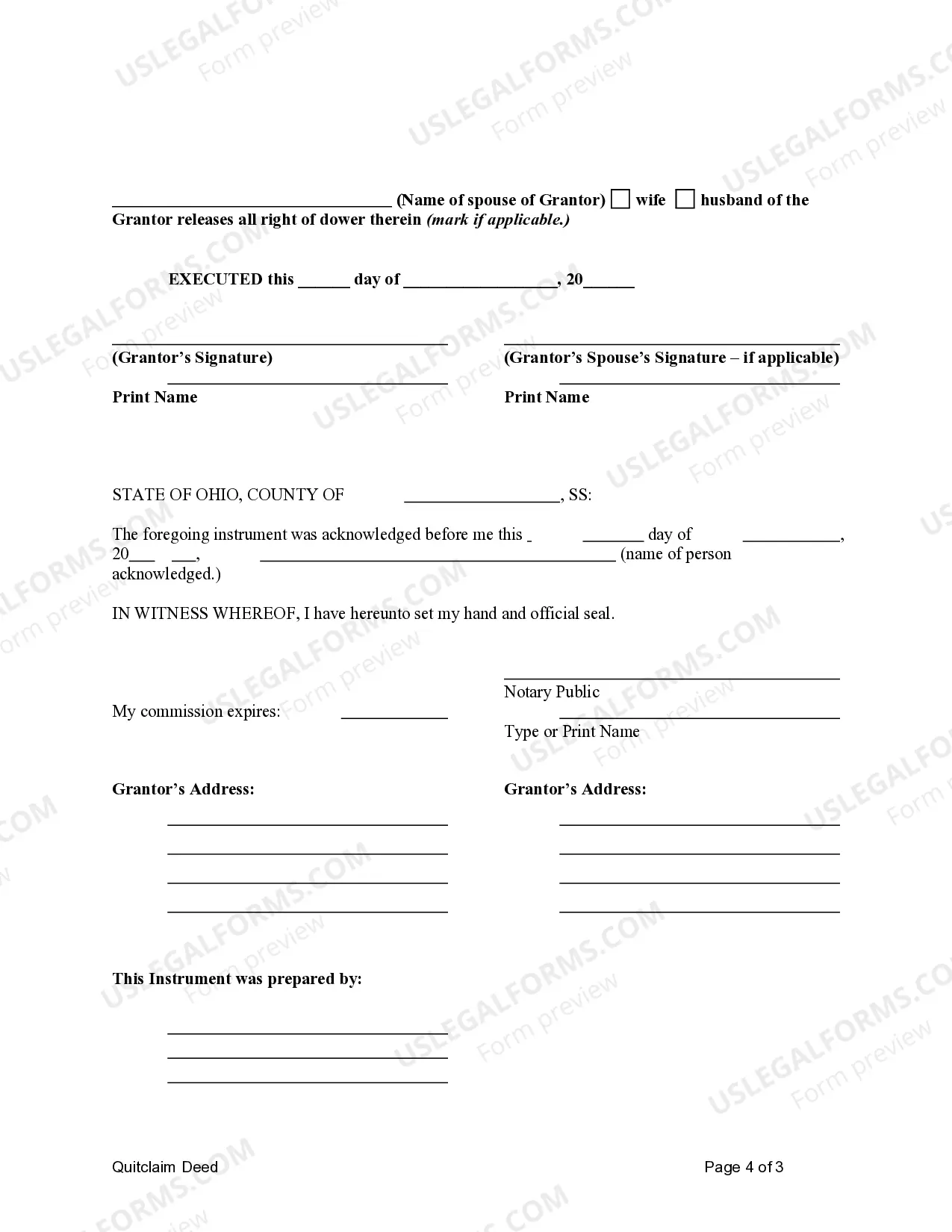

How to Transfer a Deed in Ohio Go to the Deed Transfer Department to obtain a transfer form for a quit claim deed or warranty deed.Take the form, along with the person to whom the the property is being transferred, to a notary public.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.

§ 5301.25) ? Once completed and acknowledged the quit claim deed must be filed at the County Recorder's Office in the jurisdiction where the land is located. Signing (R.C. § 5301.01) ? A quit claim deed in Ohio is required to be signed in the presence of a notary public.

2 The tax is levied on the party named as grantor in the subject deed and must be paid before the deed is recorded. The real property transfer tax, also known as a conveyance fee, is limited to 4 mills, i.e., $4 per $1,000 of the value of the property sold or transferred.

The Deed Transfer Department transfers the owner's name and address on the real estate tax list and duplicate. The department also collects the transfer tax/ conveyance fee ($4.00 per $1,000 of sale price) and the transfer fee ($. 50 per parcel).