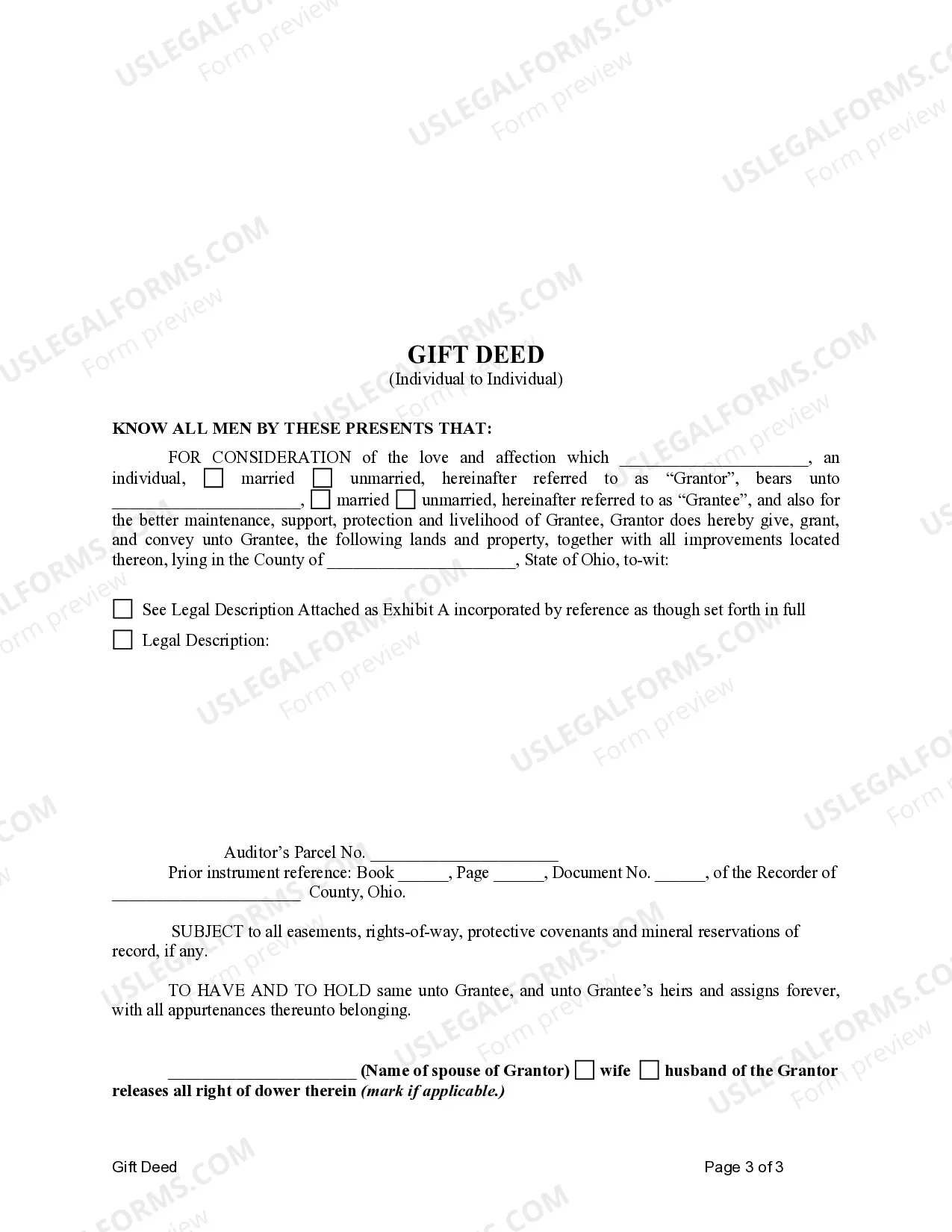

This sample form, a Gift Deed - Ohio - Individual to Individual is for use in gifting property. Adapt to fit your circumstances.

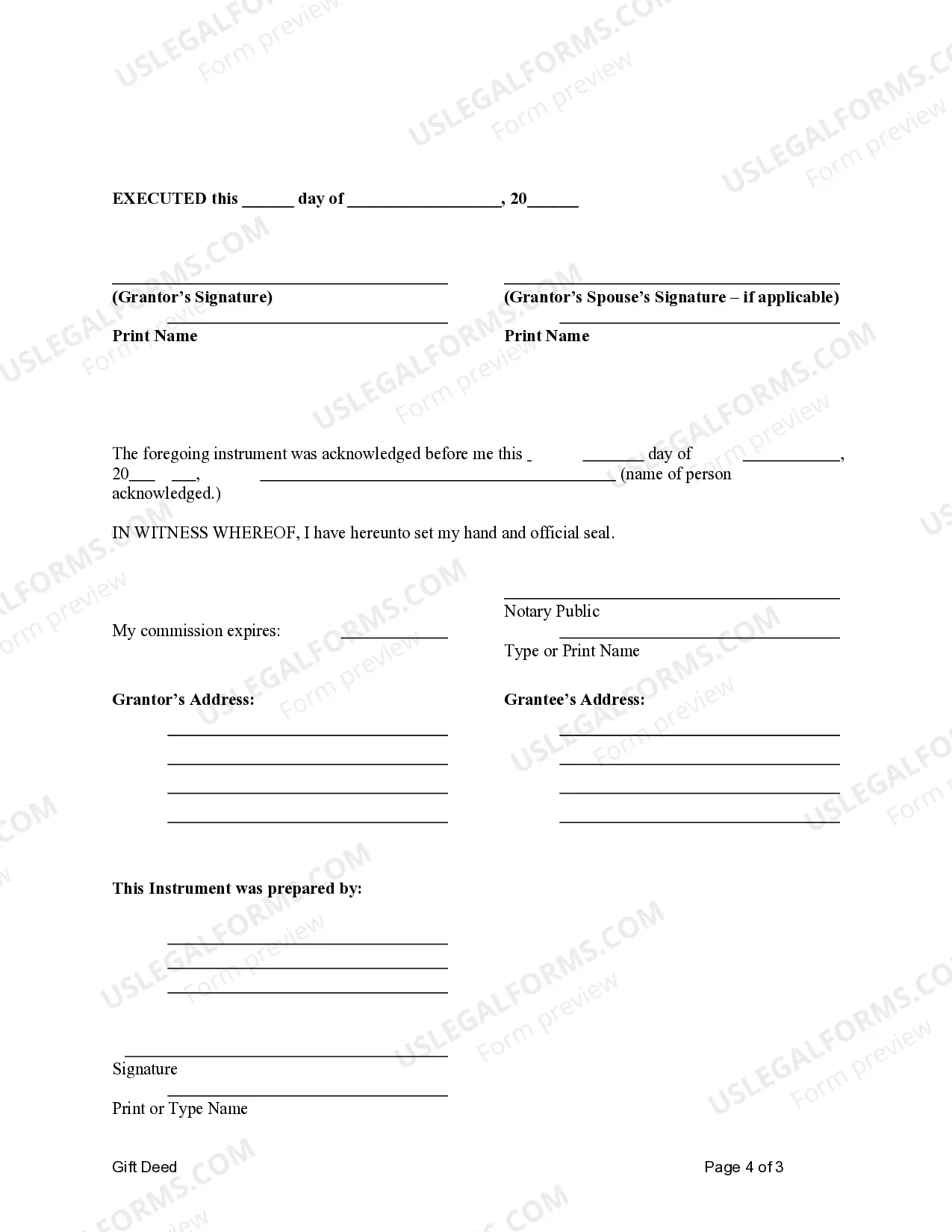

A Columbus Ohio Gift Deed for Individual to Individual is a legal document that allows one individual to transfer ownership of real property to another individual as a gift, without any monetary compensation involved. This type of deed is typically used when someone wants to gift their property to a family member, friend, or loved one. The Columbus Ohio Gift Deed for Individual to Individual must adhere to specific legal requirements to ensure its validity. It must include the names and addresses of both the granter (the person gifting the property) and the grantee (the recipient of the gift). The deed should also contain a clear description of the property being transferred and its legal description, which often includes the lot of number, subdivision, and other relevant information. Additionally, the deed must outline that the transfer is a gift, stated explicitly in the document. Both the granter and grantee must sign the deed in the presence of a notary public or other authorized witnesses as per Ohio law. There are different types of Columbus Ohio Gift Deed for Individual to Individual that may exist based on specific circumstances. These can include: 1. Standard Gift Deed: This is a typical gift deed wherein one individual transfers the ownership of real property to another individual without any conditions or expectations of compensation in return. 2. Gift Deed with Reservation of Life Estate: In this type of gift deed, the granter transfers the ownership of the property to the grantee but retains the right to live on the property until their death. Upon the granter's death, the grantee becomes the sole owner of the property. 3. Gift Deed with Right of Reversion: This gift deed allows the granter to retain the right to take back ownership of the property if specific conditions are not met. For example, if the grantee fails to occupy the property within a specified period or breaches certain agreed-upon terms, the granter has the right to reclaim ownership. It's important to consult with a qualified attorney or real estate professional when drafting or executing a Columbus Ohio Gift Deed for Individual to ensure compliance with all legal requirements and to address any specific circumstances or concerns.