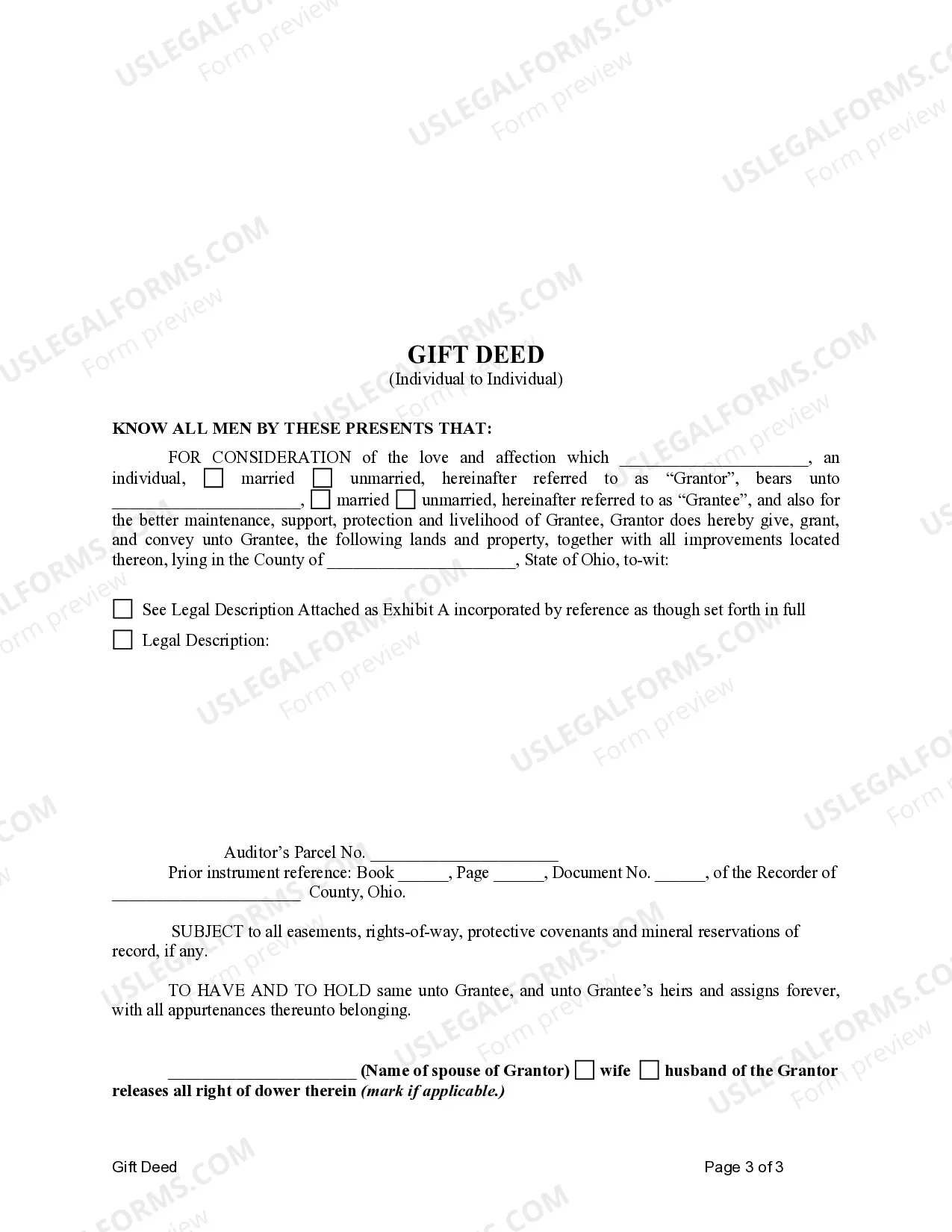

This sample form, a Gift Deed - Ohio - Individual to Individual is for use in gifting property. Adapt to fit your circumstances.

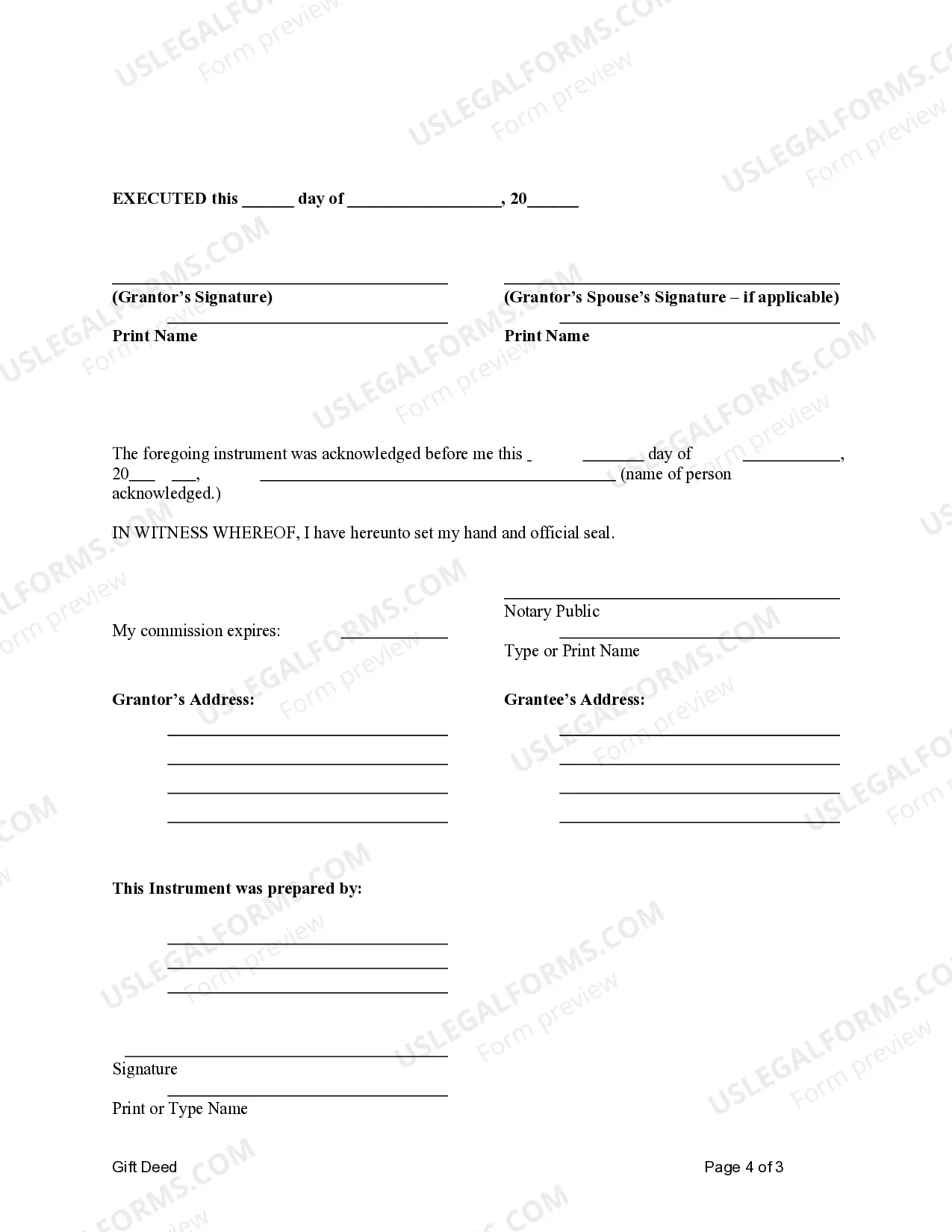

A Cuyahoga Ohio Gift Deed for Individual to Individual is a legal document used to transfer ownership of property from one individual to another as a gift. This type of deed is commonly used when a person wants to give their property to a family member, friend, or loved one without any monetary exchange. The Cuyahoga Ohio Gift Deed for Individual to Individual is a detailed document that outlines the terms and conditions of the gift transfer. It includes important information such as the names and addresses of both the giver and the recipient, a description of the property being gifted, and any specific conditions or restrictions attached to the gift. One of the commonly recognized types of Cuyahoga Ohio Gift Deed for Individual to Individual is the Quitclaim Deed. This type of gift deed is often used when the giver is unsure of the legal status of the property or wants to transfer ownership without any guarantees. The Quitclaim Deed transfers the givers' interest in the property, if any, to the recipient without making any promises about the condition or validity of the title. Another type of Cuyahoga Ohio Gift Deed for Individual to Individual is the Warranty Deed. This type of gift deed guarantees that the giver holds clear and marketable title to the property being gifted. The Warranty Deed provides the recipient with certain legal protections and ensures that they receive full ownership of the property without any potential future claims or disputes. A third type of Cuyahoga Ohio Gift Deed for Individual to Individual is the Life Estate Deed. This type of gift deed transfers ownership of the property to the recipient for their lifetime while allowing the giver to retain the right to live on or use the property until their death. Once the giver passes away, full ownership of the property automatically transfers to the recipient without the need for probate or additional legal proceedings. In conclusion, a Cuyahoga Ohio Gift Deed for Individual to Individual is a legal document used to transfer ownership of property as a gift from one individual to another. The document can be a Quitclaim Deed, Warranty Deed, or Life Estate Deed, each serving a specific purpose depending on the circumstances and preferences of the parties involved. It is essential to consult with an attorney or real estate professional to ensure the proper preparation and execution of the gift deed.