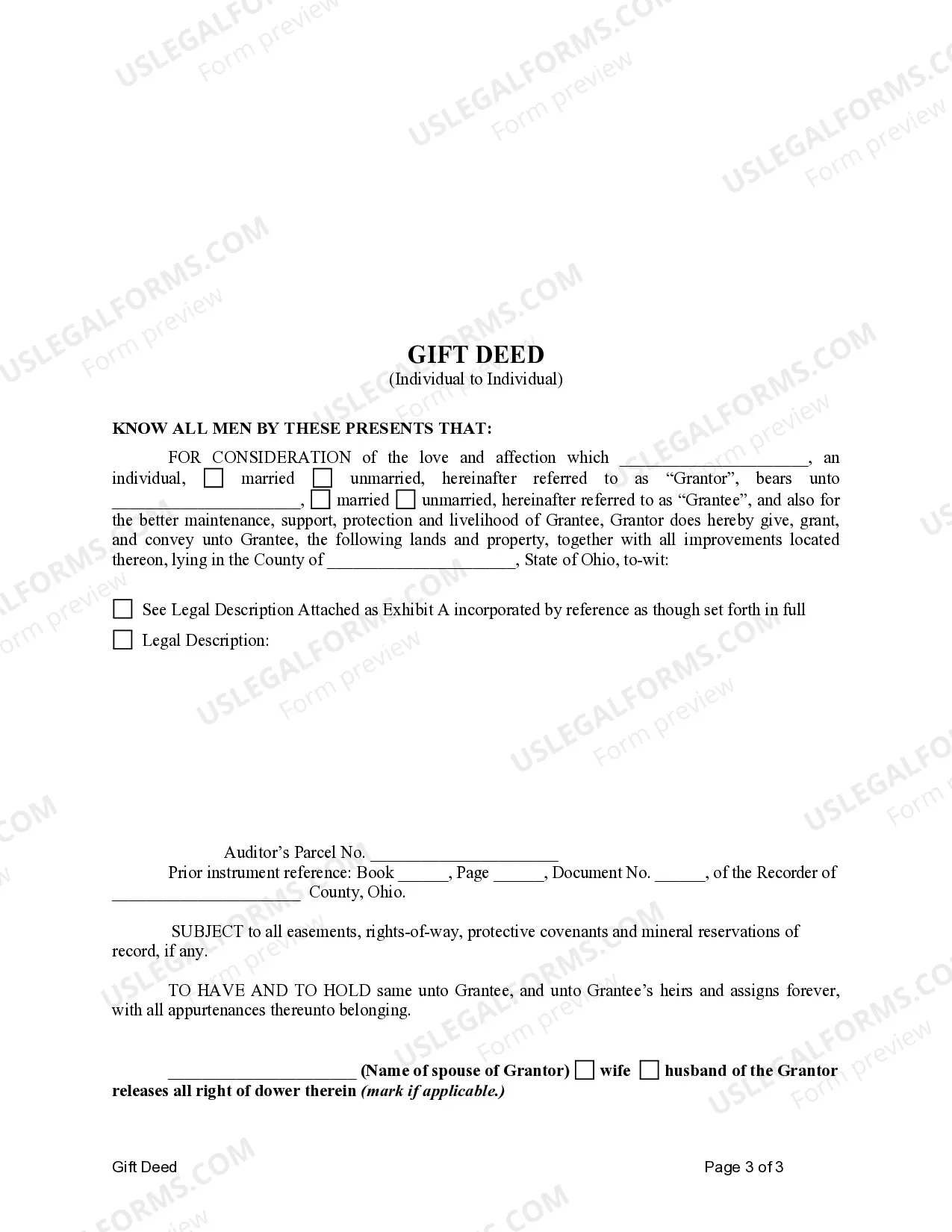

This sample form, a Gift Deed - Ohio - Individual to Individual is for use in gifting property. Adapt to fit your circumstances.

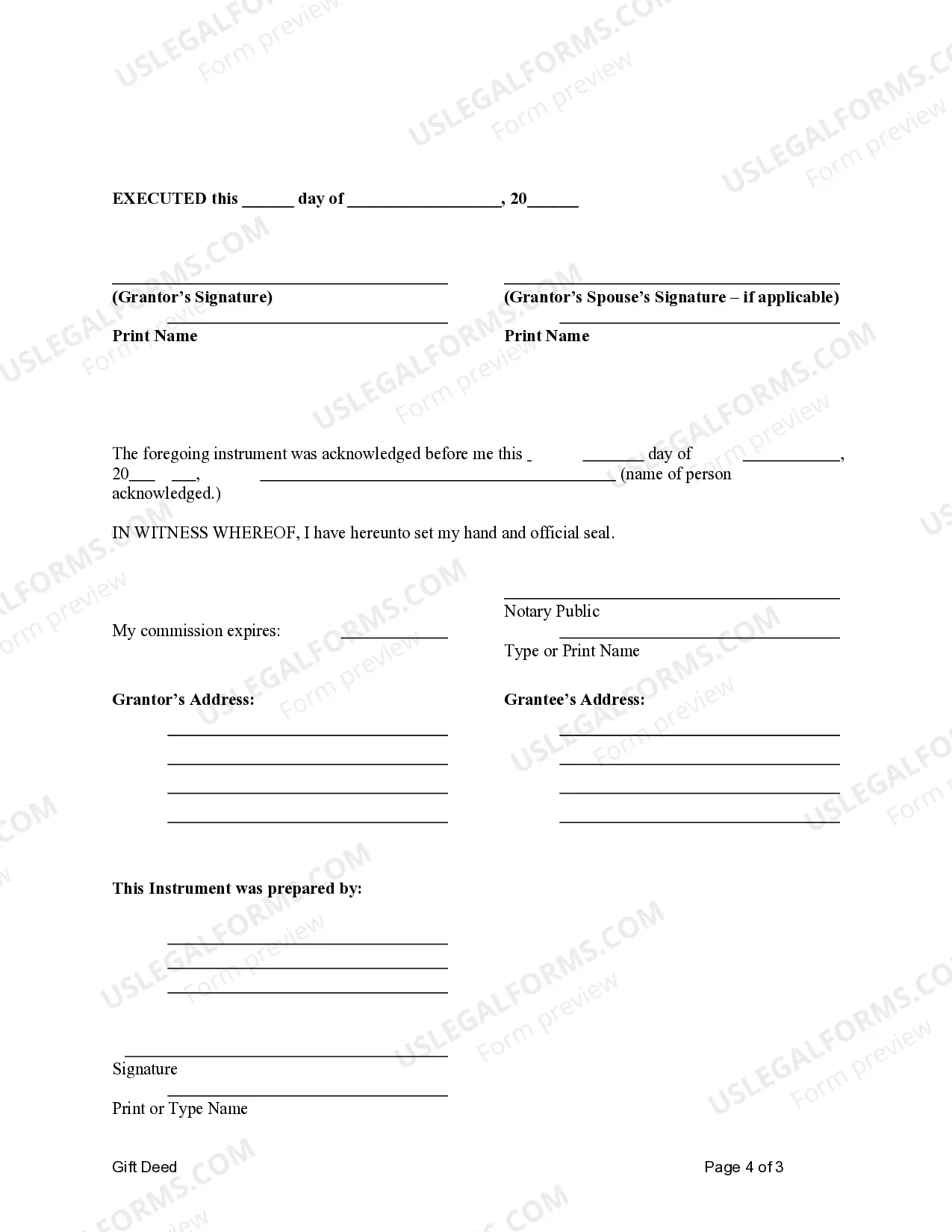

A Dayton Ohio Gift Deed for Individual to Individual is a legal document that facilitates the transfer of property ownership from one individual to another as a gift, without any monetary exchange. It serves as evidence of the transfer and ensures that the recipient becomes the legal owner of the property. The Dayton Ohio Gift Deed for Individual to Individual is commonly used for various purposes such as transferring property between family members, friends, or even as charitable donations. It can be a practical option when the donor wants to pass on their property while they are still alive, or when they want to avoid the complexities and expenses associated with probate. This gift deed must include specific details to be legally binding, such as: 1. Granter and Grantee Information: The full legal names and addresses of both the donor (granter) and recipient (grantee) should be clearly stated. 2. Property Description: A detailed and accurate description of the property being gifted, including its address, parcel number, and any applicable legal descriptions. This helps to avoid confusion and ensures that the correct property is being transferred. 3. Consideration: Even though this is a gift, the deed must include a statement indicating that the transfer is being made without any monetary consideration. This is crucial to establish that the transfer is indeed a gift, not a sale. 4. Signature and Notary: The gift deed must be signed and dated by the granter in the presence of a notary public. The notary will then provide their official seal, acknowledging the granter's signature. There are various types of Gift Deed for Individual to Individual that can be used depending on the specific situation: 1. General Gift Deed: This is the most common type of gift deed, used when the donor wants to give away their property to another person without any specific restrictions or conditions. 2. Gift Deed with Reservation of Life Estate: In this type of deed, the donor transfers the property to the recipient but retains the right to use and enjoy the property for the remainder of their life. After the donor's passing, the property automatically transfers to the recipient. 3. Gift Deed with Restrictions: This type of deed may impose certain conditions or restrictions on the use of the gifted property. For example, the donor may stipulate that the property can only be used for residential purposes or that it cannot be sold for a specific period. In summary, a Dayton Ohio Gift Deed for Individual to Individual is a legal document used to transfer ownership of property as a gift. It is essential to consult with a qualified real estate attorney to ensure that all legal requirements are met, and the gift deed accurately reflects the intentions of both the donor and recipient.A Dayton Ohio Gift Deed for Individual to Individual is a legal document that facilitates the transfer of property ownership from one individual to another as a gift, without any monetary exchange. It serves as evidence of the transfer and ensures that the recipient becomes the legal owner of the property. The Dayton Ohio Gift Deed for Individual to Individual is commonly used for various purposes such as transferring property between family members, friends, or even as charitable donations. It can be a practical option when the donor wants to pass on their property while they are still alive, or when they want to avoid the complexities and expenses associated with probate. This gift deed must include specific details to be legally binding, such as: 1. Granter and Grantee Information: The full legal names and addresses of both the donor (granter) and recipient (grantee) should be clearly stated. 2. Property Description: A detailed and accurate description of the property being gifted, including its address, parcel number, and any applicable legal descriptions. This helps to avoid confusion and ensures that the correct property is being transferred. 3. Consideration: Even though this is a gift, the deed must include a statement indicating that the transfer is being made without any monetary consideration. This is crucial to establish that the transfer is indeed a gift, not a sale. 4. Signature and Notary: The gift deed must be signed and dated by the granter in the presence of a notary public. The notary will then provide their official seal, acknowledging the granter's signature. There are various types of Gift Deed for Individual to Individual that can be used depending on the specific situation: 1. General Gift Deed: This is the most common type of gift deed, used when the donor wants to give away their property to another person without any specific restrictions or conditions. 2. Gift Deed with Reservation of Life Estate: In this type of deed, the donor transfers the property to the recipient but retains the right to use and enjoy the property for the remainder of their life. After the donor's passing, the property automatically transfers to the recipient. 3. Gift Deed with Restrictions: This type of deed may impose certain conditions or restrictions on the use of the gifted property. For example, the donor may stipulate that the property can only be used for residential purposes or that it cannot be sold for a specific period. In summary, a Dayton Ohio Gift Deed for Individual to Individual is a legal document used to transfer ownership of property as a gift. It is essential to consult with a qualified real estate attorney to ensure that all legal requirements are met, and the gift deed accurately reflects the intentions of both the donor and recipient.