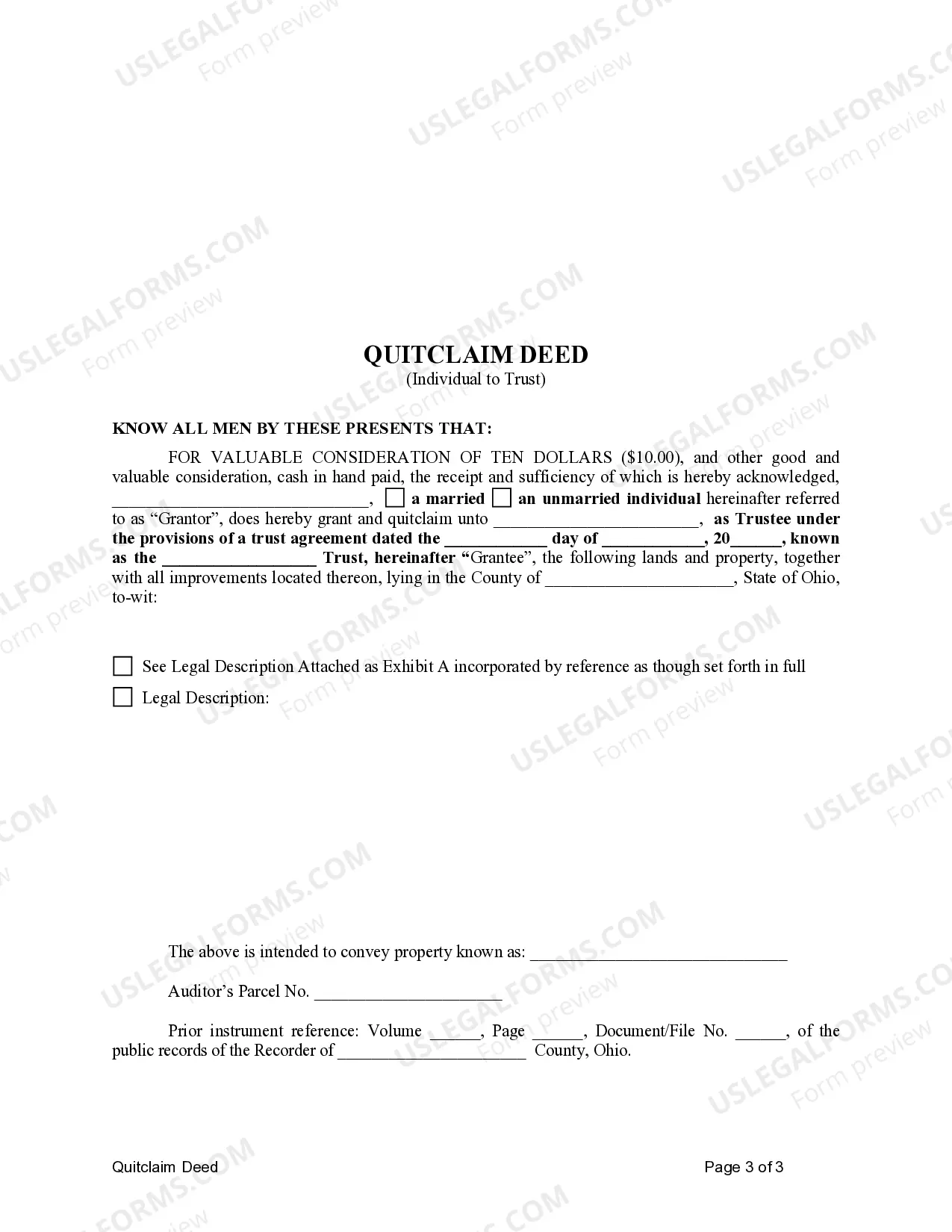

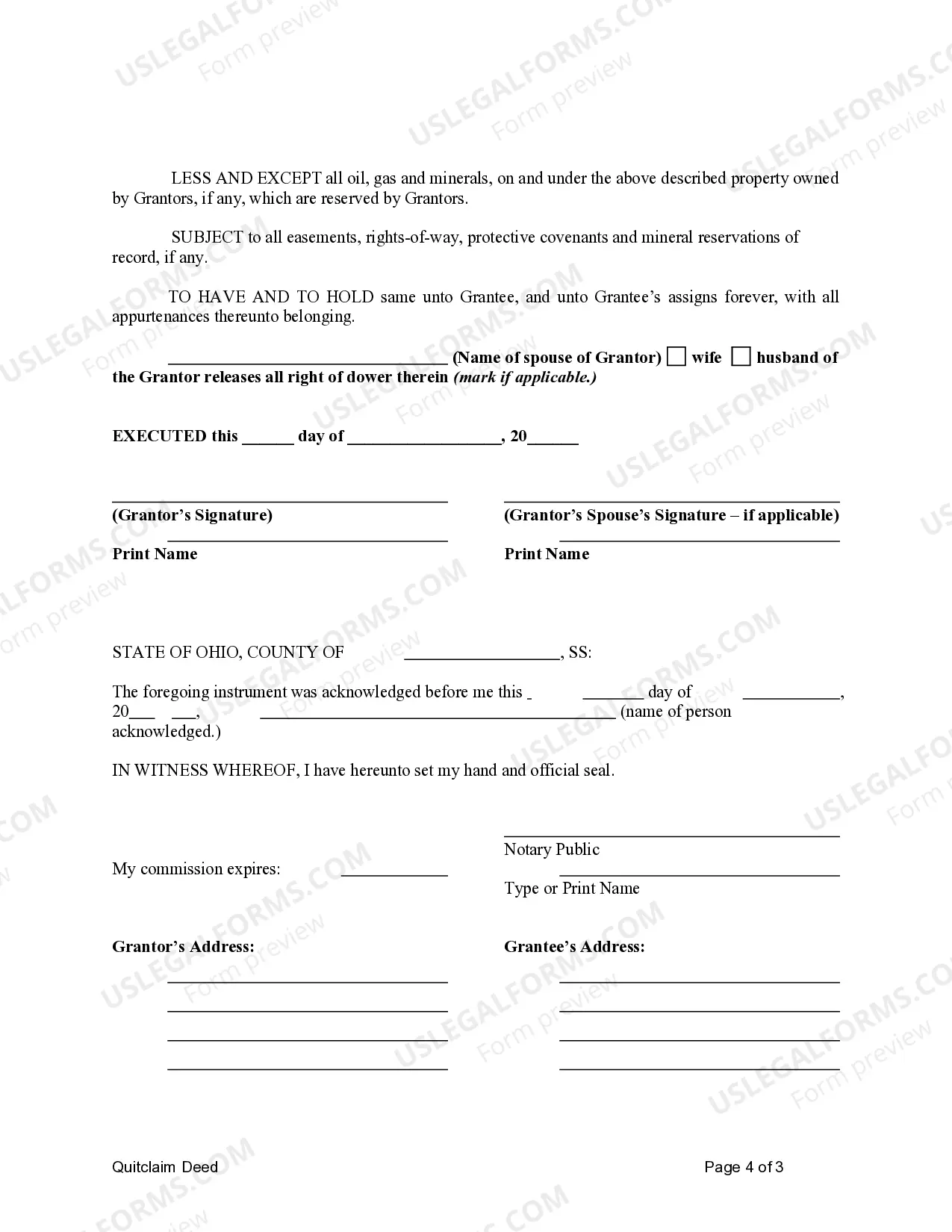

This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Columbus Ohio Quitclaim Deed — Individual to Trust is a legal document used to transfer ownership of real estate property from an individual to a trust. This type of deed is commonly used when an individual wants to transfer their property rights and ownership to a trust they have established, such as a revocable living trust. The Columbus Ohio Quitclaim Deed — Individual to Trust is a specific variant of the quitclaim deed, which is a type of deed commonly used to transfer property rights without making any guarantees or warranties about the title. In other words, the granter (the individual transferring the property) is simply relinquishing any claim they may have to the property, without guaranteeing its ownership status or any potential defects in the title. By transferring the property through a quitclaim deed, the individual effectively transfers their ownership interest to the trust, making the trust the new legal owner of the property. This transfer allows the individual to place the property within the trust, thereby ensuring its proper management and disposition according to their wishes. There are variations of the Columbus Ohio Quitclaim Deed — Individual to Trust that may have specific designations or requirements, such as "Columbus Ohio Quitclaim Deed — Individual to Revocable Living Trust." In this case, the trust established by the individual is referred to as a revocable living trust, which allows them to maintain control over the property during their lifetime while providing a clear plan for its transfer to beneficiaries upon their death. Using relevant keywords, such as Columbus Ohio, Quitclaim Deed, Individual to Trust, Revocable Living Trust, and Property Transfer, can help potential users of this document find the specific variant that suits their needs and legal requirements. However, it is crucial to consult with a qualified legal professional to ensure compliance with local laws and regulations when considering transferring property through a Columbus Ohio Quitclaim Deed — Individual to Trust or any other type of real estate deed.