This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

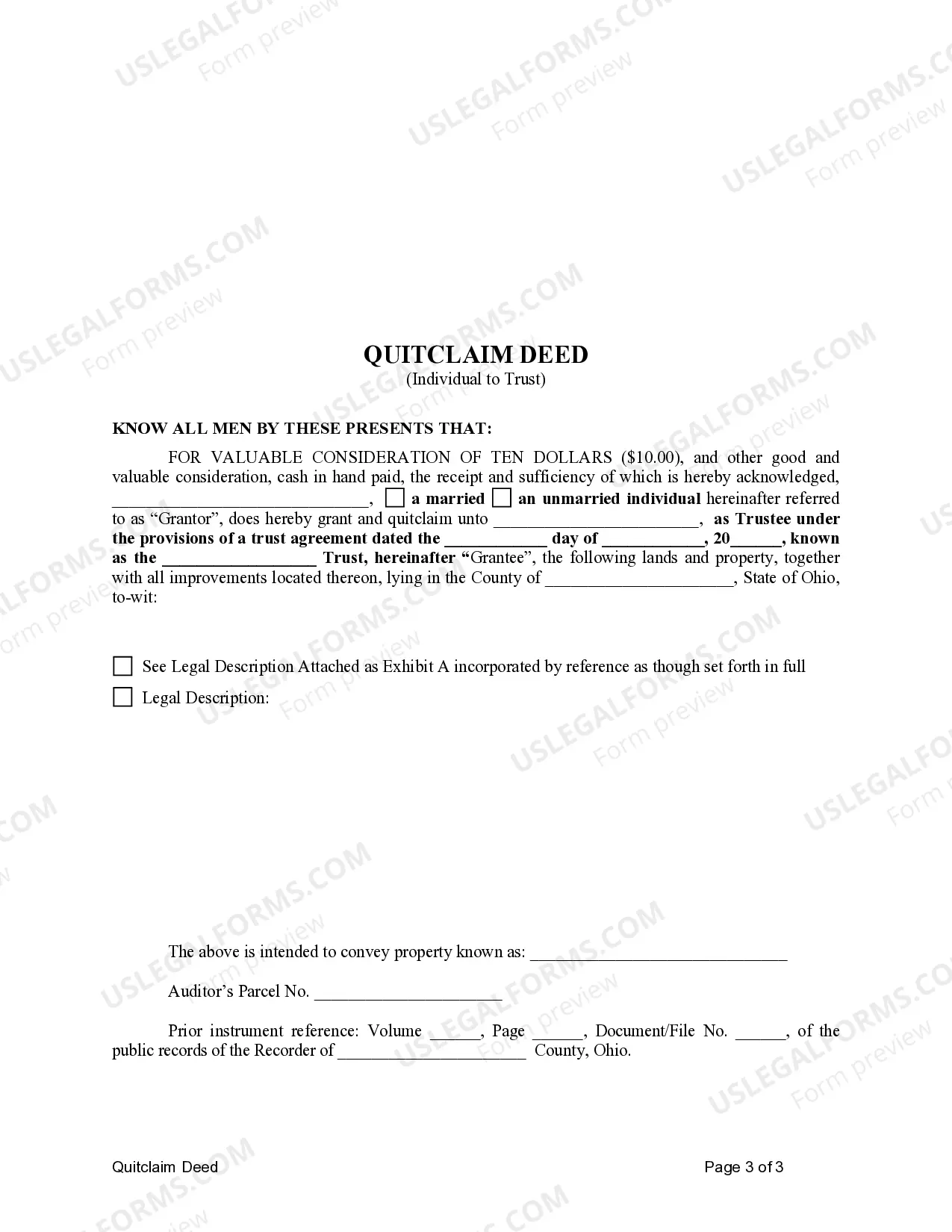

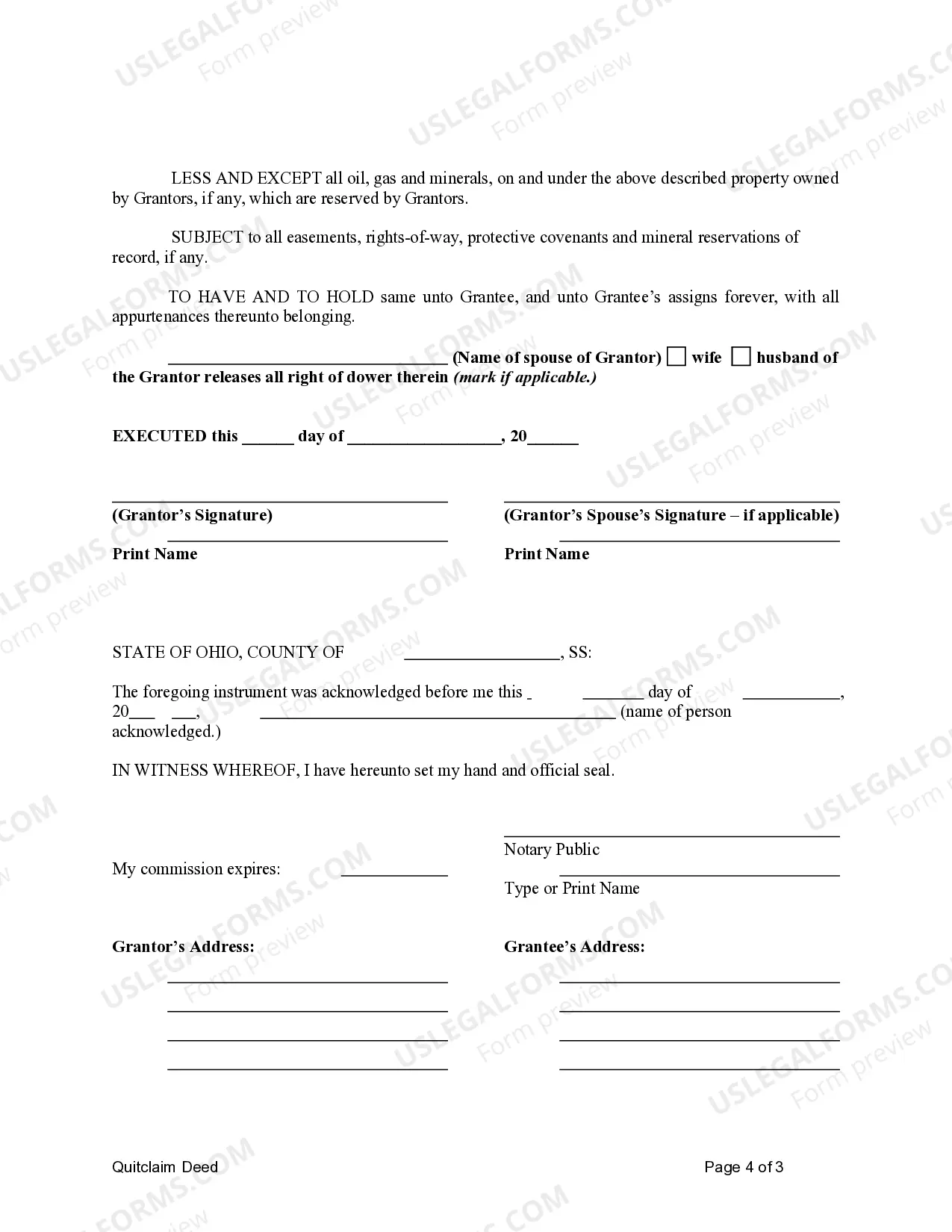

Title: Understanding the Franklin Ohio Quitclaim Deed — Individual to Trust: A Detailed Overview Introduction: A Franklin Ohio Quitclaim Deed — Individual to Trust is a legal document that allows an individual to transfer property ownership to a trust entity. In this article, we will provide a comprehensive explanation of the different types of Franklin Ohio Quitclaim Deeds — Individual to Trust and the key aspects to keep in mind during the transfer process. Key terms: 1. Quitclaim Deed: A legal instrument used to transfer property ownership without any guarantee or warranty. It only transfers the interest the granter has in the property. 2. Individual to Trust: Specifies that the property ownership is being transferred from an individual (granter) to a trust entity (grantee). 3. Franklin, Ohio: Refers to the specific location where the Quitclaim Deed is executed. Types of Franklin Ohio Quitclaim Deed — Individual to Trust: 1. Standard Franklin Ohio Quitclaim Deed — Individual to Trust— - This type of quitclaim deed is the most common method used to transfer property ownership from an individual to a trust in Franklin, Ohio. — It involves thgranteror signing and notarizing the deed, which is then recorded with the Franklin County Recorder's Office. 2. Jointly Held Property Franklin Ohio Quitclaim Deed — Individual to Trust— - If the property is jointly owned by individuals, such as spouses or business partners, this type of quitclaim deed is used. — It allows for the transfer of ownership from both individuals to a trust entity. 3. Intergenerational Transfer Franklin Ohio Quitclaim Deed — Individual to Trust— - This type of quitclaim deed is utilized when property ownership is being transferred between family members, such as parents to children or grandparents to grandchildren. — It can help protect the property from probate and estate taxes while ensuring smooth intergenerational transfers. Important Considerations: 1. Legal Assistance: It is advisable to consult with a real estate attorney or legal professional to ensure the quitclaim deed adheres to all relevant laws and regulations. 2. Trust Entity: Before executing the quitclaim deed, the individual should establish a trust entity, including naming a trustee who will manage the property. 3. Title Search and Liens: Conduct a thorough title search to identify any existing liens, judgments, or encumbrances that need to be addressed before transferring the property to the trust. 4. Recording and Filing: After the quitclaim deed is properly executed, it must be recorded with the Franklin County Recorder's Office to officially transfer ownership and provide notice to the public. Conclusion: Understanding the Franklin Ohio Quitclaim Deed — Individual to Trust is crucial when transferring property ownership from an individual to a trust entity. Whether it's a standard transfer, jointly held property, or an intergenerational transfer, consulting with legal professionals and being aware of key considerations ensures a smooth and legally compliant process.Title: Understanding the Franklin Ohio Quitclaim Deed — Individual to Trust: A Detailed Overview Introduction: A Franklin Ohio Quitclaim Deed — Individual to Trust is a legal document that allows an individual to transfer property ownership to a trust entity. In this article, we will provide a comprehensive explanation of the different types of Franklin Ohio Quitclaim Deeds — Individual to Trust and the key aspects to keep in mind during the transfer process. Key terms: 1. Quitclaim Deed: A legal instrument used to transfer property ownership without any guarantee or warranty. It only transfers the interest the granter has in the property. 2. Individual to Trust: Specifies that the property ownership is being transferred from an individual (granter) to a trust entity (grantee). 3. Franklin, Ohio: Refers to the specific location where the Quitclaim Deed is executed. Types of Franklin Ohio Quitclaim Deed — Individual to Trust: 1. Standard Franklin Ohio Quitclaim Deed — Individual to Trust— - This type of quitclaim deed is the most common method used to transfer property ownership from an individual to a trust in Franklin, Ohio. — It involves thgranteror signing and notarizing the deed, which is then recorded with the Franklin County Recorder's Office. 2. Jointly Held Property Franklin Ohio Quitclaim Deed — Individual to Trust— - If the property is jointly owned by individuals, such as spouses or business partners, this type of quitclaim deed is used. — It allows for the transfer of ownership from both individuals to a trust entity. 3. Intergenerational Transfer Franklin Ohio Quitclaim Deed — Individual to Trust— - This type of quitclaim deed is utilized when property ownership is being transferred between family members, such as parents to children or grandparents to grandchildren. — It can help protect the property from probate and estate taxes while ensuring smooth intergenerational transfers. Important Considerations: 1. Legal Assistance: It is advisable to consult with a real estate attorney or legal professional to ensure the quitclaim deed adheres to all relevant laws and regulations. 2. Trust Entity: Before executing the quitclaim deed, the individual should establish a trust entity, including naming a trustee who will manage the property. 3. Title Search and Liens: Conduct a thorough title search to identify any existing liens, judgments, or encumbrances that need to be addressed before transferring the property to the trust. 4. Recording and Filing: After the quitclaim deed is properly executed, it must be recorded with the Franklin County Recorder's Office to officially transfer ownership and provide notice to the public. Conclusion: Understanding the Franklin Ohio Quitclaim Deed — Individual to Trust is crucial when transferring property ownership from an individual to a trust entity. Whether it's a standard transfer, jointly held property, or an intergenerational transfer, consulting with legal professionals and being aware of key considerations ensures a smooth and legally compliant process.