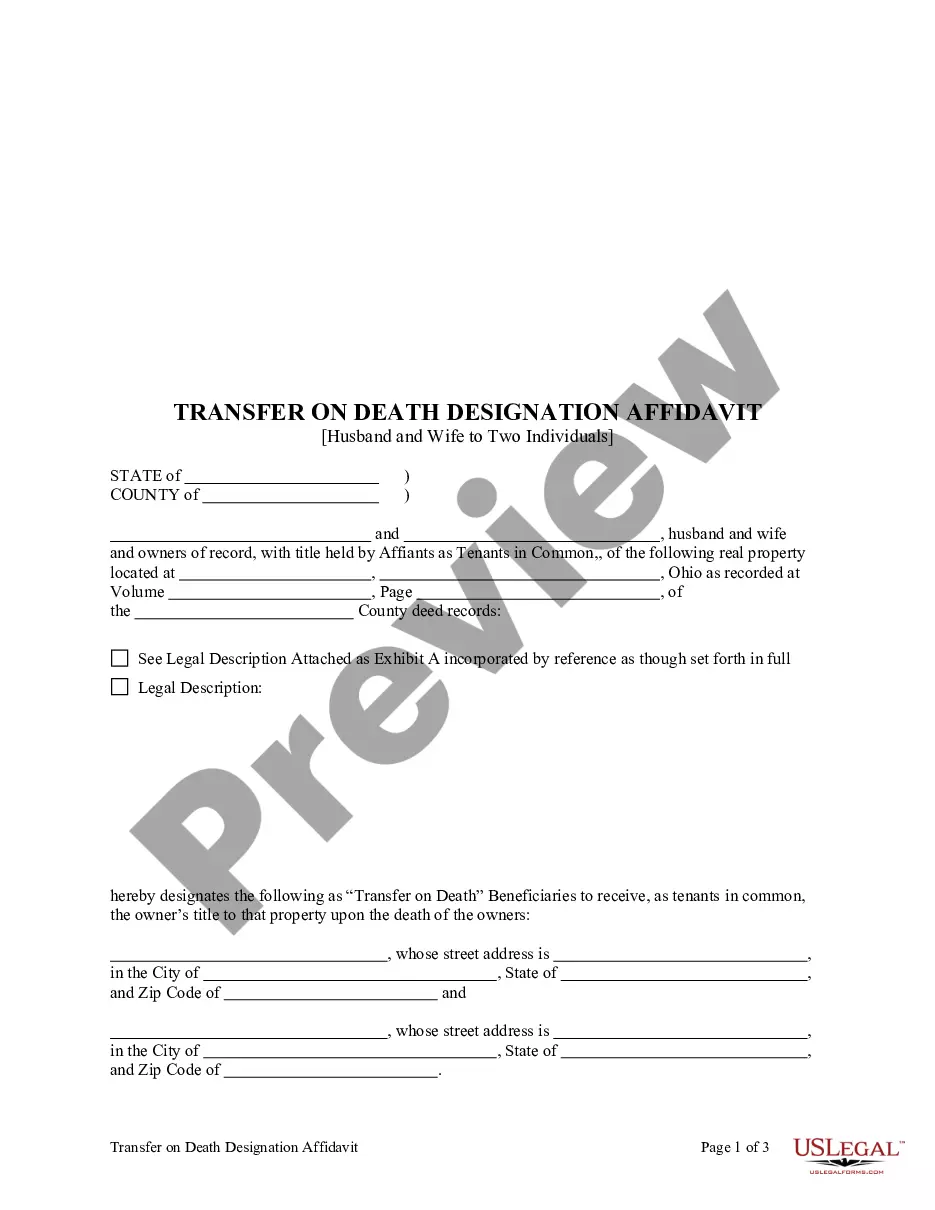

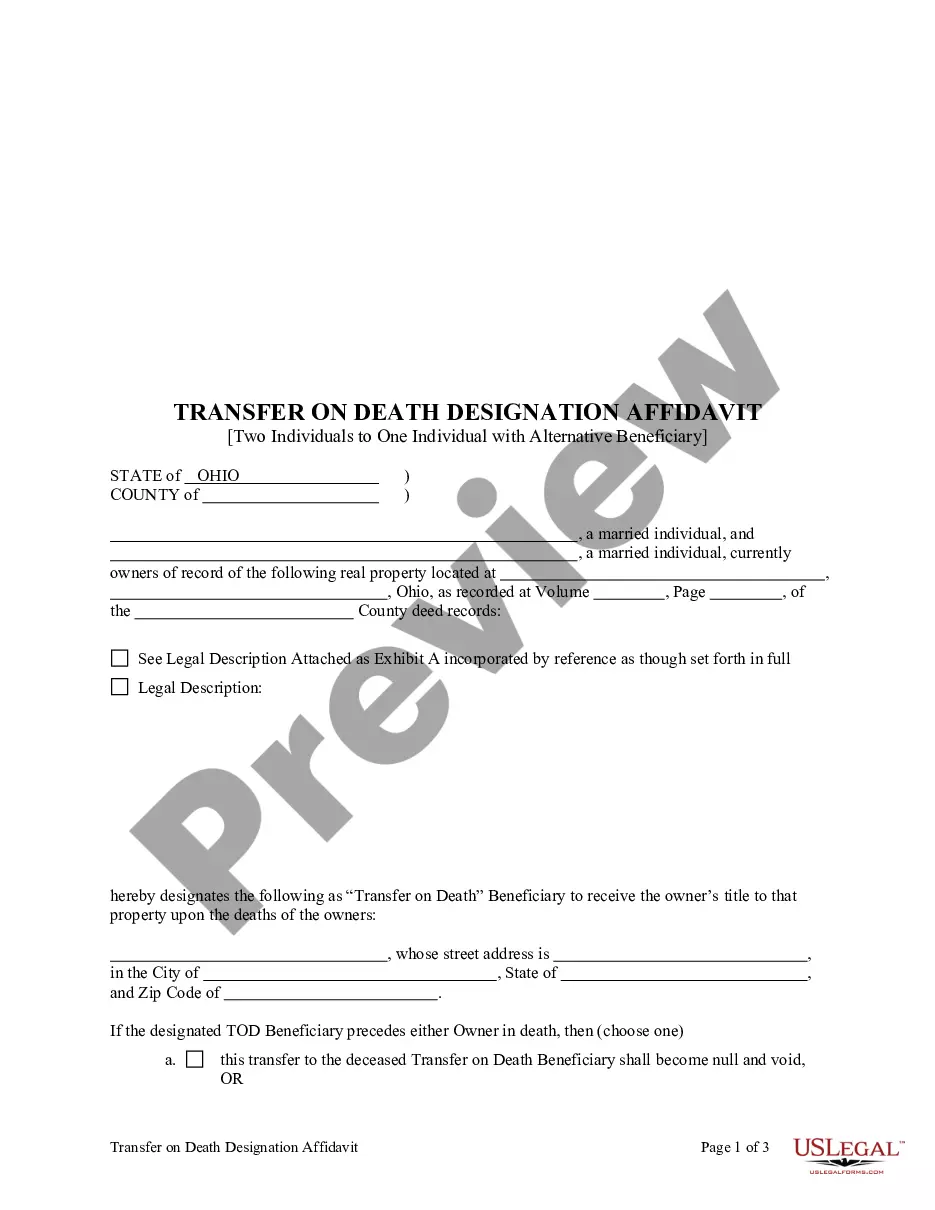

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the grantee is an individual. The transfer to the designated beneficiary is not effective until the death of both grantors. The affidavit may be canceled by designating a new transfer on death beneficiary in a new affidavit, selling the property, etc. This deed complies with all state statutory laws.

Columbus Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Husband And Wife To Individual?

Finding authenticated templates tailored to your local laws can be difficult unless you access the US Legal Forms collection.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as real-world circumstances.

All the files are appropriately sorted by usage area and jurisdiction, making it simple and quick to locate the Columbus Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual.

Maintaining orderly paperwork and adhering to legal requirements is crucial. Utilize the US Legal Forms library to have essential document templates for any necessity readily available!

- For those already familiar with our service and have utilized it previously, obtaining the Columbus Ohio Transfer on Death Designation Affidavit - TOD from Husband and Wife to Individual requires only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- New users will need to complete a few additional steps to finish the process.

- Follow the instructions listed below to begin using the most extensive online form collection.

- Review the Preview mode and form details. Ensure you’ve chosen the appropriate one that fulfills your requirements and completely aligns with your local jurisdiction standards.

Form popularity

FAQ

Living Trusts In Ohio, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

More than 25 states, including Ohio, now allow the use of Transfer-On-Death deeds. You don't have to actually live in a state that allows TOD deeds to be able to use one, but the property must be located in such a state.

More than 25 states, including Ohio, now allow the use of Transfer-On-Death deeds. You don't have to actually live in a state that allows TOD deeds to be able to use one, but the property must be located in such a state.

The Transfer on Death Designation Affidavit (TOD), when properly recorded, permits the direct transfer of the described real property to the designated beneficiary or beneficiaries upon the death of the owner, thus avoiding Probate administration.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (?TOD?) Designation Affidavit. What is a TOD Designation Affidavit?

Transfer on Death (TOD) Similarly, you can use a transfer on death affidavit to automatically transfer real estate or vehicles upon your death. Assets designated as TOD will not need to pass through probate court.

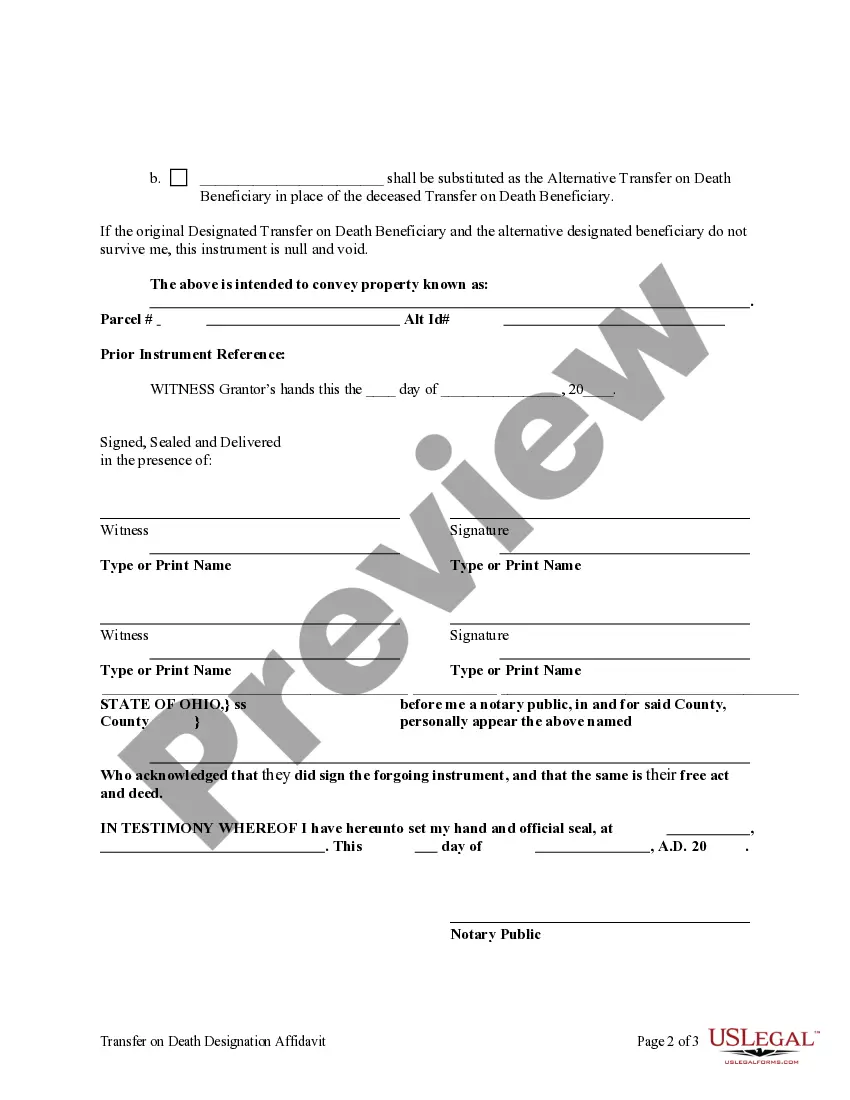

How to create a Transfer on Death for your home Choose your recipients. You can choose one or more people to become owner of any home or land that you own.Find a copy of your deed.Complete the TOD for real estate form.Take the form to a notary .Submit the form at your County Recorder's Office.

Ohio Eliminates Transfer on Death Deeds. Get answers to questions on the impact of Ohio's elimination of Transfer on Death deeds. Effective December 28, 2009, Ohio eliminated transfer on death deeds and replaced that deed with a TRANSFER ON DEATH DESIGNATION AFFIDAVIT.