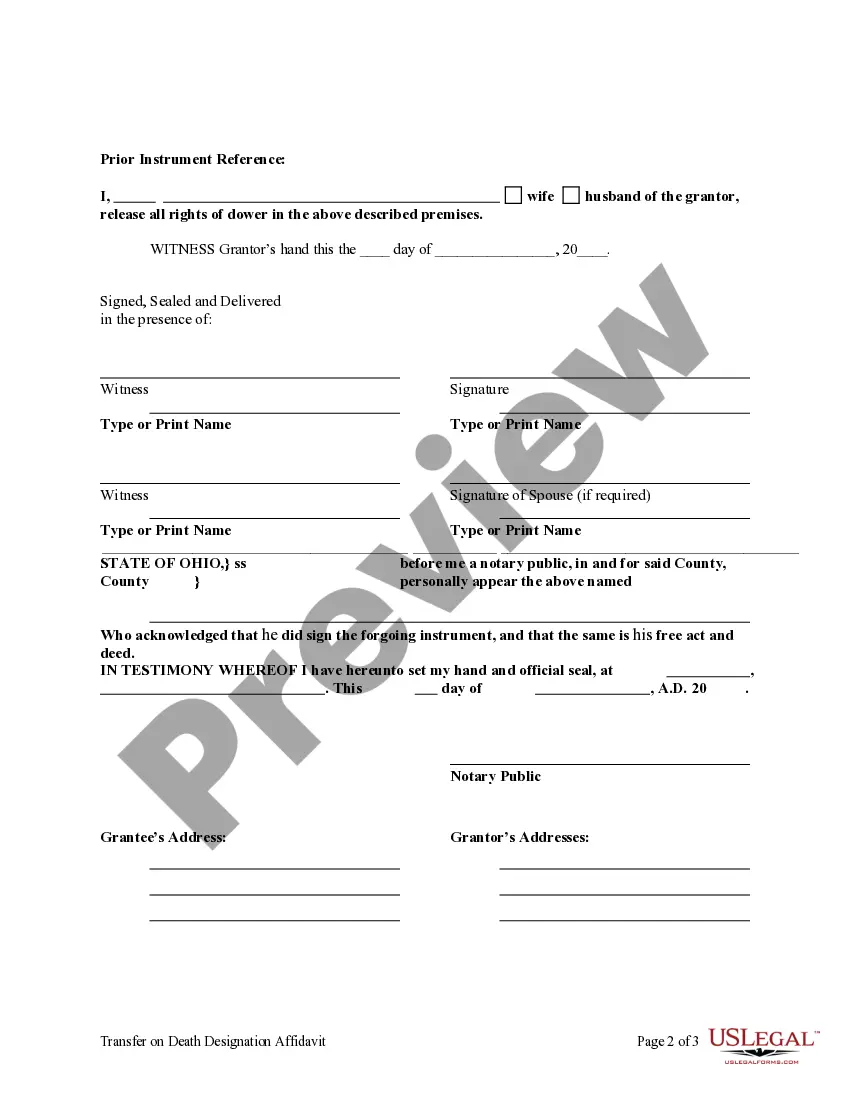

Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the Beneficiary. It should be signed in front of a Notary Public. The form does NOT include provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the owner's entire, separate interest in the real property to one or more persons, including the owner, with or without the designation of another transfer on death beneficiary.

Dayton Ohio Transfer on Death Designation Affidavit — TOD from Individual to Individual without Contingent Beneficiary is a legal document used for estate planning purposes. This affidavit allows an individual to designate a specific beneficiary who will inherit their assets upon their death, without the need for probate. The Transfer on Death (TOD) designation is a popular estate planning tool in Ohio that allows individuals to pass on certain assets, such as real estate, vehicles, or investment accounts, directly to a named beneficiary without going through the probate process. By utilizing a Dayton Ohio Transfer on Death Designation Affidavit, individuals can maintain control over their assets during their lifetime while ensuring a smooth transfer to their chosen beneficiary upon their passing. In the case of a transfer on death without a contingent beneficiary, the individual designates one primary beneficiary who will receive the assets. However, if the primary beneficiary predeceases the owner or is unable or unwilling to accept the inheritance, the assets may end up in probate, unless the individual creates an updated affidavit or will. It's important to note that there are different types of Dayton Ohio Transfer on Death Designation Affidavits, and they can vary depending on the types of assets being transferred. For example, there may be separate affidavits for real estate, vehicles, or investment accounts. Each affidavit will outline the specific details required for that particular asset, such as the asset's description, location, and the name and contact information of the primary beneficiary. When creating a Dayton Ohio Transfer on Death Designation Affidavit — TOD from Individual to Individual without Contingent Beneficiary, it is crucial to consult with an experienced estate planning attorney who can provide guidance on the legal requirements and help ensure that the document meets all necessary criteria. This will help to avoid any potential challenges or disputes related to the transfer of assets and provide peace of mind for both the individual creating the affidavit and their designated beneficiary.Dayton Ohio Transfer on Death Designation Affidavit — TOD from Individual to Individual without Contingent Beneficiary is a legal document used for estate planning purposes. This affidavit allows an individual to designate a specific beneficiary who will inherit their assets upon their death, without the need for probate. The Transfer on Death (TOD) designation is a popular estate planning tool in Ohio that allows individuals to pass on certain assets, such as real estate, vehicles, or investment accounts, directly to a named beneficiary without going through the probate process. By utilizing a Dayton Ohio Transfer on Death Designation Affidavit, individuals can maintain control over their assets during their lifetime while ensuring a smooth transfer to their chosen beneficiary upon their passing. In the case of a transfer on death without a contingent beneficiary, the individual designates one primary beneficiary who will receive the assets. However, if the primary beneficiary predeceases the owner or is unable or unwilling to accept the inheritance, the assets may end up in probate, unless the individual creates an updated affidavit or will. It's important to note that there are different types of Dayton Ohio Transfer on Death Designation Affidavits, and they can vary depending on the types of assets being transferred. For example, there may be separate affidavits for real estate, vehicles, or investment accounts. Each affidavit will outline the specific details required for that particular asset, such as the asset's description, location, and the name and contact information of the primary beneficiary. When creating a Dayton Ohio Transfer on Death Designation Affidavit — TOD from Individual to Individual without Contingent Beneficiary, it is crucial to consult with an experienced estate planning attorney who can provide guidance on the legal requirements and help ensure that the document meets all necessary criteria. This will help to avoid any potential challenges or disputes related to the transfer of assets and provide peace of mind for both the individual creating the affidavit and their designated beneficiary.