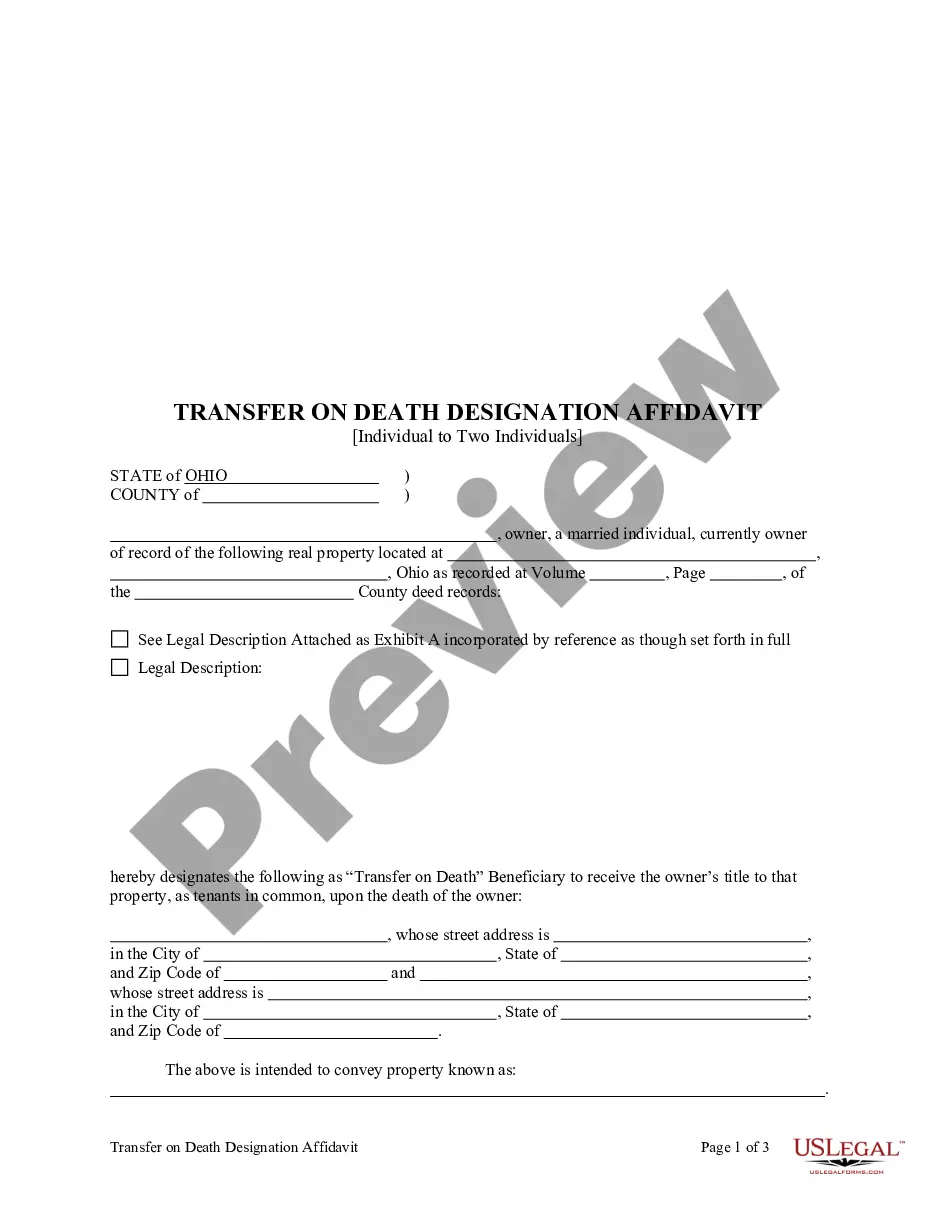

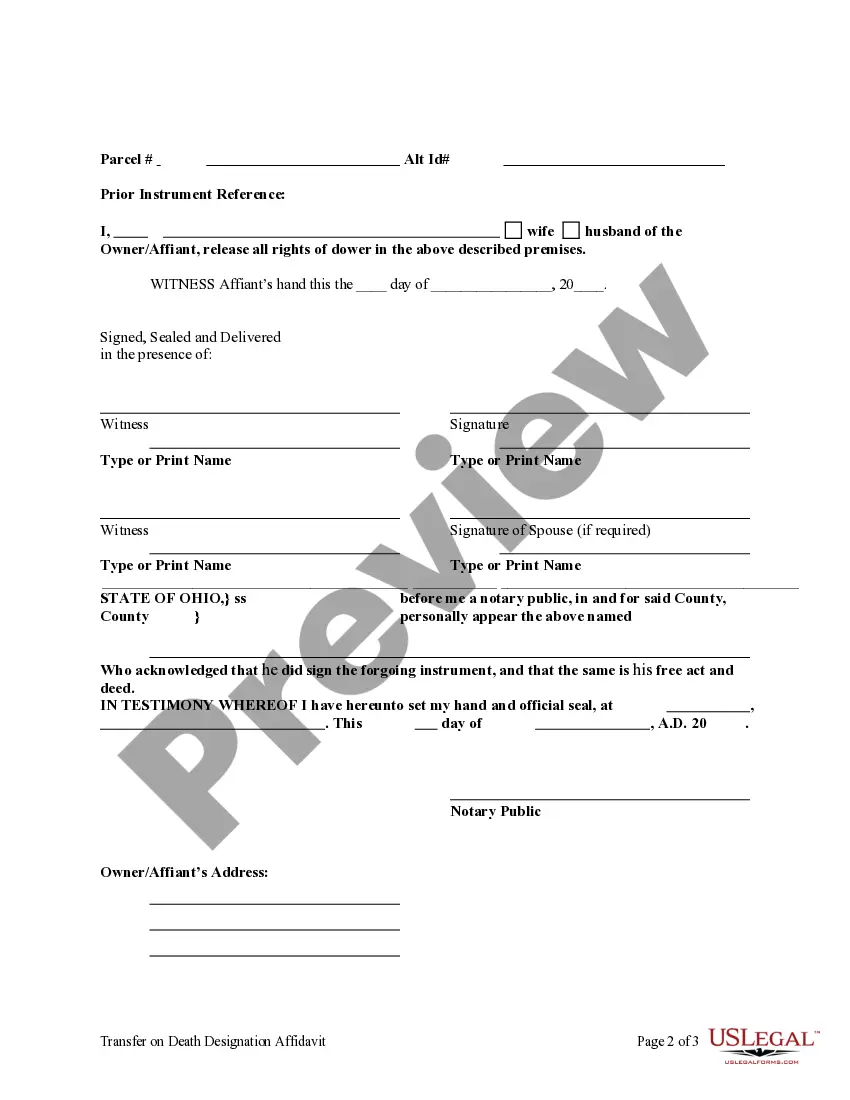

Transfer on Death Designation Affidavit from Individual to Two Individuals as tenants in common: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the designated Beneficiary. It should be signed in front of a Notary Public. The form does NOT include provision for an contingent beneficiary in the event one of the designated beneficiaries predecease the affiant/owner. If the designated beneficiaries predecease the Owner/Affiant, the deed is null and void. The designation of the beneficiaries in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the affiant/owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the affiant's entire, separate interest in the real property to one or more persons, including the affiant, with or without the designation of another transfer on death beneficiary.

The Dayton Ohio Transfer on Death Designation Affidavit, also known as TOD from Individual to Two Individuals without Contingent Beneficiary, is a legal document that allows an individual to designate specific beneficiaries who will inherit their assets upon their death. This affidavit ensures a smooth transfer of assets by bypassing probate court proceedings. In Dayton, Ohio, there are various types of Transfer on Death Designation Affidavits depending on the specific circumstances. Here are some variations: 1. TOD from Individual to Two Individuals without Contingent Beneficiary: This particular affidavit is designed for individuals who want to transfer their assets to two specific beneficiaries without appointing a contingent beneficiary. It allows for a direct transfer of assets to the designated beneficiaries after the individual passes away. 2. TOD from Individual to Two Individuals with Contingent Beneficiary: In contrast to the previous type, this affidavit includes a contingent beneficiary. In case one or both of the primary beneficiaries predecease the individual, the contingent beneficiary becomes the new recipient of the assets. 3. TOD from Individual to Spouse and Children without Contingent Beneficiary: This type of affidavit is suitable for individuals who wish to transfer their assets to their spouse and children directly. It allows for the distribution of assets among the named beneficiaries without the need for probate court intervention. 4. TOD from Individual to Multiple Individuals with Contingent Beneficiary: This affidavit is suitable for individuals who want to distribute their assets among multiple beneficiaries. It allows for including a contingent beneficiary in case any of the primary beneficiaries are unable to receive the assets. 5. TOD from Individual to Trustee for Multiple Beneficiaries without Contingent Beneficiary: In this case, the individual designates a trustee to manage and distribute their assets to multiple beneficiaries. This affidavit provides flexibility in managing the distribution of assets, and the trustee ensures that the beneficiaries receive their designated share. It is essential to consult with an attorney or legal professional in Dayton, Ohio, to determine the specific type of Transfer on Death Designation Affidavit that aligns with your personal circumstances. Accuracy and adherence to local legal requirements are crucial to avoid any complications during the asset transfer process.The Dayton Ohio Transfer on Death Designation Affidavit, also known as TOD from Individual to Two Individuals without Contingent Beneficiary, is a legal document that allows an individual to designate specific beneficiaries who will inherit their assets upon their death. This affidavit ensures a smooth transfer of assets by bypassing probate court proceedings. In Dayton, Ohio, there are various types of Transfer on Death Designation Affidavits depending on the specific circumstances. Here are some variations: 1. TOD from Individual to Two Individuals without Contingent Beneficiary: This particular affidavit is designed for individuals who want to transfer their assets to two specific beneficiaries without appointing a contingent beneficiary. It allows for a direct transfer of assets to the designated beneficiaries after the individual passes away. 2. TOD from Individual to Two Individuals with Contingent Beneficiary: In contrast to the previous type, this affidavit includes a contingent beneficiary. In case one or both of the primary beneficiaries predecease the individual, the contingent beneficiary becomes the new recipient of the assets. 3. TOD from Individual to Spouse and Children without Contingent Beneficiary: This type of affidavit is suitable for individuals who wish to transfer their assets to their spouse and children directly. It allows for the distribution of assets among the named beneficiaries without the need for probate court intervention. 4. TOD from Individual to Multiple Individuals with Contingent Beneficiary: This affidavit is suitable for individuals who want to distribute their assets among multiple beneficiaries. It allows for including a contingent beneficiary in case any of the primary beneficiaries are unable to receive the assets. 5. TOD from Individual to Trustee for Multiple Beneficiaries without Contingent Beneficiary: In this case, the individual designates a trustee to manage and distribute their assets to multiple beneficiaries. This affidavit provides flexibility in managing the distribution of assets, and the trustee ensures that the beneficiaries receive their designated share. It is essential to consult with an attorney or legal professional in Dayton, Ohio, to determine the specific type of Transfer on Death Designation Affidavit that aligns with your personal circumstances. Accuracy and adherence to local legal requirements are crucial to avoid any complications during the asset transfer process.