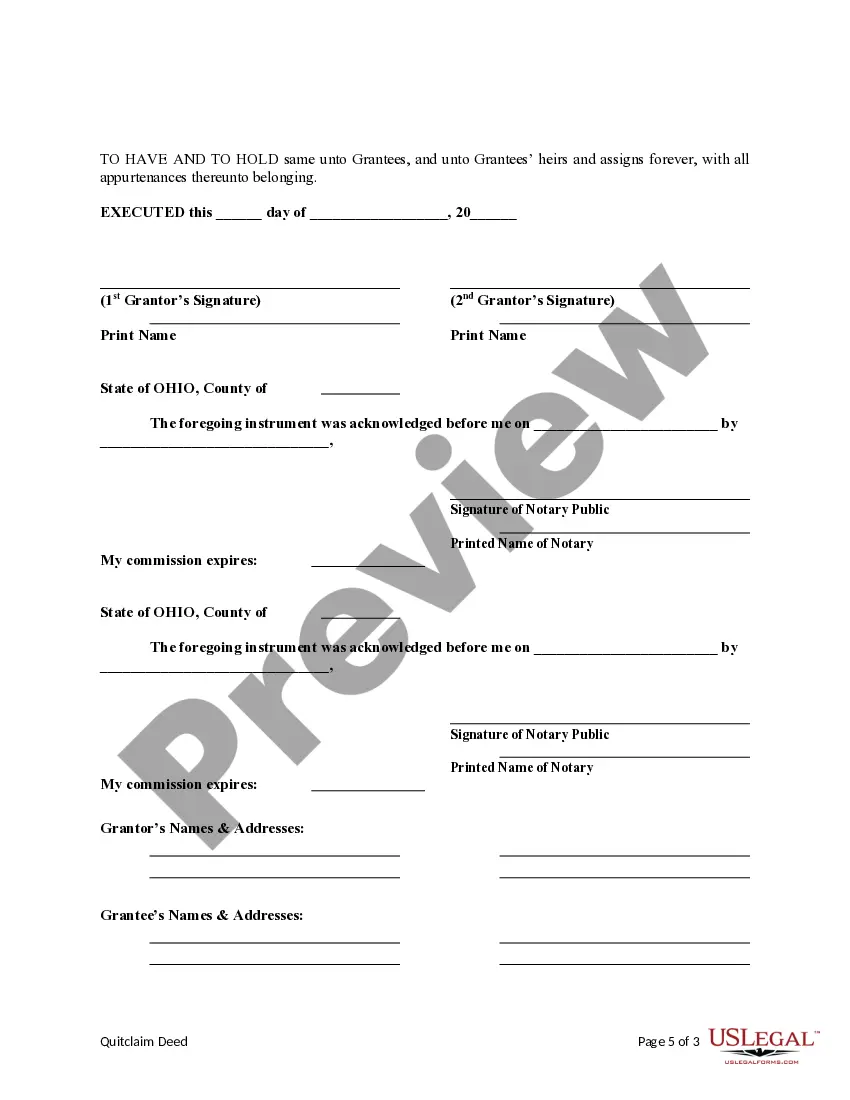

This form is a Deed of Trustee distributing trust asset to individual pursuant to the terms of the trust. Grantor, as Trustee, conveys with fiduciary covenants to the Grantee. This deed complies with all state statutory laws.

The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument is a legal document that outlines the process of distributing assets or funds to an individual beneficiary as determined by the terms of a trust instrument. This type of deed serves as a crucial component in estate planning and ensuring proper asset management. The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument entails several key elements. First, it outlines the identity of the trustee who will oversee the distribution process and ensure compliance with the trust's provisions. The trustee is typically responsible for managing and safeguarding the trust assets until they are ready for distribution. Additionally, this document specifies the identification details of the beneficiary or beneficiaries receiving the distribution. It ensures that the intended individuals are correctly identified, usually by including their full name, contact information, and relationship to the trust creator. The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument also includes a comprehensive description of the assets or funds being distributed. This description may include real estate properties, bank accounts, investments, personal property, or any other assets held within the trust. The document should specify the exact nature and value of each asset to ensure accurate distribution. Furthermore, this type of deed defines the timing and manner in which the distribution will occur. It may outline if the distribution will be made in a lump sum or in installments. The document may also stipulate any conditions or restrictions associated with the distribution, such as age restrictions or requirements for the beneficiary to meet certain milestones. Different types of Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument can vary depending on the specific circumstances and intentions of the trust creator. Some common variations include: 1. Lifetime Distribution: This type of deed allows for distributions to be made to the beneficiary during their lifetime, ensuring they receive income or financial support as specified in the trust instrument. 2. Testamentary Distribution: This variation specifies that the distribution will only occur after the death of the trust creator. It ensures that the assets are transferred to the beneficiary according to the trust's provisions upon the creator's passing. 3. Specific Asset Distribution: In this type of deed, the document focuses on the distribution of specific assets rather than a monetary amount. This can include properties or valuable possessions that the trust creator wants to distribute to a particular individual. 4. Discretionary Distribution: This type of deed grants the trustee discretionary powers to determine the timing and amount of distributions based on the beneficiary's needs and circumstances. In conclusion, the Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument is a crucial legal document that ensures the proper distribution of assets or funds to a beneficiary as specified in a trust instrument. It outlines the trustee's responsibilities, beneficiary identification, asset descriptions, distribution timing, and potentially any variations based on the trust's provisions.The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument is a legal document that outlines the process of distributing assets or funds to an individual beneficiary as determined by the terms of a trust instrument. This type of deed serves as a crucial component in estate planning and ensuring proper asset management. The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument entails several key elements. First, it outlines the identity of the trustee who will oversee the distribution process and ensure compliance with the trust's provisions. The trustee is typically responsible for managing and safeguarding the trust assets until they are ready for distribution. Additionally, this document specifies the identification details of the beneficiary or beneficiaries receiving the distribution. It ensures that the intended individuals are correctly identified, usually by including their full name, contact information, and relationship to the trust creator. The Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument also includes a comprehensive description of the assets or funds being distributed. This description may include real estate properties, bank accounts, investments, personal property, or any other assets held within the trust. The document should specify the exact nature and value of each asset to ensure accurate distribution. Furthermore, this type of deed defines the timing and manner in which the distribution will occur. It may outline if the distribution will be made in a lump sum or in installments. The document may also stipulate any conditions or restrictions associated with the distribution, such as age restrictions or requirements for the beneficiary to meet certain milestones. Different types of Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument can vary depending on the specific circumstances and intentions of the trust creator. Some common variations include: 1. Lifetime Distribution: This type of deed allows for distributions to be made to the beneficiary during their lifetime, ensuring they receive income or financial support as specified in the trust instrument. 2. Testamentary Distribution: This variation specifies that the distribution will only occur after the death of the trust creator. It ensures that the assets are transferred to the beneficiary according to the trust's provisions upon the creator's passing. 3. Specific Asset Distribution: In this type of deed, the document focuses on the distribution of specific assets rather than a monetary amount. This can include properties or valuable possessions that the trust creator wants to distribute to a particular individual. 4. Discretionary Distribution: This type of deed grants the trustee discretionary powers to determine the timing and amount of distributions based on the beneficiary's needs and circumstances. In conclusion, the Cuyahoga Ohio Deed of Trustee — Distribution to an Individual Pursuant to Trust Instrument is a crucial legal document that ensures the proper distribution of assets or funds to a beneficiary as specified in a trust instrument. It outlines the trustee's responsibilities, beneficiary identification, asset descriptions, distribution timing, and potentially any variations based on the trust's provisions.