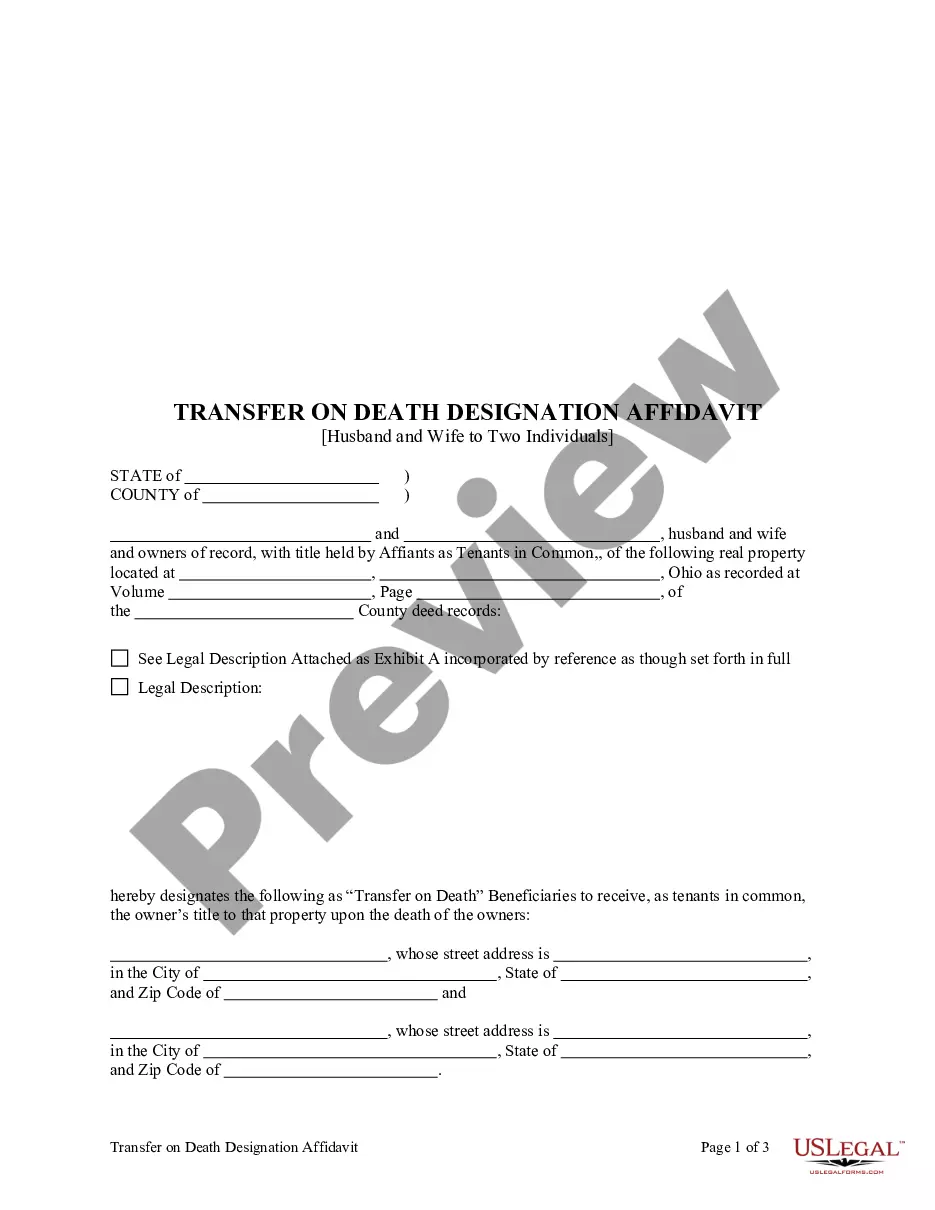

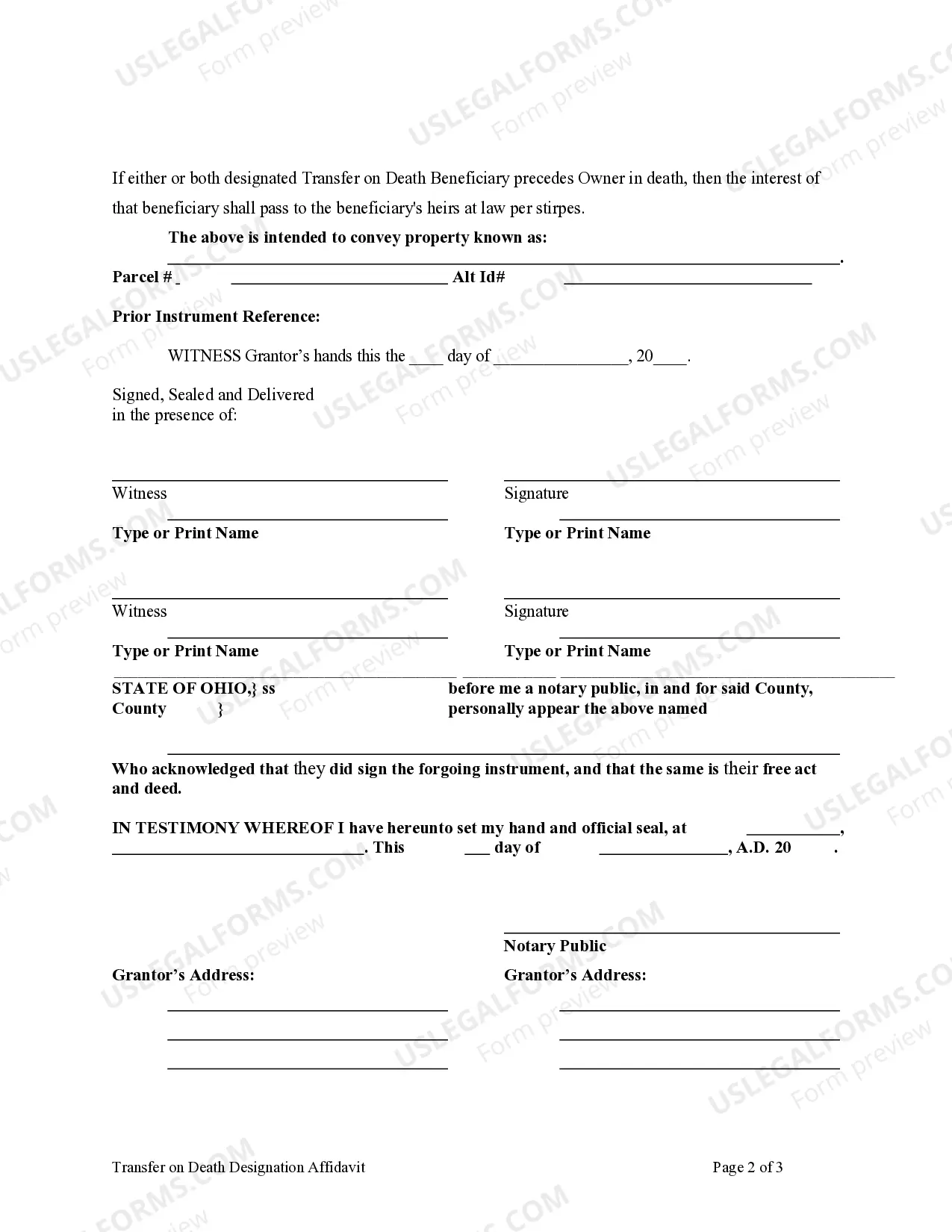

This form is a Transfer on Death Designation Affidavit where the affiants are husband and wife and the beneficiaries are two individuals. This affidavit of designation is revocable by affiants/grantors until afiant's death and effective only upon the death of the affiants. The beneficiaries take the property as tenants in common. Is a beneficiary fails to survive the grantors, their interest goes to their heirs per stirpes. This deed complies with all state statutory laws.

The Dayton Ohio Transfer on Death Designation Affidavit (TOD) is a legal document that allows a married couple residing in Dayton, Ohio, to designate two individuals as beneficiaries for their assets upon their death. This affidavit ensures a smoother transfer of assets, avoiding the need for probate and simplifying the distribution process. There are two types of Dayton Ohio Transfer on Death Designation Affidavits that a husband and wife can choose based on their specific circumstances: 1. Dayton Ohio TOD — Husband and Wife to Two Individuals Beneficiaries with Equal Shares: This type of affidavit allows the couple to name two individuals as beneficiaries who will inherit their assets in equal shares upon their passing. This is a common choice for couples with two children or close relatives who they wish to distribute their assets equally between. 2. Dayton Ohio TOD — Husband and Wife to Two Individuals Beneficiaries with Unequal Shares: In this case, the couple can designate two individuals as beneficiaries with specified unequal shares. This option is suitable for situations where the couple wishes to ensure that one beneficiary receives a larger portion of their assets, perhaps due to financial need or personal circumstances. The Dayton Ohio Transfer on Death Designation Affidavit offers several benefits and considerations for married couples when planning their estate: — Avoiding probate: By using a TOD affidavit, the transfer of assets can occur directly to the designated beneficiaries upon the death of both spouses, without the need for probate court involvement. This saves time, effort, and potential costs associated with the probate process. — Simplicity: This document provides a straightforward method of transferring assets by clearly outlining the intentions of the spouses and the designated beneficiaries. It eliminates the need for complex and lengthy legal procedures ensuring a more efficient distribution process. — Control over assets: The couple retains full control and ownership of their assets during their lifetime. They can freely modify or revoke the TOD designation at any time if their circumstances or preferences change. — Privacy: Since the TOD affidavit does not go through probate, it remains private and does not become a matter of public record. This offers increased privacy for the family and beneficiaries involved. When using the Dayton Ohio Transfer on Death Designation Affidavit, it is important for the husband and wife to carefully consider their options and consult with a qualified attorney to ensure proper execution and compliance with Ohio state laws. Note: It is always recommended seeking professional legal advice when creating or modifying important legal documents like a transfer on death designation affidavit.The Dayton Ohio Transfer on Death Designation Affidavit (TOD) is a legal document that allows a married couple residing in Dayton, Ohio, to designate two individuals as beneficiaries for their assets upon their death. This affidavit ensures a smoother transfer of assets, avoiding the need for probate and simplifying the distribution process. There are two types of Dayton Ohio Transfer on Death Designation Affidavits that a husband and wife can choose based on their specific circumstances: 1. Dayton Ohio TOD — Husband and Wife to Two Individuals Beneficiaries with Equal Shares: This type of affidavit allows the couple to name two individuals as beneficiaries who will inherit their assets in equal shares upon their passing. This is a common choice for couples with two children or close relatives who they wish to distribute their assets equally between. 2. Dayton Ohio TOD — Husband and Wife to Two Individuals Beneficiaries with Unequal Shares: In this case, the couple can designate two individuals as beneficiaries with specified unequal shares. This option is suitable for situations where the couple wishes to ensure that one beneficiary receives a larger portion of their assets, perhaps due to financial need or personal circumstances. The Dayton Ohio Transfer on Death Designation Affidavit offers several benefits and considerations for married couples when planning their estate: — Avoiding probate: By using a TOD affidavit, the transfer of assets can occur directly to the designated beneficiaries upon the death of both spouses, without the need for probate court involvement. This saves time, effort, and potential costs associated with the probate process. — Simplicity: This document provides a straightforward method of transferring assets by clearly outlining the intentions of the spouses and the designated beneficiaries. It eliminates the need for complex and lengthy legal procedures ensuring a more efficient distribution process. — Control over assets: The couple retains full control and ownership of their assets during their lifetime. They can freely modify or revoke the TOD designation at any time if their circumstances or preferences change. — Privacy: Since the TOD affidavit does not go through probate, it remains private and does not become a matter of public record. This offers increased privacy for the family and beneficiaries involved. When using the Dayton Ohio Transfer on Death Designation Affidavit, it is important for the husband and wife to carefully consider their options and consult with a qualified attorney to ensure proper execution and compliance with Ohio state laws. Note: It is always recommended seeking professional legal advice when creating or modifying important legal documents like a transfer on death designation affidavit.