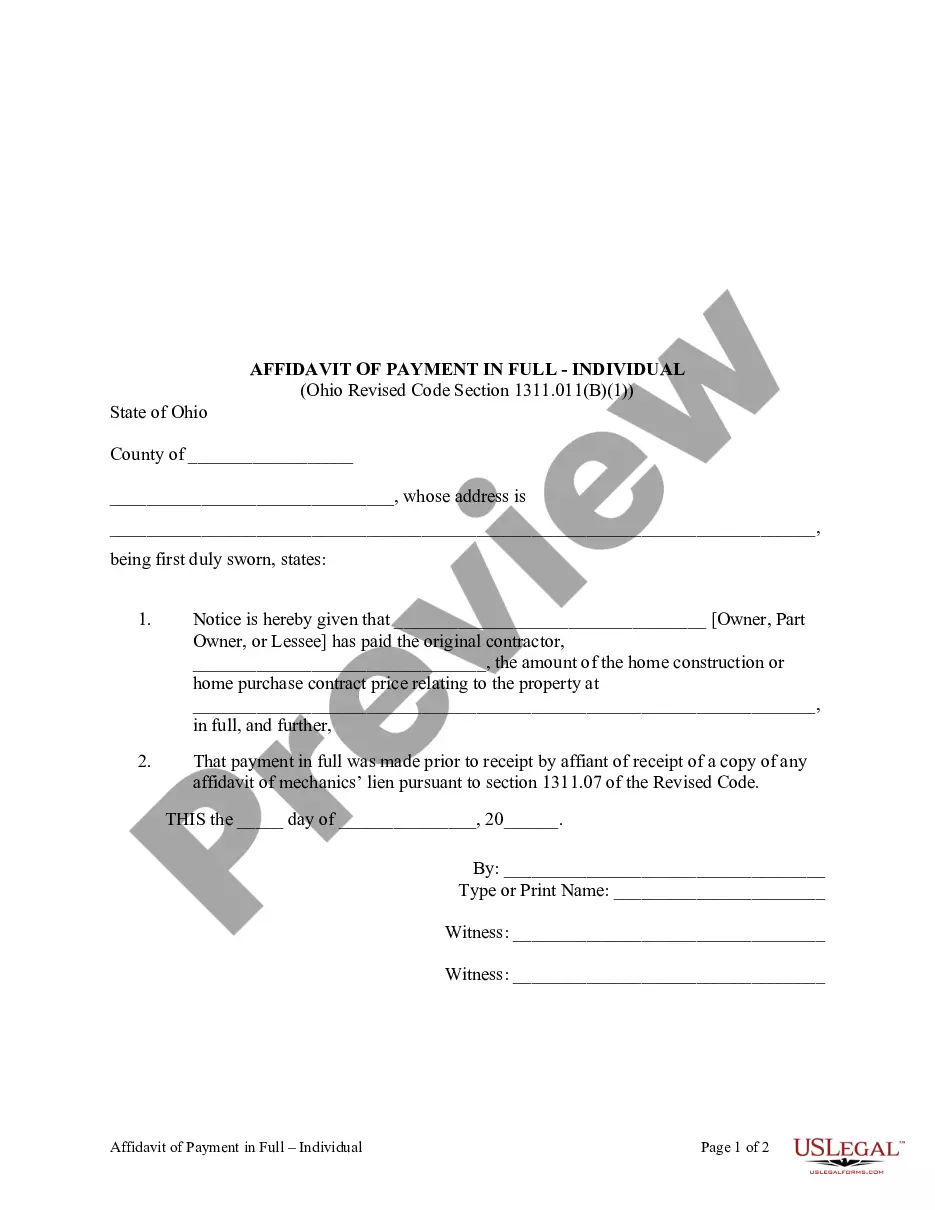

Affidavit of Payment in Full - Individual

Note: This summary

is not intended to be an all inclusive summary of the law of construction liens in Ohio, but does

contain basic and other provisions.

Definitions relative to Ohio Mechanics' Liens as used in sections 1311.01 to 1311.22 of the Revised Code:

(A) "Owner," "part owner," or "lessee" includes all the

interests either legal or equitable, which such person may have in the

real estate upon which the improvements are made, including the interests

held by any person under contracts of purchase, whether in writing or otherwise.

(B) "Materialman" includes any person by whom any materials

are furnished in furtherance of an improvement.

(C) "Laborer" includes any mechanic, workman, artisan, or

other individual who performs labor or work in furtherance of any improvement.

(D) "Subcontractor" includes any person who undertakes to

construct, alter, erect, improve, repair, demolish, remove, dig, or drill

any part of any improvement under a contract with any person other than

the owner, part owner, or lessee.

(E) "Original contractor," except as otherwise provided

in section 1311.011 [1311.01.1] of the Revised Code, includes a construction

manager and any person who undertakes to construct, alter, erect, improve,

repair, demolish, remove, dig, or drill any part of any improvement under

a contract with an owner, part owner, or lessee.

(F) "Construction manager" means a person with substantial

discretion and authority to manage or direct an improvement, provided that

the person is in direct privity of contract with the owner, part owner,

or lessee of the improvement.

(I) "Materials" means all products and substances including,

without limitation, any gasoline, lubricating oil, petroleum products,

powder, dynamite, blasting supplies and other explosives, tools, equipment,

or machinery furnished in furtherance of an improvement.

(J) "Improvement" means constructing, erecting, altering,

repairing, demolishing, or removing any building or appurtenance thereto,

fixture, bridge, or other structure, and any gas pipeline or well including,

but not limited to, a well drilled or constructed for the production of

oil or gas; the furnishing of tile for the drainage of any lot or land;

the enhancement or embellishment of real property by seeding, sodding,

or the planting thereon of any shrubs, trees, plants, vines, small fruits,

flowers, or nursery stock of any kind; and the grading or filling to establish

a grade.

(L) "Home construction contract" means a contract entered

into between an original contractor and an owner, part owner, or lessee

for the improvement of any single- or double family dwelling or portion

of the dwelling or a residential unit of any condominium property that

has been submitted to the provisions of Chapter 5311. of the Revised Code;

an addition to any land; or the improvement of driveways, sidewalks, swimming

pools, porches, garages, carports, landscaping, fences, fallout shelters,

siding, roofing, storm windows, awnings, and other improvements that are

adjacent to single- or double family dwellings or upon lands that are adjacent

to single- or double family dwellings or residential units of condominium

property, if the dwelling, residential unit of condominium property, or

land is used or is intended to be used as a personal residence by the owner,

part owner, or lessee.

(M) "Home purchase contract" means a contract for the purchase

of any single- or double family dwelling or residential unit of a condominium

property that has been subjected to the provisions of Chapter 5311. of

the Revised Code if the purchaser uses or intends to use the dwelling,

a unit of a double dwelling, or the condominium unit as his personal residence.

(N) "Lending institution" means any person that enters into

a contract with the owner, part owner, purchaser, or lessee to provide

financing for a home construction contract or a home purchase contract,

which financing is secured, in whole or in part, by a mortgage on the real

estate upon which the improvements contemplated by the home construction

contract are to be made or upon the property that is the subject of the

home purchase contract, and that makes direct disbursements under the contract

to any original contractor or the owner, part owner, purchaser, or lessee.

(O) "Original contractor" includes any person with whom

the owner, part owner, lessee, or purchaser under a home purchase contract

or a home construction contract has directly contracted.

Who My File a Lien?

Pursuant to Ohio statutes, a contractor, subcontractor,

or materialman who has provided labor or materials to a construction project

may file a lien against the property for the value of the labor performed

or materials supplied by filing an Affidavit of Mechanic's Lien.

A lien may not be obtained against property when the party claiming the

lien has been paid in full before the property owner has received a copy

of the lien claimant's Affidavit of Mechanic's Lien. O.R.C. 1311.01(B).

How Long Does a Lien Claimant Have to File a Lien?

An Affidavit for a Mechanic's Lien must

be filed within sixty days from the last day of work performed by the party

claiming the lien, if the project is a one or two family residential dwelling.

Otherwise, the lien claimant has seventy-five (75) days to file for a lien.

An exception is liens involving oil and gas leases, which may be filed

within one hundred and twenty (120) days. O.R.C.1311.06(B).

What is a Notice of Commencement?

Prior to beginning work on a project which may

give rise to a mechanic's lien, the property owner should file a Notice

of Commencement with the county recorder in the county where the property

is located. A Notice of Commencement is an affidavit which describes

the improvements to be made to the property, the legal description of the

property, and the names and addresses of all parties involved in the

contract, along with some statutory notices, that put potential buyers or lenders

on notice that improvements that may cause a lien to be filed are being

made. O.R.C. 1311.04(A)(1).

A subcontractor, materialman, or laborer, may make

a written request for a copy of the Notice of Commencement, to which the

owner is obligated to respond within ten days. O.R.C. 1311.04(D).

What is a Notice of Furnishing?

As a counterpart to the owner's Notice of Commencement

is the Notice of Furnishing that must be served by a subcontractor or materialsman

on the property owner. A Notice of Furnishing serves to put the owner

on notice that the party furnishing labor and materials may be entitled

to a lien against the property. O.R.C. 1311.05(A)

If the Notice to Commencement has been filed,

a party who wants to preserve their right to file a lien must file their

Notice of Furnishing within twenty-one days of the Notice of Commencement

being served. O.R.C. 1311.04(I).

How is a Lien Released?

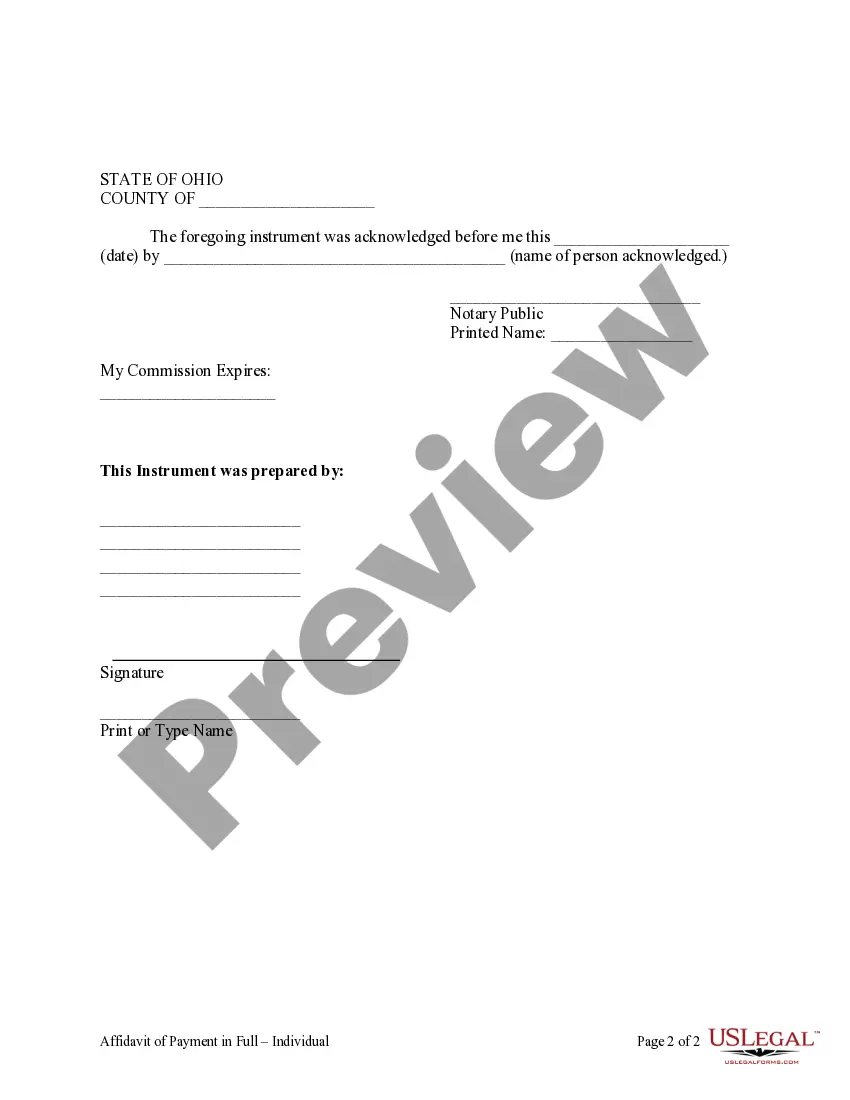

When an Affidavit has been filed and the lien

claimant has subsequently been paid, the property owner may file an affidavit

attesting to the fact that the lien has been satisfied. The lienholder

has thirty days from receipt of this affidavit to file a lien release or

be subject to pay the property owner damages as a result. O.R.C.

1311.01(B)(3).

Lending institutions may not release funds to

a contractor until that contractor has filed an affidavit stating that

the contractor has paid all subcontractors, laborers, and materialmen in

full, and that there are no further claims pending against the project.

A property owner may issue written demand that the contractor issue this

affidavit and may withhold payment until the affidavit is received.

O.R.C. 1311.01(B)(4).

If there is a dispute between subcontractors

and the principal contractor regarding payment, such that the subcontractor

will not release his lien, under Ohio statutes, the property owner

is entitled to withhold payment to the principal contractor in the amount

of the lien. In response, the principal contractor and lending institution

may demand that the lien holder provide them with information regarding the

amount of the lien and the dates upon which work was performed. The

owner or lending institution may only release payment to the original contractor

when the lien holder has given notice that he has been paid, the subcontractor

issues a lien release, the original contractor provides a bond, or the

time under which a lien may be filed has expired. O.R.C. 1311.01(B)(8).

How Else May a Property Owner Respond to a Lien?

After a lien has been filed, a property owner

may serve a Notice to the Lien holder to Commence Suit. Within thirty

days of serving the notice the property owner must file the notice with

an affidavit indicating how service was accomplished. The lien holder

has sixty days after being served to file suit or his lien will be rendered

void. O.R.C. 1311.11(B)(3)