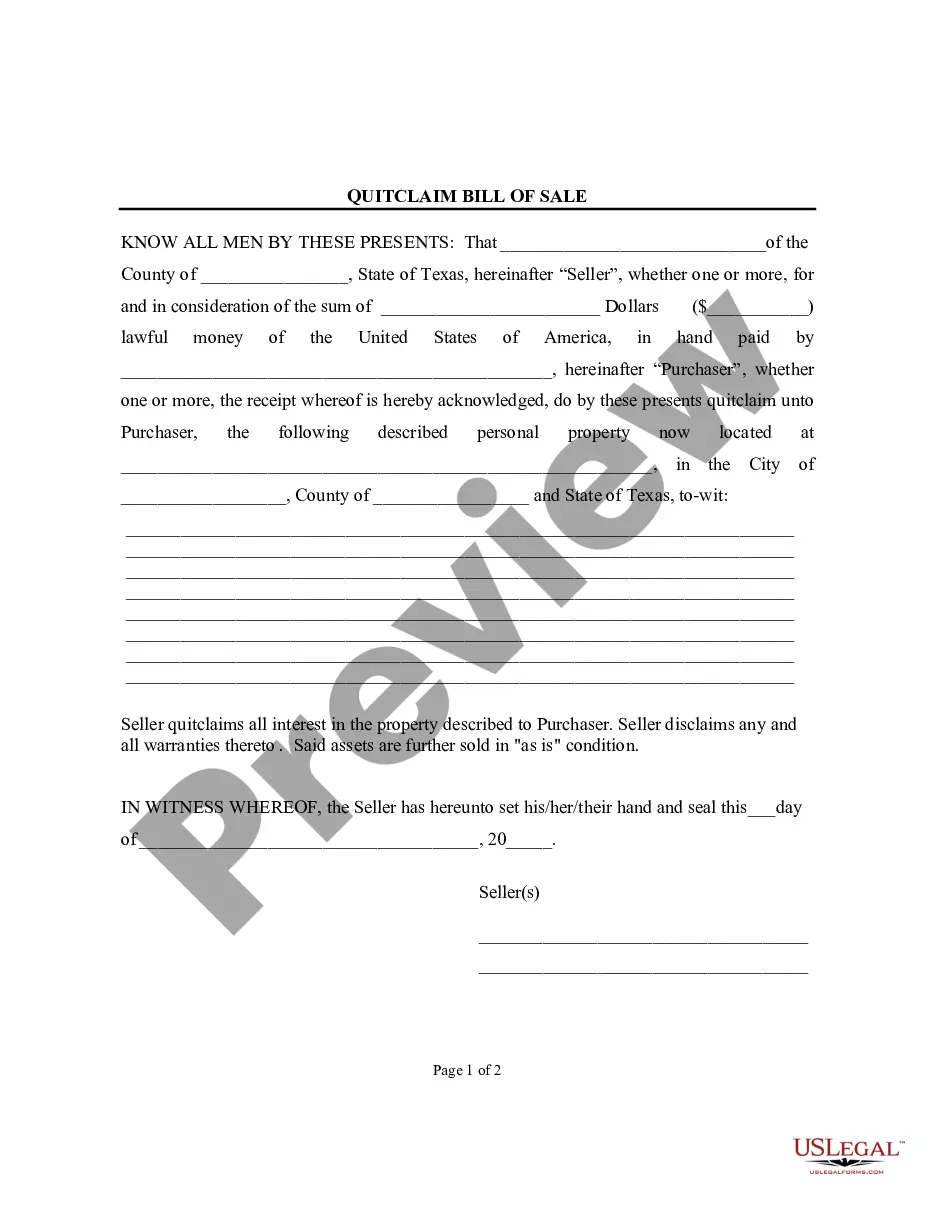

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Cincinnati Ohio Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership of a property from a married couple to a corporation through a quitclaim deed. This type of deed is commonly used when a couple wants to transfer the ownership of their property to a corporation they own, or when they want to change the way the property is legally held. In this case, the husband and wife are the granters, while the corporation is the grantee. The quitclaim deed essentially allows the couple to transfer any and all interest they have in the property to the corporation, without making any warranties or guarantees regarding the property's title. There are a few different variations of the Cincinnati Ohio Quitclaim Deed from Husband and Wife to Corporation, which may include: 1. Cincinnati Ohio Enhanced Life Estate Deed from Husband and Wife to Corporation: This type of deed grants the corporation ownership rights to the property, while reserving a life estate for the husband and wife. The life estate allows the couple to continue living in the property until their passing, after which the full ownership rights transfer to the corporation. 2. Cincinnati Ohio Joint Tenancy with Rights of Survivorship Quitclaim Deed from Husband and Wife to Corporation: With this type of deed, the husband and wife transfer their ownership interest in the property to the corporation, while maintaining the right of survivorship. This means that if one spouse passes away, the other spouse automatically becomes the sole owner of the property. If both spouses pass away, the corporation becomes the owner. 3. Cincinnati Ohio Tenants in Common Quitclaim Deed from Husband and Wife to Corporation: In this scenario, the couple transfers their ownership interest to the corporation as tenants in common. This means that each party holds a separate, distinct share of the property, and can allocate their share to someone else through a will or other legal means. Using a Cincinnati Ohio Quitclaim Deed from Husband and Wife to Corporation can provide certain advantages, such as protecting the property from individual debts or liabilities, aiding in estate planning, or facilitating the management of the property under corporate ownership. However, it is essential to consult with a qualified attorney to ensure all legal requirements are met and understand the implications of such a transfer.