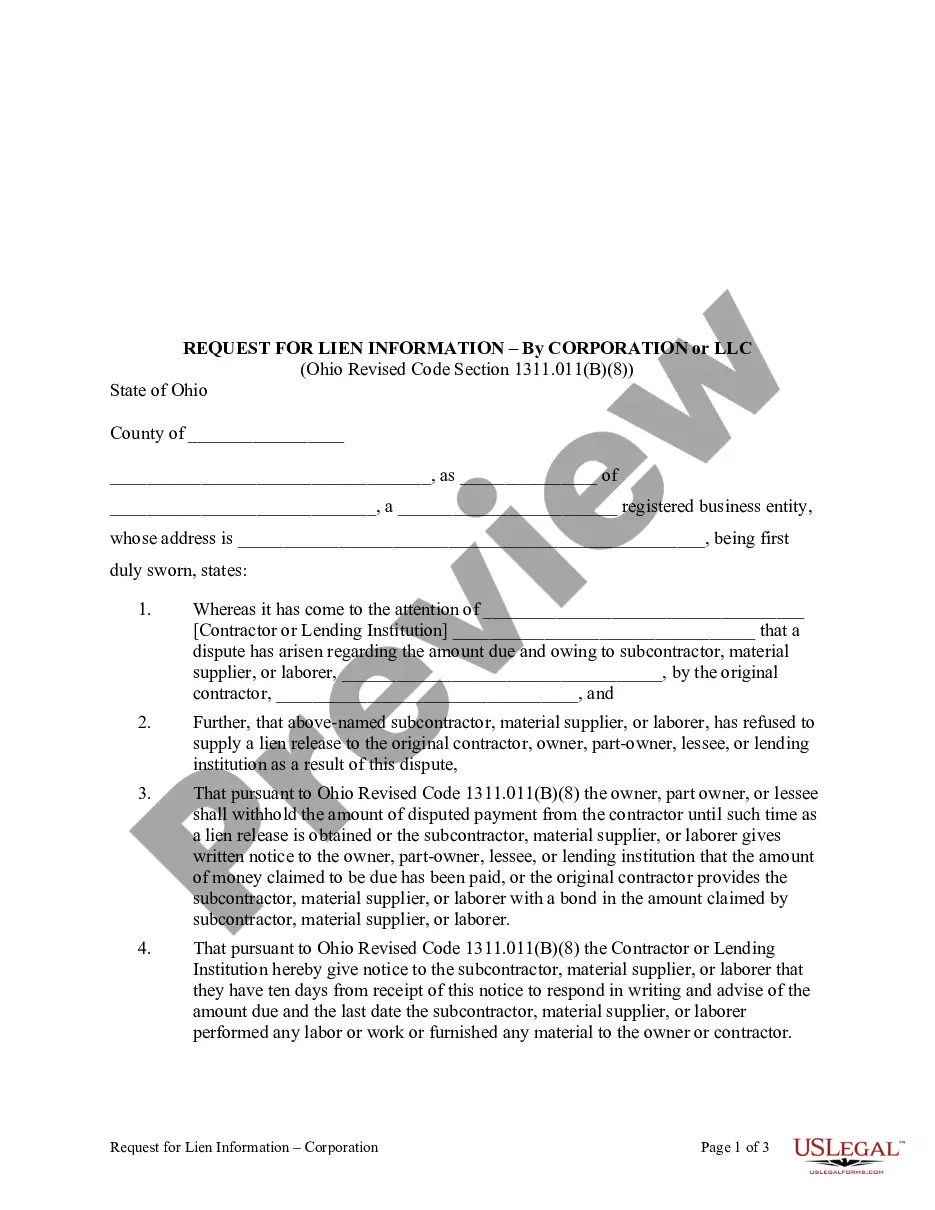

When a dispute arises over payment from the contractor to subcontractor, materialman, or laborer, and the subcontractor, materialman, or laborer refuses to release his or her lien as a result, the owner and/or lending institution may withhold payment from the contractor in the amount disputed. The amount to be withheld must be supplied by the subcontractor, materialman, or laborer, to the contractor within ten days of receipt of a request to supply this information. Failure of the subcontractor, materialman, or laborer to supply this information within ten days will result in the contractor submitting the amount to be withheld to the owner and/or lending institution.

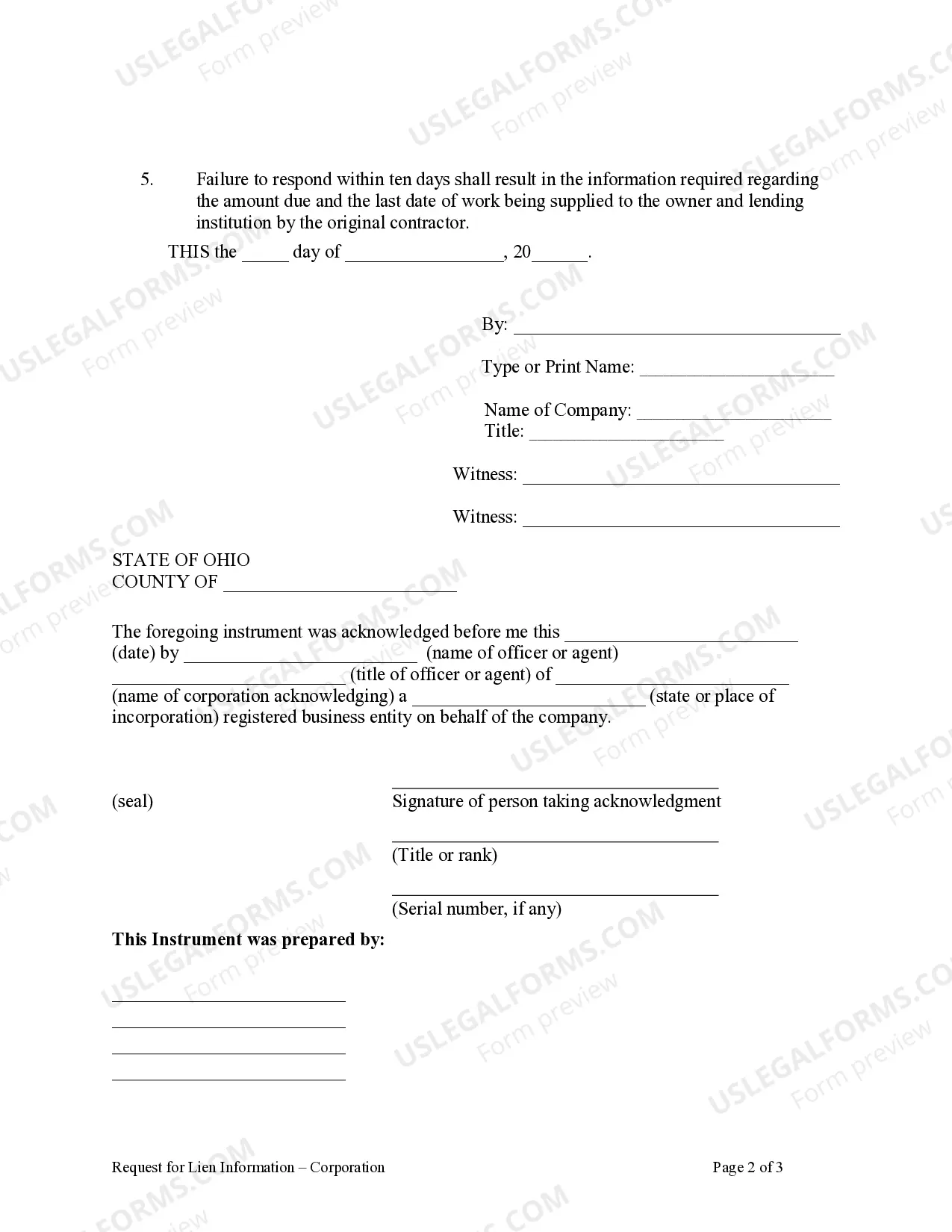

The Dayton Ohio Request for Lien Information — Corporation or LLC is an official and crucial document that individuals or entities must complete when seeking information about liens related to corporations or limited liability companies in Dayton, Ohio. This request form is specifically designed for those who want to investigate and gather lien-related details pertaining to these business entities operating within the city. When initiating a Request for Lien Information — Corporation or LLC in Dayton, the form requires specific information to ensure accurate results. It typically includes essential details such as the name of the corporation or LLC in question, their registered agent, identification number, principal address, and any additional details that may help narrow down the search. There are a few different types of Dayton Ohio Request for Lien Information — Corporation or LLC forms, each tailored to meet specific requirements. These variations exist to accommodate the different levels of information seekers may need. Some commonly seen types include: 1. Dayton Ohio Request for Lien Information — Corporation or LLC (Basic): This type of request form allows individuals to generate a basic lien report for a corporation or LLC. It provides general information about any existing liens against the entity, such as the lien holder's name, lien filing date, and lien amount. It is suitable for those seeking a quick overview or initial research. 2. Dayton Ohio Request for Lien Information — Corporation or LLC (Detailed): A more comprehensive version of the request form, this type provides in-depth and detailed information about the liens held against a corporation or LLC. It includes not only the lien holder's name, lien filing date, and lien amount but also provides a detailed description of the lien, any accompanying legal documents, and relevant dates. This form is ideal for individuals or entities looking for a more thorough analysis of the lien's nature and status. 3. Dayton Ohio Request for Lien Information — Corporation or LLC (Multiple Entities): This variant of the request form is intended for those who wish to inquire about lien information for multiple corporations or LCS simultaneously. It allows the requester to submit multiple entity names, identification numbers, and other required details on a single form, streamlining the process for those conducting research on multiple entities. Completing a Dayton Ohio Request for Lien Information — Corporation or LLC form accurately and ensuring all necessary information is provided helps to avoid delays or incorrect results. It is crucial for individuals or entities who aim to assess the financial standing and potential risks associated with doing business with a corporation or LLC in Dayton, Ohio. By utilizing the appropriate form type, necessary details can be efficiently obtained, aiding informed decision-making and mitigating potential financial risks.The Dayton Ohio Request for Lien Information — Corporation or LLC is an official and crucial document that individuals or entities must complete when seeking information about liens related to corporations or limited liability companies in Dayton, Ohio. This request form is specifically designed for those who want to investigate and gather lien-related details pertaining to these business entities operating within the city. When initiating a Request for Lien Information — Corporation or LLC in Dayton, the form requires specific information to ensure accurate results. It typically includes essential details such as the name of the corporation or LLC in question, their registered agent, identification number, principal address, and any additional details that may help narrow down the search. There are a few different types of Dayton Ohio Request for Lien Information — Corporation or LLC forms, each tailored to meet specific requirements. These variations exist to accommodate the different levels of information seekers may need. Some commonly seen types include: 1. Dayton Ohio Request for Lien Information — Corporation or LLC (Basic): This type of request form allows individuals to generate a basic lien report for a corporation or LLC. It provides general information about any existing liens against the entity, such as the lien holder's name, lien filing date, and lien amount. It is suitable for those seeking a quick overview or initial research. 2. Dayton Ohio Request for Lien Information — Corporation or LLC (Detailed): A more comprehensive version of the request form, this type provides in-depth and detailed information about the liens held against a corporation or LLC. It includes not only the lien holder's name, lien filing date, and lien amount but also provides a detailed description of the lien, any accompanying legal documents, and relevant dates. This form is ideal for individuals or entities looking for a more thorough analysis of the lien's nature and status. 3. Dayton Ohio Request for Lien Information — Corporation or LLC (Multiple Entities): This variant of the request form is intended for those who wish to inquire about lien information for multiple corporations or LCS simultaneously. It allows the requester to submit multiple entity names, identification numbers, and other required details on a single form, streamlining the process for those conducting research on multiple entities. Completing a Dayton Ohio Request for Lien Information — Corporation or LLC form accurately and ensuring all necessary information is provided helps to avoid delays or incorrect results. It is crucial for individuals or entities who aim to assess the financial standing and potential risks associated with doing business with a corporation or LLC in Dayton, Ohio. By utilizing the appropriate form type, necessary details can be efficiently obtained, aiding informed decision-making and mitigating potential financial risks.