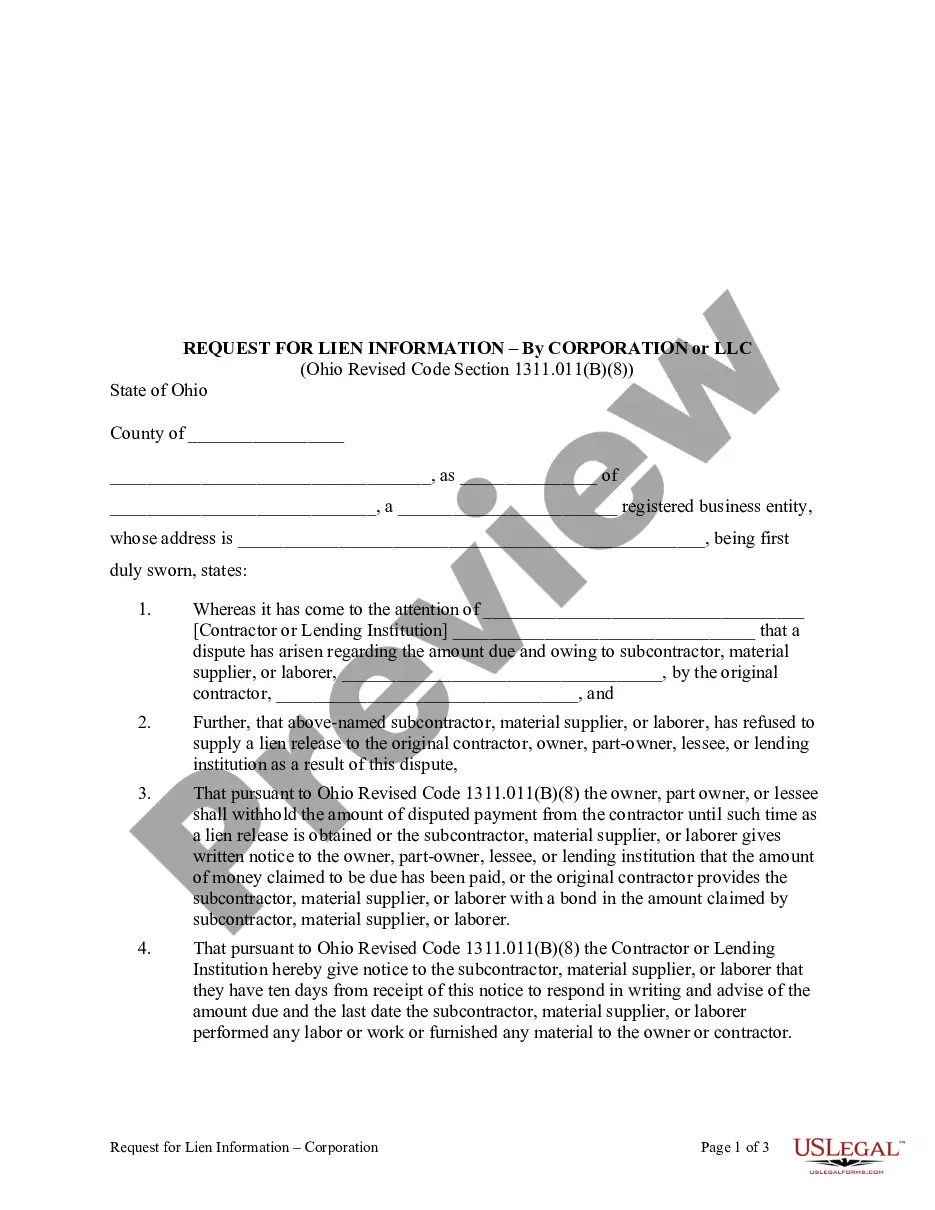

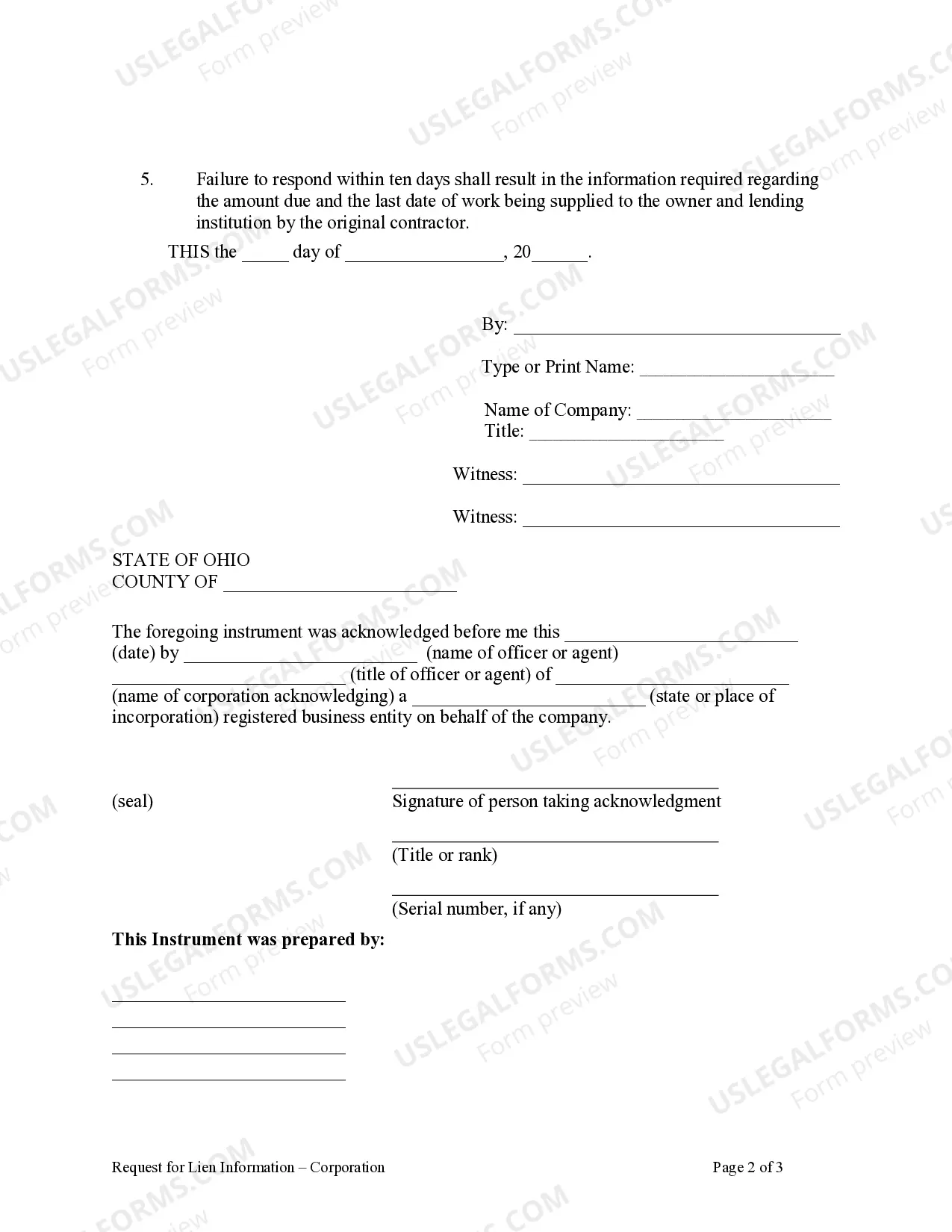

When a dispute arises over payment from the contractor to subcontractor, materialman, or laborer, and the subcontractor, materialman, or laborer refuses to release his or her lien as a result, the owner and/or lending institution may withhold payment from the contractor in the amount disputed. The amount to be withheld must be supplied by the subcontractor, materialman, or laborer, to the contractor within ten days of receipt of a request to supply this information. Failure of the subcontractor, materialman, or laborer to supply this information within ten days will result in the contractor submitting the amount to be withheld to the owner and/or lending institution.

Franklin Ohio Request for Lien Information — Corporation or LLC is a formal application process that individuals, corporations, or limited liability companies (LCS) can undertake to obtain crucial lien information pertaining to a specific entity in Franklin County, Ohio. This information is essential for various reasons, such as conducting due diligence, understanding an entity's financial health, or pursuing legal actions. The Franklin Ohio Request for Lien Information — Corporation or LLC is primarily used to investigate potential liens imposed on the assets or properties of a particular corporation or LLC, safeguarding the interests of businesses and individuals engaging with these entities. By completing this request, interested parties gain access to information related to any liens held against the named corporation or LLC within Franklin County. Keywords: 1. Franklin Ohio: Denotes the specific location and jurisdiction where the request is made. 2. Request for Lien Information: Implies the intent to obtain details concerning liens filed against a corporation or LLC. 3. Corporation: Refers to a legally recognized business entity distinct from its owners and shareholders. 4. LLC: Abbreviation for Limited Liability Company, a business structure that combines aspects of corporations and partnerships. 5. Franklin County, Ohio: Signifies the geographic location within Ohio state where the requested lien information is held. 6. Application Process: Represents the formal procedure that interested parties must follow to make a request. 7. Due Diligence: Indicates the steps taken to investigate, assess, and verify relevant information before engaging in any business transactions with a corporation or LLC. 8. Financial Health: Refers to an assessment of the financial stability and well-being of the corporation or LLC, typically considering factors such as assets, liabilities, and outstanding liens. 9. Legal Actions: Describes potential legal proceedings or legal strategies that individuals or entities may undertake based on the obtained lien information. Types of Franklin Ohio Request for Lien Information — Corporation or LLC: 1. Preliminary Lien Information Request — Corporation or LLC. 2. Final Lien Information Request — Corporation or LLC. 3. Historical Lien Information Request — Corporation or LLC. These variations of the request may differ in terms of the specific liens covered, the availability of historical records, or the level of detail provided in the requested information. It is important to specify the type of request based on the particular requirements and objectives of the applicant.Franklin Ohio Request for Lien Information — Corporation or LLC is a formal application process that individuals, corporations, or limited liability companies (LCS) can undertake to obtain crucial lien information pertaining to a specific entity in Franklin County, Ohio. This information is essential for various reasons, such as conducting due diligence, understanding an entity's financial health, or pursuing legal actions. The Franklin Ohio Request for Lien Information — Corporation or LLC is primarily used to investigate potential liens imposed on the assets or properties of a particular corporation or LLC, safeguarding the interests of businesses and individuals engaging with these entities. By completing this request, interested parties gain access to information related to any liens held against the named corporation or LLC within Franklin County. Keywords: 1. Franklin Ohio: Denotes the specific location and jurisdiction where the request is made. 2. Request for Lien Information: Implies the intent to obtain details concerning liens filed against a corporation or LLC. 3. Corporation: Refers to a legally recognized business entity distinct from its owners and shareholders. 4. LLC: Abbreviation for Limited Liability Company, a business structure that combines aspects of corporations and partnerships. 5. Franklin County, Ohio: Signifies the geographic location within Ohio state where the requested lien information is held. 6. Application Process: Represents the formal procedure that interested parties must follow to make a request. 7. Due Diligence: Indicates the steps taken to investigate, assess, and verify relevant information before engaging in any business transactions with a corporation or LLC. 8. Financial Health: Refers to an assessment of the financial stability and well-being of the corporation or LLC, typically considering factors such as assets, liabilities, and outstanding liens. 9. Legal Actions: Describes potential legal proceedings or legal strategies that individuals or entities may undertake based on the obtained lien information. Types of Franklin Ohio Request for Lien Information — Corporation or LLC: 1. Preliminary Lien Information Request — Corporation or LLC. 2. Final Lien Information Request — Corporation or LLC. 3. Historical Lien Information Request — Corporation or LLC. These variations of the request may differ in terms of the specific liens covered, the availability of historical records, or the level of detail provided in the requested information. It is important to specify the type of request based on the particular requirements and objectives of the applicant.