A General Warranty Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property from a married couple (the Granters) to a limited liability company (the Grantee) located in Columbus, Ohio. This type of deed provides the highest level of protection to the Grantee, as it guarantees that the Granters have clear title to the property and promises to defend the title against any future claims. The Columbus Ohio General Warranty Deed from Husband and Wife to LLC typically includes several key elements: 1. Introduction: The deed begins by identifying the Granters (the husband and wife) and the Grantee (the LLC) involved in the transaction. 2. Property Description: Next, a detailed description of the property being transferred is provided. This usually includes the legal description of the property, such as lot numbers, block numbers, and subdivision names, to ensure accurate identification of the parcel. 3. Consideration: The consideration section states the agreed-upon price or value at which the property is being transferred. If there is no monetary consideration involved (such as a gift or transfer for no cost), it will be explicitly mentioned. 4. Covenants and Warranties: The general warranty section is the most crucial part of this deed. It guarantees that the Granters are the true owners of the property and holds them responsible for defending the title against any future claims. It may include covenants such as the Covenant of Basin (to ensure ownership by the Granters), the Covenant of Right to Convey (to guarantee their authority to transfer ownership), the Covenant Against Encumbrances (promising the property is free from liens or other encumbrances), and the Covenant of Quiet Enjoyment (ensuring the Grantee's undisturbed possession of the property). 5. Execution and Notarization: The deed must be executed by the Granters and notarized to validate its authenticity. Both husband and wife typically sign the document to indicate their consent to the transfer. 6. Recording: After execution, the deed must be recorded with the appropriate county recorder's office in Columbus, Ohio, to provide public notice of the ownership transfer and establish the priority of the Grantee's claim over any future ones. There are not typically different types of Columbus Ohio General Warranty Deeds from Husband and Wife to LLC. However, variations in specific clauses or additional provisions may exist depending on the circumstances of the transaction or the preferences of the parties involved. For example, the deed might include specific indemnification language, additional warranties, or special considerations for tax purposes. It is always advisable to consult with a qualified attorney or real estate professional to ensure the deed accurately reflects the intentions of all parties and complies with Ohio state laws and regulations.

Columbus Ohio General Warranty Deed from Husband and Wife to LLC

Category:

State:

Ohio

City:

Columbus

Control #:

OH-09-78

Format:

Word;

Rich Text

Instant download

Description

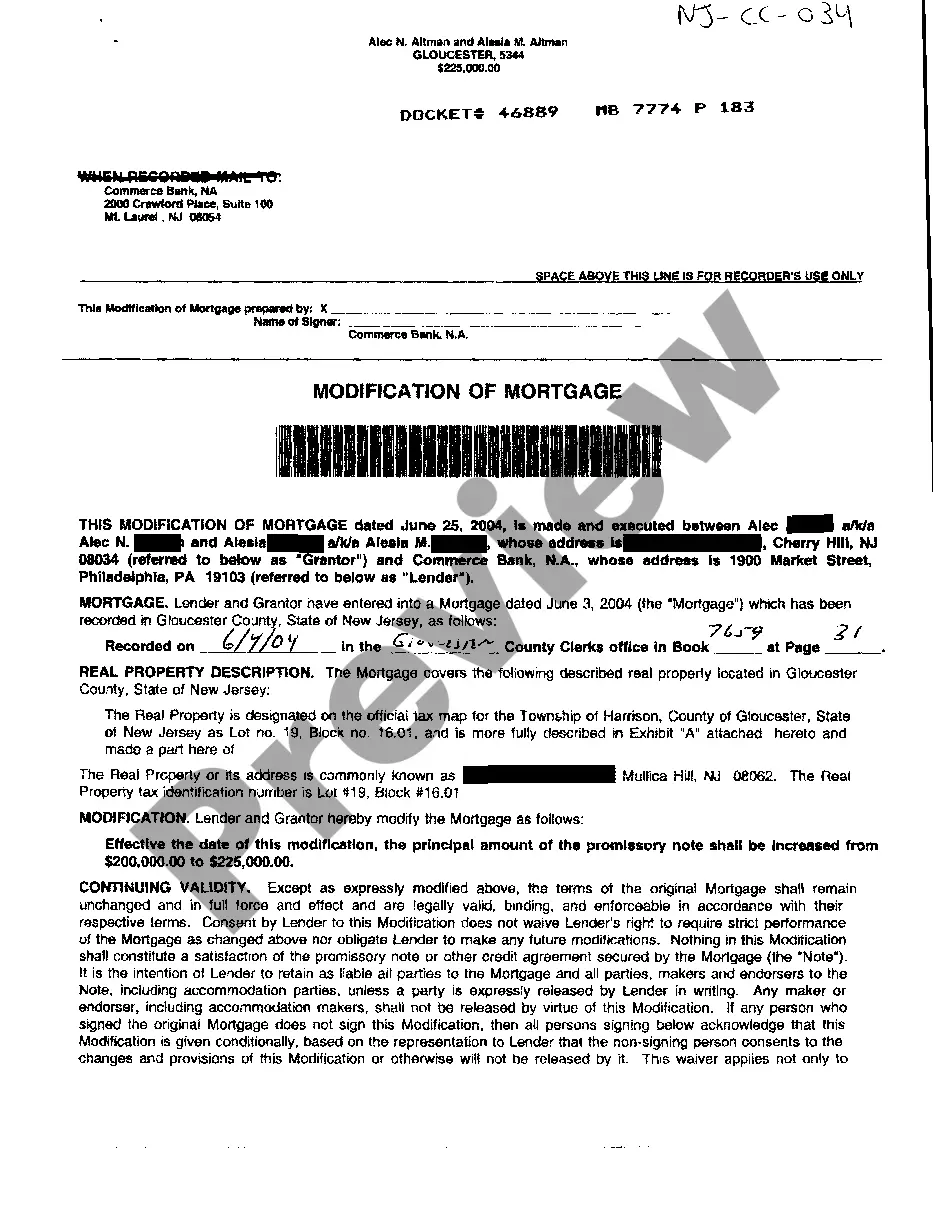

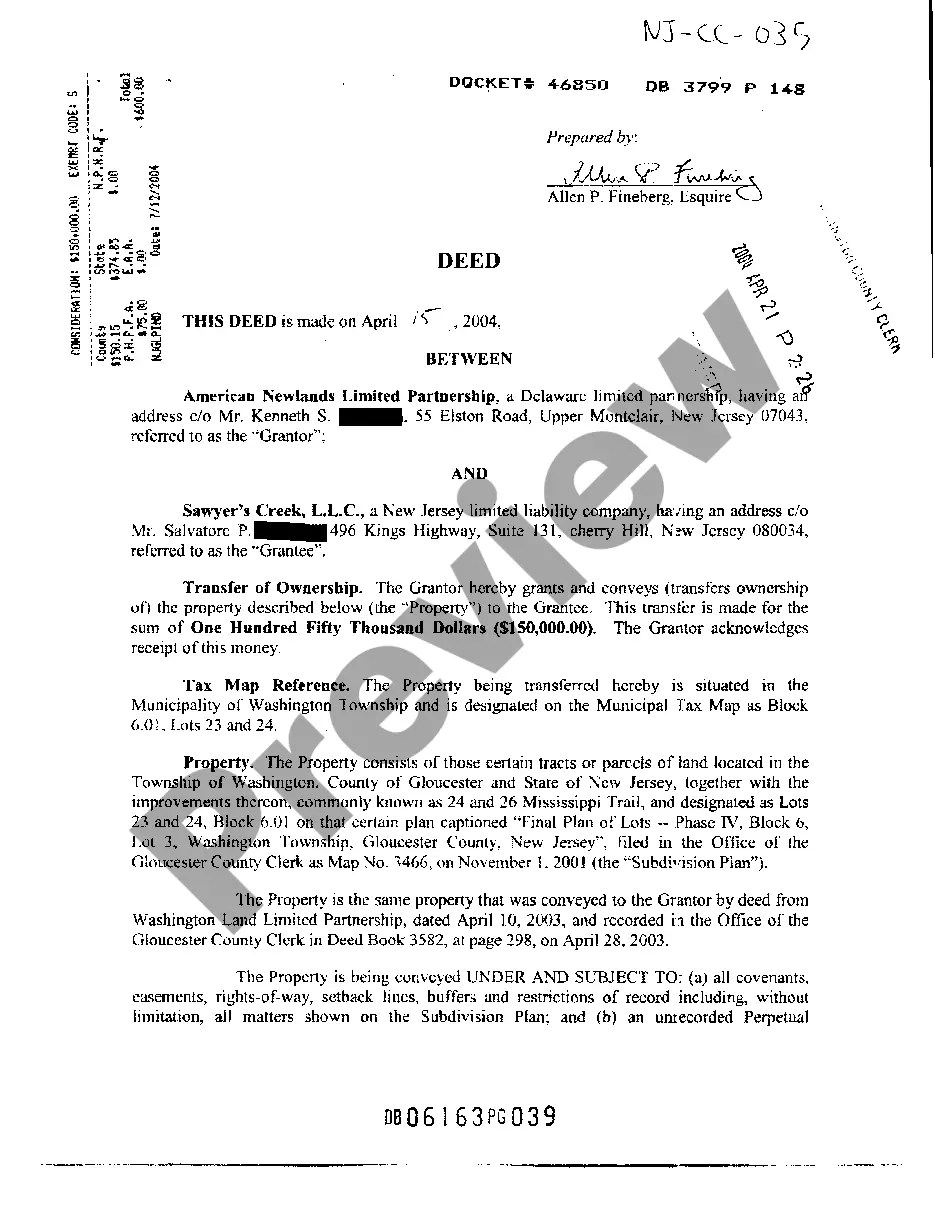

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A General Warranty Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real property from a married couple (the Granters) to a limited liability company (the Grantee) located in Columbus, Ohio. This type of deed provides the highest level of protection to the Grantee, as it guarantees that the Granters have clear title to the property and promises to defend the title against any future claims. The Columbus Ohio General Warranty Deed from Husband and Wife to LLC typically includes several key elements: 1. Introduction: The deed begins by identifying the Granters (the husband and wife) and the Grantee (the LLC) involved in the transaction. 2. Property Description: Next, a detailed description of the property being transferred is provided. This usually includes the legal description of the property, such as lot numbers, block numbers, and subdivision names, to ensure accurate identification of the parcel. 3. Consideration: The consideration section states the agreed-upon price or value at which the property is being transferred. If there is no monetary consideration involved (such as a gift or transfer for no cost), it will be explicitly mentioned. 4. Covenants and Warranties: The general warranty section is the most crucial part of this deed. It guarantees that the Granters are the true owners of the property and holds them responsible for defending the title against any future claims. It may include covenants such as the Covenant of Basin (to ensure ownership by the Granters), the Covenant of Right to Convey (to guarantee their authority to transfer ownership), the Covenant Against Encumbrances (promising the property is free from liens or other encumbrances), and the Covenant of Quiet Enjoyment (ensuring the Grantee's undisturbed possession of the property). 5. Execution and Notarization: The deed must be executed by the Granters and notarized to validate its authenticity. Both husband and wife typically sign the document to indicate their consent to the transfer. 6. Recording: After execution, the deed must be recorded with the appropriate county recorder's office in Columbus, Ohio, to provide public notice of the ownership transfer and establish the priority of the Grantee's claim over any future ones. There are not typically different types of Columbus Ohio General Warranty Deeds from Husband and Wife to LLC. However, variations in specific clauses or additional provisions may exist depending on the circumstances of the transaction or the preferences of the parties involved. For example, the deed might include specific indemnification language, additional warranties, or special considerations for tax purposes. It is always advisable to consult with a qualified attorney or real estate professional to ensure the deed accurately reflects the intentions of all parties and complies with Ohio state laws and regulations.

Free preview

How to fill out Columbus Ohio General Warranty Deed From Husband And Wife To LLC?

If you’ve already used our service before, log in to your account and download the Columbus Ohio General Warranty Deed from Husband and Wife to LLC on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Columbus Ohio General Warranty Deed from Husband and Wife to LLC. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!