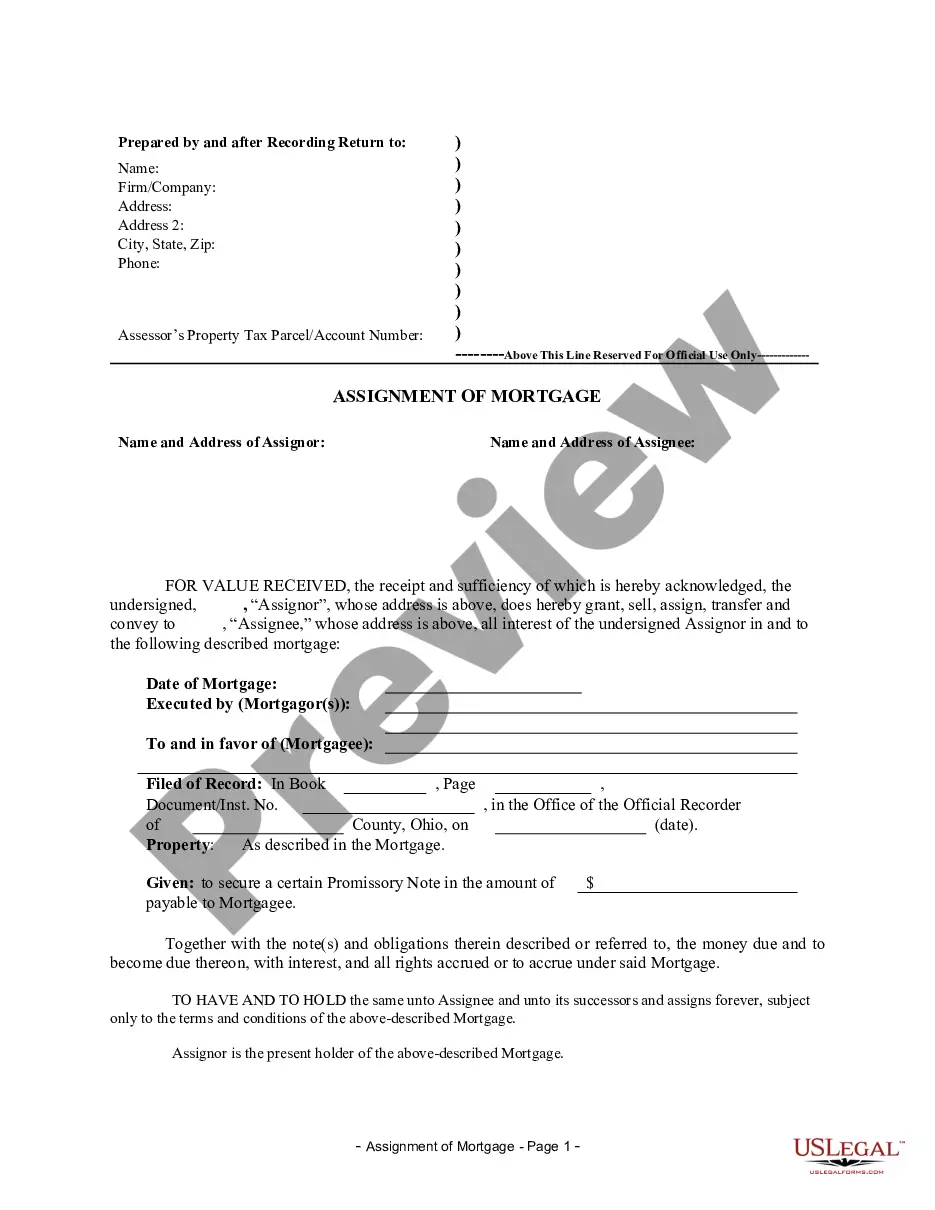

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder is a legal document used in real estate transactions to transfer the rights and obligations of a mortgage from one individual mortgage holder to another. It typically occurs when the current mortgage holder (assignor) sells or transfers their interest in the property to a new mortgage holder (assignee). The assignment of mortgage allows the assignee to step into the shoes of the assignor and assume all mortgage-related responsibilities. The Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder ensures a smooth and legally binding transfer of the mortgage. It includes various essential details: 1. Parties Involved: The assignment document identifies the assignor and assignee involved in the transaction. It outlines their legal names, addresses, and contact information. 2. Property Information: Detailed information about the mortgaged property, such as its address, legal description, parcel number, and any associated liens or encumbrances, is specified. 3. Mortgage Details: The assignment of mortgage includes complete details of the existing mortgage, including the original loan amount, interest rate, term, and any outstanding balance at the time of the assignment. 4. Assignment Consideration: If there is a financial consideration involved in the assignment, such as a purchase price or other agreed-upon terms, it is mentioned in the document. 5. Assignor's Representations and Warranties: The assignor typically provides assurances that they have the legal authority to assign the mortgage and that no other claims exist on the property. They affirm that the mortgage is valid, and there are no undisclosed defects. 6. Governing Law and Jurisdiction: The assignment document specifies that Cuyahoga County, Ohio, laws govern the agreement and that any disputes related to the assignment shall be resolved within the county's jurisdiction. Different types of Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder may exist depending on the specific circumstances or conditions surrounding the assignment: 1. Voluntary Assignment: This type of assignment occurs when the assignor willingly transfers the mortgage rights to another party. It is a commonly executed assignment during property sales or refinancing. 2. Involuntary Assignment: In some cases, a mortgage assignment may happen without the consent of the original mortgage holder. For instance, it can occur due to a court order, foreclosure, or other legal proceedings. It is important to note that the assignment of mortgage requires proper documentation and formalization to maintain transparency and protect all parties involved. Consulting legal professionals and ensuring compliance with Ohio state laws is crucial to executing a valid Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder.Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder is a legal document used in real estate transactions to transfer the rights and obligations of a mortgage from one individual mortgage holder to another. It typically occurs when the current mortgage holder (assignor) sells or transfers their interest in the property to a new mortgage holder (assignee). The assignment of mortgage allows the assignee to step into the shoes of the assignor and assume all mortgage-related responsibilities. The Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder ensures a smooth and legally binding transfer of the mortgage. It includes various essential details: 1. Parties Involved: The assignment document identifies the assignor and assignee involved in the transaction. It outlines their legal names, addresses, and contact information. 2. Property Information: Detailed information about the mortgaged property, such as its address, legal description, parcel number, and any associated liens or encumbrances, is specified. 3. Mortgage Details: The assignment of mortgage includes complete details of the existing mortgage, including the original loan amount, interest rate, term, and any outstanding balance at the time of the assignment. 4. Assignment Consideration: If there is a financial consideration involved in the assignment, such as a purchase price or other agreed-upon terms, it is mentioned in the document. 5. Assignor's Representations and Warranties: The assignor typically provides assurances that they have the legal authority to assign the mortgage and that no other claims exist on the property. They affirm that the mortgage is valid, and there are no undisclosed defects. 6. Governing Law and Jurisdiction: The assignment document specifies that Cuyahoga County, Ohio, laws govern the agreement and that any disputes related to the assignment shall be resolved within the county's jurisdiction. Different types of Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder may exist depending on the specific circumstances or conditions surrounding the assignment: 1. Voluntary Assignment: This type of assignment occurs when the assignor willingly transfers the mortgage rights to another party. It is a commonly executed assignment during property sales or refinancing. 2. Involuntary Assignment: In some cases, a mortgage assignment may happen without the consent of the original mortgage holder. For instance, it can occur due to a court order, foreclosure, or other legal proceedings. It is important to note that the assignment of mortgage requires proper documentation and formalization to maintain transparency and protect all parties involved. Consulting legal professionals and ensuring compliance with Ohio state laws is crucial to executing a valid Cuyahoga Ohio Assignment of Mortgage by Individual Mortgage Holder.