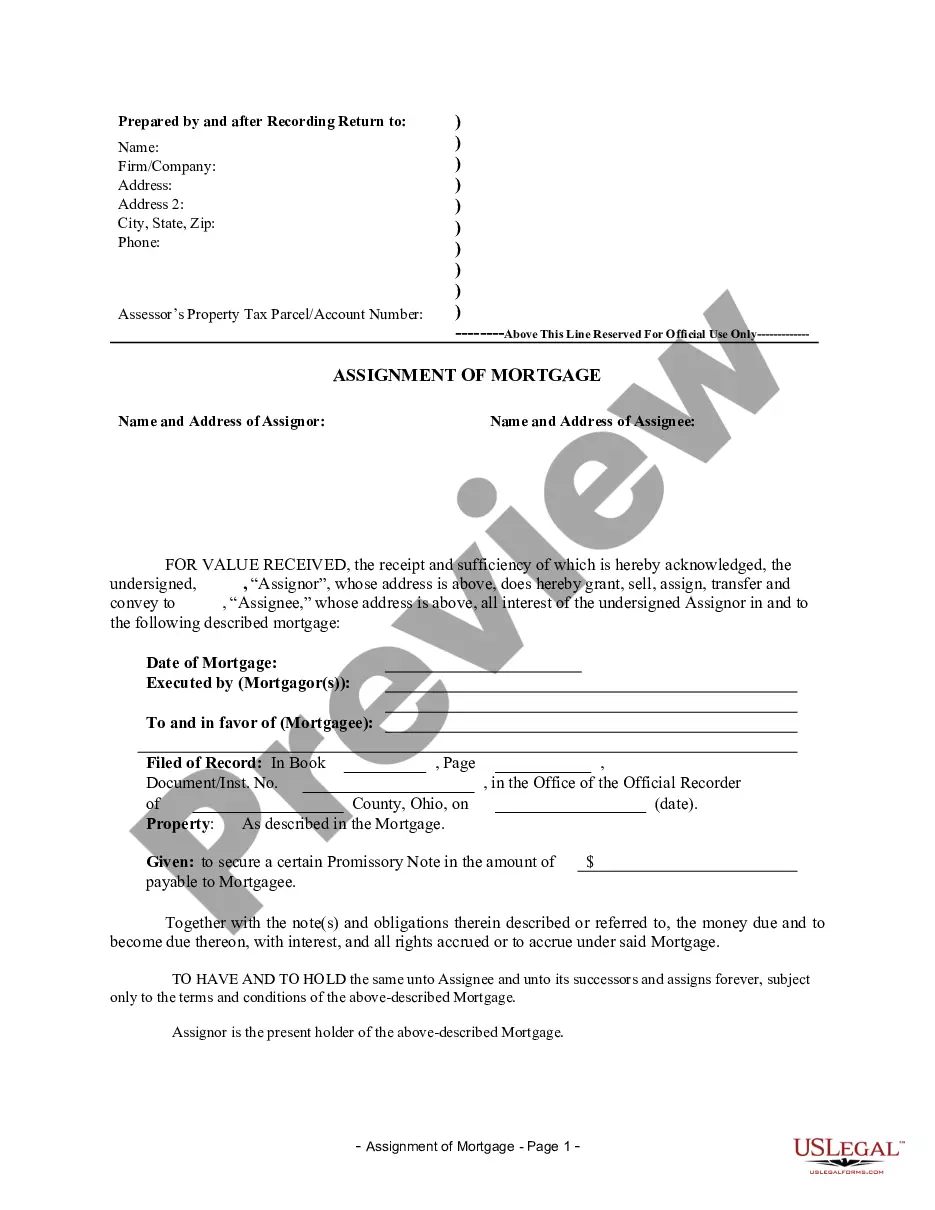

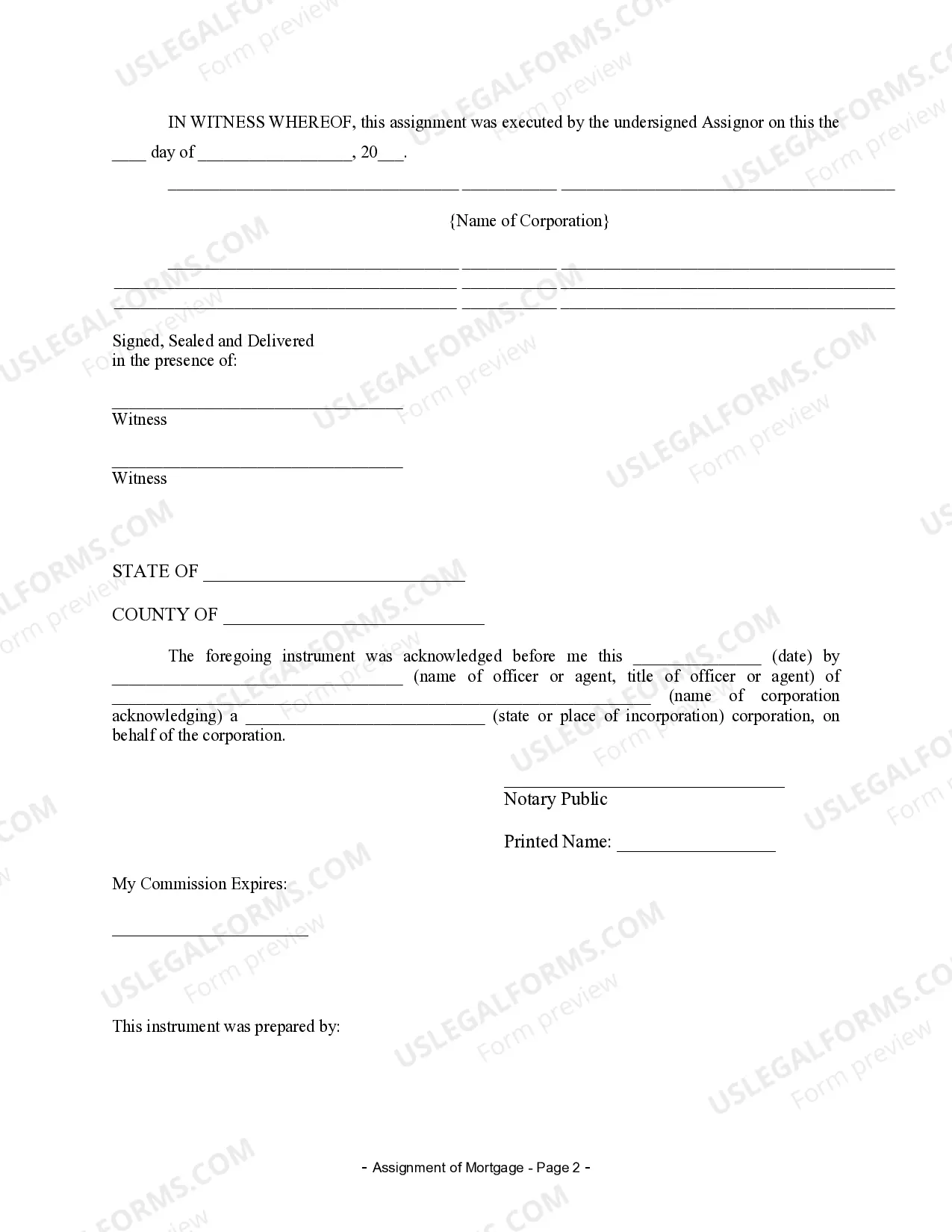

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Cincinnati Ohio Assignment of Mortgage by Corporate Mortgage Holder In Cincinnati, Ohio, an Assignment of Mortgage by a Corporate Mortgage Holder is a legal document that allows a corporate entity holding a mortgage to transfer or assign its rights and interests in the mortgage to another party. This assignment typically takes place when the original mortgage holder wishes to transfer ownership of the mortgage to a different entity, such as another financial institution or an investor. When a mortgage is initially granted to a borrower, it secures the loan in favor of the lender, who becomes the mortgage holder. However, over time, the mortgage holder may decide to sell or transfer the mortgage to another corporate entity due to various reasons, including financial restructuring, portfolio diversification, or profit optimization. The Cincinnati Ohio Assignment of Mortgage by a Corporate Mortgage Holder involves several key steps. First, the corporate mortgage holder must draft an assignment agreement that clearly outlines the terms and conditions of the transfer, including the identification of the parties involved, the property covered by the mortgage, and any outstanding obligations or payments. Next, the assignment agreement must be properly executed by the authorized representatives of both the corporate mortgage holder and the acquiring party. This ensures the legality and enforceability of the assignment. Once the assignment agreement is executed, it must be recorded in the county where the property is located. In Cincinnati, Ohio, this typically involves filing the assignment with the county recorder's office to create a public record of the transfer. This step is crucial for the acquiring entity to possess a valid legal claim over the mortgage and the underlying property. Different types of Cincinnati Ohio Assignment of Mortgage by Corporate Mortgage Holder may include: 1. Full Assignment: This type of assignment involves the complete transfer of all rights, interests, and obligations of the mortgage from the corporate mortgage holder to the acquiring party. The acquiring party assumes all rights and responsibilities associated with the mortgage, including the collection of payments and foreclosure rights. 2. Partial Assignment: In some cases, a corporate mortgage holder may wish to transfer only a portion of the mortgage to another entity. This partial assignment allows for the division of a mortgage into multiple parts, often based on geographical location, loan amount, or specific terms. 3. Assignment with Assumption: Occasionally, the corporate mortgage holder may transfer the mortgage to another entity while also requiring the acquiring party to assume certain responsibilities, such as guaranteeing the payment of outstanding amounts or fulfilling specific conditions specified in the original mortgage agreement. In conclusion, the Cincinnati Ohio Assignment of Mortgage by a Corporate Mortgage Holder is a vital legal process that facilitates the transfer of ownership and rights of a mortgage from one corporate entity to another. Understanding the various types of assignment and the steps involved can help parties navigate this process efficiently and effectively.Cincinnati Ohio Assignment of Mortgage by Corporate Mortgage Holder In Cincinnati, Ohio, an Assignment of Mortgage by a Corporate Mortgage Holder is a legal document that allows a corporate entity holding a mortgage to transfer or assign its rights and interests in the mortgage to another party. This assignment typically takes place when the original mortgage holder wishes to transfer ownership of the mortgage to a different entity, such as another financial institution or an investor. When a mortgage is initially granted to a borrower, it secures the loan in favor of the lender, who becomes the mortgage holder. However, over time, the mortgage holder may decide to sell or transfer the mortgage to another corporate entity due to various reasons, including financial restructuring, portfolio diversification, or profit optimization. The Cincinnati Ohio Assignment of Mortgage by a Corporate Mortgage Holder involves several key steps. First, the corporate mortgage holder must draft an assignment agreement that clearly outlines the terms and conditions of the transfer, including the identification of the parties involved, the property covered by the mortgage, and any outstanding obligations or payments. Next, the assignment agreement must be properly executed by the authorized representatives of both the corporate mortgage holder and the acquiring party. This ensures the legality and enforceability of the assignment. Once the assignment agreement is executed, it must be recorded in the county where the property is located. In Cincinnati, Ohio, this typically involves filing the assignment with the county recorder's office to create a public record of the transfer. This step is crucial for the acquiring entity to possess a valid legal claim over the mortgage and the underlying property. Different types of Cincinnati Ohio Assignment of Mortgage by Corporate Mortgage Holder may include: 1. Full Assignment: This type of assignment involves the complete transfer of all rights, interests, and obligations of the mortgage from the corporate mortgage holder to the acquiring party. The acquiring party assumes all rights and responsibilities associated with the mortgage, including the collection of payments and foreclosure rights. 2. Partial Assignment: In some cases, a corporate mortgage holder may wish to transfer only a portion of the mortgage to another entity. This partial assignment allows for the division of a mortgage into multiple parts, often based on geographical location, loan amount, or specific terms. 3. Assignment with Assumption: Occasionally, the corporate mortgage holder may transfer the mortgage to another entity while also requiring the acquiring party to assume certain responsibilities, such as guaranteeing the payment of outstanding amounts or fulfilling specific conditions specified in the original mortgage agreement. In conclusion, the Cincinnati Ohio Assignment of Mortgage by a Corporate Mortgage Holder is a vital legal process that facilitates the transfer of ownership and rights of a mortgage from one corporate entity to another. Understanding the various types of assignment and the steps involved can help parties navigate this process efficiently and effectively.