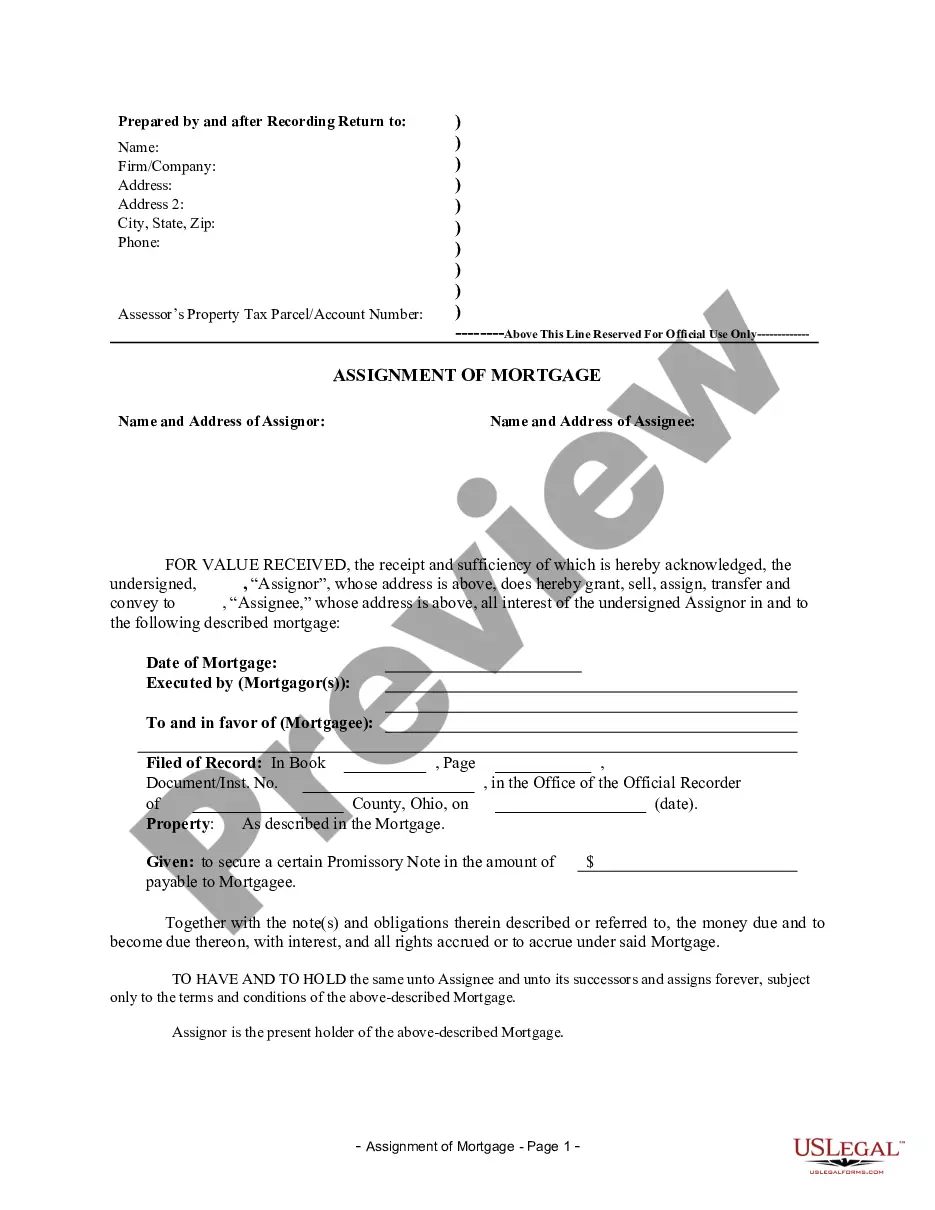

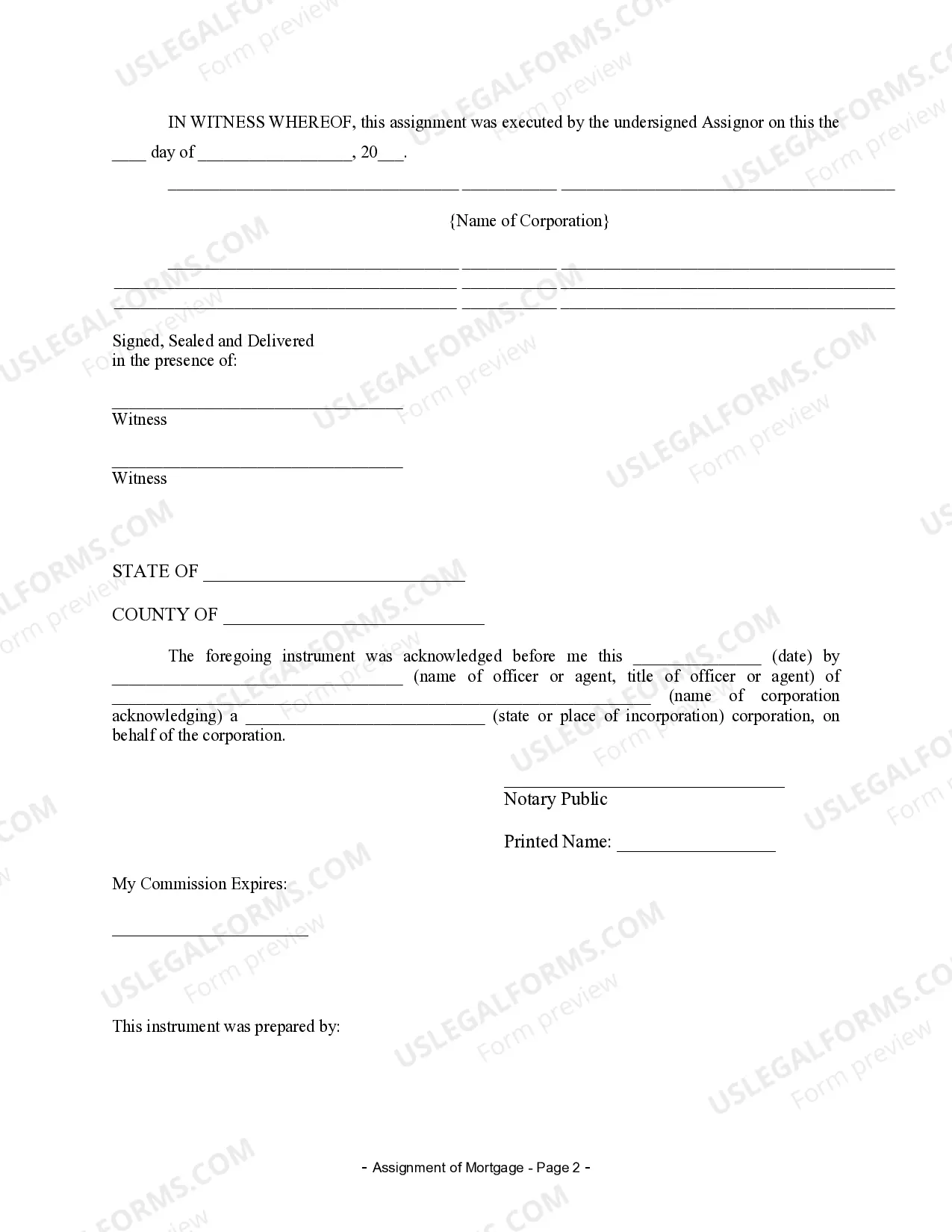

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

When it comes to the Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder, it is essential to understand its significance and different types. An Assignment of Mortgage is a legal document that transfers the ownership of a mortgage from one entity to another. In Toledo, Ohio, this process can be completed by a Corporate Mortgage Holder. Keywords: Toledo Ohio Assignment of Mortgage, Corporate Mortgage Holder, legal document, transfer ownership, mortgage, process. Description: Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder involves the transfer of ownership and rights associated with a mortgage from one corporate entity to another. This legal document plays a crucial role in ensuring the integrity and progression of property transactions in Toledo, Ohio. It enables corporate mortgage holders to transfer their interests and claim over a mortgage to another entity. In this process, all rights and responsibilities assigned to the original corporate mortgage holder are shifted to the new entity acquiring the mortgage. This ensures that the new corporate mortgage holder has the power to enforce provisions, collect payments, and exercise any other applicable mortgage rights. There are several types of Toledo Ohio Assignment of Mortgage by Corporate Mortgage Holder: 1. Absolute Assignment: This type of assignment is the complete transfer of the mortgage rights from the corporate mortgage holder to another party. The new mortgage holder assumes all responsibilities and benefits associated with the mortgage. 2. Assignment for Security: In certain cases, a corporate mortgage holder may assign a mortgage for security purposes. This means that while the ownership is transferred to another entity, the original mortgage holder maintains certain rights and control over the mortgage, usually to secure a debt. 3. Partial Assignment: In a partial assignment, a corporate mortgage holder transfers only a portion of their rights and interests in a mortgage. This can occur when a mortgage holder wishes to share the benefits and risks associated with the mortgage with another entity. 4. Assignment with Recourse: This type of assignment allows the corporate mortgage holder to retain some level of liability or recourse for any default or breach by the new mortgage holder. It ensures the original mortgage holder can enforce their rights in case of non-performance. 5. Assignment without Recourse: In contrast to the previous type, an assignment without recourse absolves the corporate mortgage holder from any liability or responsibility regarding the performance of the new mortgage holder. Once assigned, the new mortgage holder becomes solely responsible for the mortgage. Overall, the Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder is an essential aspect of property transactions. It allows corporate mortgage holders to transfer their rights and interests to another entity, ensuring a smooth transition and continuity in mortgage management.When it comes to the Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder, it is essential to understand its significance and different types. An Assignment of Mortgage is a legal document that transfers the ownership of a mortgage from one entity to another. In Toledo, Ohio, this process can be completed by a Corporate Mortgage Holder. Keywords: Toledo Ohio Assignment of Mortgage, Corporate Mortgage Holder, legal document, transfer ownership, mortgage, process. Description: Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder involves the transfer of ownership and rights associated with a mortgage from one corporate entity to another. This legal document plays a crucial role in ensuring the integrity and progression of property transactions in Toledo, Ohio. It enables corporate mortgage holders to transfer their interests and claim over a mortgage to another entity. In this process, all rights and responsibilities assigned to the original corporate mortgage holder are shifted to the new entity acquiring the mortgage. This ensures that the new corporate mortgage holder has the power to enforce provisions, collect payments, and exercise any other applicable mortgage rights. There are several types of Toledo Ohio Assignment of Mortgage by Corporate Mortgage Holder: 1. Absolute Assignment: This type of assignment is the complete transfer of the mortgage rights from the corporate mortgage holder to another party. The new mortgage holder assumes all responsibilities and benefits associated with the mortgage. 2. Assignment for Security: In certain cases, a corporate mortgage holder may assign a mortgage for security purposes. This means that while the ownership is transferred to another entity, the original mortgage holder maintains certain rights and control over the mortgage, usually to secure a debt. 3. Partial Assignment: In a partial assignment, a corporate mortgage holder transfers only a portion of their rights and interests in a mortgage. This can occur when a mortgage holder wishes to share the benefits and risks associated with the mortgage with another entity. 4. Assignment with Recourse: This type of assignment allows the corporate mortgage holder to retain some level of liability or recourse for any default or breach by the new mortgage holder. It ensures the original mortgage holder can enforce their rights in case of non-performance. 5. Assignment without Recourse: In contrast to the previous type, an assignment without recourse absolves the corporate mortgage holder from any liability or responsibility regarding the performance of the new mortgage holder. Once assigned, the new mortgage holder becomes solely responsible for the mortgage. Overall, the Toledo, Ohio Assignment of Mortgage by Corporate Mortgage Holder is an essential aspect of property transactions. It allows corporate mortgage holders to transfer their rights and interests to another entity, ensuring a smooth transition and continuity in mortgage management.