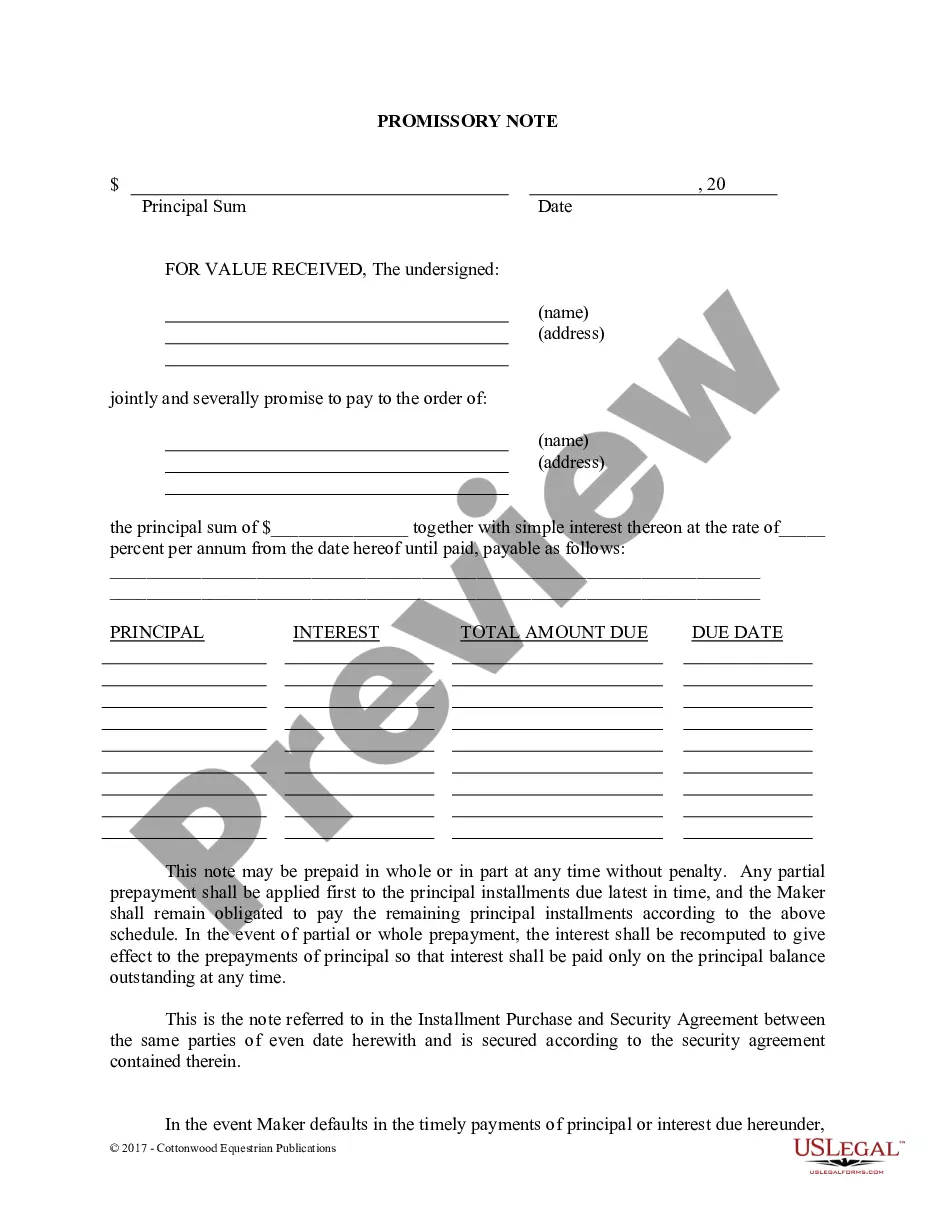

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Franklin Ohio Promissory Note — Horse Equine Forms are legally binding documents used in Franklin, Ohio, to establish a loan agreement between parties involved in the horse equine industry. These forms outline the terms and conditions under which one party (the borrower) borrows a specific amount of money from another party (the lender) and promises to repay the loan within a specified period of time. The Franklin Ohio Promissory Note — Horse Equine Forms contain essential elements, including the loan amount, interest rate (if applicable), repayment schedule, and any collateral or security provided by the borrower. These forms help ensure transparency and protect the rights and interests of both the lender and the borrower. Different types of Franklin Ohio Promissory Note — Horse Equine Forms may include: 1. Simple Promissory Note: This form is a basic agreement between the lender and borrower, stating the loan amount, repayment terms, and any applicable interest rate. 2. Secured Promissory Note: This form includes provisions for collateral provided by the borrower, such as the horse or equipment, to secure the loan. It helps protect the lender's interests in case of default. 3. Balloon Promissory Note: This form features a larger final payment (balloon payment) at the end of the loan term, with smaller regular payments throughout the loan period. It can be advantageous for borrowers who expect increased income later in the loan term. 4. Installment Promissory Note: This form divides the loan amount into a series of regular payments (installments) over an agreed-upon period. It helps borrowers manage their repayment obligations. 5. Demand Promissory Note: This form allows the lender to demand full repayment of the loan at any time, which can be beneficial in cases where the borrower's financial situation changes suddenly. 6. Co-Signer Promissory Note: This form includes a co-signer who guarantees the loan repayment if the primary borrower fails to fulfill their obligations. It provides an extra layer of security for the lender. Franklin Ohio Promissory Note — Horse Equine Forms are essential for anyone involved in lending or borrowing funds within the horse equine industry in Franklin, Ohio. They provide a clear and enforceable agreement for both parties, ensuring the protection of their rights and maintaining a healthy business relationship.Franklin Ohio Promissory Note — Horse Equine Forms are legally binding documents used in Franklin, Ohio, to establish a loan agreement between parties involved in the horse equine industry. These forms outline the terms and conditions under which one party (the borrower) borrows a specific amount of money from another party (the lender) and promises to repay the loan within a specified period of time. The Franklin Ohio Promissory Note — Horse Equine Forms contain essential elements, including the loan amount, interest rate (if applicable), repayment schedule, and any collateral or security provided by the borrower. These forms help ensure transparency and protect the rights and interests of both the lender and the borrower. Different types of Franklin Ohio Promissory Note — Horse Equine Forms may include: 1. Simple Promissory Note: This form is a basic agreement between the lender and borrower, stating the loan amount, repayment terms, and any applicable interest rate. 2. Secured Promissory Note: This form includes provisions for collateral provided by the borrower, such as the horse or equipment, to secure the loan. It helps protect the lender's interests in case of default. 3. Balloon Promissory Note: This form features a larger final payment (balloon payment) at the end of the loan term, with smaller regular payments throughout the loan period. It can be advantageous for borrowers who expect increased income later in the loan term. 4. Installment Promissory Note: This form divides the loan amount into a series of regular payments (installments) over an agreed-upon period. It helps borrowers manage their repayment obligations. 5. Demand Promissory Note: This form allows the lender to demand full repayment of the loan at any time, which can be beneficial in cases where the borrower's financial situation changes suddenly. 6. Co-Signer Promissory Note: This form includes a co-signer who guarantees the loan repayment if the primary borrower fails to fulfill their obligations. It provides an extra layer of security for the lender. Franklin Ohio Promissory Note — Horse Equine Forms are essential for anyone involved in lending or borrowing funds within the horse equine industry in Franklin, Ohio. They provide a clear and enforceable agreement for both parties, ensuring the protection of their rights and maintaining a healthy business relationship.