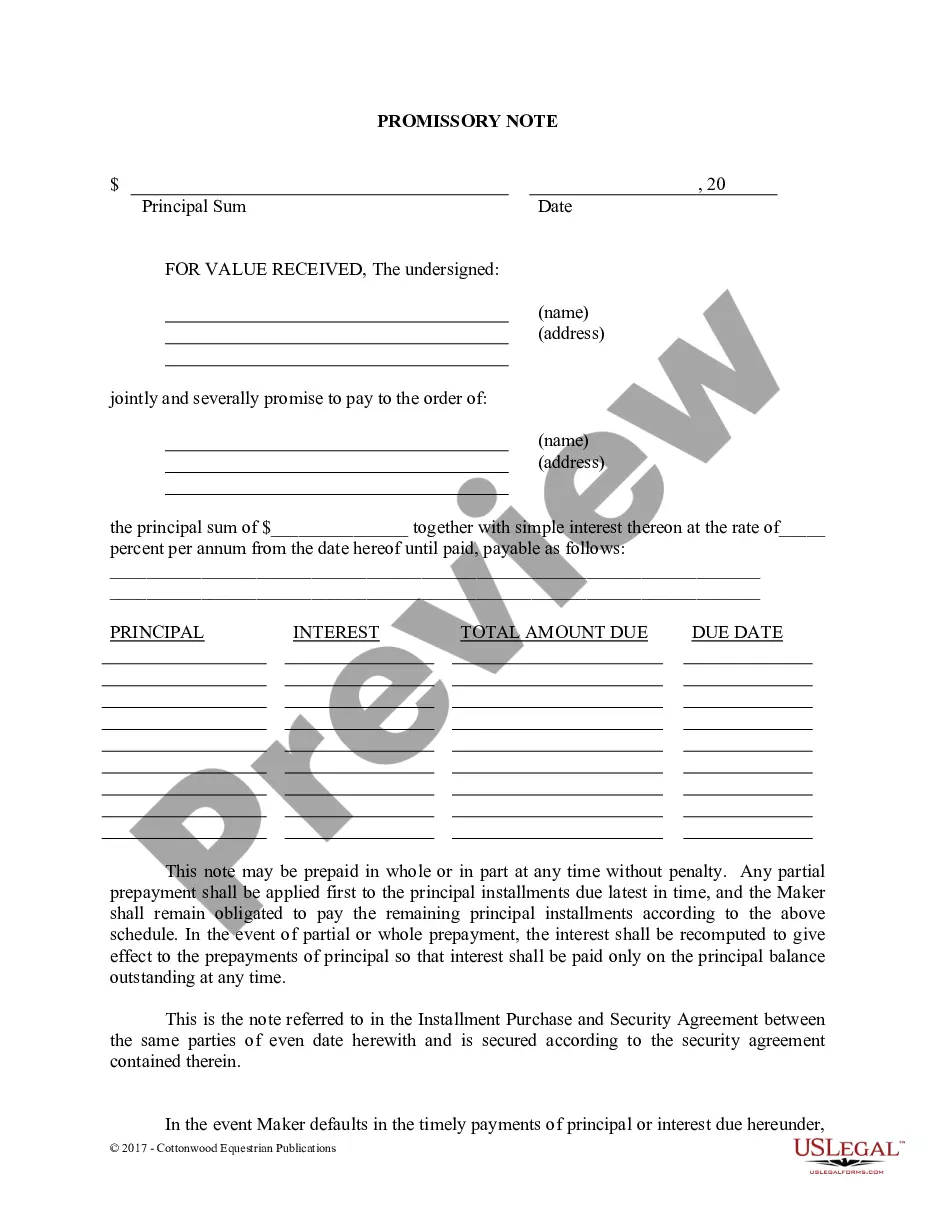

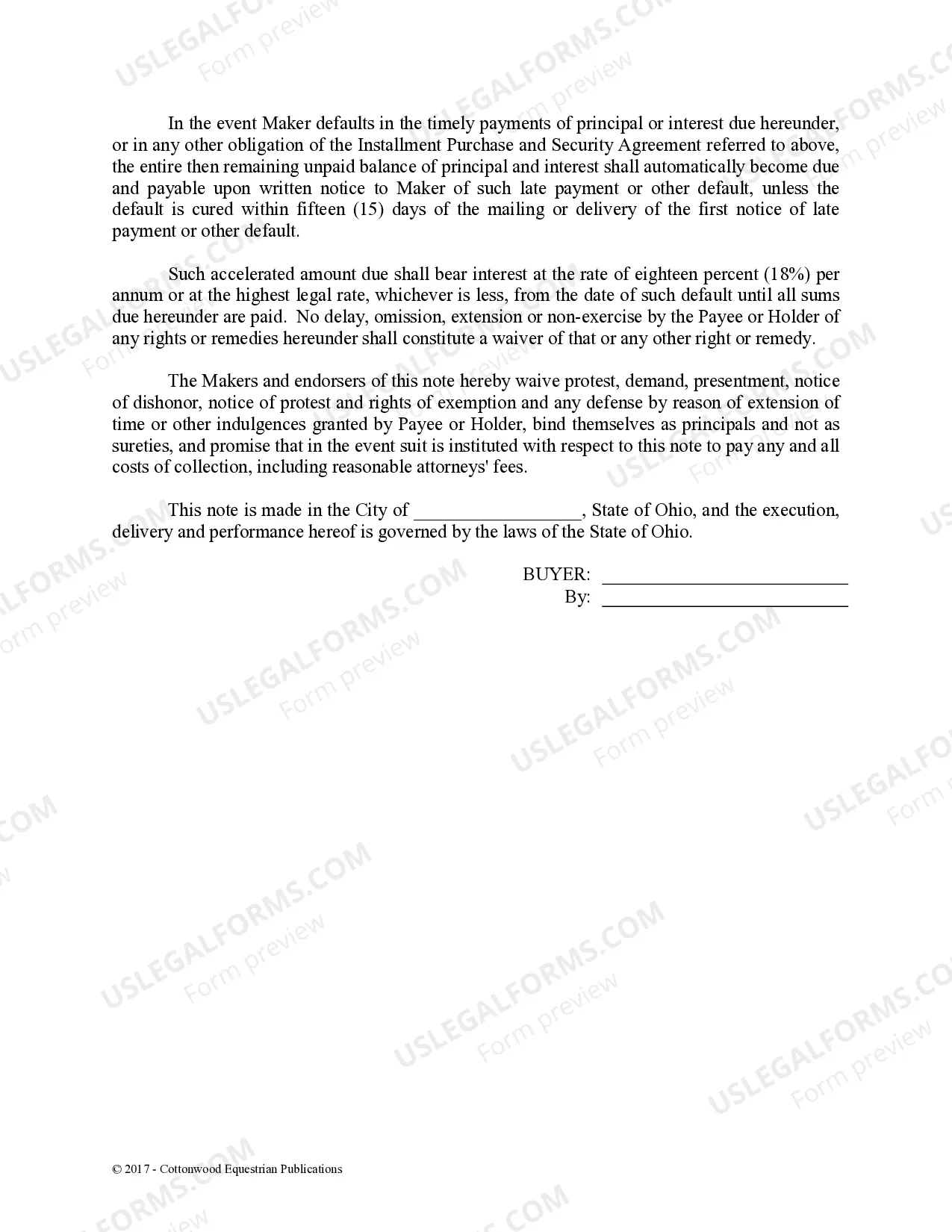

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Toledo Ohio Promissory Note — Horse Equine Forms are legal documents that outline the terms and conditions of a loan agreement between a lender and a borrower in the Toledo, Ohio area specifically relating to transactions involving horses and equine-related matters. These forms are essential for individuals or businesses who loan money in exchange for a promissory note secured by horses or equine assets. The Toledo Ohio Promissory Note — Horse Equine Forms generally consist of various sections that cover important aspects of the loan agreement. These sections typically include: 1. Parties Involved: Identifies the lender (also known as the payee) and the borrower (also known as the maker) involved in the promissory note. 2. Loan Amount and Terms: Specifies the total loan amount, the terms of repayment such as interest rate, payment schedule, and any additional fees or penalties. 3. Collateral: Outlines the specific horses or equine assets being offered as collateral for the loan. This section may include details such as breed, age, registration information, and other relevant information to identify the horse or equine asset. 4. Default and Remedies: Defines the actions that can be taken in case of default by the borrower, such as repossession of the collateral, the requirement of additional security, or legal actions to collect the outstanding debt. 5. Governing Law: States that the agreement is subject to the laws of Ohio, specifically Toledo, to ensure the enforceability of the promissory note within the jurisdiction. Different types of Toledo Ohio Promissory Note — Horse Equine Forms may exist depending on specific circumstances or variations in loan agreements. Some potential forms include: 1. Installment Promissory Note — Horse Equine Form: This type of form is used when the loan is structured with periodic installment payments. 2. Balloon Promissory Note — Horse Equine Form: This form is appropriate when a large portion of the loan, known as a balloon payment, is due at the end of the term. 3. Secured Promissory Note — Horse Equine Form: This form includes additional details regarding the collateral, such as the method of valuation or specifics of insurance requirements. 4. Demand Promissory Note — Horse Equine Form: If the borrower must pay back the loan upon request by the lender, this form would be utilized. These forms are crucial to ensure a clear understanding between the lender and the borrower, protecting their respective rights and interests in the horse or equine-related transactions. It is advisable to consult with legal professionals specialized in equine matters or local attorneys in Toledo, Ohio, to draft, review, or modify these forms as needed, considering any specific requirements or regulations applicable to this region.Toledo Ohio Promissory Note — Horse Equine Forms are legal documents that outline the terms and conditions of a loan agreement between a lender and a borrower in the Toledo, Ohio area specifically relating to transactions involving horses and equine-related matters. These forms are essential for individuals or businesses who loan money in exchange for a promissory note secured by horses or equine assets. The Toledo Ohio Promissory Note — Horse Equine Forms generally consist of various sections that cover important aspects of the loan agreement. These sections typically include: 1. Parties Involved: Identifies the lender (also known as the payee) and the borrower (also known as the maker) involved in the promissory note. 2. Loan Amount and Terms: Specifies the total loan amount, the terms of repayment such as interest rate, payment schedule, and any additional fees or penalties. 3. Collateral: Outlines the specific horses or equine assets being offered as collateral for the loan. This section may include details such as breed, age, registration information, and other relevant information to identify the horse or equine asset. 4. Default and Remedies: Defines the actions that can be taken in case of default by the borrower, such as repossession of the collateral, the requirement of additional security, or legal actions to collect the outstanding debt. 5. Governing Law: States that the agreement is subject to the laws of Ohio, specifically Toledo, to ensure the enforceability of the promissory note within the jurisdiction. Different types of Toledo Ohio Promissory Note — Horse Equine Forms may exist depending on specific circumstances or variations in loan agreements. Some potential forms include: 1. Installment Promissory Note — Horse Equine Form: This type of form is used when the loan is structured with periodic installment payments. 2. Balloon Promissory Note — Horse Equine Form: This form is appropriate when a large portion of the loan, known as a balloon payment, is due at the end of the term. 3. Secured Promissory Note — Horse Equine Form: This form includes additional details regarding the collateral, such as the method of valuation or specifics of insurance requirements. 4. Demand Promissory Note — Horse Equine Form: If the borrower must pay back the loan upon request by the lender, this form would be utilized. These forms are crucial to ensure a clear understanding between the lender and the borrower, protecting their respective rights and interests in the horse or equine-related transactions. It is advisable to consult with legal professionals specialized in equine matters or local attorneys in Toledo, Ohio, to draft, review, or modify these forms as needed, considering any specific requirements or regulations applicable to this region.