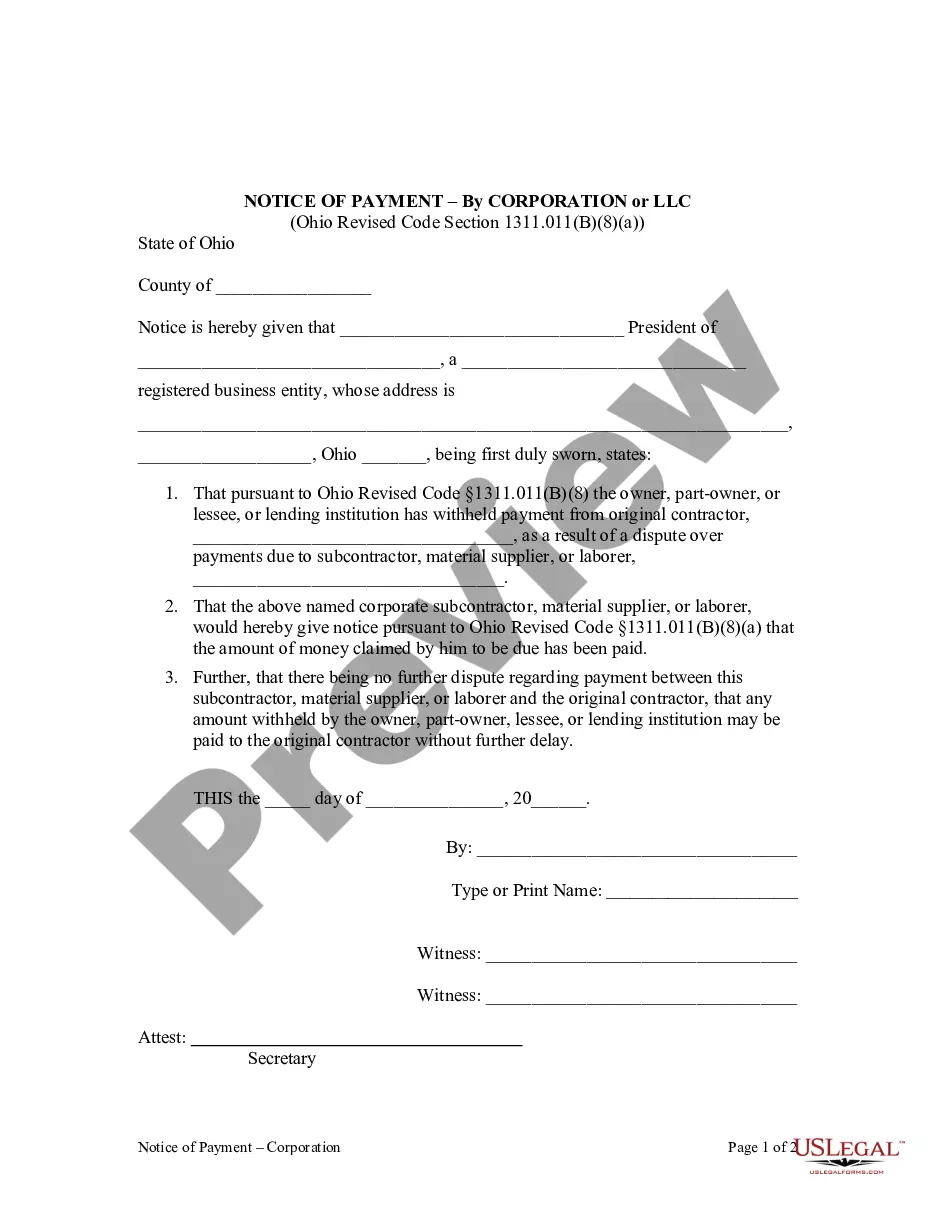

When a lending institution or an owner, part-owner, or lessee withholds payment from an original contractor due to a dispute over payment between the contractor and the subcontractor, materialman, or laborer, this form serves to notify the owner or lending institution that payment has been made to the subcontractor, materialman, or laborer, and that the owner and lender may now release funds to the original contractor.

The Akron Ohio Notice of Payment — Corporation or LLC is an essential document required for businesses operating in Akron, Ohio, and falls under the legal and financial obligations of corporations and LCS. This notice serves as a formal communication to inform these entities about the payment that needs to be made to comply with local regulations and maintain good standing with the local authorities. There are several types of Akron Ohio Notice of Payment applicable to corporations and LCS, depending on the nature of the payment and the specific requirements of the business. Some common types include the following: 1. Annual Report Notice: This type of notice typically reminds corporations and LCS to submit their annual reports, which provide vital information about the company's activities and finances during the previous year. It might also include instructions for filing the report and the associated fees. 2. Tax Payment Notice: Akron Ohio Notice of Payment may be issued by the local tax authority to remind corporations and LCS of their tax obligations. This notice would specify the deadline for payment, the applicable tax forms, and any penalties or interest in late payments. 3. Licensing Fee Notice: This notice is sent to businesses that require certain licenses or permits operating legally in Akron, Ohio. It would include information about the licensing fees, renewal deadlines, and instructions for the payment process. 4. Penalty Notice: In case of late or missed payments, Akron Ohio Notice of Payment might serve as a penalty notice, informing corporations and LCS about the consequences of non-compliance. This notice could outline the additional fines, late fees, or legal actions that could be imposed. Regardless of the specific type, the Akron Ohio Notice of Payment — Corporation or LLC should be taken seriously by businesses to avoid any adverse outcomes such as financial penalties, legal complications, or potential suspension of business activities. It is crucial for business owners and authorized representatives to carefully read and understand the notice, comply with the payment requirements within the designated timeframe, and maintain thorough records of all payments made.The Akron Ohio Notice of Payment — Corporation or LLC is an essential document required for businesses operating in Akron, Ohio, and falls under the legal and financial obligations of corporations and LCS. This notice serves as a formal communication to inform these entities about the payment that needs to be made to comply with local regulations and maintain good standing with the local authorities. There are several types of Akron Ohio Notice of Payment applicable to corporations and LCS, depending on the nature of the payment and the specific requirements of the business. Some common types include the following: 1. Annual Report Notice: This type of notice typically reminds corporations and LCS to submit their annual reports, which provide vital information about the company's activities and finances during the previous year. It might also include instructions for filing the report and the associated fees. 2. Tax Payment Notice: Akron Ohio Notice of Payment may be issued by the local tax authority to remind corporations and LCS of their tax obligations. This notice would specify the deadline for payment, the applicable tax forms, and any penalties or interest in late payments. 3. Licensing Fee Notice: This notice is sent to businesses that require certain licenses or permits operating legally in Akron, Ohio. It would include information about the licensing fees, renewal deadlines, and instructions for the payment process. 4. Penalty Notice: In case of late or missed payments, Akron Ohio Notice of Payment might serve as a penalty notice, informing corporations and LCS about the consequences of non-compliance. This notice could outline the additional fines, late fees, or legal actions that could be imposed. Regardless of the specific type, the Akron Ohio Notice of Payment — Corporation or LLC should be taken seriously by businesses to avoid any adverse outcomes such as financial penalties, legal complications, or potential suspension of business activities. It is crucial for business owners and authorized representatives to carefully read and understand the notice, comply with the payment requirements within the designated timeframe, and maintain thorough records of all payments made.