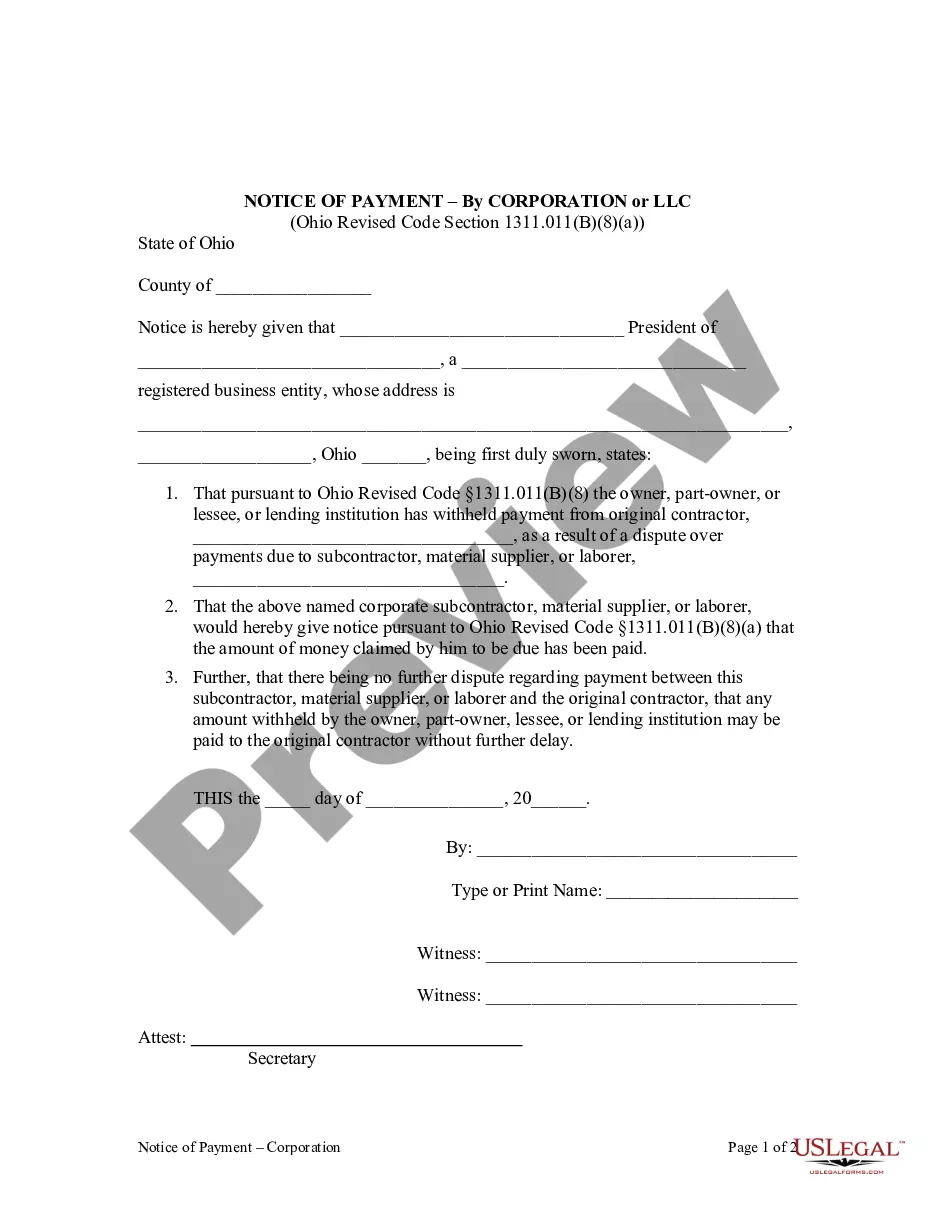

When a lending institution or an owner, part-owner, or lessee withholds payment from an original contractor due to a dispute over payment between the contractor and the subcontractor, materialman, or laborer, this form serves to notify the owner or lending institution that payment has been made to the subcontractor, materialman, or laborer, and that the owner and lender may now release funds to the original contractor.

Franklin Ohio Notice of Payment — Corporation or LLC The Franklin Ohio Notice of Payment — Corporation or LLC is a vital legal document used by businesses in Franklin, Ohio, to notify their customers or clients about unpaid bills, outstanding invoices, or any outstanding financial obligations. This notice serves as a formal request for payment and outlines the details of the debt owed to the corporation or LLC. Keywords: Franklin Ohio, Notice of Payment, Corporation, LLC, unpaid bills, outstanding invoices, financial obligations, formal request for payment, debt owed. There are various types of Franklin Ohio Notice of Payment — Corporation or LLC, each designed for different situations: 1. Standard Notice of Payment — Corporation or LLC: This type of notice is typically used when a corporation or LLC seeks payment for goods or services provided to a customer or client. It includes details such as the original amount owed, the due date, any additional charges incurred, and instructions for making the payment. 2. Final Notice of Payment — Corporation or LLC: If the initial payment request goes unanswered, a final notice is sent as a last attempt to collect payment before taking legal action. This notice is more assertive and may include consequences of non-payment, such as late fees, credit reporting, or legal action. 3. Delinquent Account Notice of Payment — Corporation or LLC: When a customer or client has consistently failed to make payments on time, this notice is used to address the delinquent account. It emphasizes the importance of resolving the outstanding balance promptly and may offer alternative payment arrangements or consequences for further non-payment. 4. Notice of Payment Plan — Corporation or LLC: In cases where a customer or client is unable to pay the full amount owed, a payment plan notice is issued. This notice outlines a structured installment payment arrangement, specifying the amount to be paid, due dates, and any applicable interest or penalties. 5. Stop Work Notice of Payment — Corporation or LLC: If a customer or client fails to make timely payments for ongoing services or projects, a stop work notice may be issued by the corporation or LLC, halting any further work until payment is received. This notice highlights the consequences of non-payment and provides a clear path for resolution. 6. Demand for Immediate Payment — Corporation or LLC: In urgent cases where immediate payment is required, such as for emergency services or critical situations, a demand for immediate payment notice is used. This notice requests prompt payment without delay and usually includes a shorter timeframe for compliance. The Franklin Ohio Notice of Payment — Corporation or LLC is an essential tool for businesses to communicate their financial expectations clearly. It ensures that businesses are recognized for the goods or services they provide and helps maintain their financial stability by ensuring prompt payment.Franklin Ohio Notice of Payment — Corporation or LLC The Franklin Ohio Notice of Payment — Corporation or LLC is a vital legal document used by businesses in Franklin, Ohio, to notify their customers or clients about unpaid bills, outstanding invoices, or any outstanding financial obligations. This notice serves as a formal request for payment and outlines the details of the debt owed to the corporation or LLC. Keywords: Franklin Ohio, Notice of Payment, Corporation, LLC, unpaid bills, outstanding invoices, financial obligations, formal request for payment, debt owed. There are various types of Franklin Ohio Notice of Payment — Corporation or LLC, each designed for different situations: 1. Standard Notice of Payment — Corporation or LLC: This type of notice is typically used when a corporation or LLC seeks payment for goods or services provided to a customer or client. It includes details such as the original amount owed, the due date, any additional charges incurred, and instructions for making the payment. 2. Final Notice of Payment — Corporation or LLC: If the initial payment request goes unanswered, a final notice is sent as a last attempt to collect payment before taking legal action. This notice is more assertive and may include consequences of non-payment, such as late fees, credit reporting, or legal action. 3. Delinquent Account Notice of Payment — Corporation or LLC: When a customer or client has consistently failed to make payments on time, this notice is used to address the delinquent account. It emphasizes the importance of resolving the outstanding balance promptly and may offer alternative payment arrangements or consequences for further non-payment. 4. Notice of Payment Plan — Corporation or LLC: In cases where a customer or client is unable to pay the full amount owed, a payment plan notice is issued. This notice outlines a structured installment payment arrangement, specifying the amount to be paid, due dates, and any applicable interest or penalties. 5. Stop Work Notice of Payment — Corporation or LLC: If a customer or client fails to make timely payments for ongoing services or projects, a stop work notice may be issued by the corporation or LLC, halting any further work until payment is received. This notice highlights the consequences of non-payment and provides a clear path for resolution. 6. Demand for Immediate Payment — Corporation or LLC: In urgent cases where immediate payment is required, such as for emergency services or critical situations, a demand for immediate payment notice is used. This notice requests prompt payment without delay and usually includes a shorter timeframe for compliance. The Franklin Ohio Notice of Payment — Corporation or LLC is an essential tool for businesses to communicate their financial expectations clearly. It ensures that businesses are recognized for the goods or services they provide and helps maintain their financial stability by ensuring prompt payment.