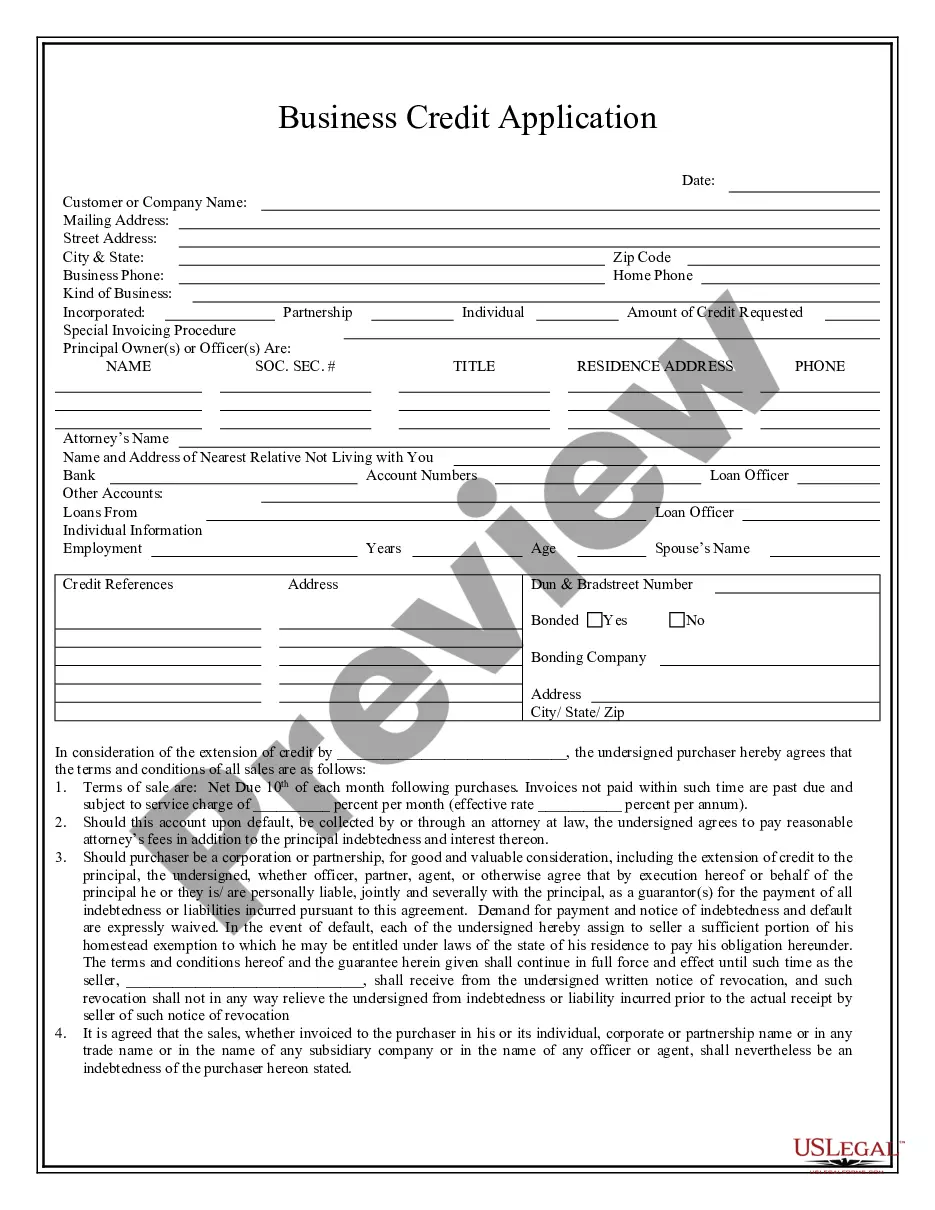

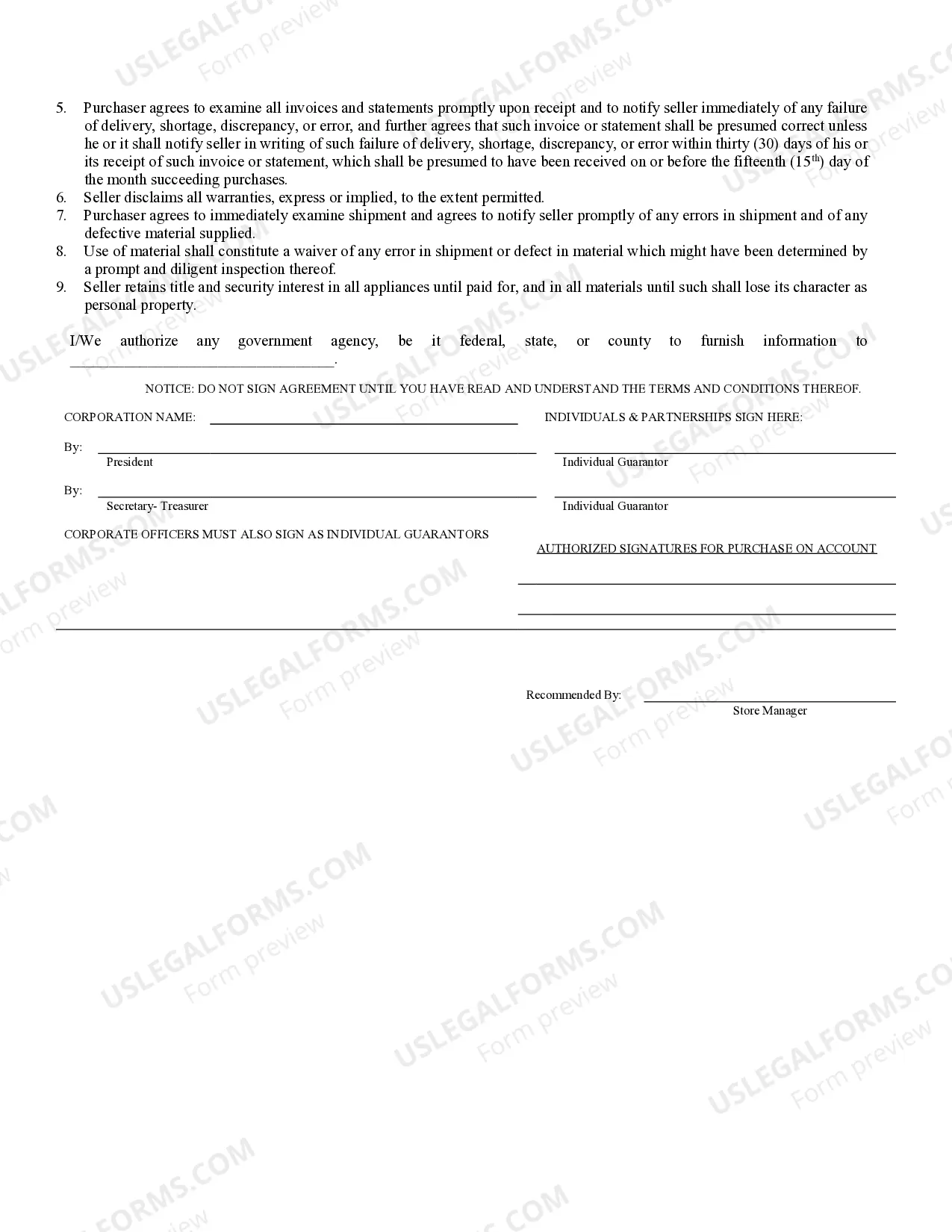

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Akron Ohio Business Credit Application is a comprehensive document designed to facilitate the process of applying for credit for businesses operating in the Akron, Ohio area. This application form serves as a crucial tool for local businesses seeking financial support from banks or lending institutions in Akron. The Akron Ohio Business Credit Application encompasses vital sections that capture essential details required by lenders. Each section aims to gather information about the business, its financial stability, and relevant contact details. By completing this application, businesses can provide lenders with a clear overview of their operations, financial standing, and creditworthiness, enabling lenders to assess the potential risks involved in extending credit. Key sections included in the Akron Ohio Business Credit Application may consist of: 1. Business Information: This section collects details about the business entity seeking credit, such as its legal name, address, contact information, and industry sector. 2. Ownership Details: Here, applicants are required to provide information about the ownership structure, including the names, roles, and contact details of company directors or partners. This section may also inquire about the percentage of ownership held by each party. 3. Financial Information: This section delves into the financial aspects of the business, presenting an overview of its revenue, assets, liabilities, and other pertinent financial data. This may include the most recent financial statements, tax returns, profit and loss statements, cash flow forecasts, and bank statements. 4. Credit History: Businesses may need to disclose their credit history, including any existing loans or credit lines they have, as well as their payment history. This allows lenders to determine the business's ability to repay loans and manage previous credit facilities. 5. Purpose of Credit: Applicants need to describe the primary purpose for which they require credit, such as business expansion, inventory purchase, equipment acquisition, or working capital needs. A detailed breakdown of how the funds will be utilized is crucial for lenders to assess the viability and profitability of the intended use. 6. References and Guarantors: Lenders generally request references to validate the business's credibility, such as suppliers, customers, or other entities with whom the business maintains a financial relationship. Additionally, guarantor information may be required, including personal guarantees from business owners or high-ranking executives who will assume responsibility for loan repayments in case of default. Types of Akron Ohio Business Credit Applications may vary based on the specific financial institution or lender. Different banks or credit unions in Akron may have their own customized credit application forms, tailored to their unique lending parameters, and procedures. It is advisable for businesses to familiarize themselves with the specific requirements of each financial institution they approach to apply for credit. In conclusion, the Akron Ohio Business Credit Application serves as a fundamental document for businesses in Akron seeking financial support. By carefully completing this application, businesses aim to provide lenders with a comprehensive overview of their operations, financial stability, and creditworthiness, enabling lenders to assess the risks involved in extending credit.Akron Ohio Business Credit Application is a comprehensive document designed to facilitate the process of applying for credit for businesses operating in the Akron, Ohio area. This application form serves as a crucial tool for local businesses seeking financial support from banks or lending institutions in Akron. The Akron Ohio Business Credit Application encompasses vital sections that capture essential details required by lenders. Each section aims to gather information about the business, its financial stability, and relevant contact details. By completing this application, businesses can provide lenders with a clear overview of their operations, financial standing, and creditworthiness, enabling lenders to assess the potential risks involved in extending credit. Key sections included in the Akron Ohio Business Credit Application may consist of: 1. Business Information: This section collects details about the business entity seeking credit, such as its legal name, address, contact information, and industry sector. 2. Ownership Details: Here, applicants are required to provide information about the ownership structure, including the names, roles, and contact details of company directors or partners. This section may also inquire about the percentage of ownership held by each party. 3. Financial Information: This section delves into the financial aspects of the business, presenting an overview of its revenue, assets, liabilities, and other pertinent financial data. This may include the most recent financial statements, tax returns, profit and loss statements, cash flow forecasts, and bank statements. 4. Credit History: Businesses may need to disclose their credit history, including any existing loans or credit lines they have, as well as their payment history. This allows lenders to determine the business's ability to repay loans and manage previous credit facilities. 5. Purpose of Credit: Applicants need to describe the primary purpose for which they require credit, such as business expansion, inventory purchase, equipment acquisition, or working capital needs. A detailed breakdown of how the funds will be utilized is crucial for lenders to assess the viability and profitability of the intended use. 6. References and Guarantors: Lenders generally request references to validate the business's credibility, such as suppliers, customers, or other entities with whom the business maintains a financial relationship. Additionally, guarantor information may be required, including personal guarantees from business owners or high-ranking executives who will assume responsibility for loan repayments in case of default. Types of Akron Ohio Business Credit Applications may vary based on the specific financial institution or lender. Different banks or credit unions in Akron may have their own customized credit application forms, tailored to their unique lending parameters, and procedures. It is advisable for businesses to familiarize themselves with the specific requirements of each financial institution they approach to apply for credit. In conclusion, the Akron Ohio Business Credit Application serves as a fundamental document for businesses in Akron seeking financial support. By carefully completing this application, businesses aim to provide lenders with a comprehensive overview of their operations, financial stability, and creditworthiness, enabling lenders to assess the risks involved in extending credit.