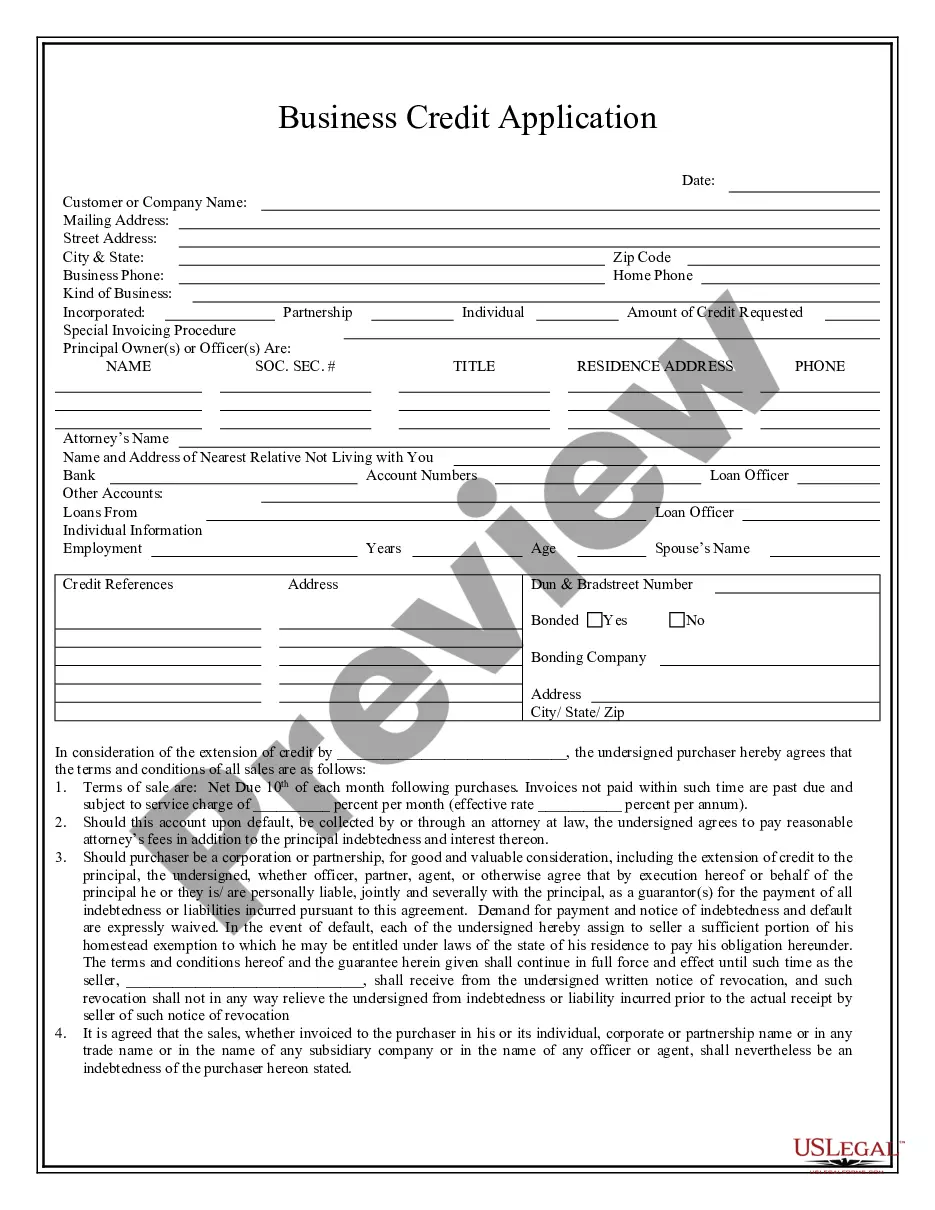

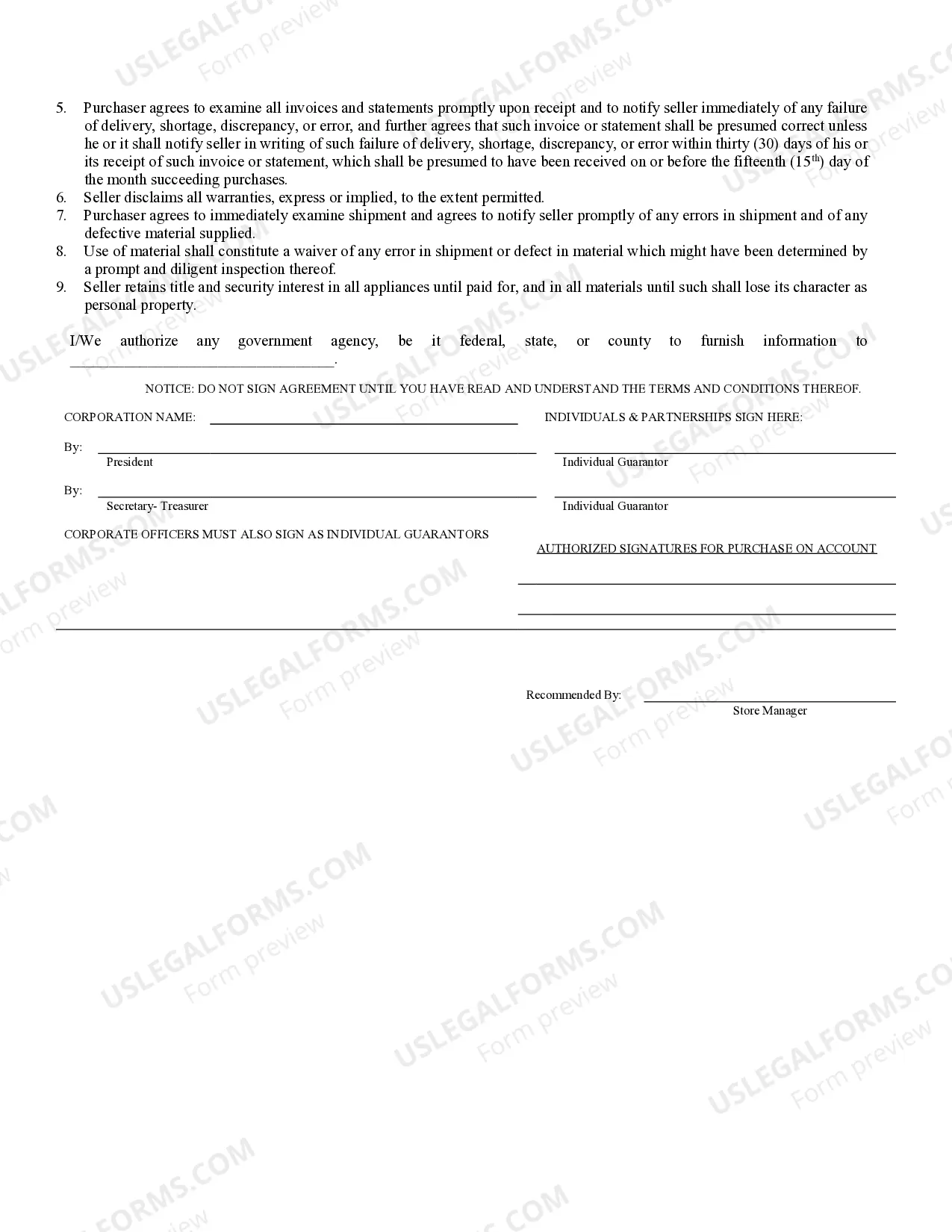

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Cuyahoga Ohio Business Credit Application is an essential document used by businesses in Cuyahoga County, Ohio, to apply for credit from financial institutions or trade vendors. This application serves as a formal request for credit and contains detailed information about the business, its financial history, and its credit needs. The Cuyahoga Ohio Business Credit Application is widely used in various industries and sectors, such as manufacturing, retail, services, and construction. By completing this application, businesses aim to secure the necessary funds to support their operations, expand their facilities, purchase inventory, or invest in new equipment. Key elements typically included in the Cuyahoga Ohio Business Credit Application are: 1. Business Information: This section requires providing details about the business, including its legal name, address, phone number, and other contact information. It may also ask for the business structure, such as whether it is a sole proprietorship, partnership, or corporation. 2. Financial Information: Businesses are required to disclose their financial status, including annual revenues, profits or losses, assets, liabilities, and debt obligations. These figures provide lenders with insights into the company's financial health and capacity to repay any credit granted. 3. Business History: This part of the application focuses on the length of time the business has been operating and any significant milestones or achievements. It may also ask about the company's market share, competitive advantages, and future growth plans. 4. Management Team: Lenders and credit providers often evaluate the competence and experience of a business's management. Therefore, this section requires the disclosure of key personnel, their qualifications, and job responsibilities. 5. Credit Requested: Here, businesses specify the amount of credit they are seeking, whether it is a specific dollar amount or a line of credit. Additionally, businesses may need to indicate the purpose of the credit, such as working capital, equipment purchase, or inventory financing. 6. Trade References: It is common for the application to request trade references, including the names and contact information of suppliers or vendors the business has previously worked with. These references allow creditors to assess the business's payment history and reliability. 7. Personal Guarantees: In some cases, lenders or creditors may require personal guarantees from the business owners or key stakeholders. These guarantees give lenders an additional layer of security in case of default. Cuyahoga Ohio Business Credit Application may vary slightly depending on the specific lender or financial institution. Some financial institutions might have their own customized application forms, incorporating additional questions or requirements tailored to their internal processes. However, the key elements mentioned above generally form the foundation of any business credit application used in Cuyahoga County, Ohio.Cuyahoga Ohio Business Credit Application is an essential document used by businesses in Cuyahoga County, Ohio, to apply for credit from financial institutions or trade vendors. This application serves as a formal request for credit and contains detailed information about the business, its financial history, and its credit needs. The Cuyahoga Ohio Business Credit Application is widely used in various industries and sectors, such as manufacturing, retail, services, and construction. By completing this application, businesses aim to secure the necessary funds to support their operations, expand their facilities, purchase inventory, or invest in new equipment. Key elements typically included in the Cuyahoga Ohio Business Credit Application are: 1. Business Information: This section requires providing details about the business, including its legal name, address, phone number, and other contact information. It may also ask for the business structure, such as whether it is a sole proprietorship, partnership, or corporation. 2. Financial Information: Businesses are required to disclose their financial status, including annual revenues, profits or losses, assets, liabilities, and debt obligations. These figures provide lenders with insights into the company's financial health and capacity to repay any credit granted. 3. Business History: This part of the application focuses on the length of time the business has been operating and any significant milestones or achievements. It may also ask about the company's market share, competitive advantages, and future growth plans. 4. Management Team: Lenders and credit providers often evaluate the competence and experience of a business's management. Therefore, this section requires the disclosure of key personnel, their qualifications, and job responsibilities. 5. Credit Requested: Here, businesses specify the amount of credit they are seeking, whether it is a specific dollar amount or a line of credit. Additionally, businesses may need to indicate the purpose of the credit, such as working capital, equipment purchase, or inventory financing. 6. Trade References: It is common for the application to request trade references, including the names and contact information of suppliers or vendors the business has previously worked with. These references allow creditors to assess the business's payment history and reliability. 7. Personal Guarantees: In some cases, lenders or creditors may require personal guarantees from the business owners or key stakeholders. These guarantees give lenders an additional layer of security in case of default. Cuyahoga Ohio Business Credit Application may vary slightly depending on the specific lender or financial institution. Some financial institutions might have their own customized application forms, incorporating additional questions or requirements tailored to their internal processes. However, the key elements mentioned above generally form the foundation of any business credit application used in Cuyahoga County, Ohio.