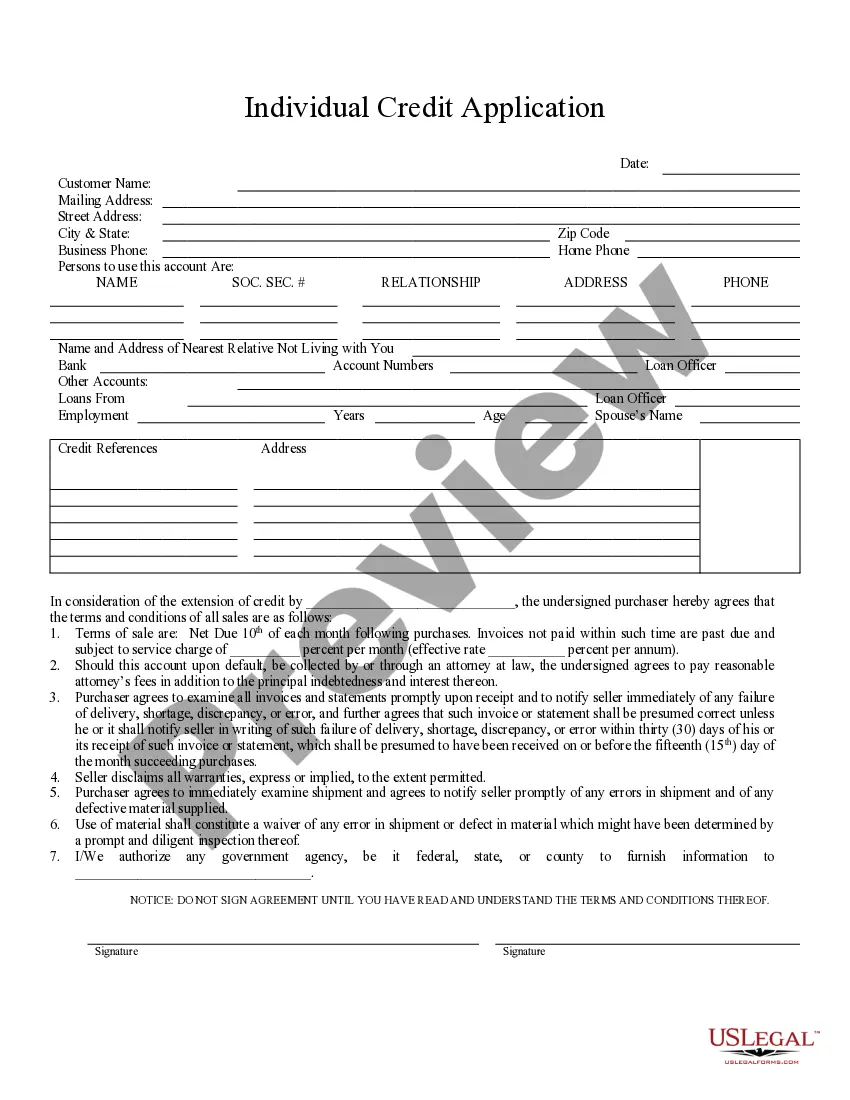

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Cincinnati Ohio Individual Credit Application is a comprehensive form used by individuals residing in Cincinnati, Ohio, to apply for credit services from financial institutions and other lending entities. This application serves as a means for individuals to request credit for various purposes, such as purchasing a home, car, or financing education. The Cincinnati Ohio Individual Credit Application collects detailed information necessary for financial institutions to assess an individual's creditworthiness. This includes personal details such as full name, date of birth, social security number, contact information, and current residential address. Additionally, applicants are required to provide employment details, including current occupation, employer's name and contact information, duration of employment, and monthly income. This information allows financial institutions to evaluate the applicant's ability to repay the credit. The Cincinnati Ohio Individual Credit Application also requires applicants to disclose their existing credit commitments, such as outstanding loans, credit card debts, and mortgages. This allows lenders to gauge the applicant's existing financial obligations and assess their capacity to handle additional credit responsibly. Furthermore, the application may include sections for applicants to provide information on their housing history, including previous addresses, rental payments, or mortgage payments. This helps lenders determine the applicant's stability and reliability in meeting financial responsibilities. Cincinnati Ohio Individual Credit Application focuses on gathering information specific to the region, considering the unique economic factors and demographics of Cincinnati. This ensures that the credit evaluation aligns with the local financial environment and takes into account variables such as the cost of living and average income in the area. Examples of different types of Cincinnati Ohio Individual Credit Application forms include: 1. Cincinnati Ohio Home Mortgage Credit Application: Specifically designed for individuals seeking credit to finance the purchase of a home or refinance an existing mortgage. 2. Cincinnati Ohio Auto Loan Credit Application: Tailored for those seeking credit to purchase a vehicle, whether new or used. 3. Cincinnati Ohio Student Loan Credit Application: Geared towards individuals pursuing higher education, allowing them to apply for credit to cover tuition fees, books, course materials, and living expenses. 4. Cincinnati Ohio Personal Loan Credit Application: Applicable for individuals seeking credit for personal use, such as debt consolidation, home improvement, or unexpected expenses. In conclusion, Cincinnati Ohio Individual Credit Application is a vital tool for individuals residing in Cincinnati to request credit services from financial institutions. These applications come in various types, each catered to specific credit needs such as home mortgage, auto loans, student loans, or personal loans. By diligently completing the application, individuals increase their chances of receiving credit and achieving their financial goals.