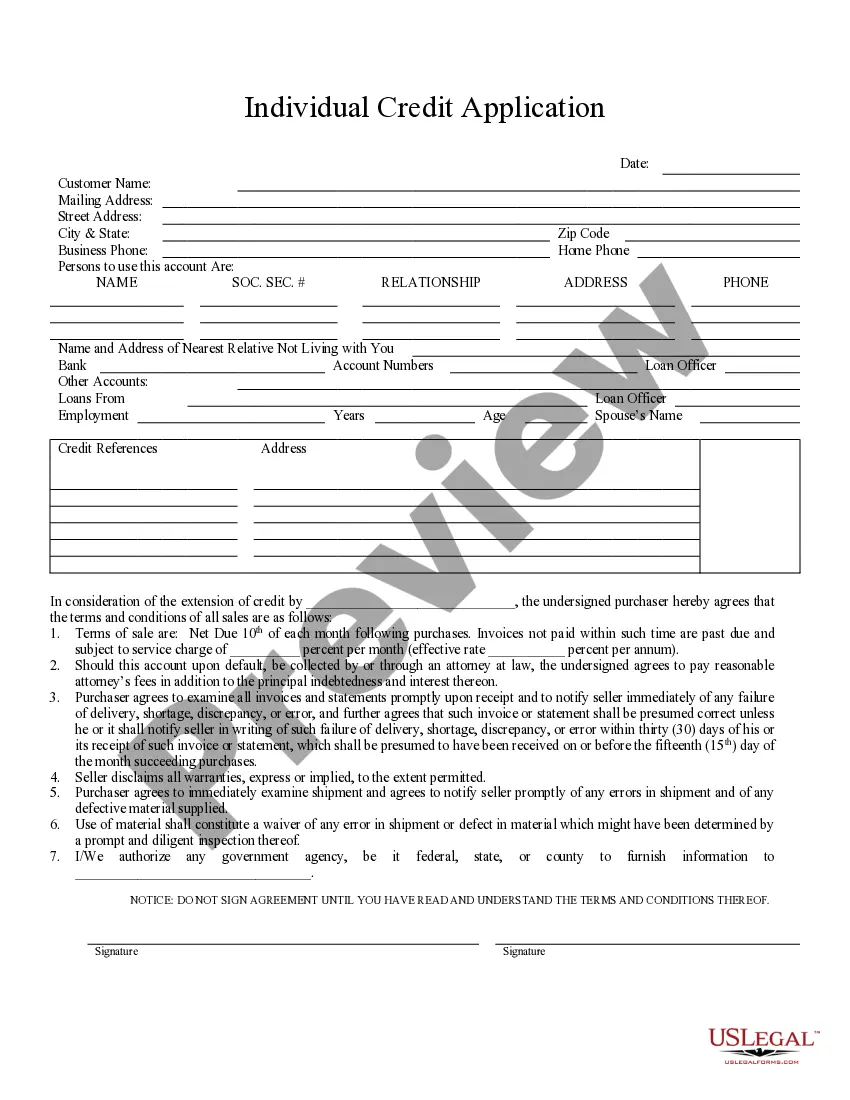

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Columbus Ohio Individual Credit Application is a crucial form used by financial institutions and lenders when evaluating the creditworthiness of an individual who is seeking a loan or credit. It gathers all pertinent information required to assess the applicant's financial standing and repayment capacity. This comprehensive application includes various sections where applicants must provide personal details such as full name, contact information, social security number, date of birth, and current address. Moreover, it also requires employment information, including the applicant's occupation, employer name, and contact details, as well as their monthly income and any additional sources of income. Additionally, the Columbus Ohio Individual Credit Application delves into the applicant's financial obligations like existing loans, credit card debts, mortgages, and other liabilities. This enables lenders to assess the individual's current debt-to-income ratio, which is a crucial determinant of creditworthiness. Furthermore, the application requires the applicant's consent to obtain a credit report, enabling lenders to assess their credit history, payment track record, and any past delinquencies. This allows lenders to evaluate the individual's previous repayment habits and overall creditworthiness. The Columbus Ohio Individual Credit Application includes a section where the applicant must list their assets, such as real estate properties, vehicles, investments, and any other valuable possessions. This information gives lenders an overall picture of the applicant's financial stability. Different types of Columbus Ohio Individual Credit Applications may exist depending on the specific purpose for which the credit is being obtained. For instance, common variations may include applications for personal loans, auto loans, mortgages, or credit cards. Each variation may have additional sections or specific requirements tailored to the specific credit type. In summary, the Columbus Ohio Individual Credit Application is a comprehensive form used by lenders and financial institutions to gather essential information about an individual's financial standing, employment, income, debts, and assets. By carefully assessing this information, lenders can make informed decisions regarding an individual's creditworthiness and determine the most suitable credit terms for the applicant.The Columbus Ohio Individual Credit Application is a crucial form used by financial institutions and lenders when evaluating the creditworthiness of an individual who is seeking a loan or credit. It gathers all pertinent information required to assess the applicant's financial standing and repayment capacity. This comprehensive application includes various sections where applicants must provide personal details such as full name, contact information, social security number, date of birth, and current address. Moreover, it also requires employment information, including the applicant's occupation, employer name, and contact details, as well as their monthly income and any additional sources of income. Additionally, the Columbus Ohio Individual Credit Application delves into the applicant's financial obligations like existing loans, credit card debts, mortgages, and other liabilities. This enables lenders to assess the individual's current debt-to-income ratio, which is a crucial determinant of creditworthiness. Furthermore, the application requires the applicant's consent to obtain a credit report, enabling lenders to assess their credit history, payment track record, and any past delinquencies. This allows lenders to evaluate the individual's previous repayment habits and overall creditworthiness. The Columbus Ohio Individual Credit Application includes a section where the applicant must list their assets, such as real estate properties, vehicles, investments, and any other valuable possessions. This information gives lenders an overall picture of the applicant's financial stability. Different types of Columbus Ohio Individual Credit Applications may exist depending on the specific purpose for which the credit is being obtained. For instance, common variations may include applications for personal loans, auto loans, mortgages, or credit cards. Each variation may have additional sections or specific requirements tailored to the specific credit type. In summary, the Columbus Ohio Individual Credit Application is a comprehensive form used by lenders and financial institutions to gather essential information about an individual's financial standing, employment, income, debts, and assets. By carefully assessing this information, lenders can make informed decisions regarding an individual's creditworthiness and determine the most suitable credit terms for the applicant.