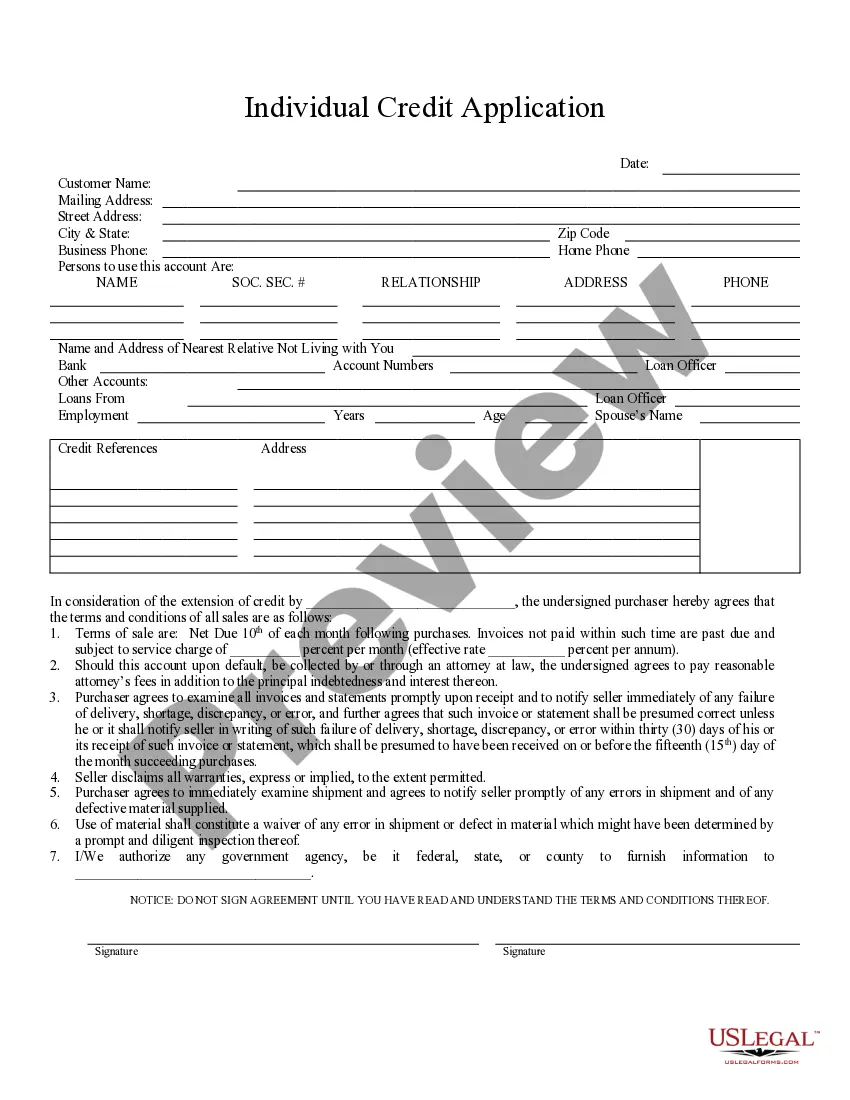

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Cuyahoga Ohio Individual Credit Application is a document used by individuals in Cuyahoga County, Ohio, to apply for credit from a financial institution or lender. This application is utilized to gather essential personal and financial information about the applicant, which helps the lender assess their creditworthiness and determine the terms and conditions of the credit. Keywords: 1. Cuyahoga Ohio: Refers to the geographic location and jurisdiction where the credit application is applicable. 2. Individual: Specifies that the credit application is designed for personal use by individuals and not for businesses or organizations. 3. Credit application: Describes the purpose of the document, which is to request credit or a loan from a financial institution. 4. Financial institution: The entity where individuals apply for credit, such as banks, credit unions, or other lending institutions. 5. Lender: The party responsible for granting the credit and extending the funds to the applicant. 6. Personal information: Includes details about the applicant's identity, such as name, address, date of birth, Social Security number, and contact information. 7. Financial information: Pertains to the applicant's financial status, including employment details, income, current debts, assets, and liabilities. 8. Creditworthiness: The evaluation of an individual's ability to handle and repay debt obligations based on their financial situation, credit history, and other relevant factors. 9. Terms and conditions: Specifies the guidelines under which the credit will be granted, including interest rate, repayment schedule, penalties, and any additional requirements or agreements. Types of Cuyahoga Ohio Individual Credit Applications: 1. Mortgage credit application: Specifically designed for individuals seeking a loan to purchase or refinance a home in Cuyahoga County, Ohio. 2. Auto loan credit application: Tailored for individuals applying for a credit facility to finance the purchase of a vehicle within the Cuyahoga Ohio region. 3. Personal loan credit application: Intended for individuals requesting an unsecured loan for various personal purposes, such as debt consolidation, home improvements, or educational expenses, in Cuyahoga County, Ohio. 4. Credit card application: Pertains to individuals interested in obtaining a credit card issued by a financial institution in Cuyahoga Ohio. These variations exist as different types of credit applications depending on the specific financial products an individual is seeking.Cuyahoga Ohio Individual Credit Application is a document used by individuals in Cuyahoga County, Ohio, to apply for credit from a financial institution or lender. This application is utilized to gather essential personal and financial information about the applicant, which helps the lender assess their creditworthiness and determine the terms and conditions of the credit. Keywords: 1. Cuyahoga Ohio: Refers to the geographic location and jurisdiction where the credit application is applicable. 2. Individual: Specifies that the credit application is designed for personal use by individuals and not for businesses or organizations. 3. Credit application: Describes the purpose of the document, which is to request credit or a loan from a financial institution. 4. Financial institution: The entity where individuals apply for credit, such as banks, credit unions, or other lending institutions. 5. Lender: The party responsible for granting the credit and extending the funds to the applicant. 6. Personal information: Includes details about the applicant's identity, such as name, address, date of birth, Social Security number, and contact information. 7. Financial information: Pertains to the applicant's financial status, including employment details, income, current debts, assets, and liabilities. 8. Creditworthiness: The evaluation of an individual's ability to handle and repay debt obligations based on their financial situation, credit history, and other relevant factors. 9. Terms and conditions: Specifies the guidelines under which the credit will be granted, including interest rate, repayment schedule, penalties, and any additional requirements or agreements. Types of Cuyahoga Ohio Individual Credit Applications: 1. Mortgage credit application: Specifically designed for individuals seeking a loan to purchase or refinance a home in Cuyahoga County, Ohio. 2. Auto loan credit application: Tailored for individuals applying for a credit facility to finance the purchase of a vehicle within the Cuyahoga Ohio region. 3. Personal loan credit application: Intended for individuals requesting an unsecured loan for various personal purposes, such as debt consolidation, home improvements, or educational expenses, in Cuyahoga County, Ohio. 4. Credit card application: Pertains to individuals interested in obtaining a credit card issued by a financial institution in Cuyahoga Ohio. These variations exist as different types of credit applications depending on the specific financial products an individual is seeking.