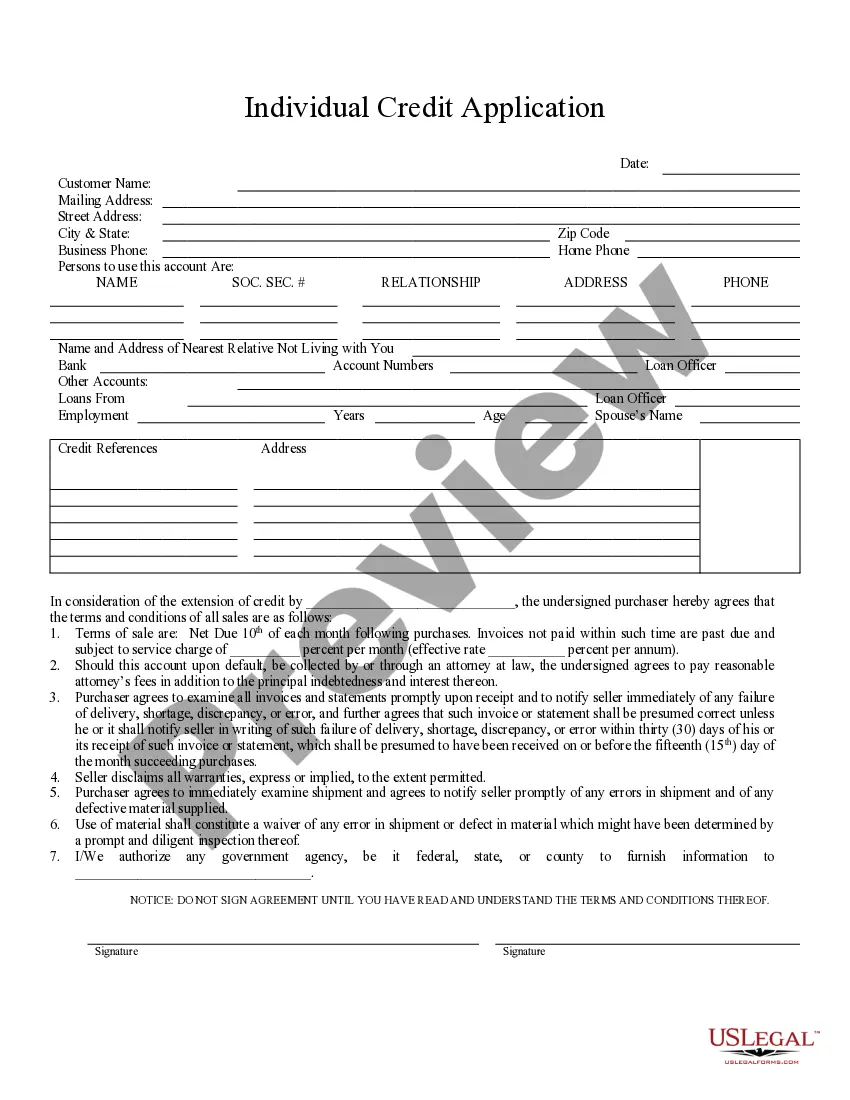

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Dayton Ohio Individual Credit Application is a document used by individuals in Dayton, Ohio to apply for credit from financial institutions or lenders. It serves as a comprehensive tool to gather personal and financial information which is essential for evaluating an individual's creditworthiness. The Dayton Ohio Individual Credit Application usually includes several sections that require individuals to provide detailed information. These sections may include personal details such as name, address, phone number, email, and social security number, which are crucial for identification purposes. It may also require employment information like current occupation, employer's name, and contact details. Financial details form a significant part of the Dayton Ohio Individual Credit Application. Individuals are typically required to disclose their income sources, including salary, bonuses, commissions, or other forms of regular income. They may also need to provide information on their monthly expenses, including rent/mortgage payments, utility bills, and other financial obligations. Another crucial section of the Dayton Ohio Individual Credit Application is the credit history section. This requires individuals to provide details about their existing loans, credit cards, and any other liabilities they may have. Lenders use this information to assess an applicant's debt-to-income ratio and determine their ability to handle additional credit. In addition to these standard sections, there may be variations of the Dayton Ohio Individual Credit Application based on the specific credit products or lenders. For instance, a mortgage application may require additional information about the property being financed, such as its address, estimated value, and other relevant details. Similarly, an auto loan application may include sections for providing details about the desired vehicle, such as make, model, year, and VIN. Overall, the Dayton Ohio Individual Credit Application is a vital document for individuals seeking credit in Dayton, Ohio. It assists lenders in evaluating an individual's creditworthiness based on their personal and financial information. By carefully completing the application and providing accurate information, individuals increase their chances of securing credit on favorable terms.Dayton Ohio Individual Credit Application is a document used by individuals in Dayton, Ohio to apply for credit from financial institutions or lenders. It serves as a comprehensive tool to gather personal and financial information which is essential for evaluating an individual's creditworthiness. The Dayton Ohio Individual Credit Application usually includes several sections that require individuals to provide detailed information. These sections may include personal details such as name, address, phone number, email, and social security number, which are crucial for identification purposes. It may also require employment information like current occupation, employer's name, and contact details. Financial details form a significant part of the Dayton Ohio Individual Credit Application. Individuals are typically required to disclose their income sources, including salary, bonuses, commissions, or other forms of regular income. They may also need to provide information on their monthly expenses, including rent/mortgage payments, utility bills, and other financial obligations. Another crucial section of the Dayton Ohio Individual Credit Application is the credit history section. This requires individuals to provide details about their existing loans, credit cards, and any other liabilities they may have. Lenders use this information to assess an applicant's debt-to-income ratio and determine their ability to handle additional credit. In addition to these standard sections, there may be variations of the Dayton Ohio Individual Credit Application based on the specific credit products or lenders. For instance, a mortgage application may require additional information about the property being financed, such as its address, estimated value, and other relevant details. Similarly, an auto loan application may include sections for providing details about the desired vehicle, such as make, model, year, and VIN. Overall, the Dayton Ohio Individual Credit Application is a vital document for individuals seeking credit in Dayton, Ohio. It assists lenders in evaluating an individual's creditworthiness based on their personal and financial information. By carefully completing the application and providing accurate information, individuals increase their chances of securing credit on favorable terms.