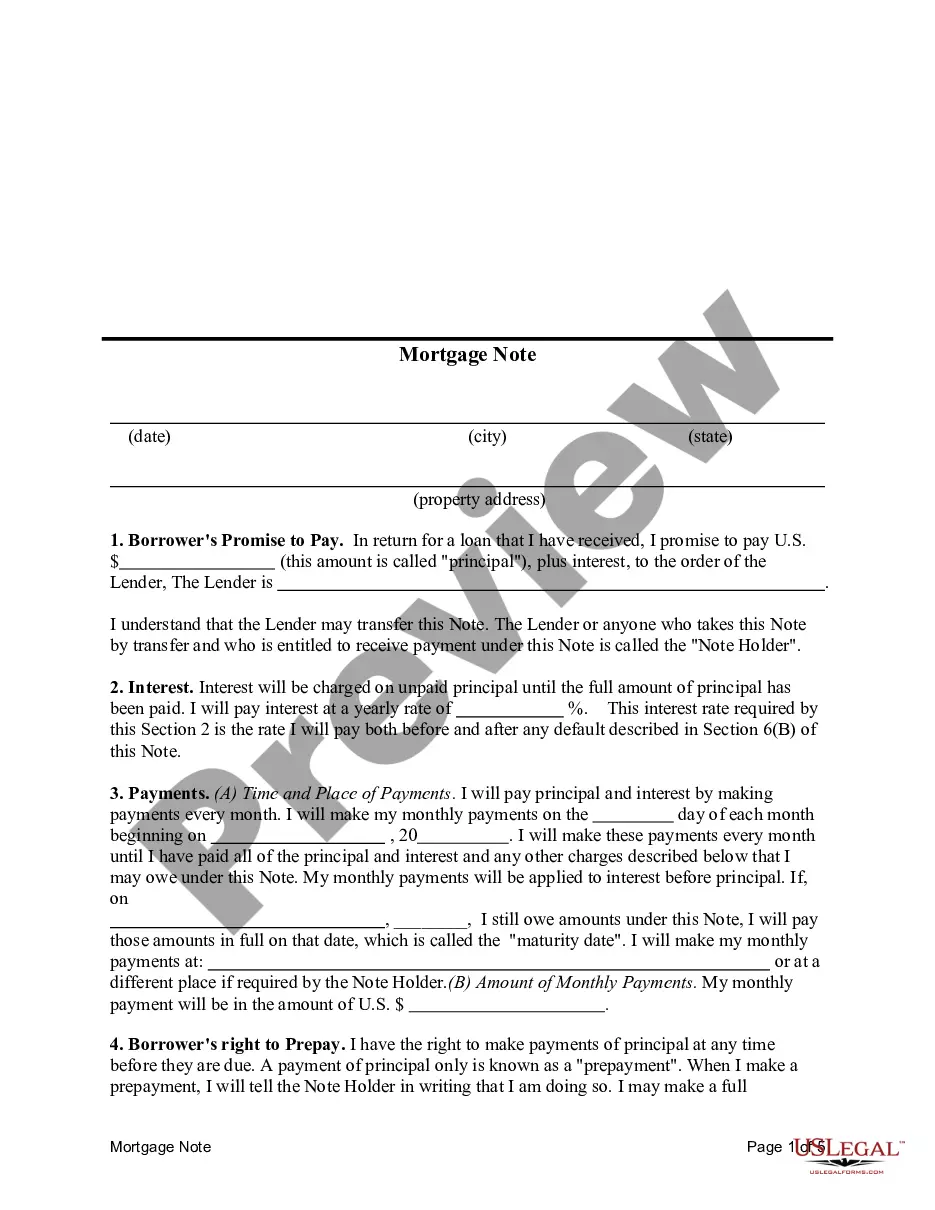

This sample form, a Mortgage Note, is for use in home financing in Ohio. Available in Word format.

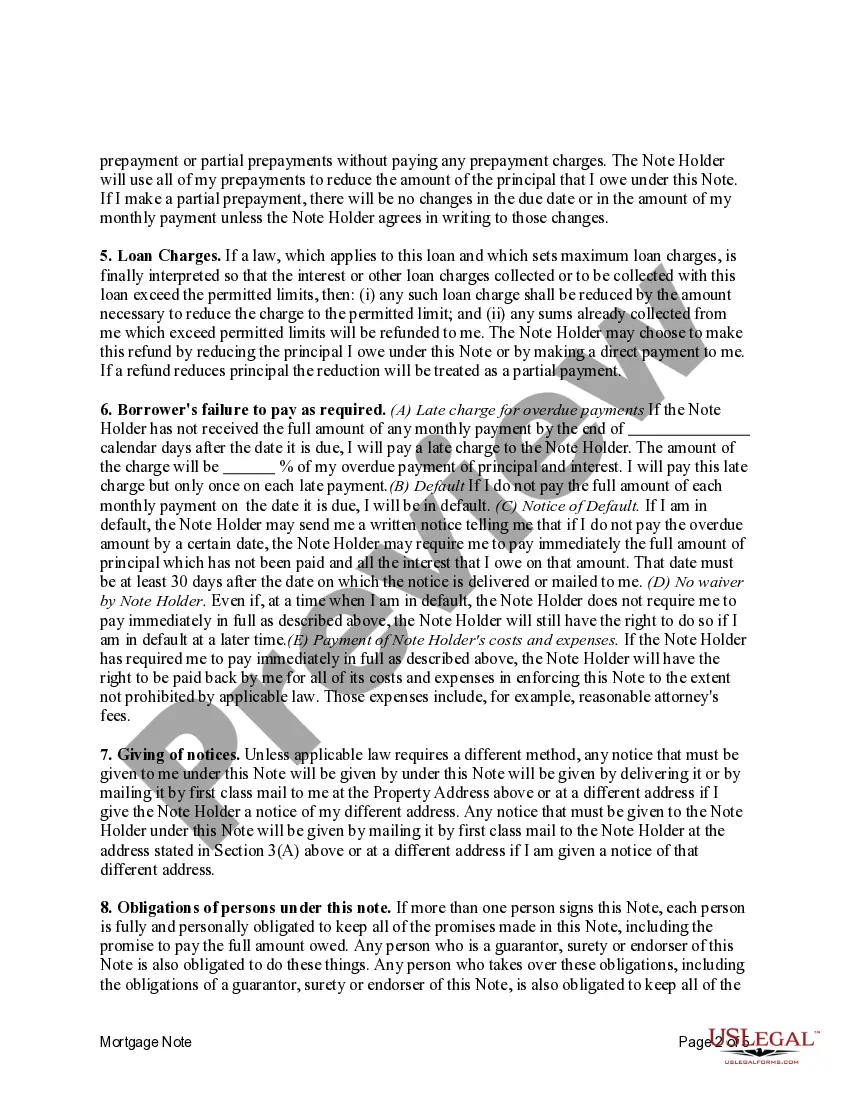

Dayton Ohio Mortgage Note: Explained in Detail A Dayton Ohio Mortgage Note is a legal document that outlines the terms and conditions of a mortgage loan in Dayton, Ohio. It serves as evidence of the debt owed by the borrower to the lender and provides details about repayment terms, interest rates, and any additional provisions regarding the mortgage. Different Types of Dayton Ohio Mortgage Notes: 1. Fixed-Rate Mortgage Note: This type of mortgage note in Dayton, Ohio, involves a fixed interest rate that remains constant throughout the loan term. Borrowers benefit from predictable monthly payments, making budgeting easier. 2. Adjustable-Rate Mortgage (ARM) Note: An ARM mortgage note in Dayton, Ohio, includes an initial fixed-rate period that is typically shorter, followed by an adjustable interest rate for the remaining loan term. This type of loan allows for potential interest rate fluctuations, which can result in either higher or lower payments over time. 3. Interest-Only Mortgage Note: With an interest-only mortgage note in Dayton, Ohio, borrowers are required to make monthly payments that cover only the interest accrued, excluding the principal amount. This type of note typically has an initial interest-only period, after which the borrower must start paying off the principal as well. 4. Balloon Mortgage Note: A balloon mortgage note in Dayton, Ohio, involves smaller monthly payments for a fixed period, usually ranging from 5 to 7 years, followed by a large balloon payment due at the end. Borrowers typically refinance or sell the property before the balloon payment is due. 5. Reverse Mortgage Note: This type of mortgage note in Dayton, Ohio, is available exclusively to homeowners aged 62 and above. It allows them to convert a portion of their home equity into loan proceeds while living in their home. The loan is repaid, along with accrued interest, when the homeowner sells the property, moves out, or passes away. When acquiring a Dayton Ohio Mortgage Note, it is crucial for borrowers to carefully review and understand the terms and conditions, interest rates, repayment options, and potential penalties. Consulting with a trusted mortgage professional or attorney is highly recommended ensuring a smooth and transparent mortgage process. In conclusion, a Dayton Ohio Mortgage Note is a legal document that serves as proof of a mortgage loan in Dayton, Ohio. Various types of mortgage notes exist, including fixed-rate, adjustable-rate, interest-only, balloon, and reverse mortgage notes, each catering to different borrower needs and financial situations. Understanding the specific terms and conditions of a mortgage note is vital for borrowers to make informed decisions and manage their mortgage responsibly.Dayton Ohio Mortgage Note: Explained in Detail A Dayton Ohio Mortgage Note is a legal document that outlines the terms and conditions of a mortgage loan in Dayton, Ohio. It serves as evidence of the debt owed by the borrower to the lender and provides details about repayment terms, interest rates, and any additional provisions regarding the mortgage. Different Types of Dayton Ohio Mortgage Notes: 1. Fixed-Rate Mortgage Note: This type of mortgage note in Dayton, Ohio, involves a fixed interest rate that remains constant throughout the loan term. Borrowers benefit from predictable monthly payments, making budgeting easier. 2. Adjustable-Rate Mortgage (ARM) Note: An ARM mortgage note in Dayton, Ohio, includes an initial fixed-rate period that is typically shorter, followed by an adjustable interest rate for the remaining loan term. This type of loan allows for potential interest rate fluctuations, which can result in either higher or lower payments over time. 3. Interest-Only Mortgage Note: With an interest-only mortgage note in Dayton, Ohio, borrowers are required to make monthly payments that cover only the interest accrued, excluding the principal amount. This type of note typically has an initial interest-only period, after which the borrower must start paying off the principal as well. 4. Balloon Mortgage Note: A balloon mortgage note in Dayton, Ohio, involves smaller monthly payments for a fixed period, usually ranging from 5 to 7 years, followed by a large balloon payment due at the end. Borrowers typically refinance or sell the property before the balloon payment is due. 5. Reverse Mortgage Note: This type of mortgage note in Dayton, Ohio, is available exclusively to homeowners aged 62 and above. It allows them to convert a portion of their home equity into loan proceeds while living in their home. The loan is repaid, along with accrued interest, when the homeowner sells the property, moves out, or passes away. When acquiring a Dayton Ohio Mortgage Note, it is crucial for borrowers to carefully review and understand the terms and conditions, interest rates, repayment options, and potential penalties. Consulting with a trusted mortgage professional or attorney is highly recommended ensuring a smooth and transparent mortgage process. In conclusion, a Dayton Ohio Mortgage Note is a legal document that serves as proof of a mortgage loan in Dayton, Ohio. Various types of mortgage notes exist, including fixed-rate, adjustable-rate, interest-only, balloon, and reverse mortgage notes, each catering to different borrower needs and financial situations. Understanding the specific terms and conditions of a mortgage note is vital for borrowers to make informed decisions and manage their mortgage responsibly.