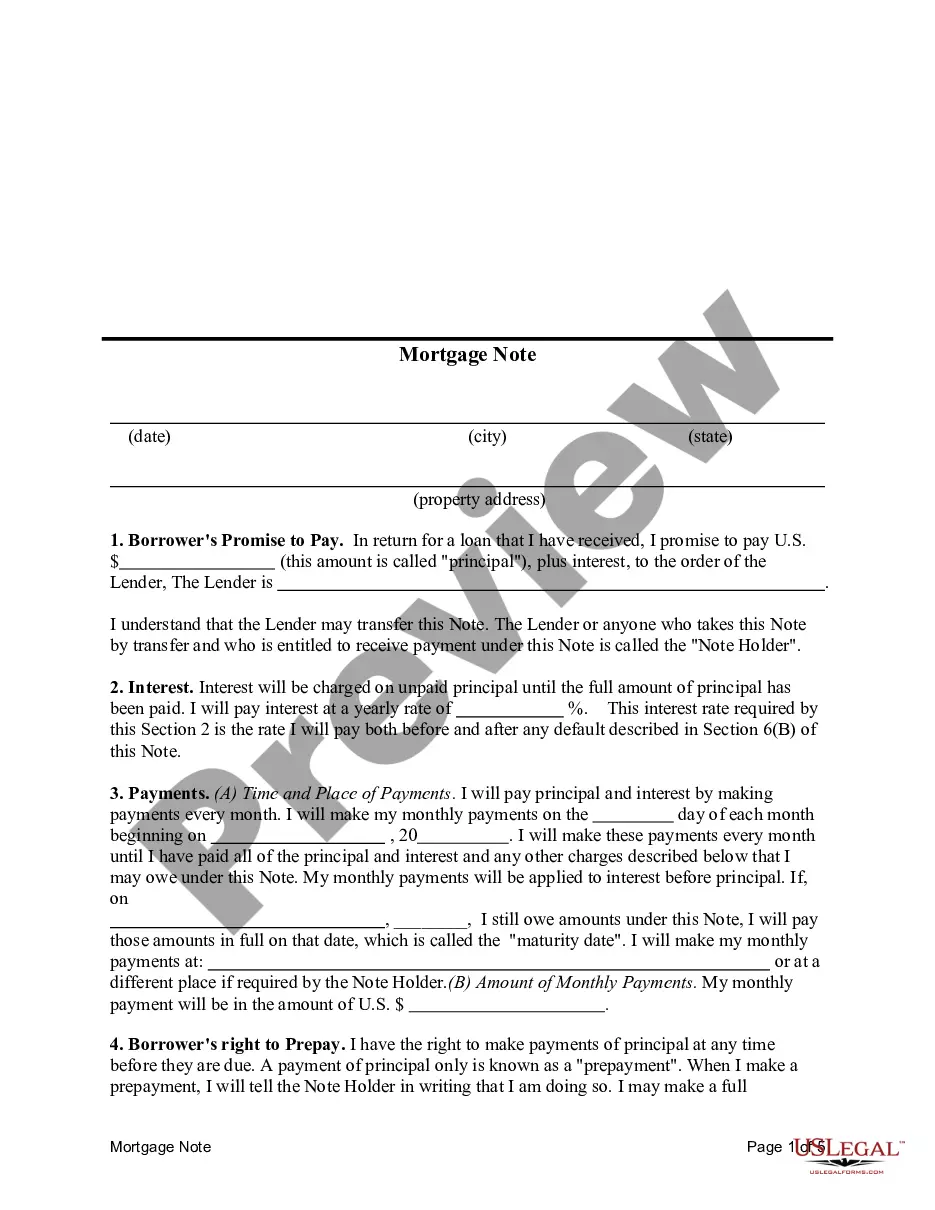

This sample form, a Mortgage Note, is for use in home financing in Ohio. Available in Word format.

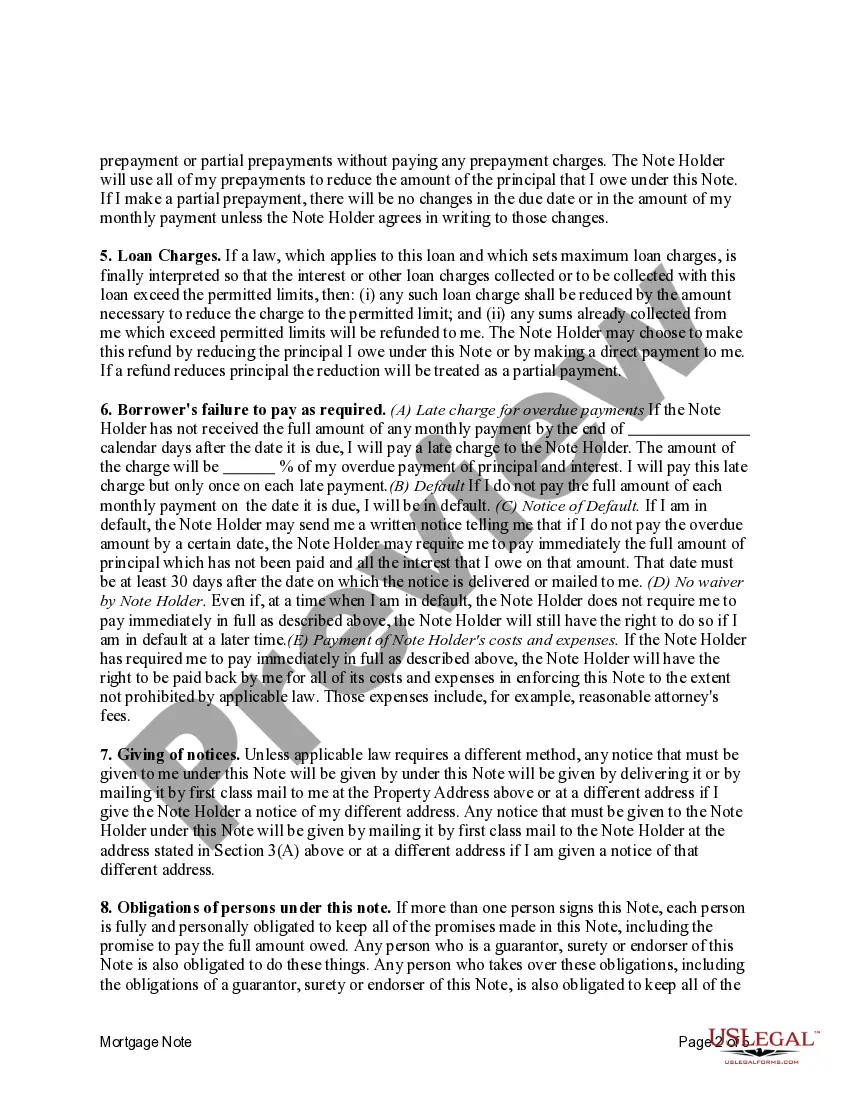

Toledo Ohio Mortgage Note: Understanding the Types and Benefits In the realm of real estate financing, the Toledo Ohio Mortgage Note plays a crucial role. A mortgage note is a legal document that outlines the terms and conditions of a loan secured by real estate property in Toledo, Ohio. It serves as a written promise to repay the borrowed amount and acts as evidence of the debt owed by the borrower to the lender. There are several types of Toledo Ohio Mortgage Notes, each designed to cater to different financial needs and circumstances. Let's delve into the various types: 1. Fixed-Rate Mortgage Note: A fixed-rate mortgage note in Toledo entails a loan with a predetermined interest rate that remains unchanged throughout the loan term. Borrowers benefit from consistent monthly payments, allowing for better budgeting and planning. 2. Adjustable-Rate Mortgage Note: In contrast to a fixed-rate mortgage, an adjustable-rate mortgage note (ARM) in Toledo features an interest rate that fluctuates over time. Typically, ARM shaves an initial fixed-rate period, after which the rate adjusts periodically based on market conditions. This type of mortgage note offers flexibility and can be advantageous when interest rates decrease. 3. Balloon Mortgage Note: A balloon mortgage note is a short-term loan that requires the borrower to make regular payments for a specified period, usually around five to seven years. However, at the end of the agreed upon term, a large lump sum payment (balloon payment) is due. This type of mortgage note can be ideal for individuals planning to sell their property or refinance before the balloon payment comes due. 4. Interest-Only Mortgage Note: With an interest-only mortgage note, borrowers are only obligated to pay interest on the loan for a specified period, typically between five and ten years. After this initial period, the borrower starts paying both principal and interest. This type of mortgage note is suitable for those expecting an increase in income over time or individuals planning to sell their property in the near future. Toledo Ohio Mortgage Notes offer several benefits for both borrowers and lenders. For borrowers, they provide access to funds necessary to purchase or refinance a property, offering financial flexibility and enabling homeownership dreams to come true. Additionally, mortgage notes also help in establishing credit history and maintaining a good credit score. For lenders, mortgage notes serve as a way to generate income through interest payments over the loan term. Lenders also have the option to sell mortgage notes to other investors, providing liquidity and freeing up capital to issue new loans. In conclusion, Toledo Ohio Mortgage Notes come in various types to suit different borrowers' needs and preferences. Whether it's a fixed-rate, adjustable-rate, balloon, or interest-only mortgage note, understanding each type is essential for making informed financial decisions. With their wide range of benefits for both borrowers and lenders, mortgage notes play a fundamental role in the real estate industry, contributing to the growth and stability of Toledo's housing market.Toledo Ohio Mortgage Note: Understanding the Types and Benefits In the realm of real estate financing, the Toledo Ohio Mortgage Note plays a crucial role. A mortgage note is a legal document that outlines the terms and conditions of a loan secured by real estate property in Toledo, Ohio. It serves as a written promise to repay the borrowed amount and acts as evidence of the debt owed by the borrower to the lender. There are several types of Toledo Ohio Mortgage Notes, each designed to cater to different financial needs and circumstances. Let's delve into the various types: 1. Fixed-Rate Mortgage Note: A fixed-rate mortgage note in Toledo entails a loan with a predetermined interest rate that remains unchanged throughout the loan term. Borrowers benefit from consistent monthly payments, allowing for better budgeting and planning. 2. Adjustable-Rate Mortgage Note: In contrast to a fixed-rate mortgage, an adjustable-rate mortgage note (ARM) in Toledo features an interest rate that fluctuates over time. Typically, ARM shaves an initial fixed-rate period, after which the rate adjusts periodically based on market conditions. This type of mortgage note offers flexibility and can be advantageous when interest rates decrease. 3. Balloon Mortgage Note: A balloon mortgage note is a short-term loan that requires the borrower to make regular payments for a specified period, usually around five to seven years. However, at the end of the agreed upon term, a large lump sum payment (balloon payment) is due. This type of mortgage note can be ideal for individuals planning to sell their property or refinance before the balloon payment comes due. 4. Interest-Only Mortgage Note: With an interest-only mortgage note, borrowers are only obligated to pay interest on the loan for a specified period, typically between five and ten years. After this initial period, the borrower starts paying both principal and interest. This type of mortgage note is suitable for those expecting an increase in income over time or individuals planning to sell their property in the near future. Toledo Ohio Mortgage Notes offer several benefits for both borrowers and lenders. For borrowers, they provide access to funds necessary to purchase or refinance a property, offering financial flexibility and enabling homeownership dreams to come true. Additionally, mortgage notes also help in establishing credit history and maintaining a good credit score. For lenders, mortgage notes serve as a way to generate income through interest payments over the loan term. Lenders also have the option to sell mortgage notes to other investors, providing liquidity and freeing up capital to issue new loans. In conclusion, Toledo Ohio Mortgage Notes come in various types to suit different borrowers' needs and preferences. Whether it's a fixed-rate, adjustable-rate, balloon, or interest-only mortgage note, understanding each type is essential for making informed financial decisions. With their wide range of benefits for both borrowers and lenders, mortgage notes play a fundamental role in the real estate industry, contributing to the growth and stability of Toledo's housing market.