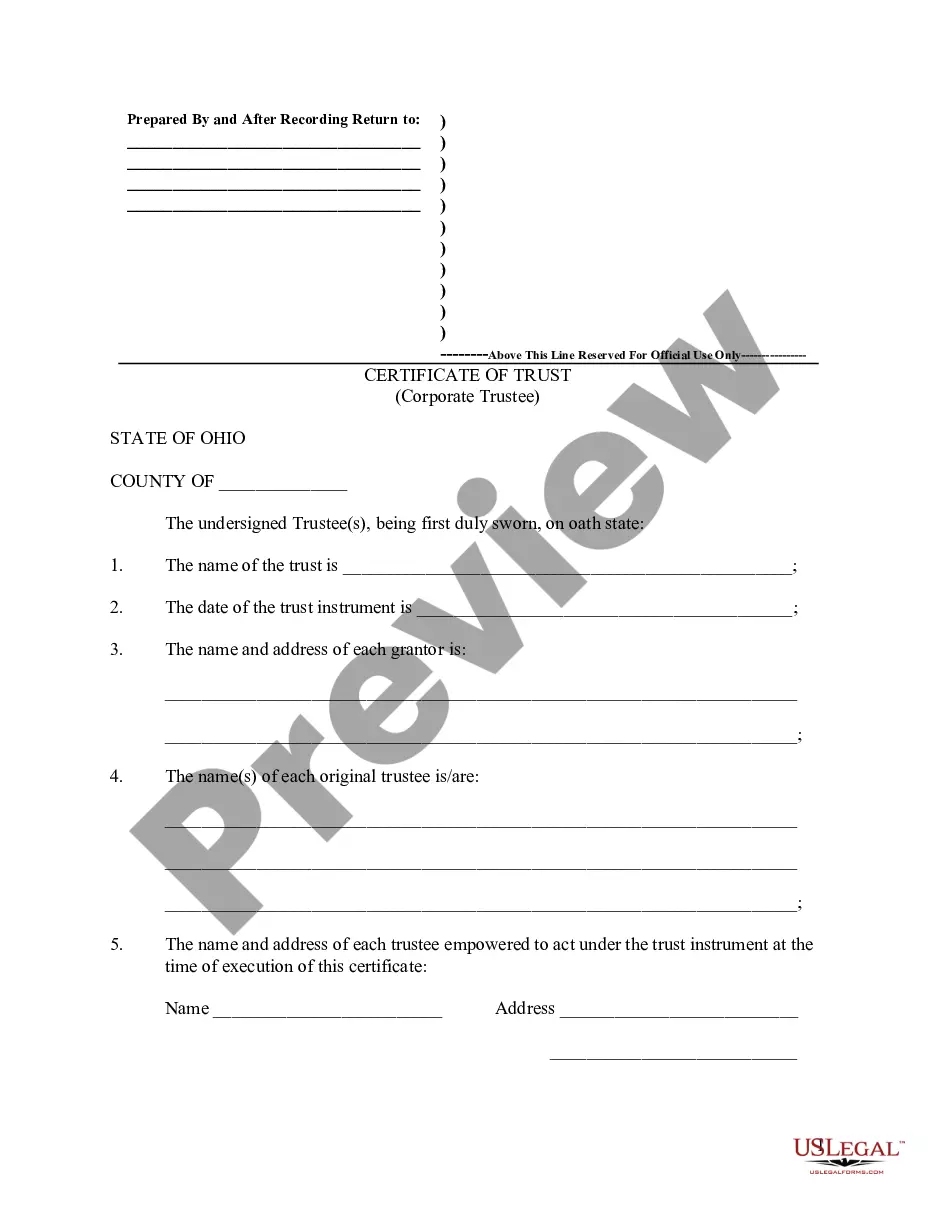

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The corporate trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Franklin Ohio Certificate of Trust by Corporation

Description

How to fill out Ohio Certificate Of Trust By Corporation?

Regardless of one’s social or professional rank, filling out law-related documents is an unfortunate requirement in today’s work environment.

Often, it is nearly impossible for someone without any legal training to prepare such documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms provides assistance.

Ensure that the form you have identified is valid for your locality as the regulations of one area do not apply to another.

Review the form and examine a brief description (if available) of situations for which the document can be utilized.

- Our platform offers an extensive library with over 85,000 ready-to-use state-specific forms suitable for nearly any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to operate more efficiently with our DIY documents.

- Whether you need the Franklin Ohio Certificate of Trust by Corporation or any other document that applies in your jurisdiction, US Legal Forms has you covered.

- Here’s how you can acquire the Franklin Ohio Certificate of Trust by Corporation in just minutes using our reliable platform.

- If you’re already a customer, you can proceed to Log In to your account to download the necessary form.

- If you are a new user, make sure to follow these steps before downloading the Franklin Ohio Certificate of Trust by Corporation.

Form popularity

FAQ

In Ohio, trusts do not automatically require notarization, but notarization is recommended for added protection. Notarizing your Franklin Ohio Certificate of Trust by Corporation can facilitate smoother transactions and enhance acceptance in various legal matters. It is advisable to check with your legal advisor or a reliable resource like uslegalforms to understand the best practices for your specific trust.

To obtain a Franklin Ohio Certificate of Trust by Corporation, you typically need to create a trust agreement that outlines the terms and conditions of the trust. Once completed, additional documents may be required for certification. Using platforms like uslegalforms simplifies this process, providing templates and guidance to help you navigate the requirements effectively.

Ohio law does not strictly require that trusts be notarized to be valid. However, notarization can enhance the trust's legitimacy, especially when presenting the Franklin Ohio Certificate of Trust by Corporation to financial institutions or courts. It’s smart to follow best practices for estate planning, which often includes notarization. To ensure compliance with all Ohio regulations, consider seeking legal expertise.

In Franklin, Ohio, a trust can still be valid even if it is not notarized. However, having your Franklin Ohio Certificate of Trust by Corporation notarized can provide an additional layer of credibility and authentication. It is important to understand the legal requirements specific to your situation. Consulting with a legal professional or using an online platform like uslegalforms can help ensure your trust meets all necessary criteria.

Placing your business in a trust can be a smart decision for asset protection and estate planning. By doing so, you safeguard the assets from creditors and make succession planning simpler. Additionally, a Franklin Ohio Certificate of Trust by Corporation can serve as an effective legal tool to manage your corporation's assets and affairs. Consulting with legal experts or utilizing UsLegalForms can provide you with the guidance necessary to make this decision wisely.

Putting a corporation in a trust involves creating a trust agreement that details how the assets will be managed. This agreement should be executed with the correct legal formalities to ensure its validity. Once the agreement is created, you would need to transfer the corporate assets into the trust. UsLegalForms can assist you in producing a Franklin Ohio Certificate of Trust by Corporation to complete this process efficiently.

Yes, you can write your own trust in Ohio, but it is crucial to ensure that it complies with state laws. A properly drafted trust can help protect your assets and dictate how they should be managed. If you’re considering a Franklin Ohio Certificate of Trust by Corporation, consulting resources like UsLegalForms can be beneficial in creating a legally sound document.

While a corporate trust can provide benefits such as asset protection, there are also disadvantages to consider. For example, the management of a corporate trust can be more complex and may involve additional administrative costs. Moreover, if not properly maintained, the trust could face legal complications. It's wise to weigh these factors carefully before establishing a Franklin Ohio Certificate of Trust by Corporation.

Filling out a certification of trust form requires basic information about the trust and its assets. First, enter the trust's name and the date it was established. Then, provide details about the trustee and the beneficiaries. UsLegalForms offers step-by-step instructions and templates for creating a Franklin Ohio Certificate of Trust by Corporation, making this process straightforward.

Yes, you can create your own certificate of trust. However, it is important that it meets the legal requirements of your state. A Franklin Ohio Certificate of Trust by Corporation should include details like the trust’s name, date of establishment, and the parties involved. Using resources from UsLegalForms can simplify the process and ensure your certificate is compliant.