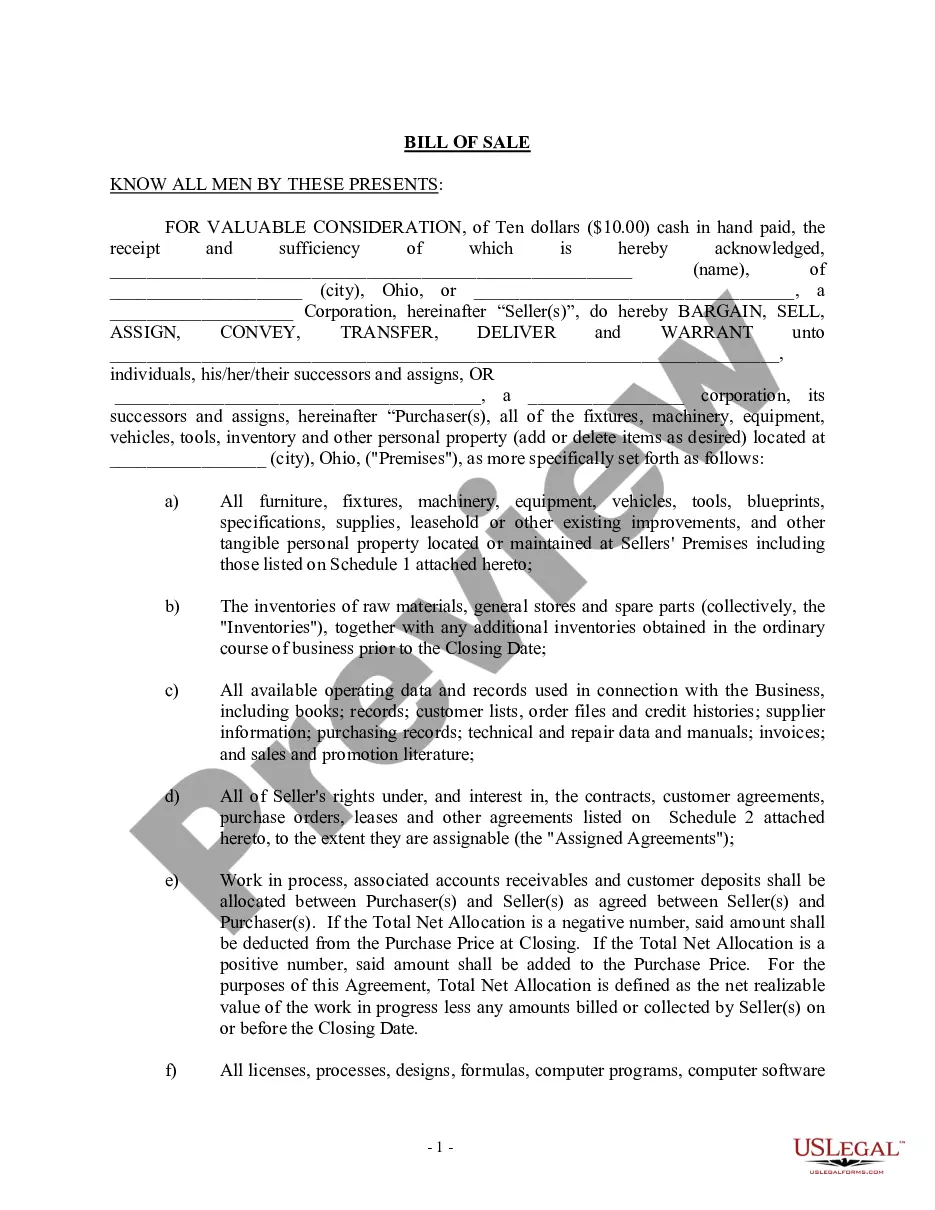

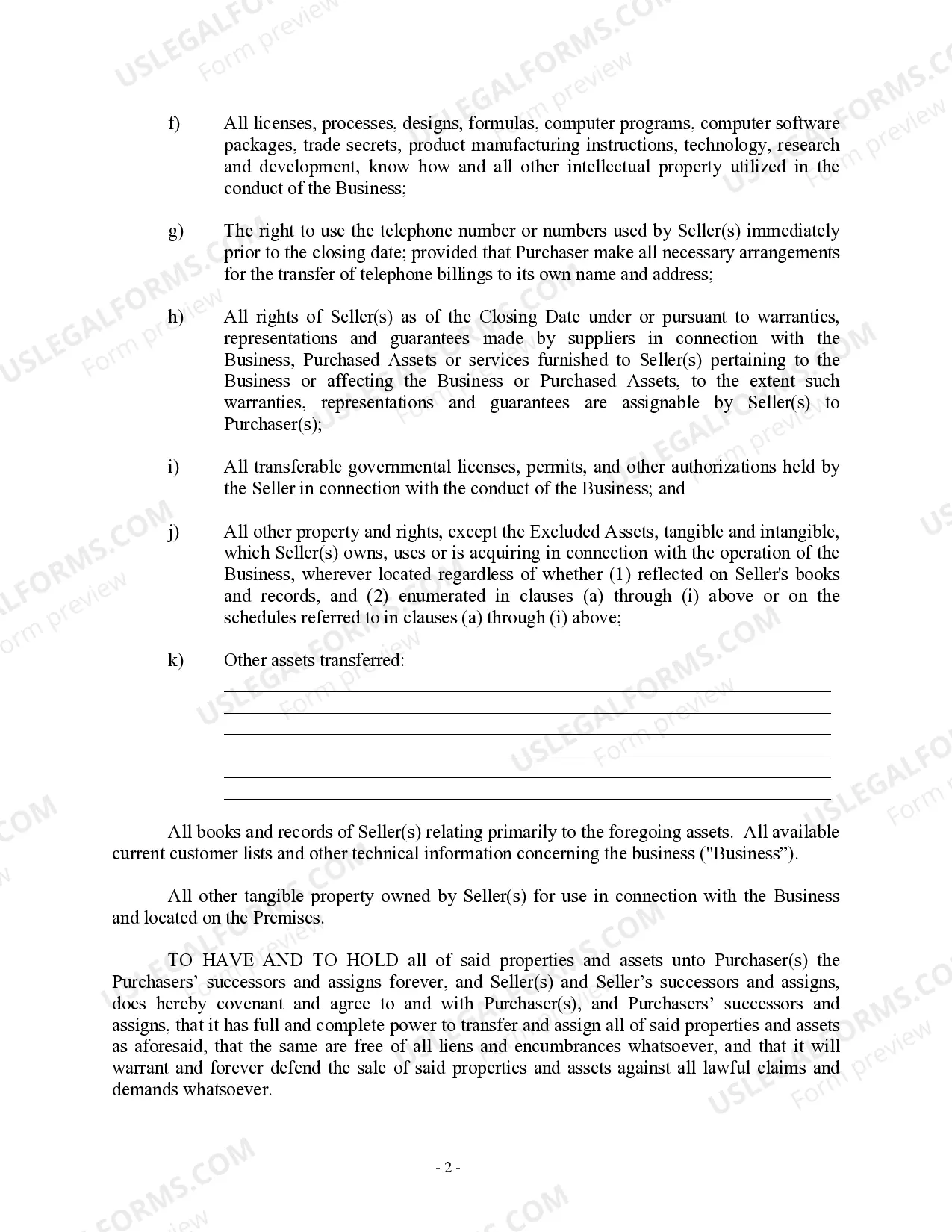

Bill of Sale in Connection with Sale of Business - Individual or Corporate Seller or Buyer. This bill of sale may include anything that is intangible but considered part of the business. These may be all licenses, processes, designs, formulas, computer programs, computer software packages, trade secrets, product manufacturing instructions etc.

The Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that formally transfers the ownership of a business from one party to another. This document acts as evidence of the transaction and outlines the specific terms and conditions agreed upon by both parties. Keywords: Columbus Ohio, Bill of Sale, sale of business, individual seller, corporate seller, legal document, ownership transfer, terms and conditions. The Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller serves various purposes. Firstly, it specifies the details of the business being sold, such as its name, location, and any relevant licenses or permits. This ensures the clarity and accuracy of the transaction. The document also includes the purchase price or consideration for the business. It outlines whether the price is being paid in full or in installments, and if there are any financing arrangements involved. This helps to establish the financial terms of the sale. Additionally, the Columbus Ohio Bill of Sale provides a warranty clause, which states that the seller legally owns the business and has the authority to sell it. This protects the buyer from any future claims or disputes regarding ownership. Furthermore, the document may include non-compete and non-disclosure clauses. These clauses prevent the seller from starting a similar business or sharing confidential information with competitors, ensuring that the buyer's interests are safeguarded. In Columbus Ohio, there may be different types of Bill of Sale documents used in connection with the sale of a business by an individual or corporate seller, depending on the specific circumstances: 1. Asset Purchase Agreement: This type of Bill of Sale outlines the transfer of specific business assets, such as equipment, inventory, and intellectual property. 2. Stock Purchase Agreement: In the case of a corporate seller, this Bill of Sale focuses on the transfer of company stocks. It includes details on the number and type of shares being sold, as well as any restrictions or conditions. 3. Merger or Acquisition Agreement: This is a more comprehensive Bill of Sale used when one business is acquiring another. It covers various aspects of the deal, including financial terms, stock transfers, and the integration of operations. In conclusion, the Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller is a crucial legal document that ensures a smooth and legally binding transaction. It outlines the specifics of the sale, including the business details, purchase price, warranties, and any relevant clauses. Depending on the circumstances, different types of Bill of Sale documents may be used in Columbus Ohio, such as Asset Purchase Agreements, Stock Purchase Agreements, or Merger or Acquisition Agreements.The Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller is a legal document that formally transfers the ownership of a business from one party to another. This document acts as evidence of the transaction and outlines the specific terms and conditions agreed upon by both parties. Keywords: Columbus Ohio, Bill of Sale, sale of business, individual seller, corporate seller, legal document, ownership transfer, terms and conditions. The Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller serves various purposes. Firstly, it specifies the details of the business being sold, such as its name, location, and any relevant licenses or permits. This ensures the clarity and accuracy of the transaction. The document also includes the purchase price or consideration for the business. It outlines whether the price is being paid in full or in installments, and if there are any financing arrangements involved. This helps to establish the financial terms of the sale. Additionally, the Columbus Ohio Bill of Sale provides a warranty clause, which states that the seller legally owns the business and has the authority to sell it. This protects the buyer from any future claims or disputes regarding ownership. Furthermore, the document may include non-compete and non-disclosure clauses. These clauses prevent the seller from starting a similar business or sharing confidential information with competitors, ensuring that the buyer's interests are safeguarded. In Columbus Ohio, there may be different types of Bill of Sale documents used in connection with the sale of a business by an individual or corporate seller, depending on the specific circumstances: 1. Asset Purchase Agreement: This type of Bill of Sale outlines the transfer of specific business assets, such as equipment, inventory, and intellectual property. 2. Stock Purchase Agreement: In the case of a corporate seller, this Bill of Sale focuses on the transfer of company stocks. It includes details on the number and type of shares being sold, as well as any restrictions or conditions. 3. Merger or Acquisition Agreement: This is a more comprehensive Bill of Sale used when one business is acquiring another. It covers various aspects of the deal, including financial terms, stock transfers, and the integration of operations. In conclusion, the Columbus Ohio Bill of Sale in connection with the sale of a business by an individual or corporate seller is a crucial legal document that ensures a smooth and legally binding transaction. It outlines the specifics of the sale, including the business details, purchase price, warranties, and any relevant clauses. Depending on the circumstances, different types of Bill of Sale documents may be used in Columbus Ohio, such as Asset Purchase Agreements, Stock Purchase Agreements, or Merger or Acquisition Agreements.