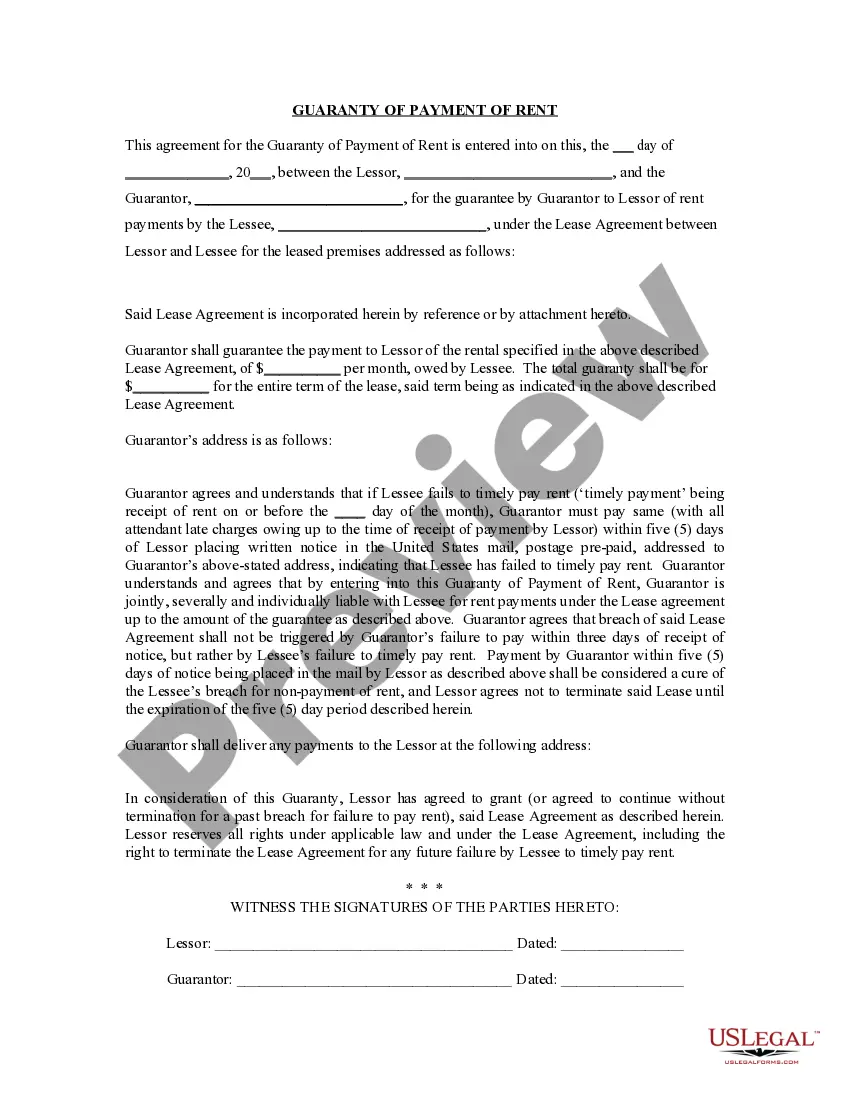

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

The Columbus Ohio Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the landlord's rental income is protected even if the tenant fails to make rent payments. It is a contractual arrangement between a third-party guarantor and the landlord, where the guarantor promises to be responsible for the rental payments in case the tenant defaults. Key elements of the Columbus Ohio Guaranty or Guarantee of Payment of Rent include the identification of the parties involved, namely the landlord, tenant, and guarantor. The agreement should clearly state the amount of rent being guaranteed, the duration of the guarantee, and any special terms or conditions agreed upon. Columbus Ohio recognizes various types of Guaranty or Guarantee of Payment of Rent, each serving different purposes. Some common types are: 1. Lease Guaranty: This type of guaranty involves a separate agreement that provides assurance to the landlord that the tenant will fulfill his rental obligations. The guarantor signs the lease guaranty, which becomes a binding contract, holding the guarantor liable for rent payments if the tenant fails to pay. 2. Corporate Guaranty: In cases where the tenant is a corporation or business entity, a corporate guaranty may be required. This type of guaranty involves a representative or officer of the corporation signing the agreement, assuming personal liability for the rent payments on behalf of the company. 3. Residential Guaranty: This guaranty is specific to residential leases and typically involves a family member or another individual close to the tenant acting as the guarantor. It provides an added layer of protection for the landlord in case the tenant is unable to fulfill their rental obligations. 4. Commercial Guaranty: In commercial leases, a commercial guaranty may be required to secure the rental income. This type of agreement typically involves a business entity or individual with proven financial stability guaranteeing the rent payments in case the tenant defaults. The Columbus Ohio Guaranty or Guarantee of Payment of Rent is an important legal tool that allows landlords to mitigate potential financial risks associated with tenant non-payment. Both landlords and tenants should thoroughly review and understand the terms and conditions of the guaranty agreement before signing to ensure a clear understanding of their respective responsibilities and obligations. It is advisable to consult with legal professionals specializing in landlord-tenant law to ensure compliance with all relevant regulations and to draft a suitable guaranty agreement tailored to the specific circumstances.The Columbus Ohio Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the landlord's rental income is protected even if the tenant fails to make rent payments. It is a contractual arrangement between a third-party guarantor and the landlord, where the guarantor promises to be responsible for the rental payments in case the tenant defaults. Key elements of the Columbus Ohio Guaranty or Guarantee of Payment of Rent include the identification of the parties involved, namely the landlord, tenant, and guarantor. The agreement should clearly state the amount of rent being guaranteed, the duration of the guarantee, and any special terms or conditions agreed upon. Columbus Ohio recognizes various types of Guaranty or Guarantee of Payment of Rent, each serving different purposes. Some common types are: 1. Lease Guaranty: This type of guaranty involves a separate agreement that provides assurance to the landlord that the tenant will fulfill his rental obligations. The guarantor signs the lease guaranty, which becomes a binding contract, holding the guarantor liable for rent payments if the tenant fails to pay. 2. Corporate Guaranty: In cases where the tenant is a corporation or business entity, a corporate guaranty may be required. This type of guaranty involves a representative or officer of the corporation signing the agreement, assuming personal liability for the rent payments on behalf of the company. 3. Residential Guaranty: This guaranty is specific to residential leases and typically involves a family member or another individual close to the tenant acting as the guarantor. It provides an added layer of protection for the landlord in case the tenant is unable to fulfill their rental obligations. 4. Commercial Guaranty: In commercial leases, a commercial guaranty may be required to secure the rental income. This type of agreement typically involves a business entity or individual with proven financial stability guaranteeing the rent payments in case the tenant defaults. The Columbus Ohio Guaranty or Guarantee of Payment of Rent is an important legal tool that allows landlords to mitigate potential financial risks associated with tenant non-payment. Both landlords and tenants should thoroughly review and understand the terms and conditions of the guaranty agreement before signing to ensure a clear understanding of their respective responsibilities and obligations. It is advisable to consult with legal professionals specializing in landlord-tenant law to ensure compliance with all relevant regulations and to draft a suitable guaranty agreement tailored to the specific circumstances.