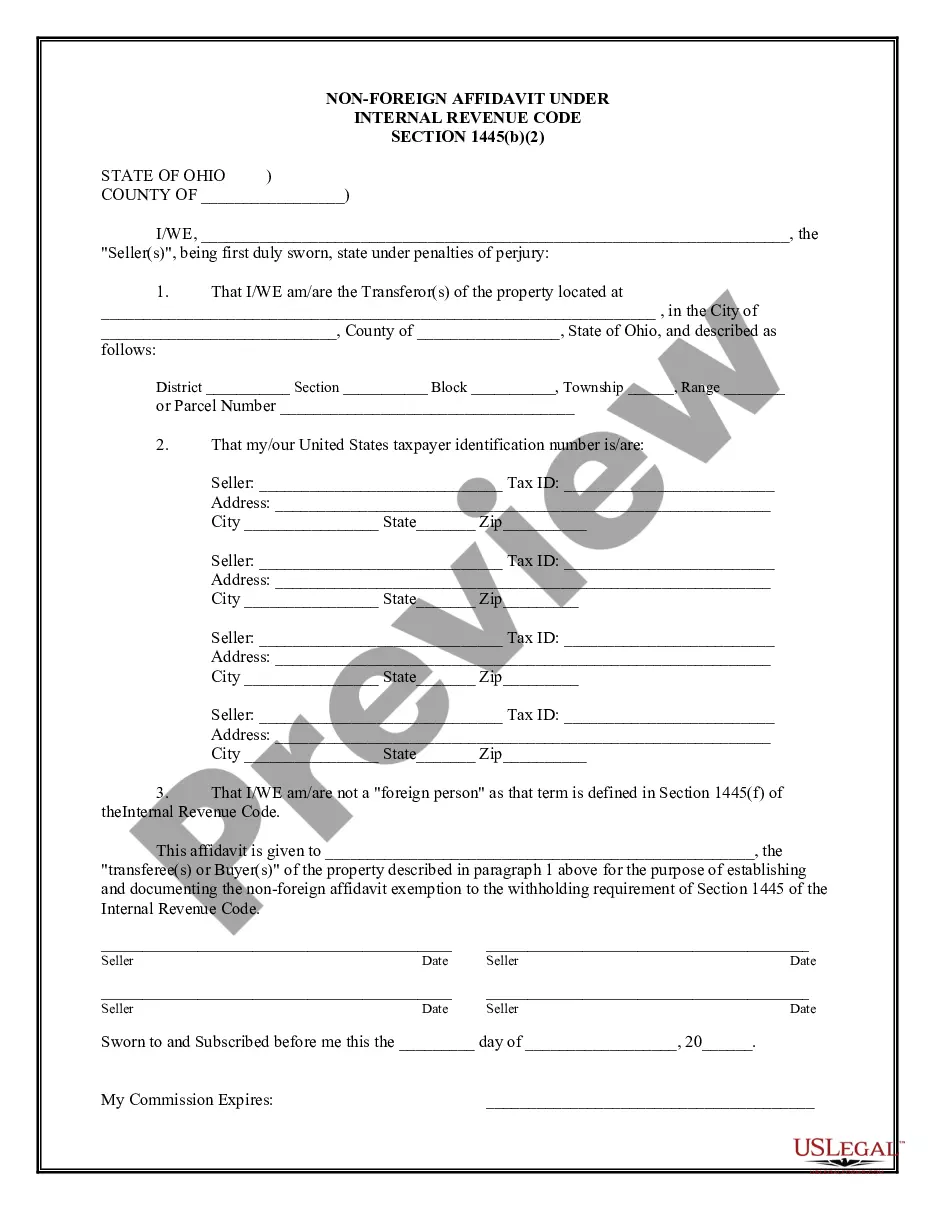

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Akron Ohio Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide Keywords: Akron Ohio, Non-Foreign Affidavit, IRC 1445, tax documents, real estate transactions, non-U.S. citizens, withholding tax Introduction: The Akron Ohio Non-Foreign Affidavit Under IRC 1445 is a crucial document used in real estate transactions within Akron, Ohio. Specifically, this affidavit is required to be completed by non-U.S. citizens involved in the sale or transfer of real property, highlighting their non-foreign status. This document plays a significant role in complying with the Internal Revenue Code (IRC) Section 1445, which governs the withholding taxes applicable to certain non-U.S. individuals engaging in real estate transactions. Types of Akron Ohio Non-Foreign Affidavits Under IRC 1445: 1. Akron Ohio Non-Foreign Affidavit for Individuals: This affidavit is specifically designed for non-U.S. citizen individuals who are selling or transferring a property within Akron, Ohio. It requires detailed information about the individual's residency, citizenship, and certain tax-related elements to establish their non-foreign status. 2. Akron Ohio Non-Foreign Affidavit for Entities: Entities, such as corporations, partnerships, or other legal entities, that are non-U.S. citizens involved in real estate transactions in Akron, Ohio, are required to complete this type of affidavit. Similar to the individual affidavit, it requests detailed information about the entity, including its formation, tax status, and ownership structure, to confirm its non-foreign status. 3. Akron Ohio Non-Foreign Affidavit for Transactions Involving Foreign Entities: When a real estate transaction within Akron, Ohio involves both U.S. and non-U.S. entities, this affidavit is utilized. In such cases, it becomes crucial to differentiate the responsibilities and status of the foreign entities involved. This affidavit requires detailed information about the transaction, the U.S. and non-U.S. entities involved, and the allocation of responsibilities and tax obligations. Key Elements of the Akron Ohio Non-Foreign Affidavit Under IRC 1445: 1. Identification Details: The affidavit starts by collecting essential identification information, including the name, address, and taxpayer identification number (TIN) of the non-U.S. citizen individual or entity involved in the real estate transaction. 2. Citizenship and Residency: The affidavit requires the individual or entity to establish their non-foreign status by providing details about their citizenship, immigration status, and length of residency in the United States. This information helps the Internal Revenue Service (IRS) determine whether the entity should be subject to withholding taxes. 3. Taxpayer Classification: The affidavit requires classification under various taxpayer categories and provides space for indicating the type of non-U.S. taxpayer, such as nonresident alien, foreign corporation, or foreign partnership. This classification helps the IRS determine the applicable withholding tax rates. 4. Exemption Eligibility: Individuals or entities may claim certain exemptions from withholding taxes based on tax treaties, U.S. residency status, or other applicable exemptions. Therefore, the affidavit provides a section to declare any eligibility for exemption and to provide relevant supporting documentation. Conclusion: The Akron Ohio Non-Foreign Affidavit Under IRC 1445 is an essential document in real estate transactions involving non-U.S. citizens within Akron, Ohio. It ensures compliance with IRC Section 1445 and aids in determining the correct withholding tax obligations. Whether completing the affidavit as an individual or an entity, accurate and detailed information is crucial to establish non-foreign status and potentially claim any applicable exemptions.