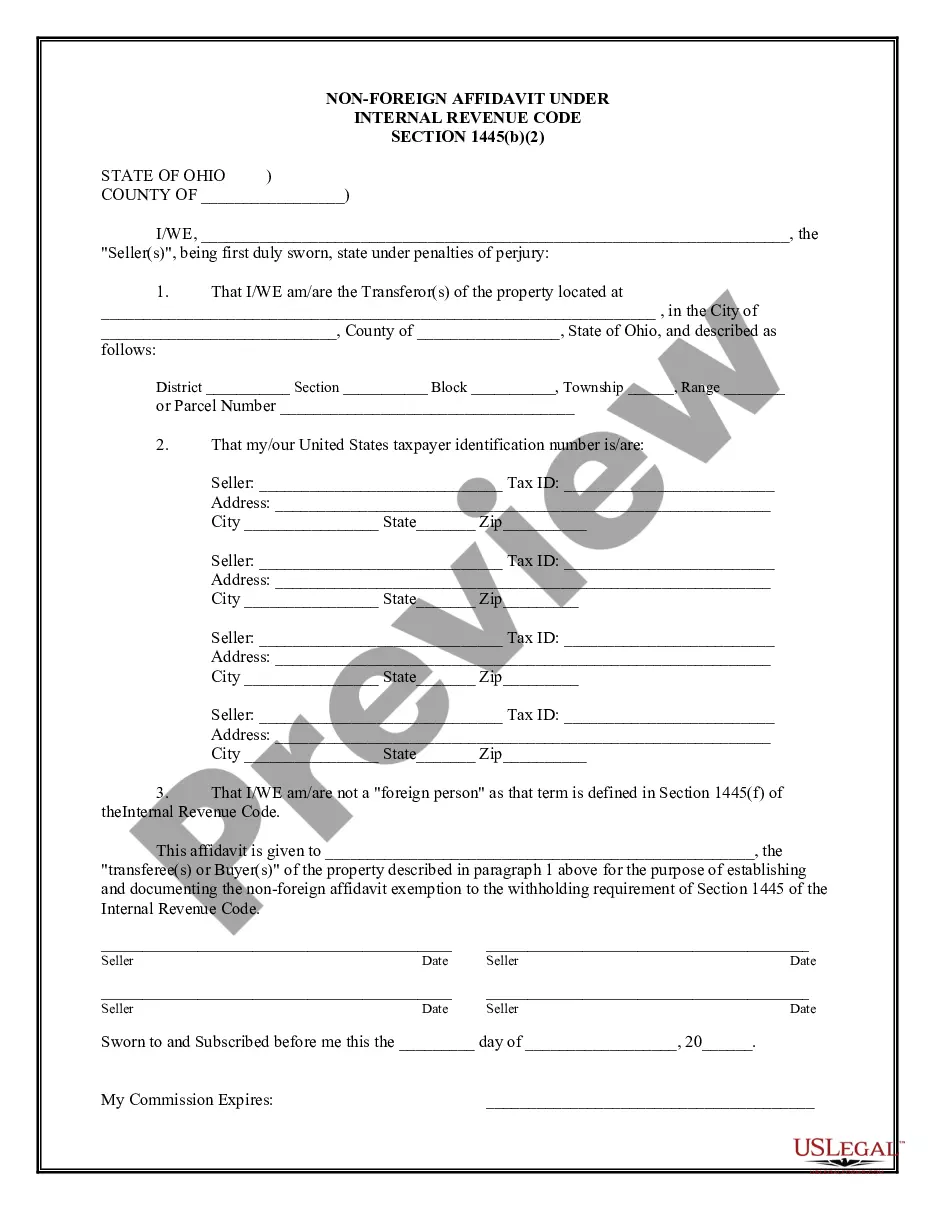

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Columbus Ohio Non-Foreign Affidavit under IRC 1445 is a legal document that is used in the city of Columbus, Ohio to certify that a seller of real property is not a foreign person for tax purposes, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the IRS to be completed by the seller of real property when the transaction involves a buyer who wishes to withhold a certain amount of the purchase price as a form of tax payment. The purpose of this affidavit is to ensure compliance with the withholding requirements imposed by the IRS on the buyer. The Columbus Ohio Non-Foreign Affidavit under IRC 1445 consists of several sections and requires specific information to be provided. Generally, it includes the following details: 1. Property Information: This includes the legal description and address of the property being sold. 2. Seller Information: The affidavit requires the full legal name, address, and taxpayer identification number (TIN) of the seller. Additionally, if the property is owned by an entity, the affidavit may require information about the responsible party of the entity. 3. Certification of Non-Foreign Status: The seller must certify under penalties of perjury that they are not a foreign person as defined by the IRC Section 1445. This certification includes the seller's written declaration that they are a U.S. citizen, resident alien, domestic partnership, corporation, or another domestic entity based on the definitions provided by the IRS. 4. Signature and Date: The affidavit must be signed and dated by the seller or an authorized representative, affirming the information provided. Different types or variations of the Columbus Ohio Non-Foreign Affidavit Under IRC 1445 may exist depending on specific requirements mandated by the city or specific circumstances of the real estate transaction. For example, there may be variations of the affidavit for different types of property (residential, commercial, etc.), different types of sellers (individuals, corporations, partnerships), or different types of transactions (sales, transfers, exchanges). It is important to consult with a legal professional or a trusted advisor to ensure the correct affidavit is utilized for a specific situation.The Columbus Ohio Non-Foreign Affidavit under IRC 1445 is a legal document that is used in the city of Columbus, Ohio to certify that a seller of real property is not a foreign person for tax purposes, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the IRS to be completed by the seller of real property when the transaction involves a buyer who wishes to withhold a certain amount of the purchase price as a form of tax payment. The purpose of this affidavit is to ensure compliance with the withholding requirements imposed by the IRS on the buyer. The Columbus Ohio Non-Foreign Affidavit under IRC 1445 consists of several sections and requires specific information to be provided. Generally, it includes the following details: 1. Property Information: This includes the legal description and address of the property being sold. 2. Seller Information: The affidavit requires the full legal name, address, and taxpayer identification number (TIN) of the seller. Additionally, if the property is owned by an entity, the affidavit may require information about the responsible party of the entity. 3. Certification of Non-Foreign Status: The seller must certify under penalties of perjury that they are not a foreign person as defined by the IRC Section 1445. This certification includes the seller's written declaration that they are a U.S. citizen, resident alien, domestic partnership, corporation, or another domestic entity based on the definitions provided by the IRS. 4. Signature and Date: The affidavit must be signed and dated by the seller or an authorized representative, affirming the information provided. Different types or variations of the Columbus Ohio Non-Foreign Affidavit Under IRC 1445 may exist depending on specific requirements mandated by the city or specific circumstances of the real estate transaction. For example, there may be variations of the affidavit for different types of property (residential, commercial, etc.), different types of sellers (individuals, corporations, partnerships), or different types of transactions (sales, transfers, exchanges). It is important to consult with a legal professional or a trusted advisor to ensure the correct affidavit is utilized for a specific situation.